Summary:

- AMD secured a major win by supplying processors for Sony’s PlayStation 6.

- The company is also making significant strides in the GPU accelerator market, closing the gap with Nvidia in AI inference benchmarks.

- Accretive design wins and continued progress in accelerator design and sales make AMD a Buy.

Jonathan Kitchen/DigitalVision via Getty Images

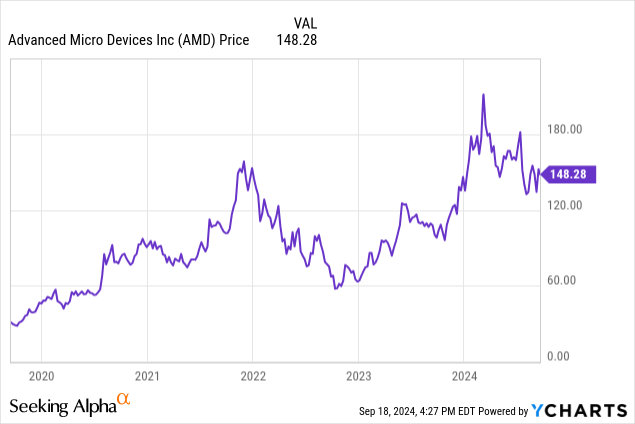

Advanced Micro Devices (NASDAQ:AMD)(NEOE:AMD:CA) has been racking up wins lately as the company secured a major design win to supply APUs to Sony’s (SONY) upcoming PlayStation 6 console, has wiggled its way into a foothold in the AI accelerator market, and has made up ground on Nvidia (NVDA) in the latest AI inference benchmarks. The stock is well off 2024 highs, but I think the company is well positioned to continue its overall upward trajectory.

I’ve written a fair few articles covering AMD for Seeking Alpha over the past few years, with the first one published all the way back in 2015. The company had just issued a revenue warning and dropped 15%, to around $2 per share. Looking at the stock as a potential turnaround play with the launch of an exciting new line of processors called “Zen” coming to market the following year, I rated AMD a Buy. You can read the article here for a walk down memory lane.

As Intel (INTC) has crumbled and the AI accelerator market has boomed in the decade since, AMD is 7000% higher today than in it was in 2015, and yet still represents a solid growth opportunity.

AMD Continues To Win

After an apparent bidding war between AMD, Intel, and Broadcom (AVGO) for who would supply the processors for the upcoming PlayStation 6, Sony has reportedly tapped AMD for the design and TSMC (TSM) for the manufacturing of the chip. Though this news was just reported recently by Reuters, the decision was apparently made back in 2022. Intel at the time seems to have been keen to secure a win for both its design division and its foundry division, the latter of which had only recently opened its doors to external customers — a big-name, high-volume product would have been a major boon for Intel and CEO Pat Gelsinger, whose turnaround plan emphasized the need to rehabilitate the company’s manufacturing base.

However, it appears AMD was able to outbid the field, which surprisingly included Broadcom, indicating Sony might have been evaluating a move away from the x86 architecture. But while Sony might have invited bids and everyone might have played along, it would have been a major surprise had it chosen any company but AMD for the job. With its APUs, which are essentially CPU cores with integrated graphics on the same die, AMD has provided the processors for every major console release since the PlayStation 4 and Xbox One back in 2012.

We are now in the fifth year of the current console cycle, which begin with the launch of the PS5, and semi-custom SoC sales, which mostly consist of console APUs shipments, have slowed to a trickle. While the product isn’t currently earning much for the company or doing much to pique investor interest, the revenue and earnings potential here is substantial.

There’s no way to know for sure exactly how much of AMD’s revenue was directly attributable to the PlayStation 5 (and the Xbox Series X, though it sold significantly fewer units) because the company’s Gaming segment includes discrete desktop GPU sales and semi-custom SoC sales. But when PS5 sales were booming in 2022, estimates put AMD’s annual sales to Sony for PS5 SoCs at about $3.8 billion, or about 16% of the company’s FY2022 and FY2023 revenue.

There is the PS5 Pro on the horizon, which should give AMD a boost when it releases in November, but the real prize is, of course, the PlayStation 6. It will be a while before it releases, probably sometime in 2028 along with an Xbox competitor likely also supplied by AMD, but the revenue impact will be significant. Everyone is hyper focused on the stock as an AI play, and there is obviously a very large addressable market there too, but investors shouldn’t discount the multi-billion dollar design wins outside of the data center. At even a conservative $3 billion annual run rate for the first couple years of the console cycle, that’s a 13% boost to the company’s top line.

Margins on these SoCs will likely be lower than GPU accelerator sales due to the competitive nature of the bidding and the lower barrier to entry to create processors with CPUs and integrated graphics, but there is still potential for accretive earnings. Further, AMD is in a much better bargaining position now due to the company’s financial recovery, reducing the desperation that might have been present for past console bidding wars, and the backwards compatibility that gamers expect would be hard to achieve if Sony had gone with another supplier.

In addition to winning the PS6 contract, AMD has continued to rack up AI design wins as the company reported more than $1 billion in quarterly revenue from MI300 GPU accelerators for the first time in Q2. Microsoft is using MI300X accelerators to power GPT-4 Turbo, co-pilot services, and is offering generally available instances to end users. HPE (HPE), Lenovo (OTCPK:LNVGY), Dell (DELL), and Supermicro (SMCI) also offer AMD accelerator platforms, with additional partners being added every quarter.

And this shouldn’t come as a surprise, as AMD has been closing in on Nvidia, specifically in AI inference workloads. I covered most of the technical specifics in a previous article, which you can read here, but vendor-submitted benchmarks from MLPerf Inference v4.1 show AMD’s MI300X providing similar tokens per second performance to Nvidia’s H100, which launched in early 2023. That said, this was only a single model (Llama 2 70B) in a single configuration (1 node w/ 8x GPUs) and AMD is still well behind the H200 and will be even further behind the B100 and B200 as well when they release later this year. But considering how wide the gap was before, this progress is still highly encouraging.

It will be interesting to see how the MI325X, AMD’s new accelerator coming in Q4 sporting 288GB of HBM3E, matches up against the H200 and B100. Nvidia still has a clear advantage in most models, most server configurations, and in the software layer with CUDA, but AMD is closer to Nvidia than it has ever been. AMD is undercutting Nvidia on price in an attempt to offer a price to performance advantage, and the closer it gets to matching performance in inference workloads, the more attractive this value proposition will be to potential customers.

Investor Takeaway

AMD has secured a contract to supply Sony’s PS6 and will likely do the same for the eventual Xbox competitor. While these wins might fly under the radar to investors with their eyes firmly planted on the AI growth story, these types of successes bolster the company’s operating results and can be underrated, accretive contributors to the bottom line.

In addition, AMD continues to add accelerator customers as revenues and earnings gradually begin to factor AI-derived growth into the mix. Though the company has a long way to go before seriously challenging Nvidia, AMD is chipping away at the total addressable market by offering attractive price to performance alternatives. As its accelerators improve, which benchmarks like MLPerf show is currently underway, AMD will be able to expand its data center revenues and reap the benefits of the continued growth of AI applications.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.