Summary:

- Advanced Micro Devices, Inc.’s stock price surge may be reaching its limits due to macroeconomic headwinds, a potentially overheated semiconductor market, and threats from Intel and Nvidia.

- Growing macroeconomic headwinds, including high inflation and interest rates, pose a threat to AMD’s expansion and could lead to reduced sales and inventory buildup.

- Intel’s resurgence and Nvidia’s dominance in the AI and GPU space present competitive threats to AMD, putting pressure on AMD’s pricing power and margins.

andriano_cz

Advanced Micro Devices, Inc. (NASDAQ:AMD) has enjoyed a remarkable stock price surge during the past few years, primarily driven by its impressive gains in the processor market against rival Intel (INTC).

Having said that, AMD’s relentless rise may be reaching its limits. Growing macroeconomic headwinds, a potentially overheated semiconductor market, and the looming threats of Intel’s resurgence and Nvidia’s (NVDA) continued dominance in the AI and GPU space create a challenging environment for AMD.

While the company undoubtedly possesses strengths, an analysis of the current landscape reveals substantial risks that could make AMD stock vulnerable to a downturn in the near future.

Macroeconomic Headwinds

Growing macroeconomic headwinds pose a significant threat to AMD’s continued expansion in three key aspects.

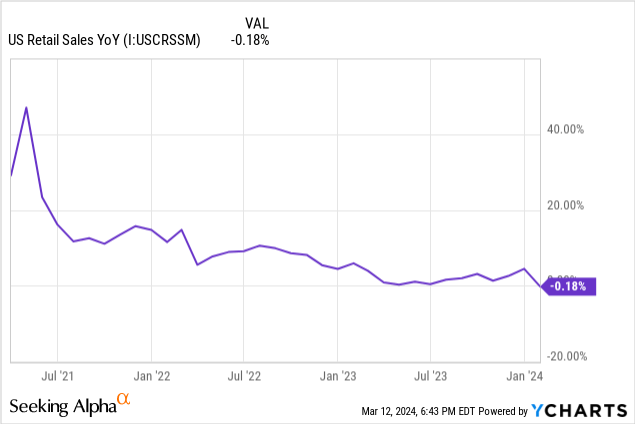

First, high inflation and interest rates erode consumer purchasing power, particularly for discretionary tech spending like high-end computer components. The following graph illustrates that the year-over-year change in monthly retail sales in the U.S. has seen a steady decline throughout the last three years, and it just turned negative as of the last available data:

Second, with real interest rates currently high and exerting further pressure on the economy, a potential recession could put further pressure on demand, leading to reduced sales and inventory buildup.

Third, the global chip shortage that benefited chipmakers in recent years is normalizing and could turn problematic if demand softens as chip supply increases.

I believe that the risk of a recession leading to a supply-demand mismatch is high and could lead to price erosion and pressure on AMD’s margins.

Competitive Threats

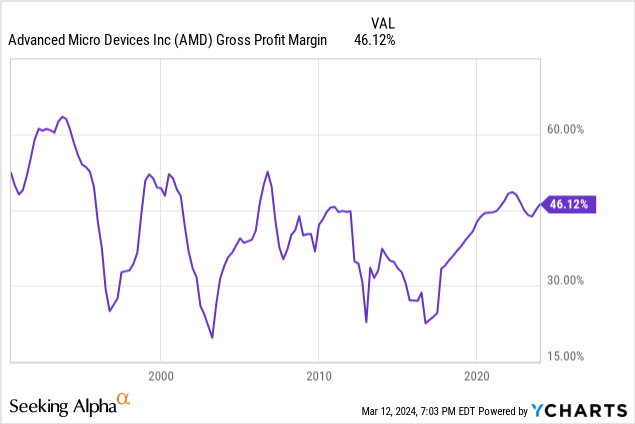

AMD has been enjoying historically high gross profit margins in recent years, as the below graph illustrates, but Intel’s resurgence poses a significant threat to AMD’s market dominance in overall value proposition.

