Summary:

- Advanced Micro Devices, Inc.’s Q3 2024 earnings pullback is a dip-buy opportunity due to strong AI and data center momentum, with data center revenue surging 122% YoY.

- Significant customer wins with Meta and Microsoft validates AMD’s AI capabilities, positioning it for continued market share gains and robust growth in AI accelerators.

- AMD’s valuation, despite being higher than the sector median, is justified by its exceptional execution, strong profitability metrics, and superior growth prospects in AI and data centers.

- Risks include competition from Nvidia and Intel, potential custom silicon solutions from hyperscale customers, and manufacturing capacity constraints, but AMD’s strategic investments and product roadmap mitigate these risks.

sankai

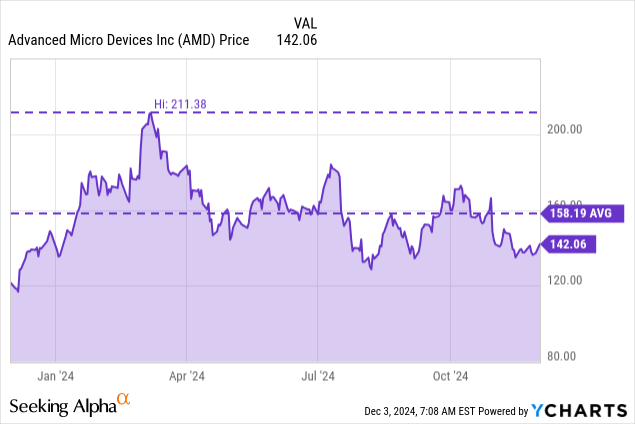

The recent pullback in Advanced Micro Devices, Inc. (NASDAQ:AMD) stock following its Q3 2024 earnings report presents what, I believe, is a Dip-Buy opportunity for long-term investors. Because of AMD’s accelerating momentum in the artificial intelligence and data center markets, backed by strong financial performance that positions the company for sustained growth.

