Summary:

- Advanced Micro Devices, Inc.’s Zen 5 Ryzen 9000 (non-X3D) chips have shown minimal performance gains, but the upcoming X3D versions could significantly boost gaming performance and productivity tasks.

- The X3D chips, launching November 7, 2024, may offer substantial performance improvements, potentially igniting a new upgrade cycle for gamers.

- AMD’s valuation hinges on continued strong execution and market share gains, especially against Intel’s upcoming Ultra 200S series and Nvidia’s dominance in GPUs.

- Investors should monitor product reviews closely; strong X3D performance could drive sales, while disappointing results may maintain the status quo.

MF3d

Introduction

Advanced Micro Devices, Inc.’s (NASDAQ:AMD) Zen 5 Ryzen 9000 (non-X3D) chips have so far been received with reviews that essentially sum up to “meh.” The new CPUs show little to no gains over the previous 7000 series chips, albeit with improved power efficiency. This has caused most consumers to forgo upgrades, leading to disappointing sales of AMD’s new chips. However, AMD has now confirmed on X that the X3D versions of the new chips are right around the corner, leading to some excitement that the X3D chips could see better performance improvements in gaming than their non-X3D 9000 counterparts.

Brief History of the X3D Chips

AMD originally started the X3D versions of its chips with the Ryzen 7 5800X3D chip launched in April 2022. The X3D CPUs improve gaming performance substantially due to their increased L3 Cache relative to their non-X3D counterparts. This has the effect of significantly improving gaming performance, but comes at the cost of productivity tasks such as video editing and rendering, large computational programs, or various other productivity related workloads. Thus, the target demographic for the X3D chips is mostly gamers, or productivity users that also game on the same machine.

Ryzen 9000X3D

With AMD’s announcement on X, they confirmed that at least one version of the new X3D chips will be launching on November 7, 2024. Unfortunately, that’s all the details we have for now. I would expect a launch event shortly before that launch date announcing more detailed specs and performance metrics for these chips. I would also expect more than one version based on core counts (like previous launches), although the launch timing of each chip may vary.

Speculators have suggested, based on one leak, that the new X3D parts are somewhere between 10-30% faster than their 7000X3D predecessors. This is a substantial increase from the non-X3D Zen 5 chips that mostly only saw a low single digit percentage gain to no gain whatsoever in most games, or even a small regression in a few titles. Furthermore, early rumors suggest that these X3D chips may be able to keep up in productivity tasks with the non-X3D versions for the first time ever. This would make the chips a no-brainer for users that both play games and perform productivity related workloads.

However, this remains speculative, and we don’t know what testing methods were used in any leaks, so it is highly possible that actual results upon release are different. Consumers should consult multiple unbiased review sources before making a purchase decision.

What This Means For Investors

AMD’s stock price has been largely driven by AI related news, which has yet to really make its way into the consumer desktop space. For now, the hype around AI mostly applies to enterprise level and datacenter GPUs. While I’m moderately optimistic about AMD’s opportunities here, this is an entire discussion for another article.

Ultimately, should these 9000X3D chips show strong performance, it could re-ignite a new upgrade cycle for gamers wanting to upgrade to the latest and fastest chips. Many consumers are likely still on Zen 3 waiting for a more meaningful upgrade path. These new chips have the potential to provide that, particularly at the high end.

Then again, if the processors disappoint, much like their non-X3D Zen 5 chips did, then the chips are likely mostly dead on arrival, with the only viable consumers being those building a brand-new high-end PC from scratch. In this scenario, gamers are more likely to wait yet another generation before having a strong enough performance uplift to want to upgrade.

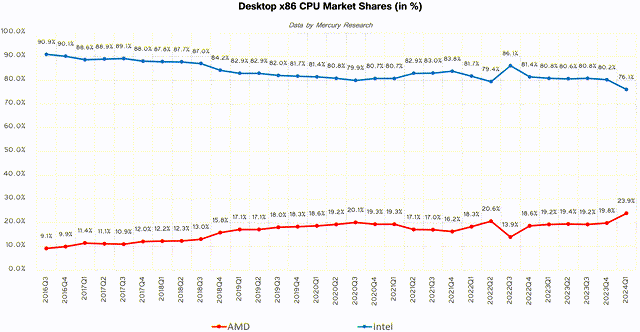

Intel vs AMD Desktop CPU Market Share (Anandtech)

AMD has been successfully taking market share away from Intel (INTC) in desktop CPUs for several years now. This is the result of AMD innovating faster than Intel and bringing more compelling products to market. This all started with the original 1st-generation Zen processors back in 2017, and has continued with AMD hitting new market share highs as of Q1 2024.

