Summary:

- While a low Q4 revenue outlook is touted as a factor for Advanced Micro Devices’ stock dropping despite earnings meeting expectations in Q3, this isn’t a driving factor.

- AMD revenue earnings for 2024 are trending toward being largely identical to that of FY 2023, thus dashing investor convictions on forward growth.

- The company continues to lose revenue segment diversification benefits. The rise of “data center” revenues pits it squarely against Nvidia in the years to come.

- The overall outlook for AI spending continues to be cloudy due to low AI-driven labor cost benefits in the short- to mid-term.

MF3d

In the week leading up to its Q3 earnings release, the share price of Advanced Micro Devices, Inc. (NASDAQ:AMD) — a presumptive rival to Nvidia (NVDA) — rose steadily. Earnings were more-or-less within expectations, with revenues of $6.8 billion versus an expectation of $6.7 billion and adjusted earnings per share of $0.92 being spot on with consensus estimates.

However, the earnings release triggered a slide in the stock price. A widely shared attribution for that was that the company’s Q4 revenue outlook of between $7.2 billion and $7.8 billion missed analysts’ consensus expectations for the next quarter. However, given that the consensus for Q4 averages around $7.55 billion and the company’s outlook lies squarely around this estimate, this isn’t quite the only factor.

Trend Drilldown

Using the framework described in the previous article about AMD — which described trends in its first half (H1) of 2024 — it’s apparent that there are no massive shifts over the latest quarter:

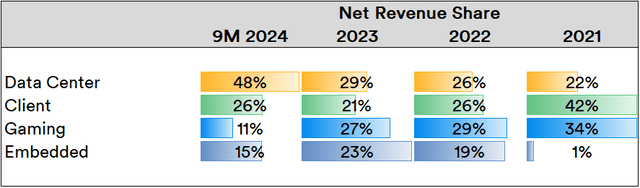

Source: Created by Sandeep G. Rao using data from AMD’s Financial Statements

Relative to H1, Q3 cements further the importance of the company’s “Data Center” segment, which gains another 2% of total revenue share while “Gaming” dips from 14% by H1 to 11% as of the latest quarter.

In overall line item trends, however, the company seems to be trending towards a sense of “flat” growth:

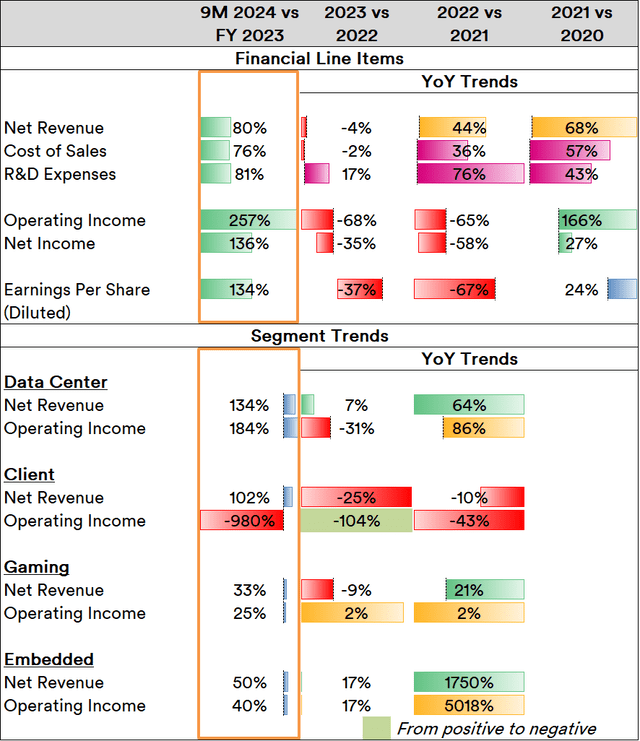

Source: Created by Sandeep G. Rao using data from AMD’s Financial Statements

Net revenues and cost of sales, as well as research & development (R&D) expenses, are running roughly on par with the previous year. However, both Operating and Net Incomes trend higher than par due to slightly lowered trends in general costs as well as the amortization schedule on acquisition-related intangibles.

Segment-wise, “Data Center” is trending towards closing the year with around a 50% increase in revenue, with operating income trending to closing well over that. The “Client” segment has already posted a positive operating income that is nearly 10 times the loss it incurred in the previous year, while the “Gaming” and “Embedded” segments are posed with continuing diminishment of revenue share. AMD is thus treading the path that Nvidia traversed over two years ago, by virtue of “corporate” clients steadily becoming its mainstay.

Thus, the loss of segment diversification and the flattening of total revenue growth are the dominant factors in analysts’ views that the company’s growth outlook has entered still waters.

Growth Catalysts Ahead?

Following the results, CEO Lisa Su sought to assuage investors’ concerns on growth by stating that the company is ramping up production and earning the trust of large data center companies. During the call, she said:

“What I will say is customers are very, very open to AMD. And we see that everywhere we go. Everyone is giving us a very fair shot at earning their business, and that’s what we intend to do.”

The latest introduced products in the earnings release are also geared toward attracting data center clients: both the EPYC 9005 Series processors and the Instinct MI325X accelerators are touted to have performance and energy consumption improvements for the types of workloads typical for these companies. Juxtaposing CEO Lisa Su’s comments versus key products introduced, it is likely that the “data center” segment is being considered to be the dominant breadwinner going forward. End user diversification, thus, may not be a very sustainable argument for choosing the stock going forward.

The heightened focus on data centers puts the company square and center in rivalry with Nvidia. Meanwhile, as an article published in July had already highlighted, the planned outlay for data center capacity expansion is considered to be at odds with the overall demand projected going forward. This is given that AI-driven labor cost benefits are expected to remain low over the short- to midterm.

A further deflation of the stock’s valuation, which has a very high Price to Earnings (PE) Ratio, isn’t out of the question. However, Nvidia’s Q3 earnings are slated to be released in the latter part of November; if Nvidia shows a stilling of growth as well, this is an industry-wide issue and not just AMD’s.

Chipmaker companies will never fall out of favor in a networked world and an entirely reasonable investment, given how fundamental they are to said world. However, investor conviction is a distinctly different matter; the AI mania might have pushed certain stocks to highs that need to be rationalized.

For investors interested in holding on to a “fundamental” and not yet in possession of the stock, there will likely be numerous opportunities over the rest of the year wherein AMD stock can be acquired for a lower price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.