Summary:

- AMD’s recent acquisitions of Silo AI and ZT Systems create a full-stack offering for data center infrastructure design and may boost EPYC and Instinct sales growth.

- AMD is ramping up production of the MI325 and MI350 GPUs in 2h25 and remains on track to release Mi400 in 2026.

- AMD trades at a significant discount to the market, providing room for growth both through operations and multiple expansion.

luza studios/E+ via Getty Images

Advanced Micro Devices (NASDAQ:AMD) recently announced their acquisition of ZT Systems in a deal valued at $4.9b. Though this deal will not necessarily be directly accretive to the top-line, management anticipates the acquired design team will create synergies across the company and accelerate their go-to-market strategy for their Data Center segment. I am reiterating my STRONG BUY recommendation for AMD shares with a price target of $225/share at 11x eFY25 price/sales.

Be sure to catch up on my most recent research covering AMD:

AMD Is About To Accelerate Their Growth Strategy (Earnings Preview)

AMD Operations

AMD is progressing forward to becoming a full-stack data center design enabler with their recent acquisitions of Silo AI and, more recently, ZT Systems. These two acquisitions are expected to help AMD accelerate growth across multiple verticals, leveraging the expertise of each respective firm. Silo AI was acquired in q2’24 for $665mm in cash on July 10, 2024, with the intent of absorbing the 300 scientists and engineers to bolster AMD’s software capabilities.

Silo AI should help AMD bolster their embedded segment and services capabilities across multiple nodes, including industrial IoT, automotive, and other industries that can leverage LLMs. Silo AI’s MLOps ideology helps companies modernize their machine learning’s capabilities for more autonomous capabilities. I believe this acquisition will help AMD create a more complete product as the firm takes aim at embedding their MI300X GPUs as the go-to chip for AI training and inferencing. This may also create an additional services capability, as the additional data scientists and engineers can work one-on-one with enterprise and hyperscaler customers in helping them develop their AI/ML vision.

The ZT Systems acquisition was announced on August 19, 2024, in a cash/stock (75/25) deal valued at $4.9b, adding a similar benefit to AMD on the infrastructure architecture side of the business. ZT Systems is similar to Super Micro Computer (SMCI) with respect to their server rack manufacturing business, which AMD intends on carving out going into the acquisition. This move falls in line with AMD’s fabless business model in which the company is seeking to remain capital-light and continue to outsource the manufacturing capabilities. In turn, AMD intends on leveraging ZT System’s 1,000 design engineers to help design a more optimized stack for their customers. Though the acquisition may not directly be accretive to AMD’s business in the sense of generating additional revenue directly, I believe that it may passively help accelerate AMD’s growth trajectory by helping customers design a more optimized and complete system across CPUs, GPUs, networking, and server racks. From my perspective, the design team will help customers build out the schematics of the server rack for the infrastructure aggregators to manufacture and ship out to the end-customer. Management believes that this will help accelerate sales for AMD’s MI300X & MI400 series GPUs going forward. The acquisition is expected to close in 1h25 and will add an additional $150mm in opex as a result of the additional headcount. Management believes that the additional opex will be minimally dilutive to margins given the accelerated growth in GPU sales. This may also help accelerate sales of AMD’s EPYC CPU + Instinct GPU in tandem across both enterprises and hyperscalers for both training and inferencing AI/ML models.

AMD Financials

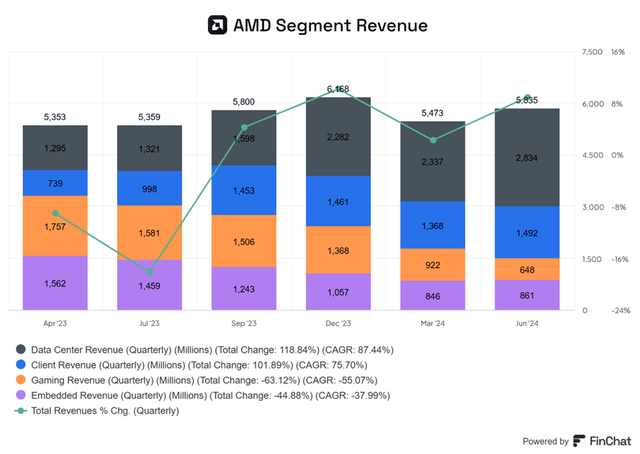

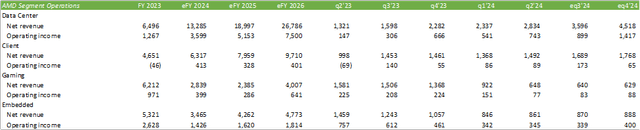

AMD reported a strong end to 1h24 with 9% top-line growth and a strong adjusted operating margin of 22%. AMD’s growth was driven by strong data center sales for their Instinct & EPYC GPUs & CPUs.

