Summary:

- AMD reported decent Q3 results, surpassing expectations on revenue, with significant growth in the Data Center segment.

- The company only matched bottom line estimates, and current quarter guidance was a tad light.

- The nearly 8% post-earnings pullback makes the valuation look a little more attractive.

JHVEPhoto

After the bell on Tuesday, we received third quarter results from Advanced Micro Devices (NASDAQ:AMD). The chipmaker reported a solid Q3 with revenues beating street estimates and adjusted earnings per share in line. However, the company issued slightly weaker than expected guidance, sending the stock down in the after-hours session. With decent growth expected in the coming year, this is definitely not the time to panic, and perhaps an opportunity to take advantage of the pullback.

Previous coverage on the name:

I last covered the chipmaker back in late July, at which point the company had just released its second quarter results. The company reported solid results, beating the street on both the top and bottom lines, with its Data Center segment more than doubling revenues over the year ago period. Management also provided better than expected guidance, something we had not seen a lot of times in recent years.

AMD had a decent growth outlook and strong balance sheet when I last looked at it. However, the only thing that prevented me from being a full believer was the stock’s valuation. The stock traded at an adjusted price to earnings ratio between that of competitors Intel (INTC) and Nvidia (NVDA), but above the average of those two, and the latter of which seemed to be a much better value then. Since my last article, going into Tuesday’s report, AMD had risen just over 10%, a bit more than the 6% gain in the S&P 500.

The Q3 earnings report:

Thanks to strong growth in the Data Center, AMD has been able to offset weakness in other parts of the business. The company a couple of years back was showing dramatic top line growth, but that stopped for a time in 2023. Going into Tuesday, analysts were expecting the best quarterly revenue growth on a percentage basis since late 2022 almost 16% to $6.71 billion. In the table below, you can see the company’s headline results.

Q3 Non-GAAP Results (Q3 Earnings Release)

AMD came in nicely ahead of the street for revenues. Record Data Center segment revenue of $3.5 billion was up 122% year over year, while the Client unit showed 29% growth. Unfortunately, Gaming revenues plunged by nearly 70%, while Embedded was down 25% but did rise on a sequential basis. As the company continues to grow revenues, it is also nice to see gross margins improving. AMD matched bottom line estimates, as it usually doesn’t blowout the street on the bottom line.

The problem for AMD on Tuesday afternoon was guidance. Management said that Q4 revenues would be $7.5 billion, plus or minus $300 million. That midpoint was a little shy of the street’s average estimate for $7.55 billion, a key reason why the stock sold off. However, I should note that AMD has been notorious for giving weak guidance, something that I previously covered. With the street expecting nearly 22.4% growth, the amount of the miss here on the midpoint turns out to be less than one percentage point of revenues, so it’s not exactly a terrible guide.

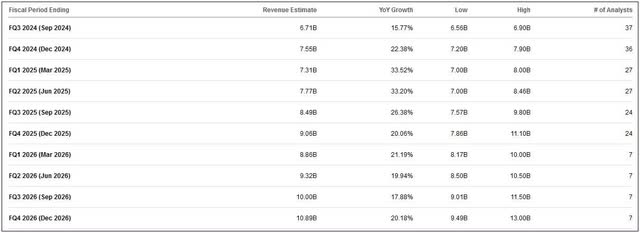

In addition to that guidance, AMD called for $5 billion in sales related to artificial intelligence, up half a billion from its previous forecast. That number was a bit disappointing to some that were expecting more growth as the company looks to take on Nvidia. Some of the problem here is with overall supply, as AMD outsources its production to Taiwan Semiconductor Manufacturing (TSM). Still, as the artificial intelligence boom continues into the coming years, analysts went into Tuesday’s report expecting decent revenue growth as seen in the graphic below.

AMD Revenue Estimates (Seeking Alpha)

The solid balance sheet:

Now that AMD is generating some decent profits, solid free cash flow is finally being delivered. Through the first nine months of this year, AMD generated $1.314 billion of free cash flow, up from $879 million in the nine-month period for 2023. AMD finished Q3 with over $4.5 billion in cash and investments on the balance sheet, against just over $1.7 billion in debt.

One hope in the coming years is that growing revenues leads to more profits and thus higher free cash flow. This will allow the company to spend more on share buybacks, hopefully getting the share count back down from its post-Xilinx acquisition highs. During Q3, AMD spent $250 million to repurchase shares, although this barely moved the diluted share count from Q2 levels. The company has spent just over $600 million on shares in the first 9 months of the year, although that’s down about $150 million from 2023 levels.

A look at current valuations:

AMD went into earnings trading at roughly 29.5 times its expected calendar 2025 earnings per share, down from over 41.5 times back in March, while competitor Intel goes for less than 20.5 times. Intel is expected to show more earnings per share growth next year on a percentage basis, but that’s only because earnings have been significantly depressed recently as the chip giant looks to get its growth story back on track. AMD is also expected to show more than triple the revenue growth percentage that Intel is in 2025.

When we look at Nvidia, the situation is quite different. Nvidia shares go for about 34.9 times its January 2026 fiscal year expected earnings. Nvidia is expected to show about almost 50% more revenue growth (in percentage terms) than AMD, but AMD is expected to show a higher earnings growth rate. Of course, Nvidia has become the clear revenue leader in this space in recent quarters. Its massive sales and earnings growth has made its growth rates moving forward come down quite significantly as it deals with the law of large numbers rather than struggling sales.

Final thoughts and recommendation:

AMD’s Q3 report on Tuesday was a little mixed, definitely featuring something for everyone. Revenues topped street estimates as Data Center growth continued to top 100% year over year, while the adjusted bottom line matched expectations. On the flip side, current quarter guidance was a tad light, and the company didn’t raise its AI revenue figure for this year as much as hoped.

I’m going to upgrade my rating on the stock to buy thanks to the after-hours dip. The nearly 8% fall puts AMD’s adjusted price to earnings valuation right near the Intel / Nvidia average instead of a few points above previously, which I discussed previously was key for my rating. Revenue growth is projected to accelerate in the coming quarters, and hopefully we’ll see share repurchases pick up steam too. The average price target on the street entering earnings was $188, so even if that comes down a few bucks, you’d still be looking at around $20 of upside from where the stock finished Tuesday’s extended hours trading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.