Summary:

- Advanced Micro Devices, Inc. delivered impressive Q2 results with record data center revenue, exceeding Wall Street expectations.

- The company’s focus on creating an integrated AI ecosystem positions them well for future growth in the data center and AI markets.

- Nvidia’s delays with their Blackwell AI chips provide AMD with a significant opportunity to gain market share and capitalize on demand for AI infrastructure.

- The growth curve we are seeing with AMD mimics what we saw at the beginning of the AI boom 18 months ago with Nvidia. I could not be more excited.

Javier Lizarazo Guerra

Investment Thesis

While a later analysis, I wanted to take some time to dive into the Advanced Micro Devices, Inc. (NASDAQ:AMD) quarter (especially now since the stock has sold off since earnings). In short, the quarter was impressive, but this article is more than just a quarterly analysis. This article is here to show that I think the company has reached an inflection point.

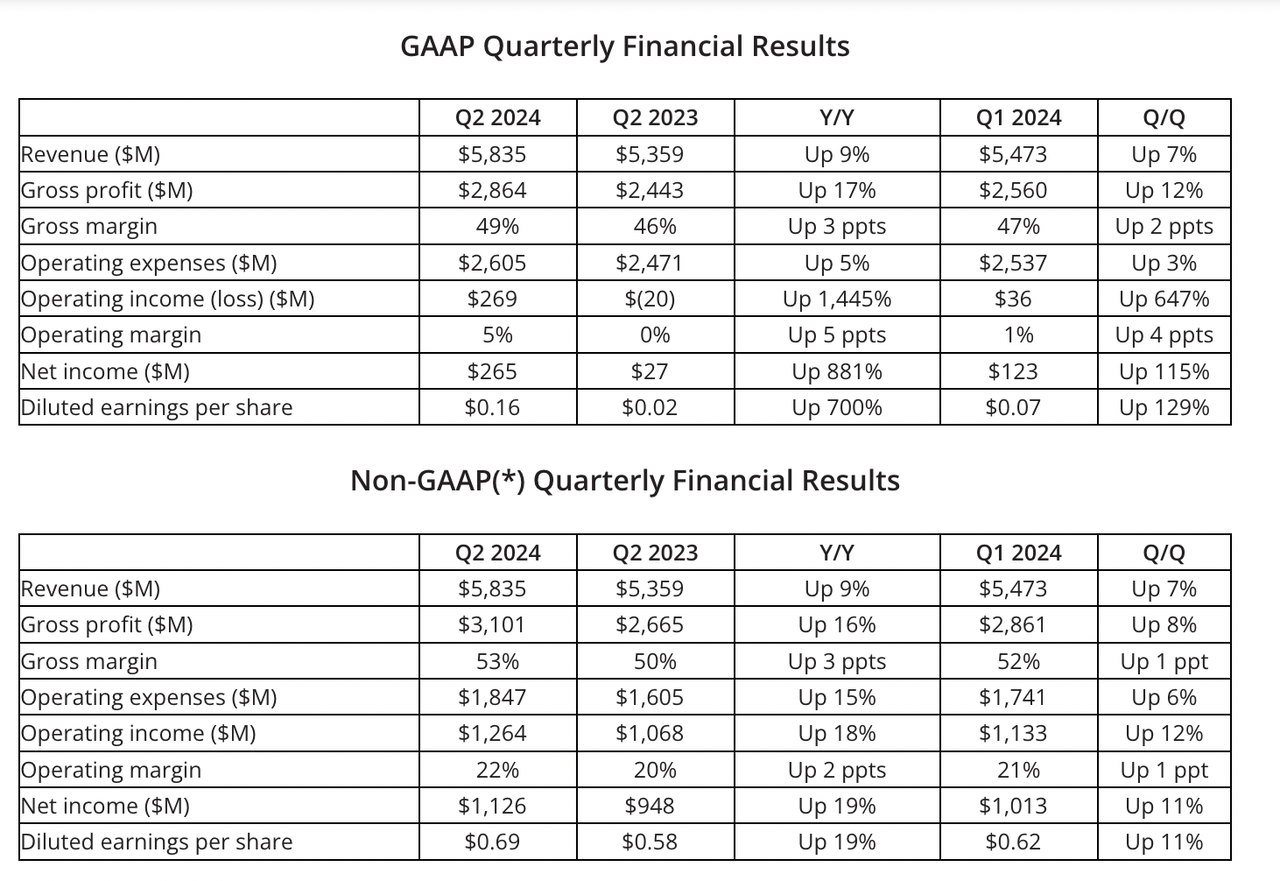

The AI chip innovator delivered an impressive performance in 2Q 2024 with revenue growth that exceeded Wall Street expectations. The company reported $5.84 billion in revenue, which surpassed consensus estimates by $113 million, and achieved non-GAAP earnings per share of $0.69, slightly above the forecast of $0.68.

One of the biggest contributors to AMD’s solid quarter was their Data Center segment, which hit a record $2.8 billion in revenue, up year-over-year by 115%. Their strong performance and revenue surge was largely driven by the growing demand for their Instinct, EPYC, and Ryzen processors, particularly in the AI market. The Client segment also performed well, with revenue of $1.5 billion, reflecting 49% year-over-year growth. I think this is a defining moment for the company. I’ll largely spend the rest of this report focusing on this segment because I think what happens here next will be big.

The selloff leading up to and following their earnings appears to be an overreaction by the market. The broader semis sector experienced a steep selloff, influenced by a couple of macroeconomic fears.

First, tech shares peaked and then fell off starting on July 17th (AMD included in this mix) as market participants began to worry about trade tensions with China impacting semiconductor supply chains. The market was also concerned at this time about the incoming rate hike from the BoJ, which later started the snowball that lead to the Yen Carry trade unwinding.

