Summary:

- AMD share prices have dropped substantially following earnings, based largely on forward guidance figures that may have been perceived as weak by the market.

- A 68% plunge in gaming segment revenues also contributed to the sell-off and overshadowed other aspects of the report that were more positive.

- Recent price behavior suggests that a potential trend reversal might be in place, as key support levels have been broken during this downturn.

- Markets seem to be overlooking incredible elements of strength in AMD’s data center sales growth, which has now doubled in two consecutive quarters.

- Recent declines in share prices have improved the stock’s risk-reward parameters, and I think AMD looks incredibly compelling right now for investors looking to add exposure in the technology sector.

JHVEPhoto

When I last covered Advanced Micro Devices, Inc. (NASDAQ:AMD) on October 14th, 2024, with my article “AMD: Ready To Move Higher”, the stock was attempting to find a supportive base after falling by as much as 46.4% from the all-time highs posted on March 8th, 2024. In large part, my bullish thesis was based on the fact that, in my view, notable growth rates in the firm’s AI processor sales overshadowed shorter-term weaknesses in AMD’s gaming segment and that the major declines that the stock has experienced during the early periods of this year appeared to be over-extended and ready to finally start moving higher. Since then, we have received a major update on the earnings front, and I must say that the overall stock performance that followed has certainly disappointed my prior expectations:

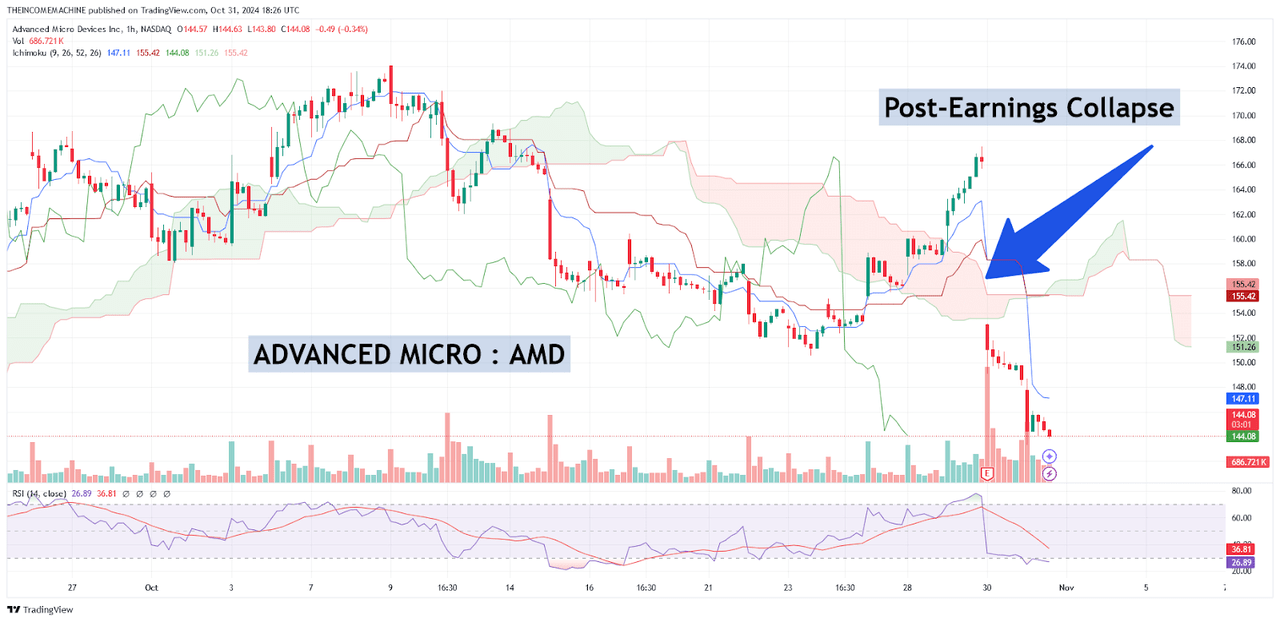

AMD: Post-Earnings Share Price Declines (Income Generator via Trading View)

Following AMD’s most recent earnings report, share prices collapsed below the $145 level and left an enormous bearish price gap in its wake. Unfortunately, it simply cannot be ignored that these events have done a lot of damage to my prior outlook. However, the market’s failure to respond to AMD’s third quarter earnings release in a bullish manner has now provided investors with an even more attractive entry point, and I am raising my rating perspective to a “strong buy” in light of these important new developments.