Since Q1, Intel’s CPUs have hit some major roadblocks. Thus, it’s likely that AMD CPUs have gained even more share in Q2 ’24 and Q3 ’24. These problems are covered in depth in this Gamers Nexus video for those interested.

Going forward, Intel’s upcoming Ultra 200S series processors (the naming scheme is changing) do show some early signs of improvement. Intel has directly boasted about power efficiency gains with this new generation. In some ways, the new Intel chips will “reset” Intel’s branding and marketing strategy and set a new base to beat for future generations. Thus, I’d expect Intel to claw back a small amount of market share post-launch, unless AMD’s X3D chips really hit it out of the park. There is room here for Intel at the lower end in particular, as AMD’s lowest end Zen 5 chip is the Ryzen 5 9600X, priced at USD280. This is generally a bit more than someone buying a budget gaming PC would look to spend on the CPU.

AMD’s Valuation: Pricing In Strong Execution

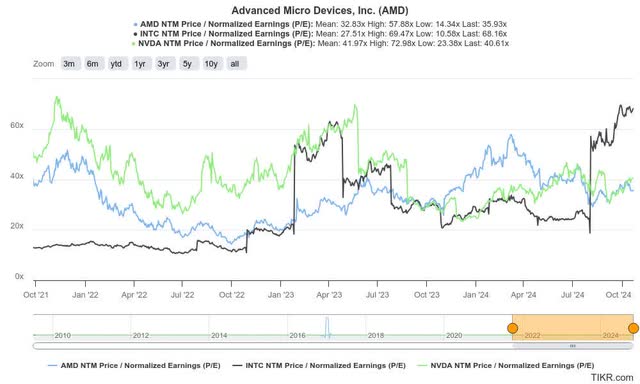

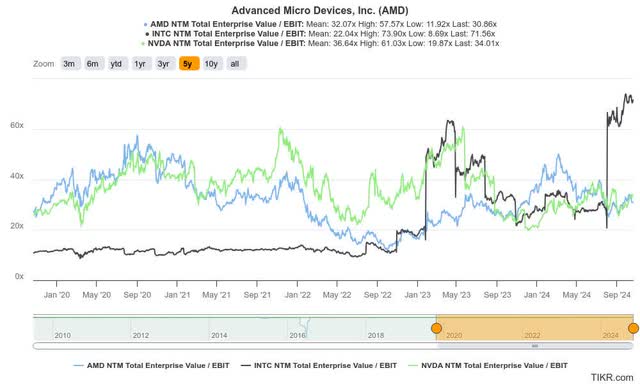

Assessing AMD’s valuation is not particularly easy, given differences to peers in Intel and Nvidia (NVDA). Obviously, Nvidia has been winning the enterprise datacenter GPU market, leading to truly unbelievable margins. This makes something like a Price/Sales ratio somewhat irrelevant, given the difference in margins. AMD also competes in the datacenter GPU space, but has been unable to match Nvidia’s dominance.

Interestingly, investors assessing forward P/Es would find AMD and Nvidia trading at similar forward P/Es of just under 40. This is likely a combination of an inevitable slowdown in growth for Nvidia (to be clear, I’m not saying no growth, just a YoY decrease as they lap some 200% or more growth rates going forward for the next few quarters), and a continued growth path for AMD. This is especially true if they can take more market share from Intel in CPUs, and begin to penetrate Nvidia’s market share on the GPU side (something they have not yet been able to achieve to a meaningful degree). Of course, Intel’s multiples look funny given the company’s recent struggles and likely temporarily reduced profitability (making the multiples appear high when the market is simply pricing in a reversion to more normalized profits in future years after a year or two of reduced profitability).

AMD, Nvidia, and Intel Forward P/E (TIKR.com) AMD, Nvidia, and Intel Forward EV/EBIT (TIKR.com)

Long story short, AMD needs to continue executing to justify its current valuation. Its valuation multiples currently sit near the middle of where they’ve traded in the last few years. This is close to peers, but is not low on an absolute basis. Thus, if AMD can show strong execution starting with the new X3D chips and demonstrate continued execution across a multi-year road map, there may be some upside in the short term for those multiples as investors increase optimism. However, if they cannot continue to push the boundaries of CPU technology and with the continued struggles in datacenter GPUs, then there could perhaps be some downside in these multiples.

Conclusion

AMD’s upcoming X3D chips are AMD’s chance to compete with both their previous generations of CPUs, and Intel’s upcoming Ultra 200S series of processors. Both these product lines should launch in the next month or so, so investors should tune in to product reviews to stay up to date with who is offering consumers the best products. Should AMD’s X3D chips show a substantially greater performance uplift than previous versions of these chips, then investors could be in for increased sales via a new upgrade cycle. If, however, the performance is disappointing, I would expect things to mostly remain status quo for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.