Then, shares of GPU makers like Nvidia (NVDA) and AMD fell off further after Google’s July 23rd earnings. The search giant noted they may be “over-investing” in GPUs. Investors became concerned that the current rate of GPU spending may not be sustainable, given where demand is for AI software is at this point.

After this, shares briefly popped after AMD earnings exceeded expectations, but then shares fell off again as fears over the Yen carry trade magnified.

In essence, overall GPU demand fears, the Yen Carry trade, and fears of potential U.S. trade restrictions means that shares haven’t been able to catch a break for almost a month.

Contrasting this, I believe AMD’s strong performance in AI and with data centers suggest that eventually, the market’s reaction to these fears is likely misguided, and underestimates their growth potential in the areas AMD is trying to corner. Investors really appear to be overly focused on short-term market volatility rather than the solid fundamentals.

AMD’s forward growth rates in their data center operations are starting to match those of Nvidia as a whole. During the Nasdaq Investor Conference in June, AMD’s CFO Jean Hu highlighted that the data center business has been growing faster than other segments, and this trend is expected to continue through the company’s 4th Gen EPYC processors and the MI300X GPU used in AI workloads.

With this accelerated growth in the data center segment (data canter sales are up 115% now YoY in Q2 vs. growth of 80% YoY in Q1), shares of AMD continue to appear to have a strong upside potential given their below sector median forward PEG ratio. I think as their playbook slowly unfolds, the company’s strategies will pay off big, and the market is likely to reward them significantly. I still think shares are a strong buy.

Why I’m Doing Follow-up Coverage

Last month, I covered AMD in a pre-earnings analysis, focusing on their ambitious plans to build an AI ecosystem. At the time, AMD was trading at $181.61/share. Since then, the stock has dropped significantly, now hovering around $136.77. I think this largely appears to be driven by the macroeconomic factors I mentioned, rather than any real deterioration in AMD’s fundamentals. When fundamentals severely deviate from price action, this is when I get interested.

I’m writing this follow-up analysis because I believe this selloff has created an extremely unique opportunity for investors. AMD’s continued focus on creating an integrated AI ecosystem, covering everything from their GPUs & CPUs to AI software, offers powerful growth that excites me. The key point of this piece is that I think the story remains intact.