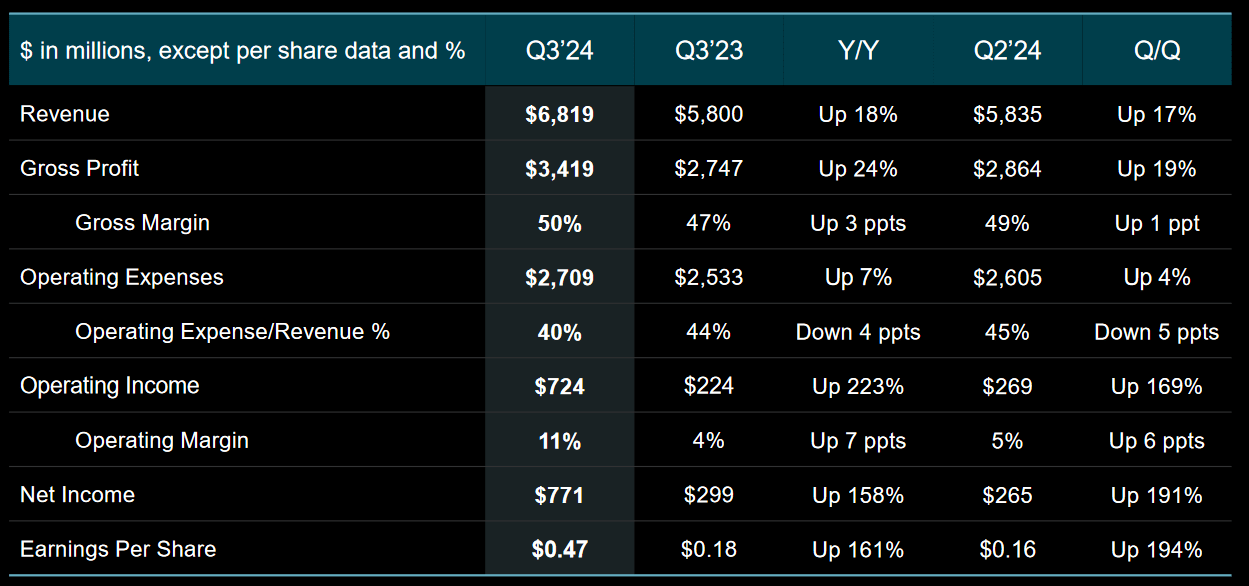

AMD: Quarterly Earnings Figures (AMD: Quarterly Earnings Presentation)

I will begin with what I believe to be the central risks for the bullish outlook when considering new long positions in AMD. Any time we see the market respond with substantial selling pressure, even when a quarterly earnings report shows EPS figures that are broadly in-line with analyst expectations, clear warning signals are being sent, and the potential suggestion is that share prices might be vulnerable to further downside. In this case, AMD’s adjusted per-share earnings figure of $0.92 matched consensus estimates, while topline revenue figures ($6.82 billion) actually surpassed expectations by 1.64%. However, the main problematic issue was seen with the firm’s forward guidance figures (adjusted EPS of $1.16 and revenues of $7.5 billion), which would indicate annualized declines of -22%, if realized.