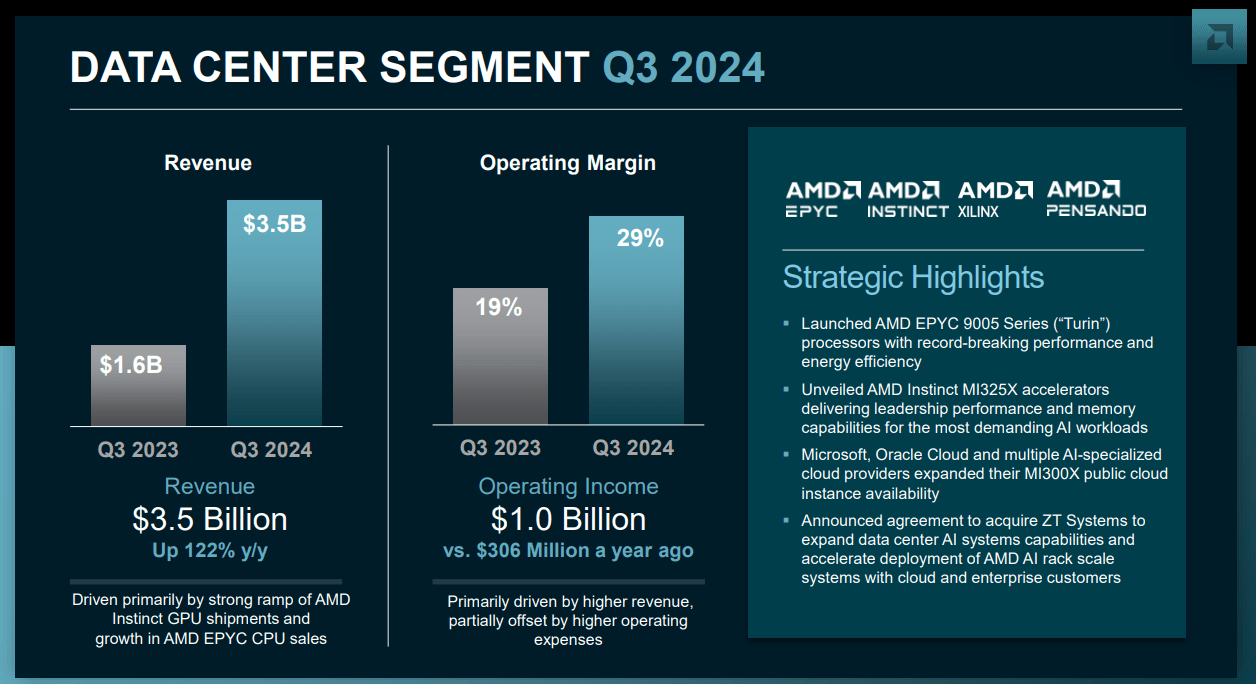

AMD’s remarkable execution in the data center segment has emerged as the company’s primary growth engine. The third quarter results revealed an extraordinary surge in data center revenue, which more than doubled YoY with a 122% increase to reach $3.5 billion. This segment now represents 52% of AMD’s total revenue, marking a fundamental shift in the company’s business toward higher margin AI-driven opportunities. The growth was broad-based, encompassing both traditional server CPUs and AI accelerators.

What makes this performance particularly impressive is the rapid market acceptance of AMD’s AI solutions. When the company began 2024, management projected data center GPU revenue of approximately $2 billion for the year. As deployment velocity accelerated and customer adoption expanded, this forecast was raised to $4.5 billion in July. Now, with strong validation from major customers like Meta (META) and Microsoft (MSFT), AMD has further increased its outlook to exceed $5 billion in AI chip revenue for 2024. This dramatic upward revision in projections within a single year demonstrates the company’s growing competitive position in the AI accelerator market.

The strength of AMD’s AI momentum is evidenced by significant customer wins. Meta has deployed AMD’s MI300X accelerators to handle all live traffic for their demanding Llama 3.1 405B frontier model, while Microsoft has expanded its use of MI300X accelerators across multiple Copilot services. These high-profile deployments validate AMD’s technical capabilities for further market share gains. The company’s ROCm software stack has also made substantial progress, with inferencing performance improving 2.4x since launch and training performance increasing by 80%.

To strengthen its competitive position and accelerate market penetration, AMD has made strategic investments recently.

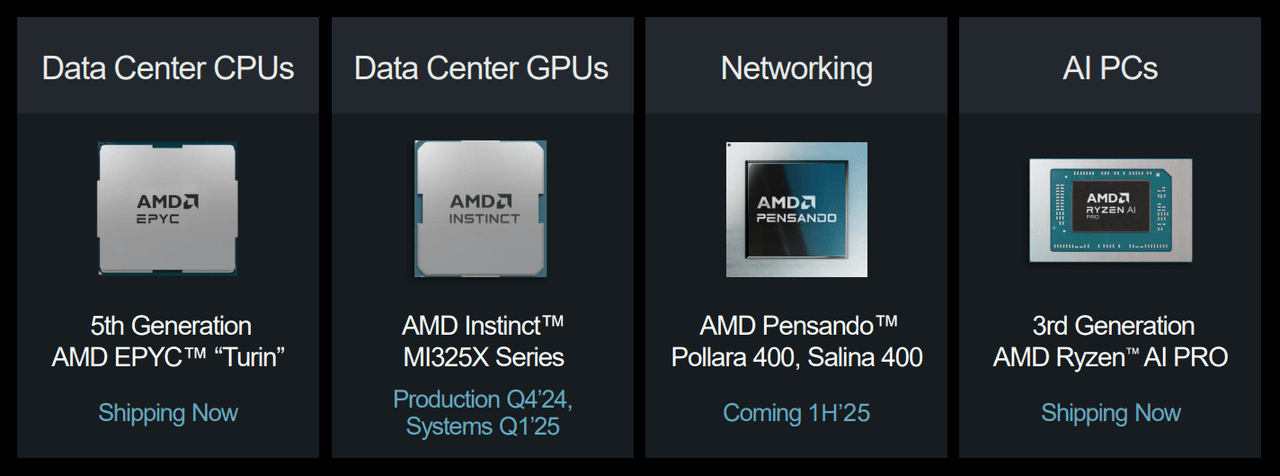

AMD projects the AI accelerator TAM will grow at more than 60% annually to reach $500 billion by 2028, representing an enormous growth opportunity. The company is executing an aggressive product roadmap to capture this opportunity, with the MI325X accelerator launching this quarter, followed by the MI350 series in late 2025 and the MI400 series based on CDNA Next architecture in 2026. This steady cadence of new products combined with AMD’s expanded system-level capabilities and strengthened software stack positions the company to compete effectively for a growing share of the AI infrastructure market.