What I Saw In The Call That Excites Me

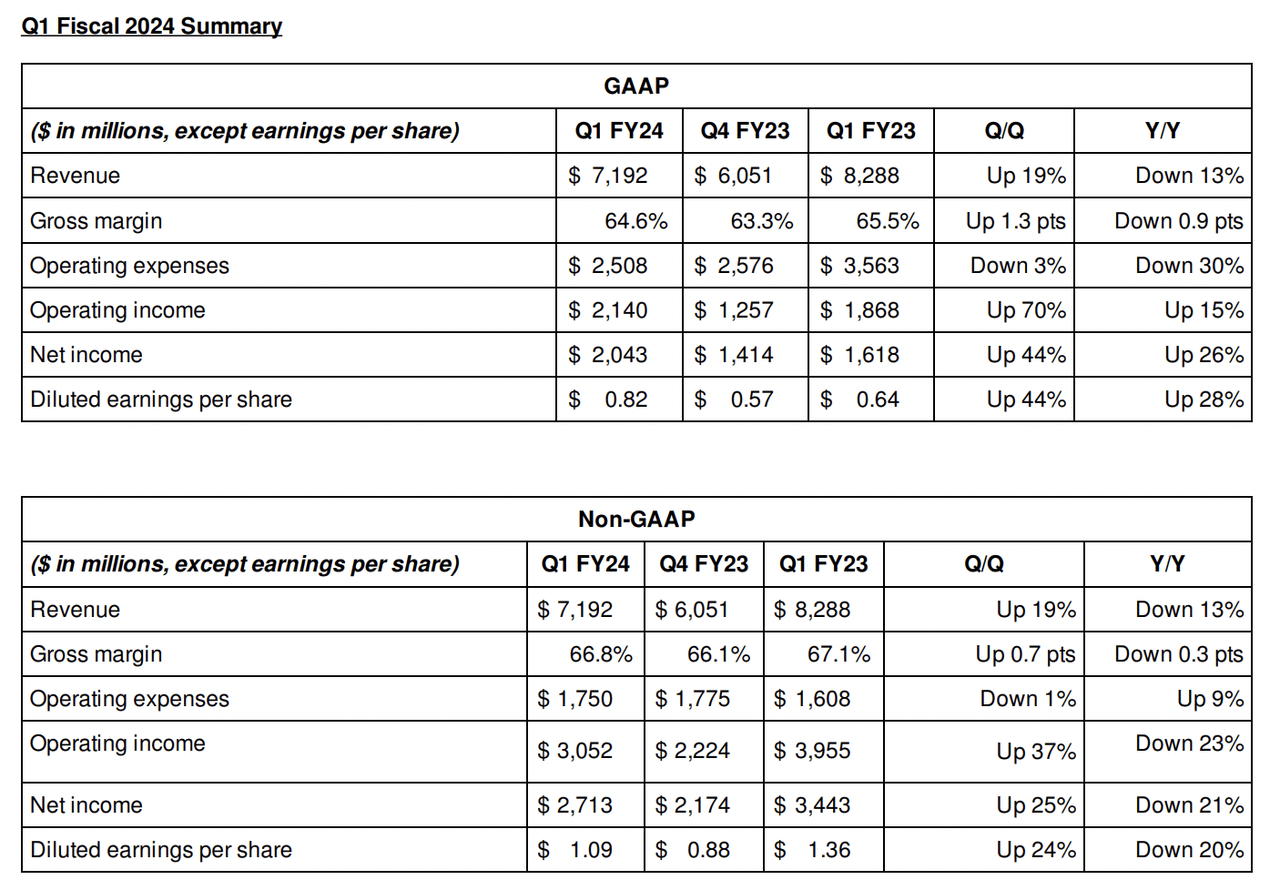

To understand AMD’s performance this last quarter, we have to look at how Nvidia has executed, especially right at the beginning of the AI boom.

Nvidia’s results in the first quarter of their FY 2024 year (so Q1 2023) showed $4.28 billion in data center revenue, marking a 14% increase year-over-year and an 18% rise from the previous quarter. At the time, this growth was driven by the launch of four new inference platforms, key partnerships with Google Cloud, ServiceNow, Medtronic, and Dell Technologies. There also were collaborations with companies like Amazon Web Services, Microsoft Azure, and Oracle Cloud Infrastructure to expand their AI offerings. This was right as the demand from ChatGPT was accelerating. The growth Q/Q and YoY was impressive, but it was not yet jaw dropping (like we’ve seen from Nvidia since).

