Summary:

- Nvidia Corporation dominates AI datacenter GPU sales, but AMD is rapidly enhancing its software and hardware capabilities to capture market share, recommending a Strong Buy on AMD.

- AMD’s acquisitions of SiloAI and ZT Systems, along with ROCm software updates, aim to compete with Nvidia’s CUDA and expand AMD’s TAM significantly.

- AMD’s projected 20% CAGR in revenue through FY25, improving margins, and undervaluation compared to peers suggest strong upside potential, with a price target of $213.

- Risks include AMD’s inventory levels and competition from Nvidia, but AMD’s end-to-end AI strategy and rack-scale solutions present a compelling growth opportunity.

JHVEPhoto

Investment Thesis

Nvidia Corporation (NASDAQ:NVDA) has dominated the sale of GPUs deployed in AI datacenters for the longest time, holding almost a 98% market share in this market segment.

One of the ways Nvidia has held on to its significant competitive advantage is due to the company’s dominant moat in software for machine learning. Nvidia’s CUDA software offers parallel computing for its GPUs, allowing for dramatic scaling in machine learning training and inference tasks, allowing enterprises to achieve significant scale in their AI ambitions.

In the past few months, Advanced Micro Devices, Inc. (NASDAQ:AMD) has been quickly ramping up efforts to offer its own competitive set of software capabilities in addition to the MI300-series of AI accelerator chips that is expected to rack up at least $4.5 billion in sales this year.

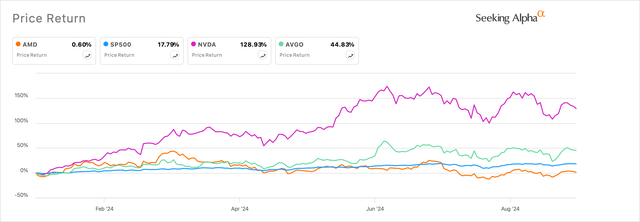

Markets are still skeptical of these catalysts that AMD is building for itself, as the company’s stock is just about to break even for the year.

Exhibit A: AMD’s stock is just about breaking even for the year with markets skeptical of its ambitions to take back market share from Nvidia (Seeking Alpha)

I believe markets have not fully digested the runway potential that AMD is building with its focus on capturing more share from its peers, and I recommend a Strong Buy on AMD.

AMD’s Renewed Focus on Adding Software Capabilities

I have covered AMD in the past, where I expressed my strong opinion on buying AMD due to its potential to expand its total addressable market (“TAM”) at higher penetration rates. I also explained how AMD was “expected to win back an additional~3% of the [AI accelerator] market” over the coming months. With software, AMD is putting its strongest foot forward in competing for market share from Nvidia.

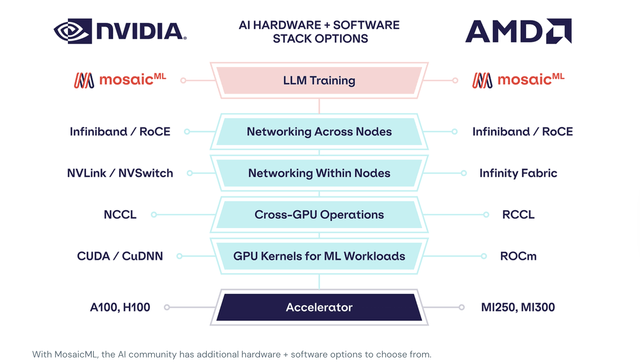

AMD has always had software capabilities in the form of its ROCm software that helped in optimizing AI workloads in data centers built using AMD’s MI300 series accelerators. This slide by the Databricks-acquired AI startup, MosaicML, explains how AMD’s solutions stacked up in comparison to Nvidia.

Exhibit B: AMD’s suite of AI training/inferencing capabilities vs Nvidia (MosaicML via Databricks)

But given Nvidia’s sheer dominance and first-mover advantage in system-level scaling of AI workloads via its CUDA, AMD needed to do more to compete for Nvidia’s platform-scale GPU dominance.

Last month AMD completed its acquisition of European startup SiloAI for $665 million and then quickly followed up by acquiring ZT Systems, a leading provider of AI and general purpose compute infrastructure. Both acquisitions will be absorbed into AMD’s Data Center Solutions Business Group. Furthermore, both of these acquisitions are designed to be acqui-hires, meaning AMD acquires the talent from these two startups while divesting other assets, such as ZT Systems’ U.S.-based data center infrastructure manufacturing business. Moreover, both of these acquisitions will be accretive to AMD’s bottom line over the next 12–16 months.

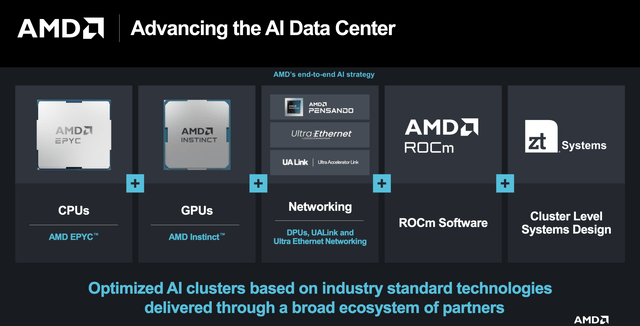

At the recently concluded Communacopia conference, AMD’s Lisa Su further explained her rationale for acquiring these companies, acknowledging some user challenges AMD’s ROCm system had. As AI workloads are ramping up beyond just model training, data center investments and upgrades are also increasing in response. The absorbed teams from SiloAI and ZT Systems will help AMD transition into an entire ecosystem deploying “end-to-end AI” in the data center.

