Summary:

- I maintain a Buy rating on Advanced Micro Devices, Inc. shares despite short-term valuation concerns, as Q3 results highlighted strong AI-driven growth in the Data Center segment.

- AMD’s Q3 revenue reached $6.8 billion, beating estimates, with Data Center revenue up 122% year-over-year, driven by AI demand.

- Weakness in the Gaming and Embedded segments is overshadowed by AI growth; management would be wise to focus capital on Data Center opportunities for now.

- Long-term risks include the cyclical nature of semiconductor stocks and geopolitical tensions, urging caution for long-term investors despite the current AI boom.

John M Lund Photography Inc

In my Q3 preview of Advanced Micro Devices, Inc.(NASDAQ:AMD), I assigned a Buy rating, even though I recognized that the stock was relatively overvalued. Now that Q3 results have been released, the stock has fallen sharply in the following hours. This was primarily because the management guided for revenues below the consensus for Q4, although its Q3 normalized EPS was in line with the consensus estimate. Its decline in Gaming and Embedded segments was disappointing, but this is not enough to detract from the growth seen in its Data Center segment, fuelled by AI demand. Given the price decline following the Q3 results, this appears to be a further buying opportunity.

Q3 Earnings Review: Growth in AI More Than Offsets Weakness Elsewhere

AMD reported revenue of $6.8 billion for Q3 2024, which is an 18% year-over-year increase, beating the analyst estimates of $6.71 billion.

Moreover, the company reported earnings of $0.92, which was in line with analyst expectations.

These are the two strong highlights, but as I mentioned, the large area of weakness was in AMD’s Q4 guidance of $7.5 billion, which is lower than the consensus $7.55 billion expectation. This is obviously the most important element for investors, given how much of the company’s future growth is already priced into the stock valuation.

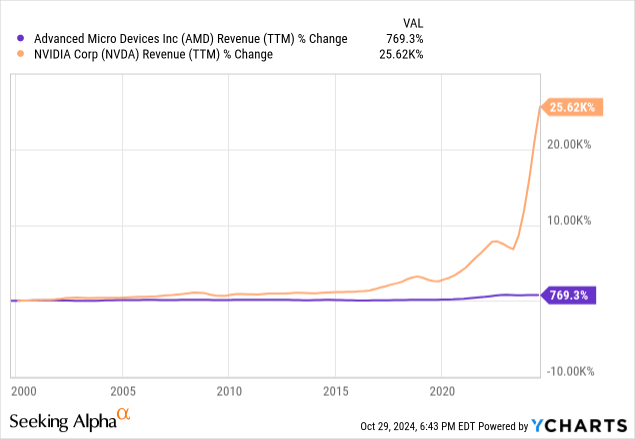

Firstly, I think the company’s achievements in its Data Center segment really need to be appreciated. With a vast 122% year-over-year growth, AMD is proving vital to the AI infrastructure market. This has primarily been supported by the ramp-up of AMD Instinct GPU shipments, as well as strong sales of EPYC CPUs. This is particularly noteworthy—there are obvious similarities between AMD and Nvidia (NVDA), and I do expect cyclical AI spending dynamics to affect both of these companies eventually, but for now, both businesses are maintaining robust demand due to the insatiable appetite Big Tech companies have in the AI arms race for more AI compute. Indeed, Goldman Sachs Research estimates that global data center demand could increase by 160% by 2030. Moreover, in the U.S., data centers are expected to account for 8% of total power demand by 2030, up from 3% in 2022—supporting this growing demand, McKinsey estimates that providing the additional capacity needed in the U.S. alone would require an investment of over $500 billion in data center infrastructure by the end of the decade—needless to say, the long-term growth thesis for AMD (affirmed in Q3) is very much intact.

The AI growth thesis is why I am not too concerned about the 69% year-over-year decline that AMD reported in its Gaming segment in Q3 or the 25% year-over-year decline that the company reported in its Embedded segment for the quarter. The Gaming segment’s weakness can primarily be attributed to a slowdown in orders from major gaming console manufacturers, likely the result of weaker demand due to no new console models entering the market recently. In terms of the Embedded segment, clients have likely reduced orders to prevent excess inventory, especially due to the rapid nature of technological change right now.

Given that these results showed strength where it counts—in AI-related revenues—I hope that management will continue to consolidate its position here and taper its focus on its other segments for now. While the Client segment also performed well, with revenue increasing by 29% year-over-year, this is also a segment that deserves less attention than AI right now. In other words, management should be heavily redirecting capital toward its Data Center segment while the opportunity is still golden.

Valuation Analysis: AMD Is Currently Well-Positioned for Near-Term and Medium-Term Growth

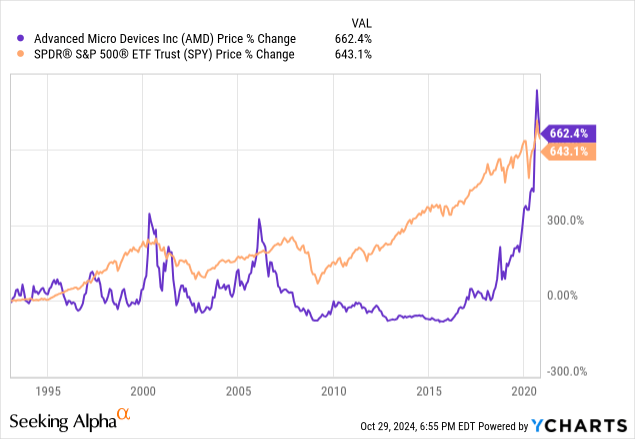

In after-hours trading, the stock is selling for approximately $153. As this is a moderate contraction from the $160 at the time of my earnings preview, the medium-term growth thesis is undoubtedly still alive for AMD investors.