Nvidia FY Q1 2024 Earnings (Nvidia )

Similarly, I think AMD is near its version of an inflection point. Their accelerated growth in data center revenue (the 115% YoY growth), driven by the adoption of their MI300 series GPUs and EPYC processors, now indicates that they are starting to gain traction in areas previously dominated by Nvidia.

AMD’s sales in their Data center division totaled $2.8 billion for their most recent quarter. While they are starting from a lower base number ($2.8 billion vs. $4.28 billion) their growth is now starting to inflect the company’s overall revenue. Keep in mind that AMD’s YoY growth was 80% in Q1 and has now accelerated to 115% YoY in Q2. Usually, as revenue hits critical mass, growth slows on a YoY basis because it’s difficult to put up a high-growth percentage on a bigger revenue number.

The opposite is happening here.

AMD’s growth is accelerating even as the revenue base hits critical mass. The only thing that can explain this is an inflection in GPU demand.

The really cool part about this is that now that they’re growing triple digits in Data Center, they’re on track to soon take an increased share of the GPU market where Nvidia dominates (their growth rate will soon eclipse Nvidia, which means their market share should go up). The data center market is crucial for the future of AI and cloud computing. AMD has to get an early foothold in order for their ecosystem of chips I mentioned before to become a big part of the data center story. I think we are starting to see this.

With this, AMD’s introduction of their new lineup is particularly timely. Unfortunately for Nvidia, their delays in their upcoming Blackwell AI chips (due to design issues), are potentially pushing back their launch date by three months. AMD’s already launched lineup of MI 300X GPUs, which beat the current Nvidia top of the line H100 on many fronts, means the company has just the right products to compete in the data center and AI application market. The company is on the right foot, just as Nvidia stumbles a little. I could not be more excited. I think the company is at a powerful inflection point.

Nvidia Delay Is AMD’s Gain

As I mentioned above, Nvidia’s highly anticipated Blackwell AI chips are facing significant delays, with Super Micro Computer (SMCI) CEO Charles Liang indicating that meaningful volumes of these GPUs may not arrive until the quarter ending in March 2025.

Nvidia’s delays in the launch of its new Blackwell AI chips and production challenges with TSMC (TSM) advanced CoWoS-L technology is expected to hit their quarterly revenue. The delays impact companies involved in server work, disrupting AI and data center build-out operations and will delay development timelines for large orders from tech giants such as Google (GOOGL), Meta (META), and Microsoft (MSFT).

While analysts suggest that Nvidia’s current position in the market is strong enough to weather a three-month delay without major shifts in market share, I disagree with this. Barron’s estimated (and covered as well by The Register) that Nvidia may see a few billion of B200 revenue moved to early 2025 instead of late 2024 because of the delays. They claim that Nvidia can make up any revenue shortfall by selling more H100 GPUs, but as Google’s CEO mentioned, they (and the industry) may be over-investing in GPUs right now.

Which brings up the fundamental question that Nvidia customers are running into:

If you’re a big tech CEO who is likely over-investing in GPU capacity right now, would you rather invest in AMD’s latest and greatest GPUs, or invest in Nvidia’s H100 GPUs, which you know will not be bleeding edge and will not be top of the line in just a few months once Nvidia’s Blackwell series launches?

What this means is that I think big tech CEOs who need bleeding-edge GPU technology now (not in 5+ months) are presently more willing to give AMD a try. My research is leading me to believe the window of opportunity for competitors like AMD to take advantage of this is now open. Evidence from earnings is confirming my hunch.

During the 2Q earnings call, CEO Lisa Su elaborated:

We delivered our third straight quarter of record data center GPU revenue with MI300 quarterly revenue exceeding $1 billion for the first time. Microsoft expanded their use of MI300X Accelerators to power GPT-4 Turbo and multiple co-pilot services including Microsoft 365 Chat, Word, and Teams. Microsoft also became the first large hyperscaler to announce general availability of public MI300X instances in the quarter.