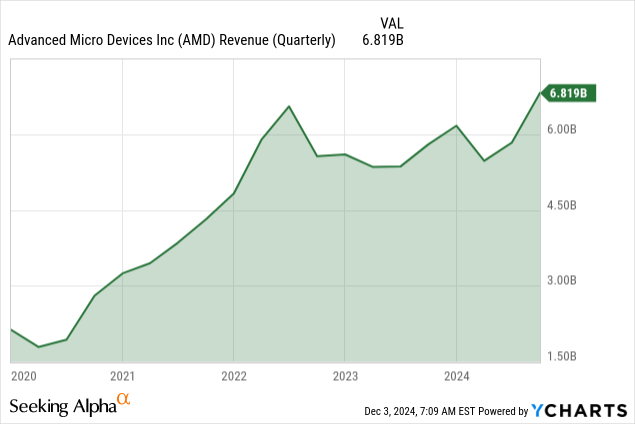

AMD’s Q3 financial results underscore the company’s strong execution, with overall revenue growing 18% YoY to $6.8 billion and gross margins Non-GAAP expanded 300 basis points to 54%. Operating income Non-GAAP increased over 34% to $1.72 billion, demonstrating solid operating leverage as the business scales. With Q4 guidance calling for approximately $7.5 billion in revenue representing 22% YOY growth, AMD’s momentum shows no signs of slowing.

Record-Breaking Data Center Growth Driven by AI Acceleration

AMD’s third quarter results revealed the company’s data center business transformation, marking an inflection point in both scale and market position. The data center segment delivered extraordinary growth, with revenue soaring 122% YoY and an operating margin of 29% sequentially to reach a record $3.5 billion.

AMD Q3 Presentation Deck

This remarkable performance has elevated the data center segment to become AMD’s largest revenue contributor now accounting for over 50% of total company revenue. More importantly, the segment’s operating income more than tripled compared to the prior year, demonstrating powerful operating leverage as the business scales.

The growth story in AMD’s data center business is multifaceted, driven by strong execution across both traditional server CPUs and emerging AI accelerators. In the server CPU market, AMD’s EPYC processors are gaining popularity both among cloud providers and enterprise customers. Meta’s deployment of more than 1.5 million EPYC CPUs across their global data center fleet is evidence of those processors’ performance and reliability at scale. This massive deployment supports Meta’s critical social media platforms and demonstrates AMD’s ability to meet the stringent requirements of the world’s largest technology companies.

The momentum in cloud deployments has been particularly noteworthy. Public cloud instances powered by EPYC processors increased 20% YoY to exceed 950 instances, with major providers like Microsoft Azure, AWS, and others expanding their AMD-powered offerings. Cloudflare’s selection of AMD’s Genoa-X processors for their next-generation servers highlights the competitive advantages of AMD’s 3D chiplet stacking technology. These servers have demonstrated impressive capabilities, supporting twice as many requests per second while delivering 60% higher performance per watt compared to their previous generation.

Enterprise adoption has shown consistent strength, with AMD reporting five consecutive quarters of double-digit YoY growth in this segment. The company has secured significant wins with major enterprises across diverse sectors including technology (Adobe, Synopsys), aerospace (Boeing, Airbus), automotive (Daimler Truck), financial services (HSBC Holdings), and consumer goods (Nestlé). This broad-based adoption reflects the growing trust in AMD’s server platforms and the compelling total cost of ownership advantages of EPYC processors.

The launch of AMD’s fifth-generation EPYC processors (code-named “Turin”) has further strengthened the company’s competitive position. These new processors have already set more than 130 performance records across virtualization, database, AI, and business applications. The expanded platform ecosystem with more than 130 enterprise platforms in development from leading OEMs and ODMs provides a comprehensive solution stack for diverse customer needs.

Parallel to the success of traditional server CPUs, AMD’s Instinct GPU business has emerged as a powerful growth driver in the AI acceleration market. The adoption of MI300X accelerators has expanded significantly, with major cloud providers and AI companies deploying these chips at scale. Microsoft’s deployment of MI300X for multiple Copilot services powered by GPT-4 models demonstrates the accelerator’s capabilities in handling sophisticated AI workloads.