Data center revenue growth continued its exceptionally high level of 115% with the Client segment coming up 49% year-over-year. Management suggested on the q2’24 earnings call that there remains some supply constraint for the MI300 chip and anticipates further ramp going into the end of eFY24. MI325 is expected to begin ramping in 1h25 with MI350 following later in 2025. Management did note that the architecture across the series is relatively similar and that customers will be able to interchange GPUs. MI400 remains set to launch in 2026. MI350 is expected to improve performance by 35x on the CDNA 4 architecture when compared to their CDNA 3 architecture. The MI400 will be powered by their CDNA Next architecture.

Client compute appears to be turning a corner with sequential growth and may continue this trajectory going into the end of eFY24 as customers undergo their next refresh cycle. Improved endpoint demand was also voiced by Intel Corp. (INTC) in their recent earnings release. AMD launched their Zen 5 products for notebooks and desktops, which should help AMD embed themselves in the AI PC space. Sales may be accelerated with the Windows 11 update as Zen 5 is said to boost the performance of the endpoints. AMD believes that the new architecture can boost performance for productivity and creative tasks by 10% and 25% for AI tasks. The technology has also been found to boost performance of popular games like Far Cry 6 and Cyberpunk 2077 by 13% and 7%, respectively. I suspect PC and laptop growth will be driven by enterprises, with consumer sales being a laggard as a result of the challenging economic environment.

Gaming continued its downward trajectory, offsetting some of the growth driven by Data Center and Client. As suggested in my previous report covering AMD, I believe there will be a series of new console releases in the coming years that may turn this segment back to growth. Embedded was also a pull on results, with a decline of -41%. Though it is too early to tell, Silo AI may help improve growth in eFY25 for enabling smart factories and other industrial capabilities.

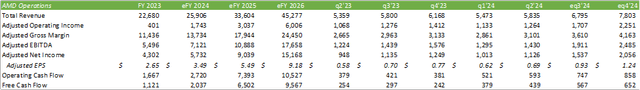

Looking to q3’24, I forecast AMD to deliver $6.75b in revenue and $0.93/share in adjusted EPS driven by significant Data Center growth and sequential improvement in Client. I forecast Gaming and Embedded to remain in flux as the two segments find their grounding. This is slightly above consensus estimates of $6.7b in revenue and $0.91/share in adjusted EPS. Given the growth backdrop and the improved supply chain, I believe AMD is well positioned to realize substantial growth as the firm expands their Instinct and EPYC offerings.

For eFY24, I am increasing my forecast to $25.9b in revenue and $3.49/share in adjusted EPS driven by these same factors. I’m forecasting a strong turnaround in Embedded come eFY25 and eFY26 driven by the recent acquisition of Silo AI as the firm may gain additional grounding in industrials and automotive.

AMD Risks

Bull Case For AMD

AMD is a value play, trading at 10.90x trailing price/sales when compared to their peer Nvidia (NVDA) at 40x. AMD shares have significant room for growth both driven by operations and their trading multiple. In terms of their growth drivers, AMD’s recent acquisitions of Silo AI and ZT Systems provide a more complete AI infrastructure offering from a design perspective, combining silicon, server, networking, and software. These acquisitions may also boost AMD’s go-to-market strategy in engaging enterprises for their private data centers, given the complexity of AI infrastructure.

Bear Case For AMD

The broader economy may be slowing down and may result in slower enterprise sales. This may lead to margin compression given the competitiveness in the hyperscaler space. If AI production applications prove not to provide a strong business case for cost savings or revenue generation, enterprises and hyperscalers may reduce investments within the space. This may lead to slower top-line growth going into eFY25 & eFY26.

AMD Valuation & Shareholder Value

AMD shares are currently trading at 10.90x trailing price/sales, significantly off of their peak valuation in March of 15x. This may provide room for AMD shares to realize some expansion to their trading multiple in the coming months as the firm ramps up production for their Instinct GPUs and releases their MI325 & MI350 series GPUs.

Looking at their peers, AMD appears to be undervalued, especially when considering the market cap-weighted average trading multiple of 32.92x price/sales. Taking NVDA out of the mix, this average falls to 13.45x, maintaining the discount narrative. At 13.45x price/sales, AMD shares should trade at $191/share.

Using an internal valuation method based on historical trading premiums and the relative probability of trading at that range, I believe AMD shares should be priced at $255/share at 11x eFY25 price/sales. I reiterate my STRONG BUY recommendation for AMD shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.