Our data center GPU business is on a steep growth trajectory as shipments ramp across an expanding set of customers. We’re also seeing strong demand for our next generation Zen 5 EPYC and Ryzen processors that deliver leadership performance and efficiency in both data center and client workloads -Earnings Call.

What I think is key here is that AMD is creeping into GPU use-cases that Nvidia previously dominated in. Numerous benchmarks show that the MI 300X that is currently on the market is better in many use cases than the H100. Nvidia’s answer to the MI 300X is the Blackwell chip. Blackwell is delayed, which poses a real issue to their market position as the best GPU maker.

AMD’s advanced offerings, particularly the MI300 accelerators, are already grabbing market share and use cases at big tech companies. Many of these companies were banking on the new Blackwell chip to arrive to help them fill their insatiable demand for AI GPUs. AMD might help them plug the hole, and with it enter new markets where only Nvidia was accepted before.

Valuation

While the market selloff has been frustrating for anyone who is long AMD, prospective investors currently have a strong fundamental setup. The chipmaker currently sports a PEG ratio well below the sector median, standing at 0.94 compared to the sector’s 1.83. The market is providing a significant discount here to the sector median, I think, largely on the premise that the market is unsure that the current EPS estimates will hold up (meaning the PEG ratio will go up if earnings growth comes in lower than expected).

In all honesty, I think this general pessimism mirrors where Nvidia was approximately 18 months ago, just before their parabolic run began. In AMD’s case, if the PEG ratio converges on the sector median, we could see shares move up by approximately 94.68%, which could potentially align AMD with Nvidia’s previous share price trajectory.

Diving deeper, the market sentiment appears cautious, driven I think by the recent downward revisions of AMD’s EPS and revenue estimates over the past three months. Specifically, 25 out of 32 analysts revised their EPS estimates downward for the upcoming quarter, and revenue estimates also saw more downgrades than upgrades. I think what this means is that estimates were too bullish on AMD performance a few months ago based on estimates, but now I believe they are too bearish. I think these downgrades mean the market is not fully recognizing AMD’s growth potential. Add to this the fact that operating income accelerated 1,445% year over year driven by cost discipline and higher margins on MI 300X chips, and I think the company is set to see parabolic EPS growth driven by strong data center sales.

Risks

I still think the fundamentals are strong, but this doesn’t mean price action won’t work against us for a bit. The Yen carry trade has become a strong factor in the recent market selloff that impacted global financial markets. The carry trade, driven by investors borrowing in a low-interest-rate currency like the Japanese yen to invest in higher-yielding assets in another country (US tech stocks), has been particularly popular due to Japan’s near-zero interest rates. However, the Bank of Japan’s recent interest rate hike and the strengthening yen hurt this strategy. As the yen rose and the dollar weakened respectively, the profitability of these trades plummeted, which triggered a mass unwinding of positions.

Reversing these trades exacerbated market volatility in the earlier part of this month.

For tech stocks, a popular destination for these yen-funded investments, the impact has been particularly severe.

JPMorgan’s recent analysis indicates that approximately 75% of global carry trades have been unwound, which, I think, is a significant development that may help alleviate market pressures.

The other major concern in the semi market centers around AI GPU demand, with multiple hyper-scalers stating during earnings season that they are likely overbuilding datacenter capacity (and with it, buying unnecessary GPU supply). Even with these concerns, AMD’s unique position as a provider of a comprehensive AI ecosystem, not just GPUs, presents a good opportunity to capitalize on the ongoing demand for AI infrastructure. Unlike competitors who may be more exposed to the fluctuations in GPU demand, AMD’s holistic product offerings, I believe, allow them to potentially buck any slowdown and capture market share.

Bottom Line

AMD delivered strong 2Q results, driven by record data center revenue. Despite recent stock selloffs influenced by macroeconomic factors, the company’s AI ecosystem positions them well to capitalize on market growth. Their growth shows they are at an inflection point.

Adding to this, due to Nvidia’s delays with their Blackwell AI chips, AMD now has a significantly better opening to make their mark than they did a few months ago.

With this, I think AMD remains a strong buy, particularly given the unique setup. Investors saw the parabolic growth its peer Nvidia benefitted from 18 months ago. Now I think it’s time for AMD to shine.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, META, GOOGL, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.