Summary:

- AMD has lagged behind the broader semiconductor index this year despite robust uptake for its Instinct accelerators in the heat of the AI arms race.

- The client segment is also benefitting from an early recovery in the PC market, propped by AMD’s inherently elevated exposure to the more affluent commercial end-market.

- Paired with an emerging recovery in higher-margin embedded sales, reinforced by longer-term adjacent demand from AI momentum, the stock continues to underappreciate an impending upgrade supercycle.

hapabapa

AMD (NASDAQ:AMD) has been a laggard compared to the broader Philadelphia Semiconductor Index (SOX) this year, despite consistent progress in ramping up its AI accelerators to support the industry’s transition to accelerated computing. The stock has largely traded rangebound in recent months, after paring earlier-year gains in March. In addition to regulatory barriers against AMD’s penetration into the Chinese market with its Instinct accelerators, the company is also grappling with intensifying competition amid the AI processor arms race.

Yet AMD’s data center segment continues to benefit from a robust demand environment, with growth remaining a function of supply availability. More importantly, its strong product slate, supported by the next-generation Turin server processors and MI325 accelerators coming 2H24, will likely bolster growth in the higher margin data center revenue stream. Meanwhile, emerging signs of recovery in its client segment are also expected to benefit from the upgrade cycle ahead. Specifically, strong uptake for the Ryzen 8000 series CPUs observed in Q1 underpins similar demand for AMD’s next-generation AI-enabled processors to support AI PCs. The gradual recovery in embedded segment sales heading into 2H24 should also restore accretion to profit margins in 2025.

Taken together, we believe AMD’s benefit from the emerging upgrade cycle across its key product segments remains underappreciated at the stock’s current levels. The moderation of China headwinds, with proliferation of recovering growth and ensuing margin accretion across key product segments ahead of the AI supercycle should propel the stock back towards record levels.

Data Center

The spotlight remains on the continued ramp of AMD’s Instinct MI300 accelerators – its answer to impending AI growth opportunities. Based on its latest earnings update, the MI300 has emerged as the “fastest ramping product” in AMD history”, with sales surpassing $1 billion since launching two quarters ago. As a result of robust uptake, management has raised guidance for anticipated data center GPU sales for a second time to $4 billion, up from $3.5 billion previously and doubling from the initial estimate.

However, there is continued evidence that the raised guidance for data center GPU sales remains conservative. Specifically, AMD’s recently disclosed AI processor roadmap at Computex underpins additive growth opportunities ahead for the segment.

The upcoming MI325X accelerators, which follows the successful launch of MI300 and starts shipping in 4Q24, will likely complement improving supply conditions. The set-up is expected to help AMD better capture imminent growth opportunities stemming from the transition to accelerated computing, reinforced by resilient capex allocations towards the build-out of AI infrastructure this year.

The MI325X boasts 288GB of HBM3E memory, with 6 TB/s GPU memory bandwidth. Comparatively, Nvidia’s (NVDA) latest H200 GPUs only offer up to 141GB of HBM3E memory with 4.8 TB/s GPU memory bandwidth, with its next-generation Blackwell HGX B100 GPUs expected to deliver 192 GB of HBM3E memory capacity with 8 TB/s memory bandwidth performance. The diminishing performance gap between AMD and its competition is expected to bolster strong uptake rates in the back half of the year.

And in the longer-term, AMD’s continued commitment to unlocking additional performance gains will be a key reinforcement to the success of its AI strategy, as it attends to increasingly structural industry optimization trends. For the upcoming MI350X and MI400 accelerators based on next-generation CDNA architecture, AMD plans on unlocking further performance and efficiency gains for “inference and large-scale AI training”. We believe this will be critical to preserving AMD’s capture of emerging data center growth opportunities. Specifically, the anticipated adoption of AI PCs over the longer-term will inevitably cannibalize some of the inferencing workloads currently processed in data centers, given the lower costs and reduced latency in processing on edge devices. As a result, competitive chip performance and efficiency will likely be a key consideration for data center end-markets in the longer-term in order to preserve inferencing demand from being compromised by AI PCs.

Meanwhile, server CPU demand also remains a resilient corner for AMD. Admittedly, the transition from CPU-based general-purpose computing to accelerated computing to support increasingly complex and compute-hungry workloads has dulled the secular demand outlook for server processors. Yet, server CPUs remain a critical component of the accelerated computing transition.