Oracle Cloud Infrastructure’s selection of AMD Instinct MI300X accelerators for its latest OCI Compute Supercluster further validates AMD’s competitive position. This platform is designed for demanding AI workloads and can scale up to 16,384 GPUs in a single cluster, demonstrating the platform’s capability to handle large-scale AI deployments. Customer feedback has been positive, with many reporting 30% higher performance compared to competitive offerings in specific inferencing workloads.

AMD’s data center momentum appears poised to continue with the launch of the MI325X accelerator. This new product extends AMD’s memory capacity and bandwidth advantages while delivering up to 40% higher inference performance compared to Nvidia’s (NVDA) H200. With production shipments starting in Q4 2024 and widespread system availability beginning in Q1 2025 through partners like Dell (DELL), Hewlett Packard Enterprises (HPE), Lenovo (OTCPK:LNVGY), and Super Micro (SMCI), AMD is well positioned to sustain its growth trajectory in the data center market.

Expanding Product Portfolio Driving Future Growth

AMD’s execution across its product portfolio demonstrates the company’s commitment to innovation and market leadership in both the data center and client computing segments. The breadth and depth of new product launches, coupled with a clear roadmap for future developments, positions AMD to capitalize on major market opportunities in AI computing and enterprise modernization.

Data Center

In the data center segment, AMD has launched its most ambitious processor family to date with the 5th Generation AMD EPYC processors, code-named “Turin.” These processors represent a significant leap forward in computing capabilities, featuring up to 192 cores and the new “Zen 5” architecture that delivers up to 17% better instructions per clock (IPC) for enterprise and cloud workloads. More impressively, the architecture achieves up to 37% higher IPC in AI and high-performance computing applications compared to the previous “Zen 4” generation.

The performance advantages of the new EPYC processors are substantial when compared to competitive offerings. Systems powered by the EPYC 9965 processor deliver up to 4x faster time to results on business applications such as video transcoding and up to 3.9x faster time to insights for scientific and HPC applications. In virtualized infrastructure, these processors achieve up to 1.6x the performance per core compared to Intel (INTC) processors.

On the AI acceleration front, AMD has outlined an aggressive product roadmap, starting with the MI325X accelerator. This new product builds on the success of the MI300X by extending memory capacity and bandwidth advantages while delivering higher inference performance compared to Nvidia’s H200. The timing of this launch is strategic with production shipments beginning in Q4 2024 and widespread system availability through major partners like Dell, HPE, Lenovo, and Super Micro starting in Q1 2025.

The MI350 series planned for launch in the second half of 2025 promises the largest generational increase in AI performance AMD has ever delivered. Development of the MI400 series based on the CDNA Next architecture is progressing well toward a 2026 launch, ensuring a steady stream of competitive products in the rapidly growing AI accelerator market.

Client Computing

In the client computing segment, AMD has achieved remarkable growth with revenue increasing 29% YoY to $1.9 billion in Q3 2024. This growth has been primarily driven by strong demand for the company’s latest generation Zen 5 processors across both desktop and notebook platforms. The desktop channel has seen significant double-digit growth following the launch of the Ryzen 9000 series processors, which offer leadership performance in productivity, gaming, and content creation applications.

A major focus for AMD in the client segment is the enterprise AI PC market. The company has launched its Ryzen AI PRO 300 Series processors, the first CPUs to combine enterprise-class security and manageability features with advanced AI capabilities for Microsoft’s Copilot+ experience. These processors deliver unprecedented AI compute capabilities with up to 50+ NPU TOPS (Trillions of Operations Per Second) of AI processing power, exceeding Microsoft’s requirements for Copilot+ AI PCs.

The timing of AMD’s enterprise AI PC push is particularly strategic given the upcoming end of support for Windows 10 in 2025. With more than 100 Ryzen AI Pro commercial platforms expected to launch in 2025, AMD is well-positioned to capture share as businesses refresh hundreds of millions of Windows 10 PCs. Major OEM partners including HP and Lenovo are on track to more than triple the number of Ryzen AI Pro platforms they offer in 2024 demonstrating strong ecosystem support for AMD’s vision.

