Summary:

- Recent declines in the AI/chip sector present a buying opportunity for high-quality stocks like Advanced Micro Devices, Inc.

- AMD is well-positioned in the AI sector and could benefit from the industry’s growth.

- AMD’s stock appreciation should be viewed as a gradual process, and investors should expect periods of consolidation and pullbacks.

- AMD’s stock has experienced a significant pullback, but it is expected to resume its long-term uptrend soon.

JHVEPhoto

The AI/chip sector has faced some challenges recently, but this is part of the investment journey. Many AI-related stocks have seen rapid appreciation, which could be seen as a temporary “overhype.” However, investing is a long-term commitment, not a quick race. We shouldn’t expect endless gains. Instead, we can strategically invest in high-quality stocks at attractive buy-in levels. In this context, the recent declines present an excellent opportunity to consider adding more Advanced Micro Devices, Inc. (NASDAQ:AMD) stock to our portfolio.

AMD has emerged as one of the AI sector’s top performers, particularly during the recent bull market phase. Its market-leading position in the GPU space, essentially powering the AI revolution, positions it as a significant beneficiary of AI’s growth.

Yet, we must consider that we are in a cycle. Stock appreciation is a gradual process. Thus, we should not expect everything to happen too quickly. Instead, we should anticipate the consolidation and pullback phases and use such opportunities wisely to accumulate shares in our favorite stocks like AMD.

AMD’s Buying Opportunity Is Here

I encourage people to view investing and stock appreciation as a gradual process, not a “get-rich-quick.” Also, this dynamic is not AMD-specific and concerns many high-quality companies feeling post-earnings selling pressure, especially in the AI space (like Palantir (PLTR)).

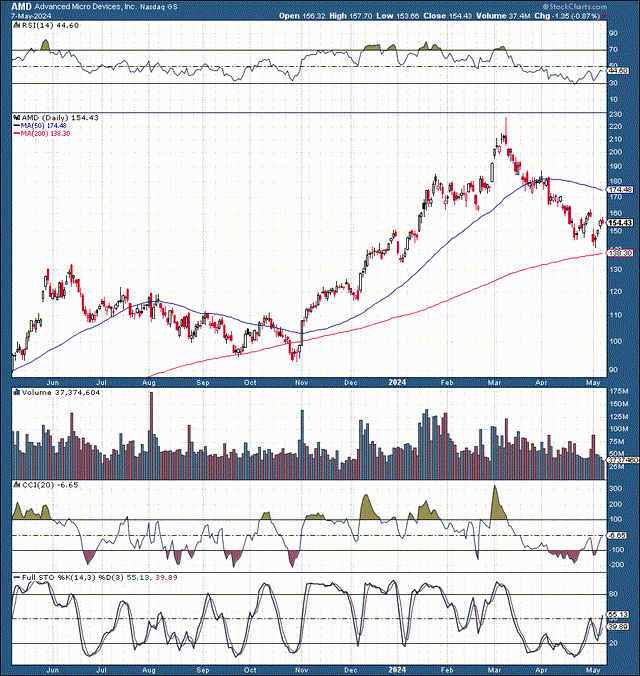

AMD’s stock appreciated by approximately 150% from its correction low (around $90) in November 2023 to its recent high of around $230. This enormous move occurred over a four-month time frame, making it extreme and making the probability of a substantial pullback highly likely.

Since the highs, we’ve seen AMD fall into our $160-140 buy-in zone, as the share price corrected by 30-40%. This dynamic did not occur because AMD lost its AI prospects. Instead, the selloffs occur as a healthy market phenomenon necessary to bring technical and valuation-related conditions back in line after emotional and sometimes irrational moves higher.

We’ve seen the RSI come down to 30. The stock became briefly oversold. AMD declined considerably, almost touching down on the 200-day MA. We’re seeing a constructive recovery pattern, and the stock should resume its long-term uptrend soon.

There Was Nothing Wrong With AMD’s Earnings

AMD’s top and bottom lines beat estimates. AMD announced record data center segment revenues of $2.3B, an 80% YoY increase. Client segment revenues were $1.4B, an 85% YoY surge. While gaming and embedded revenues were down YoY, these may be transitory phenomena, and these segments could improve as the economy returns to more significant growth in future quarters.

Regarding Q2 guidance, AMD announced $5.7B in revenues (plus/minus $300M). This guidance was in line with consensus estimates, and the market likely wanted more from AMD. This is what happens when segments become overhyped. As with AI now, everyone wants just better and better results every quarter. However, that is not indicative of reality.

The reality is that we’re not going to see “Nvidia moments” often in many companies. Instead, we will likely see gradual increases in stock prices, with many trading opportunities around the peaks and troughs. Still, the end goal is a much higher stock price for AMD and other high-quality AI stocks.