As discussed in a previous coverage, data centers typically combine both CPUs and GPUs to “dramatically speed up work”. CPUs process computing tasks one at a time in a “serial fashion”, which increases processing times of massive workloads like AI training and inferencing. Meanwhile, data center GPUs have been a key complement to server CPUs in creating accelerated computing platforms. Unlike CPUs, GPUs can execute multiple computing tasks at a time in a “parallel fashion”, thus reducing latency in processing massive workloads like AI/ML. By combining both, multiple complicated computing tasks can be performed in parallel by the accelerator, while less demanding tasks can be delegated to CPUs to be processed in sequential formation. This accordingly yields faster execution times, while also enabling power efficiency and performance gains by reducing idle time.

And AMD’s leadership in addressing server CPU demand amid the broader industry transformation is corroborated by outperformance in its EPYC processor uptake rates during Q1, despite the seasonal slowdown. Strong revenue share gains were observed, especially in enterprise and cloud deployments. Many CIOs have cited the need to “add more general purpose and AI compute capacity”, without the need to materially change the “physical footprint and power needs of their current infrastructure”. Not only does this highlight continued optimization trends, but also durability to the demand environment for AMD’s server processors.

Currently, AMD’s fourth generation Genoa EPYC server processors are capable of delivering the same level of compute with “45% fewer servers compared to the competition”, alongside up to 40% and 50% in initial opex and capex reduction. This accordingly paves way for incremental demand momentum heading into the second half of the year when the next-generation, more efficient Turin EPYC processors start shipping.

While details are limited, management’s latest disclosure has alluded to “significant performance and efficiency increase” from Turin, underpinning favourable prospects for further market share gains. This is already corroborated by a 30% premium observed in Turin-powered enterprise designs over the previous generation of Genoa platforms. AMD is also anticipating an easier ramp for the next-generation EPYC processors. Specifically, the next-generation Turin processors will be compatible with the socket SP5 used by Genoa, making adoption more efficient without the need for significant reconfigurations to existing infrastructure. We believe this configuration will better facilitate the incoming upgrade cycle, complementing Turin’s significantly efficiency and performance gains. Taken together, the upcoming launch of Turin generation EPYC processors is expected to be additive to AMD’s competitive advantage in serving the market for data center CPUs, underscoring the company’s key role in next-generation compute on-premise and in the cloud.

Client

AMD also remains a key beneficiary of the gradual PC market recovery, with idiosyncratic strengths observed through strong uptake rates for its latest Ryzen Pro 8000 Series CPUs. Specifically, sales of the company’s latest generation of Ryzen mobile and desktop processors launched in April were key to the client segment’s 85% y/y growth during Q1. In addition to industry-leading power efficiency and battery life, the Ryzen Pro 8000 Series CPUs also offer on-chip AI accelerators.

This accordingly reinforces AMD’s prospects in capturing AI PC tailwinds ahead, especially considering the impending post-pandemic refresh cycle across commercial end-markets. Specifically, the more affluent commercial end-market is expected to be early adopters of AI PCs, as purchases made during the pandemic are due for an upgrade. Meanwhile, the upcoming Windows 11 refresh, which is expected to usher a flurry of major updates from Microsoft (MSFT), alongside increasing integration of on-device AI capabilities also make another incentive for commercial end-market upgrades.

We believe the growing introduction of AI PCs into the market would become a reinforcement to AMD’s client momentum. Specifically, AI PC shipments are expected to reach as much as 50 million units by the end of the year and account for about a fifth of the anticipated total shipment mix. A recent survey also indicates that the majority of the enterprise spending segment plans to incorporate AI PCs within the near future to partake in anticipated performance gains and cost efficiencies of on-device local inferencing.

AMD’s favourable prospects ahead of the upcoming AI PC upgrade cycle is further reinforced by its upcoming client product roadmap, in our opinion. Specifically, the recently announced Zen 5 Ryzen 9000 Series processors, which succeed the latest Zen 4 Ryzen 8000 Series processors, promises even greater performance and power efficiencies. The upcoming Ryzen 9000 Series processors are expected to start shipping later this year, enabling up to 16% better performance and processing speed on average compared to its predecessor.