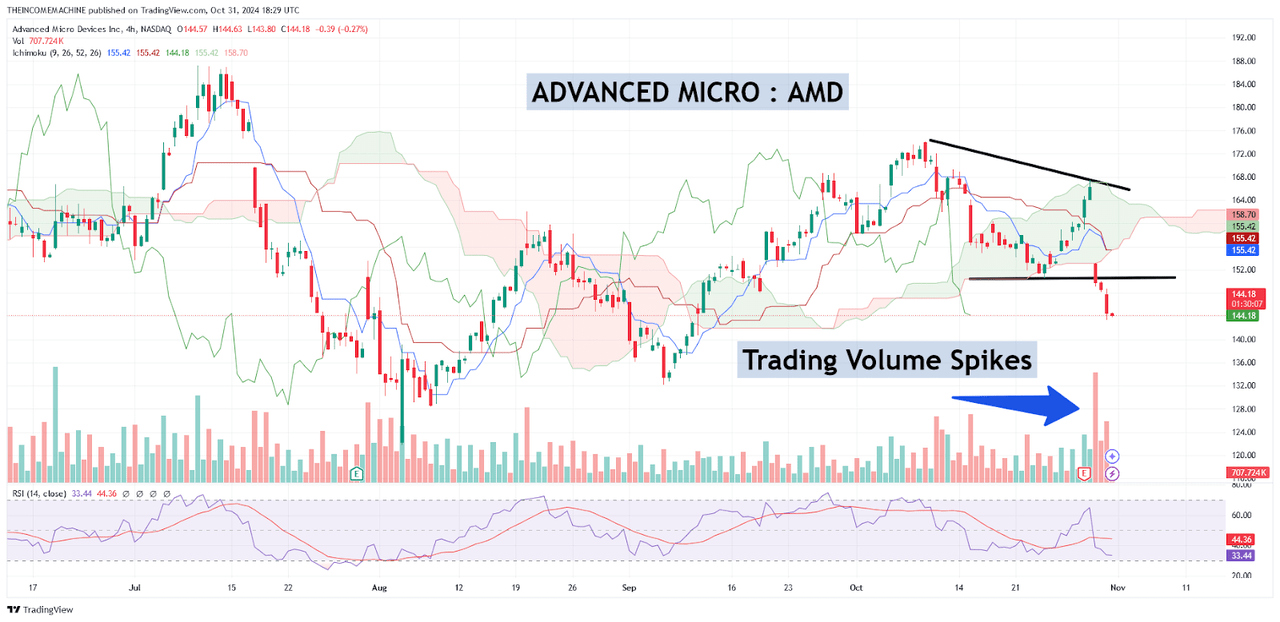

AMD: Quarterly Earnings Figures (AMD: Quarterly Earnings Presentation)

Additional concerns can be seen in AMD’s gaming segment, which produces processors for gaming computers and consoles. Given the fact that the gaming segment is largely responsible for AMD’s ability to rise to prominence over the last decade, annualized sales declines of -68% in this segment likely caught the market’s attention, and the result was a massive sell-off during the following trading sessions.

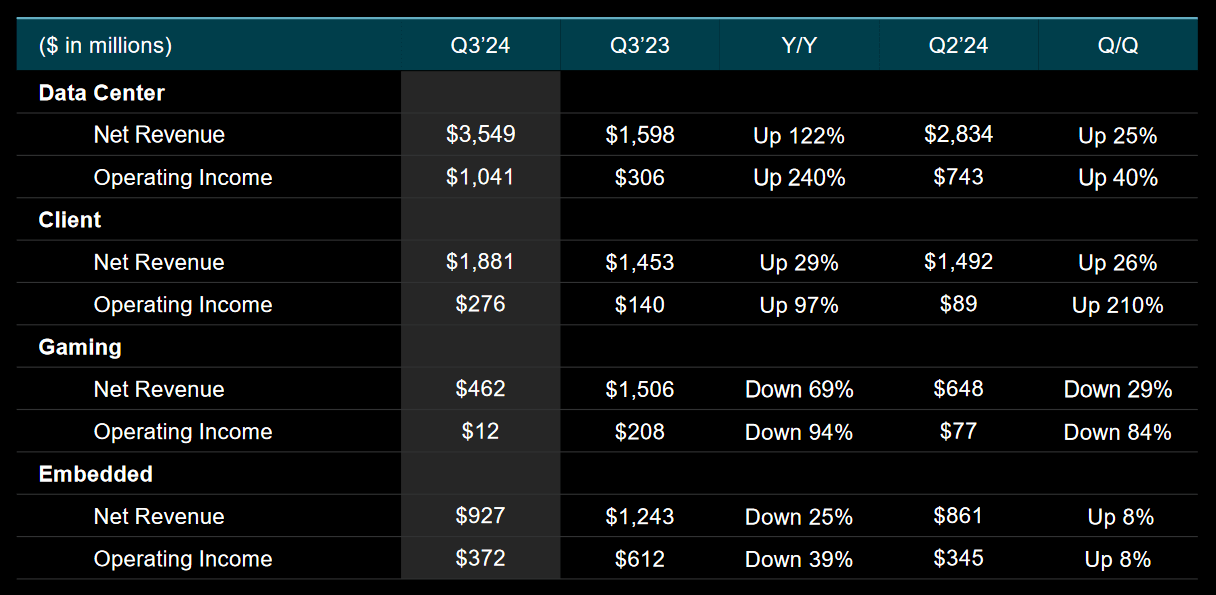

AMD: Key Support Zone Breaks (Income Generator via Trading View)