AMD recently published the latest version of their ROCm software, v6.2, last month, which includes FP8 support (support for 8-bit floating point data types). FP8 support is a big deal, since it was one of the key features announced when AMD first launched their AI accelerator GPUs last December.

Exhibit C: AMD’s end-to-end AI strategy that includes rack-scale architecture coupled with software (Investor Presentation)

AMD believes that the strategic priorities the company is consistently following up with, such as the ZT Systems and the SiloAI acqui-hires, should widen its data center accelerator TAM, which sits at $45 billion today to $400 billion in 2027, a 70% CAGR. AMD’s GPUs, which are just one part of the TAM, are now expected to contribute ~$4.5-5 billion in sales from almost zero a year earlier due to high demand for AMD’s MI-series GPUs.

The other part of AMD’s penetration plans involves its end-to-end AI play, which includes working on custom silicon projects as well as AMD’s software ambitions and rack-scale architecture competence.

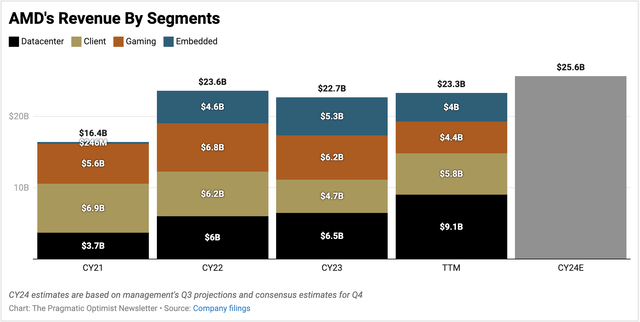

Currently, AMD is on track to achieve mid-teen growth in 2024, driven by superior growth in its Data Center business, which is growing at a ~50% growth pace.

Exhibit D: AMD’s revenue segments (Company filings)

Valuations Point To Strong Upside For AMD

The combination of these catalysts and strategic priorities that I mentioned earlier should bring AMD closer to achieving a 20% CAGR in revenue through FY25. With the Santa Clara, CA-based company on track to achieve 13-15% growth in 2024, growth is expected to accelerate in 2025 as the ZT Systems and SiloAI acquisitions become accretive to AMD’s outlook.

I also expect AMD’s margins to improve further as the expertise from ZT Systems will expand AMD’s capabilities to include rack-scale infrastructure and customized silicon. This should modestly boost AMD’s margins, as noted in its peers such as Nvidia and Broadcom (AVGO), giving a much-needed lift to AMD’s bottom line.

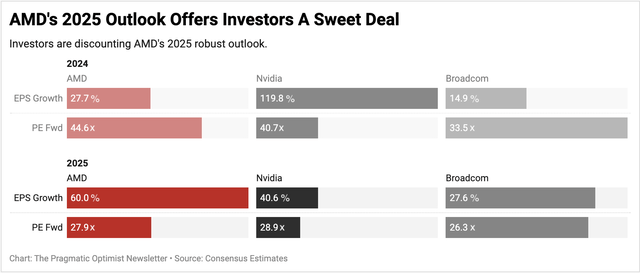

AMD will look the most expensive of the three, as noted in Exhibit E below, with AMD trading at ~45x 2024 EPS, whereas its peers trade at under ~40x 2024 EPS. However, I believe AMD is set to start outperforming in the upcoming quarters, positioning AMD well onto a path to achieve strong profitability in 2024, aided by 20% CAGR gains in sales through CY25.

Exhibit E: AMD’s valuation indicates strong upside (Author)

With AMD trading at just 28x 2025 EPS with consensus estimates expecting a 60% bump in 2025 EPS, the company’s stock looks quite undervalued when comparing AMD to its peers. They trade at similar forward valuations but are projected to grow their bottom line at a relatively slower pace compared to AMD. For example, Nvidia, which already offers its CUDA software, is priced at 29x 2025 earnings that are expected to grow 41% in 2025.

Given AMD’s robust outlook in 2025, the stock should be trading at least at 40x 2025 expected earnings, which implies a price target of $213, or ~43% upside.

Risks & Other Factors To Know

There are two risks that investors should know when assessing their capital allocation strategies towards AMD.

First and foremost are AMD’s inventory levels, which continue to balloon, albeit at a lower pace. After a few quarters of rapid expansion last year, AMD looks to be clearing inventory of their chips and supplies through their channels and at their factories. This points to very early signs that demand is firming up for AMD’s chips in its other business lines as well, such as Client Computing, Embedded, etc. Currently, AMD’s inventory stands at ~5 billion, decelerating to 9.3% y/y growth, slower than the 15% growth in inventory levels in 2023. Rapidly rising inventory will be a drag on AMD’s demand outlook and its margins.

Second is competition. AMD is no stranger to playing second fiddle. For the past decade, it gnawed at Intel’s market share in the x86 space, eventually dethroning the latter. In the AI accelerator market space, AMD finds itself in familiar territory again, as Nvidia’s CUDA has a firm grip over its clients. With ROCm, AMD is attempting to compete in Nvidia’s territory even further. The popularity of open-source frameworks such as OpenAI’s Triton and PyTorch should also help AMD’s case.

Takeaways

AMD’s stock is still sitting in discount territory, especially when viewed from the 2025 lens of its outlook. The company is making strong advances with its end-to-end approach in AI by consistently launching updates to its ROCm software and allowing enterprises to unlock the full compute potential of its MI300-series AI accelerator chips.

In addition, the company is also looking towards benefiting from the increasingly lucrative rack-scale solutions space, helping enterprises optimize their AI infrastructure deployments.

I believe markets continue to underestimate AMD’s potential here and recommend a Strong Buy on AMD.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.