The Ryzen 9000 Series processors are expected to complement the next-generation Ryzen AI advanced processing units (“APUs”) – namely, the Ryzen AI 300 – as well in furthering AMD’s capturing of emerging AI PC opportunities. The newest generation of Ryzen AI is designed based on the latest XDNA 2 architecture, and offers industry-leading AI processing power that is as much as 3x the performance of its predecessor. Paired with more on-chip memory and an extended battery life, the latest Ryzen AI APU makes a favourable choice for commercial end-markets in the upcoming PC upgrade cycle.

Embedded

AMD also looks well-positioned for an emerging cyclical recovery in its embedded segment. Recall that the embedded segment was once a key growth and profit driver of AMD’s after its acquisition of Xilinx. Yet, the segment swiftly entered into a consolidation phase last year, as end markets entered into a cycle of inventory digestion.

Looking ahead, management is expecting the cyclical downturn to bottom exiting the first half of 2024, with eyes on a gradual recovery in the back half of the year. Emerging growth tailwinds from the impending cyclical uptrend is likely to become more evident in 2025, supported by longer-term adjacent demand from and AI-era upgrade cycle.

As mentioned in the earlier section, AI at the edge promises competitive TCO and efficiency gains, given lower processing costs and reduced latency. This accordingly paves way for incremental opportunities in the embedded segment, given expectations of greater compute demand on devices to support AI at the edge.

And AMD’s second generation Versal Adaptive SoCs are expected to reinforce momentum on this front. The newest SoCs are optimized for end-to-end acceleration, spanning pre-processing, AI inferencing, and post-processing to unlock data-driven insight generation at the edge. The second generation Versal Adaptive SoCs also incorporate the AIE-ML v2 architecture, enabling up to triple the performance and processing speeds of its predecessor.

With the newest embedded product optimized for application in autonomous driving and medical imaging, AMD is primed for leading AI integration opportunities across the automotive and healthcare verticals. As recently indicated by its semiconductor peer, Nvidia, AI integration in the automotive industry is expected to become a “multibillion dollar revenue opportunity”, as inferencing activities stemming from autonomous mobility and smart cockpit solution developments continue to ramp. Coupled with improved performance and scalar compute capacity in the second generation Versal Adaptive SoCs, AMD’s embedded segment is likely to benefit from a robust cyclical recovery ahead.

Risks to Consider

i. China Headwinds

The ongoing chip war between the U.S. and China continues to be a headwind for the broader semiconductor industry. On one hand, the U.S. has levied stringent export curbs on advanced semiconductor technologies to China. Meanwhile, on the other hand, the China has restricted the use of foreign processors in both public and state-backed agencies citing national security concerns. Yet, we believe AMD has sufficiently de-risked for relevant risks over the past year compared to rivals like Intel (INTC).

In addition to the proliferation of AI momentum, AMD has also taken company-specific measures to minimize its exposure to China market headwinds. Specifically, AMD has significantly reduced its exposure to the Chinese market over the past year since the implementation of the U.S.’ export curbs. The bulk of AMD’s China revenues are likely generated primarily from client use cases, such as the Ryzen CPUs and Radeon GPUs. Meanwhile, AMD’s data center revenue exposure in China likely stems from its less advanced EPYC server processors, given compliance with U.S. export restrictions. The latest Genoa EPYC processors, as well as AMD’s latest Instinct MI300A / MI300X AI accelerators remain non-compliant with the controlling thresholds outlined in the U.S. export rules.

This is corroborated by the steep drop in AMD’s revenue mix from China. Specifically, AMD’s revenues generated from China has fallen from 25% of total sales made prior to the implementation of U.S. export curbs, to 22% in 2022 and, more drastically, to 15% in 2023.

