Summary:

- Advanced Micro Devices, Inc. investors should consider riding on another beat-and-raise from Nvidia Corporation.

- Nvidia’s strong AI read indicates more robust AI growth opportunities for AMD to capitalize upon.

- AMD’s AI revenue guidance for 2024 is expected to be conservative, lowering its execution risks.

- AMD stock also seems to have bottomed in early May as buyers returned.

- I argue why it’s time for me to turn bullish on AMD, looking to capitalize on another run toward its previous highs. Read on.

JHVEPhoto

AMD Can Ride On Nvidia’s Coattails

Advanced Micro Devices, Inc. (NASDAQ:AMD) investors who decided to return over the past four weeks are rocking it since AMD stock bottomed in late April/early May 2024. Nvidia Corporation’s (NVDA) Q1 earnings report highlighted the AI hype that has turned into a sustainable AI upcycle. Nvidia’s fiscal first-quarter earnings release delivered another solid beat against Wall Street estimates, underscoring the robustness of the AI data center opportunity. Accordingly, the Jensen Huang-led company posted a total revenue of $26B, with a data center revenue of $22.6B. Furthermore, Nvidia’s beat-and-raise quarter has bolstered investor confidence in AI infrastructure stocks, benefiting AI peers like AMD.

Consequently, AMD investors have reacted positively to the update, corroborating AMD stock’s robust bottom in early May above the $140 level. Given the solid consolidation phase over the past four to five weeks, I’m ready to reassess my thesis on AMD, as it looks primed for a recovery of its uptrend continuation thesis.

Accordingly, in my last two articles in January and March 2024, I updated investors to be cautious about AMD’s previous surge. I argued that AMD’s AI FOMO likely reached over-optimism, susceptible to a pullback as earlier investors take profit, bursting its bubble. That caution panned out, as AMD has underperformed the S&P 500 Index (SP500, SPX, SPY), justifying my cautious posture.

AMD Still Faces Cyclical Headwinds

However, AMD’s AI data center opportunities could be more robust than anticipated. I believe the market was likely disappointed with the company’s slight guidance raise on its AI revenue in AMD’s Q1 earnings release in late April. While it contributed to a post-earnings selloff, dip-buyers are assessed to have returned to stem a further decline.

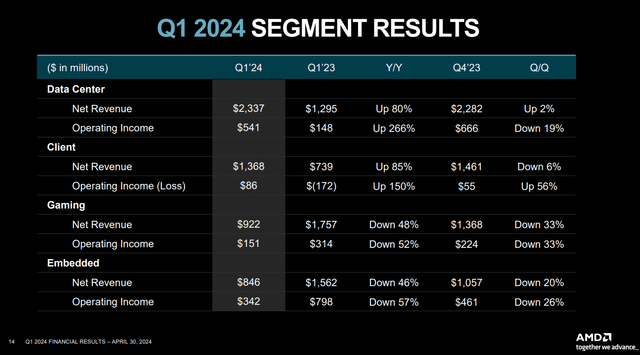

As a reminder, AMD upgraded its anticipated AI data center revenue guidance by $500M to over $4B for FY2024. Notwithstanding its raised guidance, it remains far below Nvidia’s annualized data center revenue of more than $90B based on its recent report. Hence, it’s clear that while AMD has made useful strides toward being a critical AI data center chips designer against Nvidia, the King of AI chips is undoubtedly still Nvidia.

AMD Q1 segment results (AMD filings)

Coupled with the relatively weak performance in AMD’s Client, Gaming, and Embedded segments, AMD remains vulnerable to the cyclical forces of the semiconductor industry. In other words, AMD needs its AI revenue to ramp much more quickly to sustain a higher valuation re-rating, or it could be prone to downward volatility attributed to market disappointment.