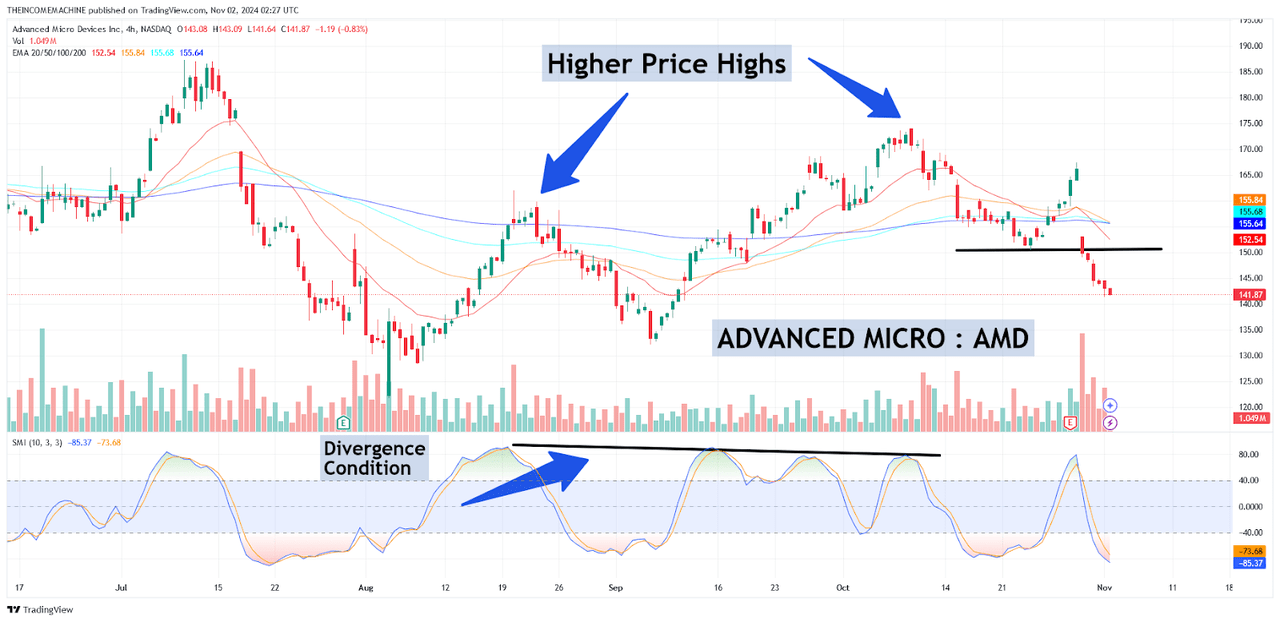

As a result, I think it is important to highlight the central damage that this post-earnings market reaction has created in changing this stock’s prior trend trajectory. Specifically, recent declines have fallen through significant support zones near $150.52, which marks the lows from October 23rd. These declines were accompanied by massive spikes in trading volumes, and the negative price reversal that began during the October 9th trading session has now ended the series of higher price lows that have been in place since August 5th. Unfortunately, this suggests that AMD’s latest uptrend has now become invalidated, while readings in the stochastic momentum index on the 4-hour price charts have strengthened in the negative direction. Interestingly, a bearish divergence condition was seen in the stochastic momentum index following this October 9th trading period, and this is a chart analysis signal that suggests downside reversals from prior highs are becoming increasingly likely.