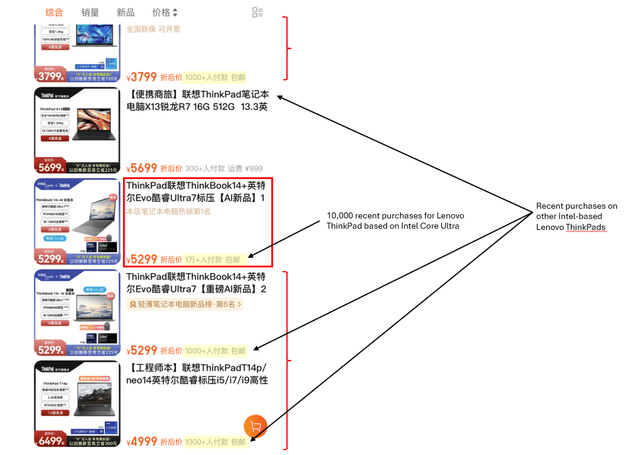

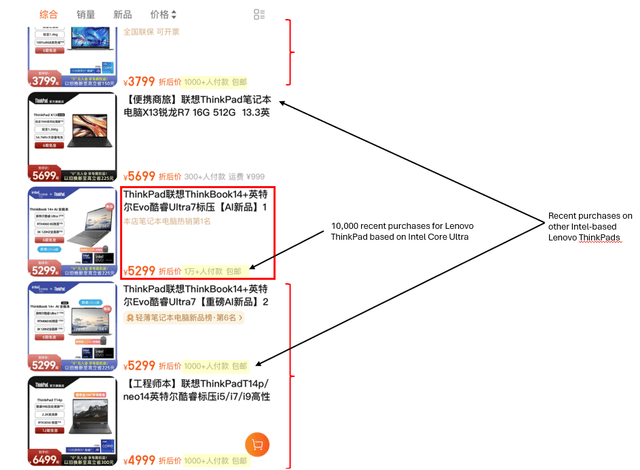

Meanwhile, Chinese government use of mobile devices fitted with AMD microprocessors is likely much lower in comparison to rivals like Intel. While Lenovo (OTCPK:LNVGY / OTCPK:LNVGF) is a key partner of AMD’s, the demand environment for its client processors in China is much less compared to Intel’s. This is corroborated by a sense check on Lenovo’s official selling page on Taobao (BABA) – a key shopping destination for Chinese consumers. Lenovo’s best-selling ThinkBook based on Intel’s latest chips has acquired as many as 10,000+ recent purchases, with many other models acquiring at least 1,000+ recent purchases. Meanwhile, the best-selling ThinkBook based on AMD’s Ryzen CPUs have only acquired 9,000+ recent purchases, with many other models acquiring under 1,000 recent purchases.

Meanwhile, at Huawei, AMD’s CPU share also lags Intel’s by wide margins due to the latter’s benefit from an exclusive export license. Specifically, the share of AMD components found within Huawei laptops have fallen from close to 50% in 2020 to under 10% exiting 2023. Paired with ongoing restrictions on EPYC incorporation in Chinese servers over the past year, AMD’s overall exposure to recent regulatory changes in China remains limited.

ii. Uncertain Gaming Backdrop

In addition to China risks, AMD also remain prone to an uncertain recovery in its core gaming segment. Relevant sales have continued on an increasingly violent double-digit percentage decline with limited visibility to its recovery trajectory. This has resulted in a significant reduction to AMD’s gaming revenue mix, which has consistently fallen from more than a third to merely a fifth of total revenues over the past year. The segment’s dire results continue to reflect a largely absent console upgrade cycle, as the industry increases focus on cloud-based gaming platforms. Meanwhile, gaming GPU demand (i.e. AMD Radeon) also remains limited, given the slower-than-expected consumer PC market recovery.

While the gaming segment remains a negative headwind to AMD’s near-term growth trajectory, persistent declines could compensate by unlocking margin accretion. Specifically, reduced gaming revenue mix allows more profitable data center revenue growth and embedded revenue recovery to proliferate – especially as new products from the two segments continue to ramp at scale. This would be favourable to AMD’s impending cash flows, which are critical to unlocking pent-up valuation gains from the stock.