I’m very bullish on AMD for next year—I think we’re going to see unexpected demand for AI continue, especially if interest rates drop. If demand for data center expansion has been this high with interest rates at abnormally high levels of over 5%, I expect that if this drops to 2.5% to 3% over the next two years, this should at least help to sustain the valuation of major semiconductor companies.

I estimate we’ll see AMD’s total revenue reach $34 billion for FY25, and that AMD’s stock will trade at a P/S ratio of 10. At a market cap of $340 billion, the company would have grown by 31.4% in 12 months. This is my bull-case outlook.

However, in reality, the valuation of AMD is vulnerable, and if demand for data center expansion proves less resilient over the next year, we may receive consensus estimate misses throughout the year. In this case, I expect a P/S ratio of approximately 9 could occur. With total revenue of $32 billion in FY25, the company’s market cap would be $288 billion at this bear-case valuation. Even in this scenario, there is still a likely 11.3% valuation growth—therefore, AMD is certainly a Buy at today’s valuation.

Nevertheless, similar to my thesis on Nvidia, I’m still skeptical about the long-term position of both companies. Nvidia is perhaps a little more vulnerable to decline right now, given its forward P/S ratio of 27.5—but it certainly has the growth rates to validate this valuation at the moment.

Because Nvidia is growing at such a fast pace and has a very high valuation compared to AMD, my rating is a Hold for the former and a Buy for the latter. I expect that both companies will face a typical semiconductor valuation contraction in due course, but we’re quite some way from that right now. While the waterfall edge is somewhere in the distance while we row our AI boats along, it actually can’t be seen yet—let’s just make sure we don’t fall asleep while the going is good.

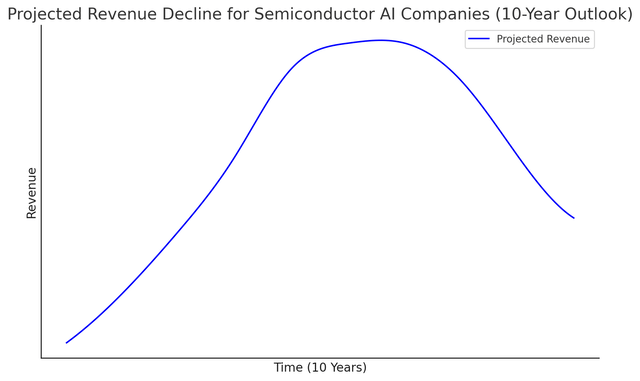

Long-Term Risk Analysis: The Uptrend Is Temporary

We need to remember that semiconductor stocks are cyclical—the AI boom is no different. Due to capex and ROI constraints, we are likely to see periods of high growth for semiconductor AI companies lasting many years (like right now) and then a period of temporary decline. It can be guaranteed that as total revenues decline for these semiconductor companies, so will their stock prices. Therefore, I urge long-term investors to proceed with caution. Unlike a slow-and-steady free cash flow machine as diversified as Microsoft (MSFT), AMD cannot be bought and held passively “forever” unless one is willing to experience heavy cycles of volatility, which I consider unfavorable and counterproductive to attaining the highest alpha.

Author’s Graph

Moreover, let’s not forget the big caution I outlined in my earnings preview—geopolitical tensions are currently severe. Many readers and investment professionals have told me that portfolios should not be mitigated against an invasion of Taiwan by China as this would lead to a global depression, and yet China continues to perform regular drills around the country. In my estimation, the risk is very real, even if an invasion is unlikely. Irrational acts often get committed in times of war. As a result, it doesn’t seem unreasonable to me for portfolios to be skewed toward bonds, gold and silver more than in a typical bull market right now. We’re at risk of hitting a severe recession in the West (a risk I believe intensifies under a potential Democratic President in the White House due to less focus on fiscal restraint than the Republicans), and I fear that under recessionary pressures, China would be more prone to attack based on our economic weakness. Could it be that a hotter geopolitical environment manifests in 2027 or 2028? Based on my analysis, I do believe so—unless Trump can moderate international relations and improve our economic condition in America. Therefore, let’s not be too heavily invested in AI for the sake of high growth when undervalued geopolitical catalysts could turn these large unrealized gains into big unrecoverable losses.

Conclusion

AMD is a tempting AI investment, especially as in Q3, the company reaffirmed that its strong position in AI continues to perform well, with its Data Center segment growing by 122% year-over-year. Despite the company’s Q4 guidance coming in below the consensus estimate, this shouldn’t really be enough to rationally deter medium-term cyclical investors who are allocating to the company based on AI growth.

That said, these same investors should be careful that they don’t fall asleep at the wheel. A major decline is certainly a possibility in the next five to 10 years, if not before, depending on how Big Tech AI spending trends develop.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.