AMD: Divergence Conditions Present (Income Generator via Trading View)

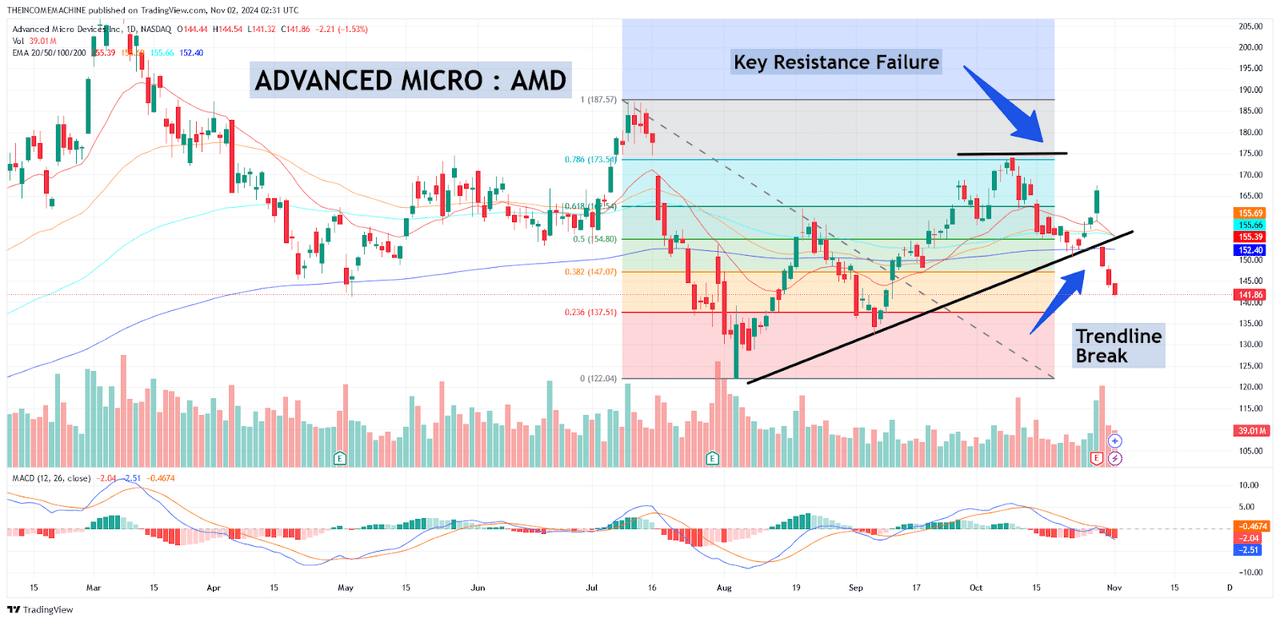

In addition to breaking the series of higher lows that had been in place since the beginning of August, recent price failures have solidified critical resistance zones near $174.10. Essentially, this area marks the 78.6% Fibonacci retracement of the stock’s decline from $187.27 to $121.82, and the current confluence of historical resistance levels and trend-based retracement levels could make this area more difficult to breach going forward.

AMD: Key Resistance Failure (Income Generator via Trading View)

However, I believe these negative market reactions have largely dismissed several important positives that are currently working in AMD’s favor. During the third quarter, net income figures came in at $0.41 per share ($771 million), and this indicates annualized gains of nearly 157.9% for the period. And while the firm’s forward guidance figures failed to inspire much enthusiasm in the market, the outlook for AMD’s data center hardware still looks incredibly strong (with annualized revenue gains of 122% for the quarter). Fortunately, this marks the second consecutive quarterly period that has been characterized by +100% growth rates in AMD’s data center segment, and this tells us that demand for new development in AI infrastructure (for example, from cloud services providers) is showing no real evidence of significant weakness.

