Summary:

- Some of AMD’s divisions perform extremely well; others do not.

- The corporation’s debt position is excellent, while its profitability numbers are not.

- AMD stock is very expensive, according to its valuation ratios.

- I think that AMD could eventually become a sound buy if investors’ AI overenthusiasm fades somewhat.

JHVEPhoto

In spite of the recent correction of AMD’s (NASDAQ:AMD) stock price, the chipmaker’s shares still remain expensive. While a lot has already been written here on Seeking Alpha about the company’s overvaluation and rather poor profitability, I would like to explain why AMD is still not the best value for money despite its strong market position, considerable size, and recent results that were better than many analysts had expected.

AMD stock price plunge

This is my first written and published analysis of AMD, even though I previously wrote about AMD’s rivalry to Nvidia (NVDA). Yes, AMD is technologically advanced and has a strong position in the AI industry. But its recent earnings still disappointed the market, although they were not much below the estimates.

A lot has already been written about AMD’s quarterly earnings. I will just touch on the key facts.

Here’s how AMD did versus analysts’ expectations for the quarter ended 29 June:

Non-GAAP earnings per share: 69 cents adjusted versus 68 cents expected

The diluted GAAP earnings per share, meanwhile, totaled $0.16 per share.

Revenue: $5.84 billion versus $5.72 billion expected

The company also forecasts about $6.7 billion in revenues in this quarter, versus Wall Street’s expectations of $6.61 billion of sales.

During the earnings call, AMD’s CEO Lisa Su that the company saw “higher than expected” sales of its artificial intelligence chips, and that sales from its MI300 chips were greater than $1 billion during the quarter. That is why the CEO now expects data center GPU sales to be above $4.5 billion in 2024, a rise from April’s $4 billion guidance.

The data center segment, selling AMD AI chips sales, reported a 115% year-over-year rise to $2.8 billion thanks to an increase in AI GPU shipments.

Sales for PCs, reported by AMD’s client segment, rose by 49% from the year-earlier period to $1.5 billion. That rise suggests that the PC market is recovering compared to a few years’ of post-pandemic slump.

AMD also produces chips for gaming consoles and GPUs for 3D graphics. The reported revenues for the segment totaled $648 million, a 59% year-over-year decrease.

AMD’s embedded segment, which is made up of products acquired through the Xilinx acquisition in 2022 for industrial customers, reported $861 million in sales, a decrease by 41% year over year.

Even though the earnings were generally sound, the whole high-tech sector, including AMD’s stock, was down somewhat due to poor macroeconomic statistics. Indeed, overvalued companies tend to lose a significant proportion of their market caps if the broader market foresees a recession in the near future. But let me discuss AMD’s earnings in the context of its quarterly and annual earnings.

AMD’s earnings history

I have composed two graphs showing the company’s sales and GAAP quarterly EPS histories.

The first diagram, representing AMD’s quarterly revenues, clearly shows that AMD’s growth has recently stalled, reaching its peak in July 2023.

The second graph showing AMD’s quarterly EPS suggests that the January 2022 period was the best for AMD. After that, the corporation’s earnings per share have started decreasing.

Both of the graphs below also represent AMD’s stock price, which is just a bit lower than its all-time high reached in January 2024. In fact, AMD’s stock used to be better value for money in January 2022 when its stock price was close to the levels seen today but the EPS were much higher.

The table below based on Seeking Alpha’s annual sales and profitability data also shows that AMD’s annual revenue reached its all-time high in 2021, while it seems the sales were at their highest in 2022. Although the 2024 sales may come similar to the 2022 results, we can see there is currently no spectacular growth. The 2021 earnings were at their highest, far above the TTM or 2023 results. So, we can clearly see, AMD is not currently experiencing any spectacular growth.