Remarkable Potential Ahead

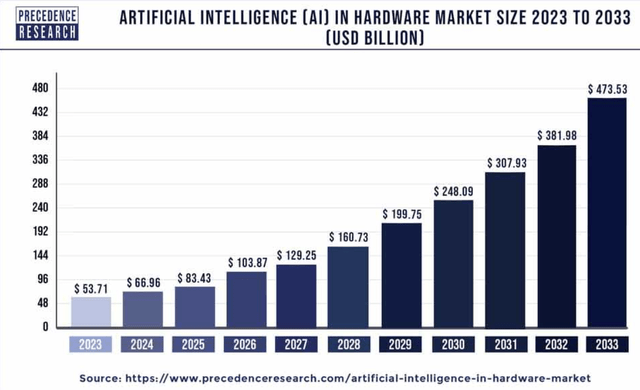

Hardware AI growth (precedenceresearch.com)

The size of the hardware-related AI market could increase by about tenfold over the next ten years. This dynamic should unlock enormous opportunities for AMD, as it remains one of the chip juggernauts powering the AI revolution. AMD retains market-leading positions in such applications as data center and cloud, AI PCs, adaptive and embedded, gaming, and more. Therefore, AMD has a long growth runway to increase revenues and improve profitability considerably in future years.

AMD Likely To Achieve Massive EPS Growth

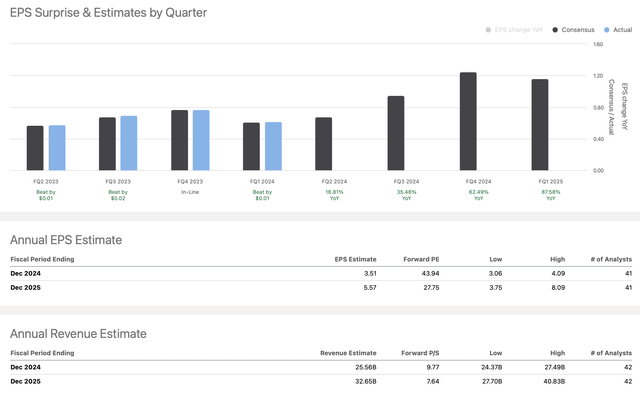

EPS estimates (seekingalpha.com)

The first factor to underscore is that AMD often surpasses consensus estimates. This dynamic implies that AMD should at least meet and potentially beat future EPS forecasts. Another element to underline is that we should see impressive EPS growth this year.

The 2024 Q4 EPS is projected to rise 62% and Q1 2025 by 88% YoY. In Total, AMD could have around $4 in EPS this year and $6-7 in EPS in 2025. AMD could achieve $7-8 in EPS in a bullish scenario next year.

If AMD achieves $6 in EPS next year, its stock trades around 24 times forward earnings. However, if AMD achieves $7 in EPS next year (my estimate), its stock will trade only around 20 times next year’s earnings here.

Regardless of the outcome, the fact remains that 25-20 times forward earnings is a reasonable valuation considering AMD’s robust growth and profitability prospects. This makes AMD’s stock an increasingly attractive investment opportunity.

The Bottom Line: AMD’s Stock Remains Hot

The bottom line is that AMD is a hot company with a hot stock, even if it has been in a cooldown phase for a while now. Also, we should remember to stay patient and realistic. It’s normal to see considerable gains, but there will be periods of deflation and substantial corrections, as we’ve seen recently with AMD and many other high-quality stocks. Still, we are early in the AI ballgame, and AMD could become one of the prime beneficiaries as its GPUs and other AI technologies are in high demand. Despite the recently volatile period, AMD could move higher again soon. My year-end price target range for AMD remains $225-250, roughly 60-80% higher from here.

Where AMD’s stock price could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $27 | $37 | $45 | $52 | $60 | $70 | $80 |

| Revenue growth | 19% | 37% | 21% | 18% | 16% | 15% | 14% |

| EPS | $4 | $7 | $9 | $11 | $13 | $15.2 | $17.8 |

| EPS growth | 50% | 75% | 29% | 22% | 18% | 17% | 17% |

| Forward P/E | 30 | 31 | 32 | 33 | 32 | 31 | 30 |

| Stock price | $210 | $280 | $352 | $429 | $486 | $552 | $615 |

Source: The Financial Prophet.

Risks to AMD

AMD faces numerous risks, including competition from Nvidia (NVDA), Intel (INTC), and other chip industry leaders. Moreover, some of AMD’s businesses are cyclical and could be impacted by a slow economy and high-interest rates for longer (if it happens). AMD also faces the risk of possible margin compression due to inflation and other challenging factors. Investors should carefully examine these and other risks before investing in AMD stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASSETS MENTIONED either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!