AMD: Quarterly Earnings Figures (AMD: Quarterly Earnings Presentation)

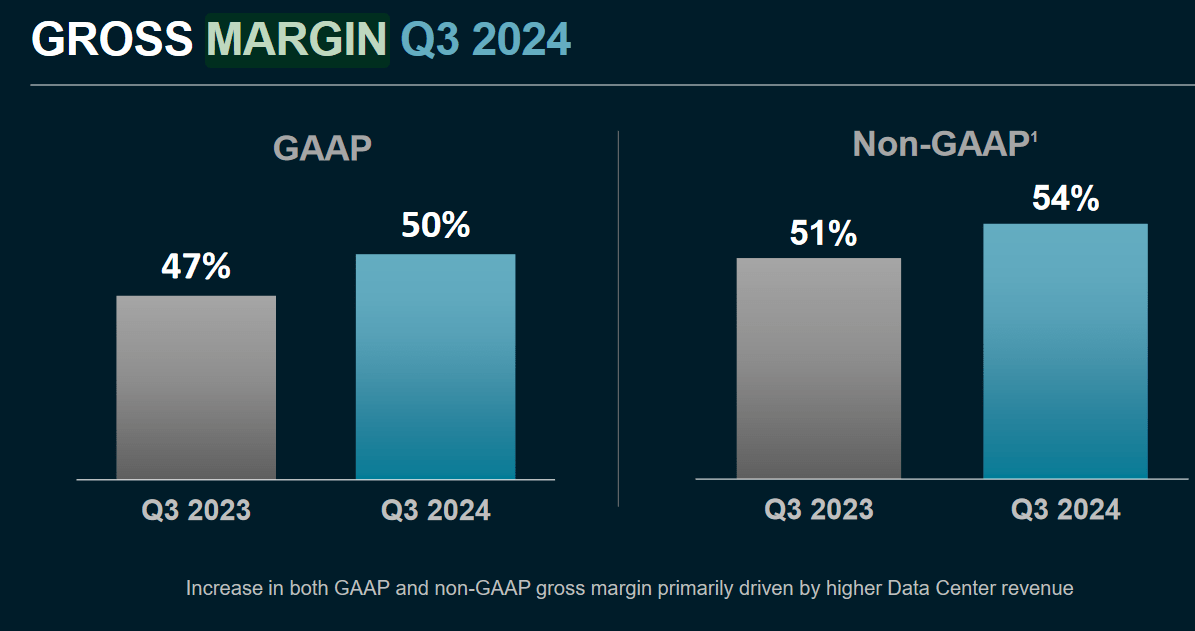

Strength in AMD’s data center revenue also aided expansion in gross margin (which rose to 54% in Q3) and growth in free cash flow figures indicated substantial YoY gains of 67% (at $496 million). Clearly, these are impressive performances, and the major sell-off that has been seen over the last few days has only strengthened my opinion that this stock is ready to begin moving higher. Comparative valuations have also improved a bit, following these declines – and next, we will assess these relative metrics to competitor companies within AMD’s industry peer group.

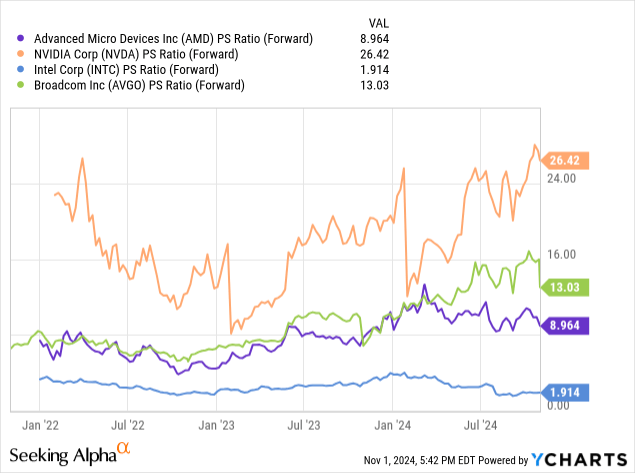

AMD: Comparative Price to Sales Ratios (YCharts)

Data by YCharts

Specifically, if we consider AMD’s weakening forward price-sales ratio of 8.964x, we can see that Nvidia Corp. (NVDA) is currently trading at a much higher ratio of 26.42x. Looking at another major player in the development of data center infrastructure hardware in Broadcom, Inc. (AVGO), valuations are a bit lower (but still elevated) at 13.03x. In order to find an industry competitor that is currently trading with a lower price-sales valuation, we might need to look at a company like Intel Corp. (INTC), which trades with a forward price-sales valuation of just 1.914x. However, I see very little in Intel’s most recent earnings figures to suggest that the stock should be trading anywhere near AMD’s current valuation. As a result, I think these recent share price declines have only made the stock more attractive because the potential for upside is looking increasingly attractive.