AMD’s annual sales and net income

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

TTM |

|

|

Revenues |

3991 |

4319 |

5253 |

6475 |

6731 |

9763 |

16434 |

23601 |

22680 |

23276 |

|

Net income |

-660 |

-498 |

-33 |

337 |

341 |

2490 |

3162 |

1320 |

854 |

1354 |

Source: Prepared by the author based on Seeking Alpha’s data

AMD’s stock fundamentals and valuations

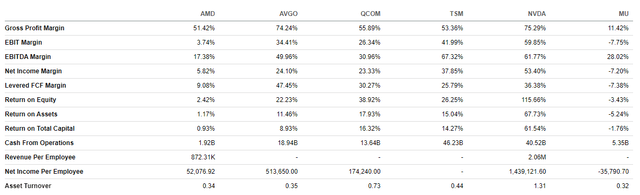

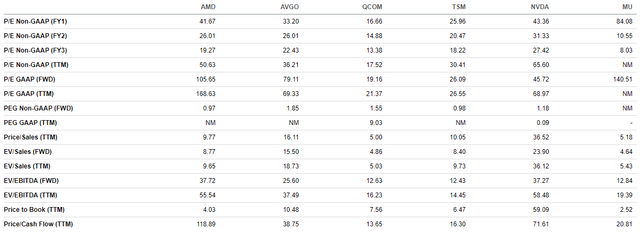

Now, a few words about AMD’s fundamentals. When I wrote about Nvidia’s fundamentals, including its profitability and valuation multiples, I said it was expensive. However, if we see AMD’s profitability and valuation ratios, we will see that these are really high even compared to these of Nvidia. This is due to the fact that AMD is not particularly profitable as opposed to NVDA. And not only Nvidia, to say the least, but also Taiwan Semiconductor (TSM), Broadcom (AVGO) and Qualcomm (QCOM). Only Micron Technology (MU) is doing worse in terms of earnings than Nvidia. MU is loss-making.

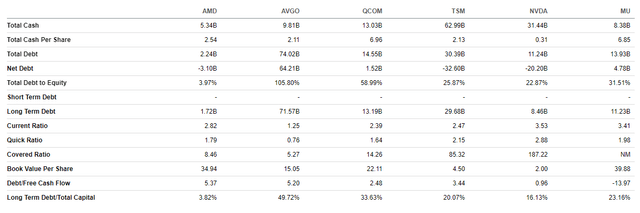

Let me go to other fundamental indicators, namely net debt, current ratio, covered ratio and debt-to-equity ratios. First of all, AMD’s net debt (debt – cash) is negative, which is obviously a great positive for the company and its investors because it can easily repay all its debt. AMD’s current ratio is also very sound, at 2.82. And so is the covered ratio, currently at 8.46 and over and above the 2 minimum limit, generally accepted for most companies. The debt-to-equity ratio is extremely strong. Generally, the ratio should not exceed 2 or 200%. In the case of AMD, it is even below 4%.

Now, let me have a closer look at the company’s valuation ratios. As I have mentioned above, AMD’s P/E ratios are the highest. The same is true of the company’s price-to-cash flow ratio, it is 118.89, over and above Nvidia’s very high P/CF of 71.61. In addition to AMD’s low profitability figures, the P/S ratio is also not particularly low. For example, MU’s and QCOM’s P/S ratios are lower than AMD’s.

Upside factors

AMD is the second-largest seller of data center graphics processing units (GPUs) after Nvidia. Although Nvidia’s stock has more than doubled this year because AI GPUs are required for training and deploying advanced AI-like ChatGPT, AMD’s stock is down somewhat this year. This could suggest the corporation’s stock is undervalued.

In fact, investors expect AMD to take market share away from its longtime competitor Nvidia with its MI300X AI chip. They also want the company to signal growth in its data center AI business, something which AMD is already doing.

Moreover, AMD shares could benefit from excellent PC-chip trends and more realistic AI-sales expectations. As I have mentioned before, right now, investors’ artificial intelligence forecasts seem to be quite elevated. If investors’ AI overenthusiasm diminishes somewhat, AMD could become an attractive buy.

According to analyst Reitzes, Taiwan Semiconductor’s upbeat results were one of the reasons to suggest the chip sector is in a good shape.

Apart from AMD’s great results reported by some of its business segments, AMD also recently announced Silo AI acquisition. Even though this deal will not put AMD on par with Nvidia, it would help the company to support its ecosystem.

Downside risks

The downside risks are obvious, in my opinion. AMD’s valuations are mostly due to the AI hype. The earnings growth rate is currently negative. Moreover, it seems AMD’s investors are far too optimistic due to the corporation’s exposure to the AI boom. Therefore, they have high expectations of the company’s earnings. Although the situation can easily change, right now, AMD’s stock seems to be substantially overvalued, given its earnings track record and valuation ratios. Then, a number of economists say that a recession is near. If they are right, overvalued and overhyped companies like AMD are likely to substantially decrease in value.

Conclusion

AMD is both an expensive stock and not a particularly profitable company. Yet, some of its business segments show some brilliant growth. After Nvidia, AMD is the second-largest player on the GPUs market. Moreover, the fact the company’s stock price corrected somewhat this year could be a good entry point for some AMD enthusiasts. However, I would not personally buy the stock. The company is not very profitable, its valuation ratios are high, and a recession could be upon us. At the same time, I would not sell the stock short because of the corporation’s growth potential. So, my rating on the stock is “Neutral”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.