Fundamental Considerations

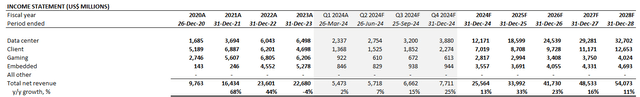

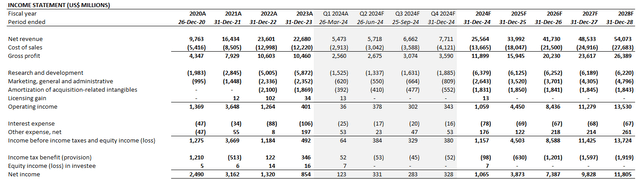

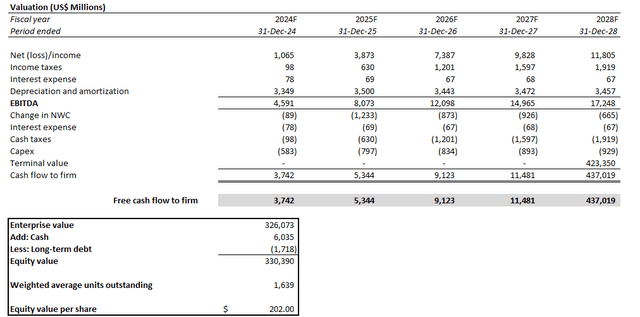

Adjusting our previous forecast for AMD’s actual 1Q24 results and forward outlook, we expect the company to grow revenue by 13% y/y to $25.6 billion in 2024. Over the longer-term, we expect the company to grow at a 16% five-year CAGR, supported by our foregoing analysis on a potentially impending upgrade supercycle across the key data center, client and embedded segments.

Taking into consideration expectations for the continued ramp of new products in the higher margin data center and embedded segments, propelled by AI-driven momentum in the demand environment, ensuing margin expansion is likely to proliferate for AMD starting 2H24 and become more evident entering 2025. We believe this will be key to compensating for near-term headwinds in gaming, and reinforce cash flows underpinning the stock’s long-term upside potential.

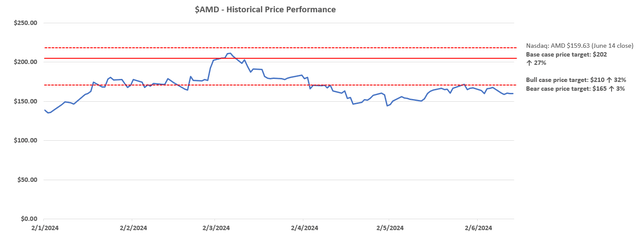

Price Considerations

We believe AMD offers a favourable risk-reward set-up at current levels. Taking our revised fundamental forecast for AMD into consideration, we remain confident in the stock’s ability in reaching $202 apiece.

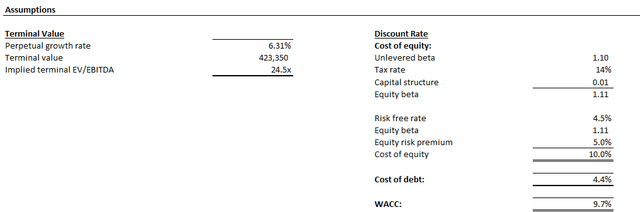

The price target is derived from the discounted cash flow approach. The analysis considers cash flows projected in conjunction with the base case fundamental analysis discussed in the earlier section. A 9.7% WACC in line with AMD’s risk profile and capital structure is applied. The analysis also considers a perpetual growth rate of 6.3% on projected 2028 EBITDA. This accordingly yields a premium terminal value, which believe to be warranted given our expectations for an impending upgrade supercycle across AMD’s key operating segments. The perpetual growth rate applied is equivalent to 3.5% applied on projected 2033 EBITDA when AMD’s growth profile is expected to normalize in line with the higher-range pace of estimated economic expansion across its core operating regions.

Conclusion

We believe that at current levels, AMD underappreciates prospects for a strong upgrade cycle ahead across its key product segments. The company’s competitive data center roadmap across both server GPUs and CPUs, underpinned by the technologies’ robust performance gains, continues to facilitate capitalization of optimization-driven upgrade cycle demand. This is further supported by AMD’s improving software stack aimed at accommodating rapidly evolving data center needs, both on-premise and in the cloud.

Meanwhile, AMD’s commercial workstation CPUs are also likely to benefit from the upcoming AI PC upgrade cycle in enterprise end-markets. Specifically, the advent of AI PCs underpin productivity gains in the long-run, incentivizing a secular transition in the emerging device upgrade cycle. And AMD’s roadmap for its Ryzen CPUs and Ryzen AI APUs accordingly unlocks significant compute performance gains at the edge.

Coupled with the emerging recovery in embedded products, AMD is well-positioned for a sustained long-term growth trajectory with accompanying accretion to its bottom-line. This would be critical to cash flows underpinning the stock’s future valuation gains. Admittedly, AMD’s inherent exposure to China headwinds and gaming market declines remain multiple compression risks in the immediate-term. However, the upcoming upgrade cycle across its key operating segments should result in net positive contributions to the stock’s valuation prospects ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.