AMD: Outlook Reversal Pivot Points (Income Generator via Trading View)

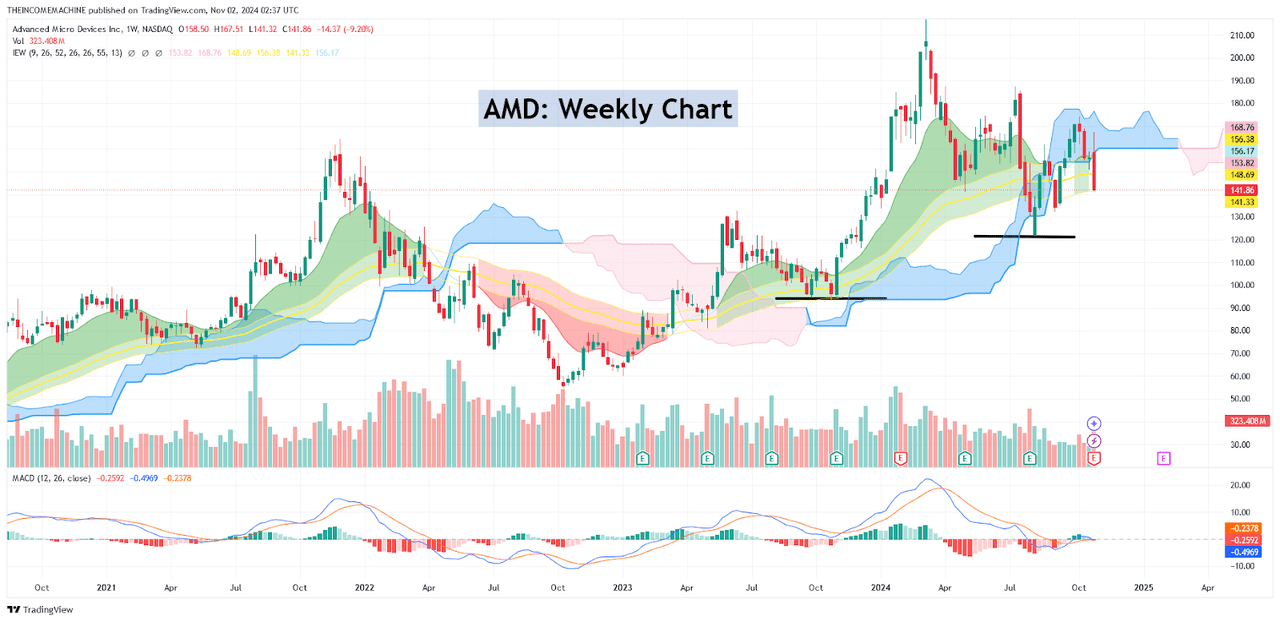

In order to change my current outlook on this stock, I would need to need better evidence that share price momentum is likely to continue accelerating to the downside. Even with the stock’s latest drop lower, important support zones near $121.83 have remained intact. However, I would consider a break below this level to be a major warning signal because there is no significant price support for this stock until we reach $93.12 (which marks the stock’s low from October 23rd, 2023). On the weekly time frames, we can also see that the 200-week exponential moving average is rapidly ascending toward the August 5th, 2024 support zone, and this suggests that a downside break through this area would also send share prices below all of the major long-term exponential moving averages. One other point that I find to be notable on the weekly time frame is the fact that the moving average convergence divergence indicator has already started to move back into positive territory after a brief drop into bearish territory (following the most recent quarterly earnings release). Overall, this might suggest that negative momentum readings have already become over-extended and that further moves to the downside might prove to be unsustainable.

Ultimately, I maintain my prior viewpoint that quarterly earnings growth in AMD’s data center segment looks quite robust and that the company is still in a position to benefit from continued demand for artificial intelligence hardware, especially if any potential delays with Nvidia’s Blackwell GPUs force data center enterprises to seek-out competing alternatives. Recent market reactions to AMD’s guidance figures seem a bit overblown from my perspective, and recent declines in share prices have made the stock’s risk-reward parameters much more attractive. As a result, I will be adding to my established long position near current levels and raising my rating outlook to a “strong buy” for this stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.