Intel, stung by its losses to AMD, is heavily investing in new technology and manufacturing capabilities:

- Israel’s government agreed to give Intel a $3.2 billion grant for a new $25 billion chip plant it plans to build in southern Israel, in what is the largest investment ever by a company in Israel;

- In Germany, Intel plans to spend more than $33 billion to develop two chip-making plants in Magdeburg, as part of a multi-billion-dollar investment drive across Europe to build chip capacity. Berlin has pledged big subsidies to attract Germany’s biggest-ever foreign investment; and

- In 2022, Intel said it would invest up to $100 billion to build potentially the world’s largest chip-making complex in Ohio.

As Intel executes its turnaround plan, it could regain competitiveness with AMD’s offerings, putting pressure on AMD’s pricing power and its ability to maintain high margins.

Additionally, Nvidia’s dominance in the AI and GPU space presents a persistent challenge to AMD. While AMD has made strides in these areas, Nvidia remains the clear market leader, boasting superior hardware and a robust software ecosystem.

For example, Nvidia’s RTX 40 series graphics cards are generally considered more powerful than AMD’s RX 7000 series, especially in ray tracing performance. Further, Nvidia’s CUDA parallel processing platform is widely adopted by developers for scientific computing and machine learning, giving Nvidia an edge in these areas. AMD is working on improving its software offerings, but hasn’t reached Nvidia’s level yet.

The rapid growth of AI applications puts Nvidia in a prime position to capitalize on this demand, and AMD faces an uphill battle to catch up. Nvidia’s advantages in these lucrative markets could limit AMD’s own growth potential and translate into broader market share gains at AMD’s expense.

Stretched Valuation

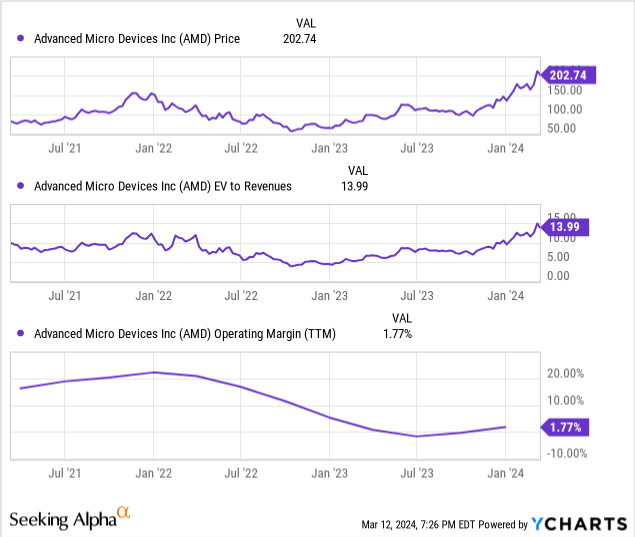

AMD has enjoyed significant growth and investor enthusiasm, but this has come at the cost of stretched valuation multiples:

The above graphs illustrate that the rise in AMD’s stock price in the last 18 months is explained entirely by an expansion in the EV-to-Revenues multiple, which would be fine if the company’s profit margins had similarly expanded, but the opposite is evident in AMD’s trailing-twelve-month operating margin.

If AMD faces challenges or fails to meet growth expectations, its stock price is vulnerable to a substantial correction as investors re-evaluate its worth.

Risks To My Analysis

While AMD’s valuation metrics may seem stretched, two factors could propel the stock to outperform its peers despite my reservations.

- AMD’s expansion into the data center market with its EPYC server processors, which compete with Intel’s Xeon processors, could continue to pay dividends, especially with increasing demand for high-performance computing, cloud computing, and general-purpose workloads; and

- AMD’s strong partnerships with major industry players, such as Microsoft (MSFT) on collaboration on gaming consoles and cloud computing, Alphabet (GOOG) on Google Cloud workloads, and Samsung (OTCPK:SSNLF) on foundry partnership for chip manufacturing, provide significant avenues for growth that are not apparent to me at this time.

If AMD consistently delivers solid earnings and revenue growth in these areas, it could justify its current valuation and even fuel further outperformance.

Conclusion

While AMD has certainly demonstrated remarkable success, the combination of macroeconomic headwinds, fierce competitive pressures, and a lofty valuation create compelling reasons for caution. Although the potential exists for AMD to continue its growth trajectory, the current environment presents obstacles that cannot be ignored. A prudent investment strategy may involve waiting for a more favorable entry point or acknowledging the increased risk profile before initiating a long-term position in AMD. I assign a Sell rating to AMD stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in AMD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.