AMD Needs To Grow Its AI Revenue Rapidly

Notwithstanding the near-term caution, AMD CFO Jean Hu is confident that AMD can benefit from the continued growth in AI data center build out. Hu highlighted that demand for accelerated computing still exceeds expectations. Accordingly, AMD “has over 100 customer engagements at various stages, including POC, qualification, lab production, and ramp.” Furthermore, AMD implied the conservatism of its AI revenue guidance, as Hu suggested the company has the “supply commitments in place to drive revenues significantly above the $4B target for the year.” With Nvidia expected to be supply constrained through 2025, AMD can capitalize on gaining market share if it executes more effectively.

Moreover, AMD has strengthened its partnership with Microsoft (MSFT), providing “a platform of AMD artificial intelligence chips to its cloud computing customers as an alternative to Nvidia components.” Accordingly, the partnership has made the Azure ND MI300X V5 instance available to Microsoft Azure’s customers. Equipped with AMD Instinct MI300X accelerators, Hugging Face was reported to have signed up as the “first customer to utilize these instances.” The end-to-end stack includes AMD’s software solutions (including the open-source ROCm).

Consequently, hyperscalers are likely keen to ensure they have AMD as an effective alternative to Nvidia’s market leadership, forging healthy competition and avoiding undesirable lock-in into Nvidia’s full-stack but proprietary ecosystem.

Is AMD Stock A Buy, Sell, Or Hold?

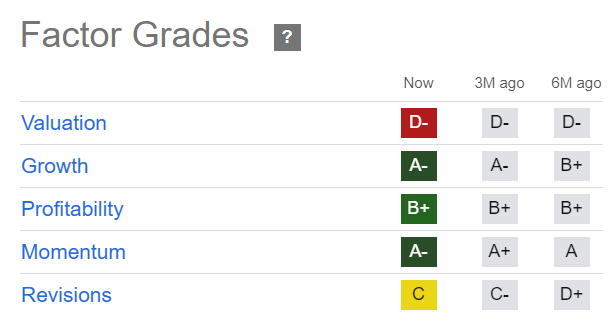

AMD Quant Grades (Seeking Alpha)

With that in mind, I have greater confidence that AMD should be able to satisfy the high expectations embedded in AMD’s “A-” growth grade. The expected recovery in its automotive and industrial business should also lift a more constructive second-half environment for AMD’s embedded business. Moreover, the AI PC refresh reignited by Microsoft should also provide robust tailwinds to AMD’s Client business through 2027.

Therefore, I have assessed that my caution on AMD stock is less justifiable from here, corroborated by AMD’s consolidation zone over the last four weeks.

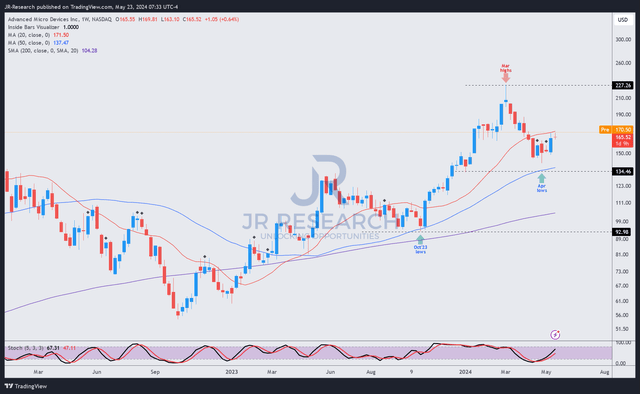

AMD price chart (weekly, medium-term) (TradingView)

AMD’s price action corroborates a consolidation zone above the $140 level over the past four weeks. However, it must regain buying momentum above the $170 level and retake the 20-week moving average (red line) for the uptrend continuation bias to resume.

Failure to retake that level could increase selling pressure, potentially compelling a further decline toward the $135 zone before bottoming. While I have determined that the risk/reward is skewed toward recovery from the current levels, investors must consider adding exposure progressively.

Notwithstanding my caution, Nvidia’s solid earnings scorecard should provide a much-needed lift for AMD as it attempts to regain composure, as NVDA stock surges above its previous all-time highs.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!