Valuation Analysis

AMD’s third quarter financial results for 2024 demonstrate the company’s strong execution and growing operational leverage as it capitalizes on expanding opportunities in AI and data center markets. These gains more than offset declines in the gaming segment which fell 69% to $462 million, and the embedded segment which decreased 25% to $927 million. The shift in revenue toward higher margin data center products has had a significant positive impact on the company’s profitability metrics.

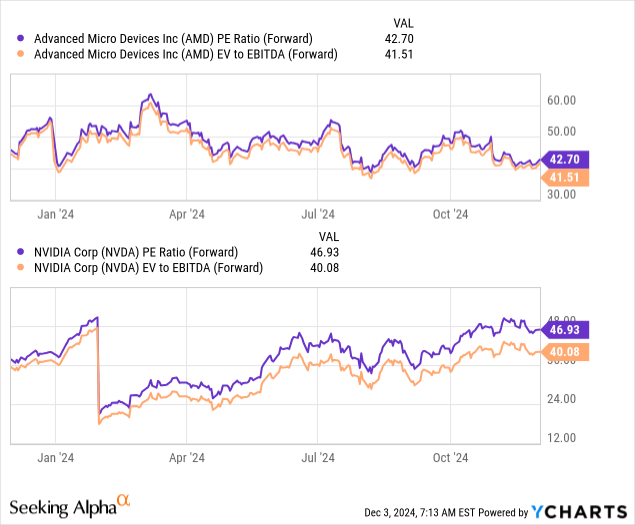

AMD currently trades at a forward P/E ratio of 42.7x, which is notably higher than the sector median of 25.7x. Similarly, the company’s EV/EBITDA multiple stands at 41.5x, compared to the sector median of 15.6x. While the absolute valuation metrics are elevated, they are justified by the company’s exceptional execution and significant opportunity in the rapidly growing AI and data center markets.

And to be honest, the semiconductor and tech sector is overvalued due to AI hype, but these stocks are unlikely to see significant reductions in valuation because of high investor expectations and long-term bets on growth in these sectors. As they say, “the trend is your friend.” With increasing demand for AI technologies and data center infrastructure, AMD is well positioned to benefit from these favorable trends.

Most significantly, AMD’s forward PEG ratio of 1.01x is substantially lower than the sector median of 1.9x, indicating that the stock is actually undervalued when accounting for its superior growth prospects. This more favorable PEG ratio is particularly noteworthy given AMD’s projected long-term EPS growth rate of 42.2% which far exceeds the sector median of 15.4%.

When compared to direct competitors, AMD’s valuation appears even more reasonable. Nvidia, the current leader in AI acceleration, trades at higher multiples with a forward P/E of 46.93x and an EV/EBITDA ratio of 40x. Intel, despite its challenges, trades at lower multiples but with negative earnings growth and declining margins. AMD’s valuation multiples position it between these extremes, offering a balanced combination of growth potential and reasonable valuation.

AMD’s profitability metrics further justify its valuation premium. The gross margin expanded substantially, reaching 54% on a non-GAAP basis, from the previous year’s 51%. This margin expansion reflects both the favorable shift in product mix and AMD’s successful execution in high-value markets. The company has maintained strong pricing power while managing costs effectively, resulting in improved profitability even as it invests in new product development and market expansion.

Operating expenses increased to $1.96 billion, up 15% YoY as the company continued to invest in research and development and go-to-market activities. However, this growth in operating expenses was well-controlled relative to revenue growth, leading to significant operating leverage. As a result, operating income Non-GAAP surged 34% YoY to reach $1.72 billion, with operating margin expanding to 25% compared to 22% in the prior year period.

The strength in operational performance translated directly to bottom-line growth, with non-GAAP earnings per share increasing 31% YoY to $0.92. This earnings growth was supported by effective cost management and improved operational efficiency, as evidenced by the company’s ability to grow operating income faster than revenue.

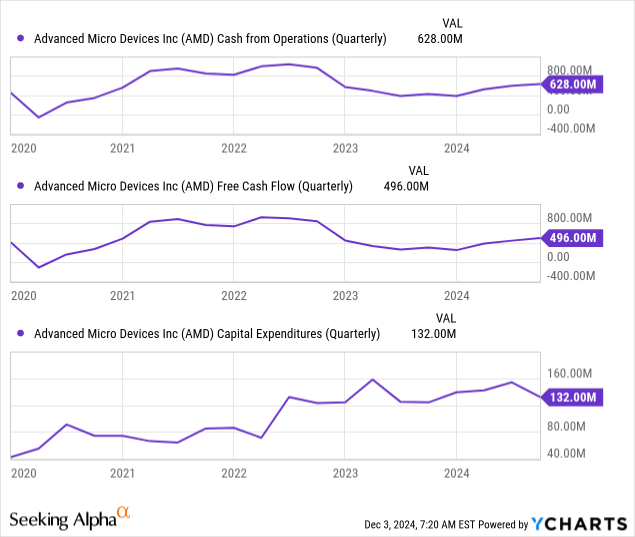

Cash flow generation remained healthy, with an operating cash flow of $628 million for the quarter, representing a 49% increase from $421 million in the same quarter last year. Free cash flow, adjusted for capital expenditures of $132 million, reached $496 million, demonstrating the company’s ability to generate significant cash while investing in future growth.

Looking ahead to the fourth quarter of 2024, management has provided a confident outlook that suggests continued momentum across key businesses. The company expects revenue to reach approximately $7.5 billion, representing robust YoY growth of 22% and sequential growth of about 10%. This guidance is particularly impressive given the challenging comparison to the prior year, and reflects management’s confidence in continued strong demand for data center and client products.

The fourth quarter gross margin is expected to remain the same. This stable margin guidance combined with the projected revenue growth suggests continued strong profitability and cash generation potential.

The company’s financial position remains solid with $4.5 billion in cash and short-term investments as of the end of Q3 2024. This strong balance sheet provides AMD with the flexibility to continue investing in growth opportunities while maintaining operational stability. With a debt-to-equity ratio of just 3.93%, AMD has maintained a conservative capital structure positions it well for future investments and market opportunities.

Competition And Risks

In the competitive landscape, AMD faces formidable challenges despite its recent successes. Nvidia continues to maintain its dominant position in the AI training market with an ecosystem advantage built around its CUDA platform that spans over a decade of development. Although AMD’s ROCm software stack has made significant progress, improving inferencing performance by 2.4x and training performance by 80% since launch, it still needs to close the gap with Nvidia’s mature software ecosystem.

Intel’s renewed focus on improving its position in both the server CPU and AI accelerator markets. Intel’s manufacturing investments and its extensive enterprise relationships could pose challenges to AMD’s market share gains, particularly in traditional data center workloads. The creation of an x86 ecosystem advisory group with Intel, while positive for standardization, also indicates the ongoing need to collaborate with their primary competitor to maintain platform relevance.

A potentially more disruptive competitive threat comes from hyperscale customers developing their own custom silicon solutions. Amazon’s revelation that its largest data center customers are using its Graviton chips, and reports of OpenAI working with Broadcom (AVGO) on custom AI chips, highlight a trend toward vertical integration. This could limit the total addressable market for merchant AI accelerators. This trend could impact AMD’s long-term growth prospects in the data center segment, which currently represents over 50% of the company’s revenue.

Manufacturing capacity constraints pose an ongoing risk, particularly given the strong demand for AI accelerators. While AMD has reported improvements in supply chain execution, with Q3 performance exceeding expectations partly due to better supply availability, maintaining adequate capacity as demand scales will be crucial. The company’s inventory levels increased by $383 million sequentially to $5.37 billion in Q3, primarily to support data center product ramps indicating the significant working capital requirements of managing supply chain constraints.

Bottom Line

The recent pullback in AMD shares presents an attractive entry point for long-term investors. The company’s strong execution in data center and AI, strategic investments in end-to-end capabilities, and expanding product portfolio position it well to capture share in the fast-growing AI accelerator market. I believe the current valuation adequately compensates investors while providing significant upside potential as AMD continues to execute its AI strategy.

Looking ahead, I expect AMD to maintain strong momentum through 2025 driven by:

-

Continued data center share gains with new EPYC and Instinct products

-

Expanding AI revenue streams across training and inference workloads

-

Operating leverage driving margin expansion.

For these reasons, I recommend investors use the current weakness as an opportunity to build or add to positions in AMD stock with a multiyear investment horizon.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.