Summary:

- Advanced Micro Devices delivered weak overall performance in the first quarter earnings results, with lackluster forward guidance.

- The elevated valuation of AMD is sharpening the question regarding its growth prospects.

- I believe that the company has solid fundamentals to gain potential in the AI accelerator and APU-related markets.

- In my view, AMD stock should be surrounded by bullish sentiment, with the potential to deliver up to a 50% gain as enterprises begin commercializing the AI technology potential.

JHVEPhoto

Advanced Micro Devices, Inc. (NASDAQ:AMD) struggled to put some nice growth numbers in the recent Q1 financial results, which, along with the unimpressive guidance, leaves investors without much confidence to Buy the stock now. Moreover, with the current balance of power, where Nvidia and Intel are sharing the leading positions in the GPU and CPU-related markets, the reasonable question is: where are AMD’s growth prospects, which could infuse confidence in the market participants again? This article will try to elaborate on this query, going through the market potential in AI accelerators, gaming GPUs, and commercial APUs and the resulting valuation rating.

Struggling for growth

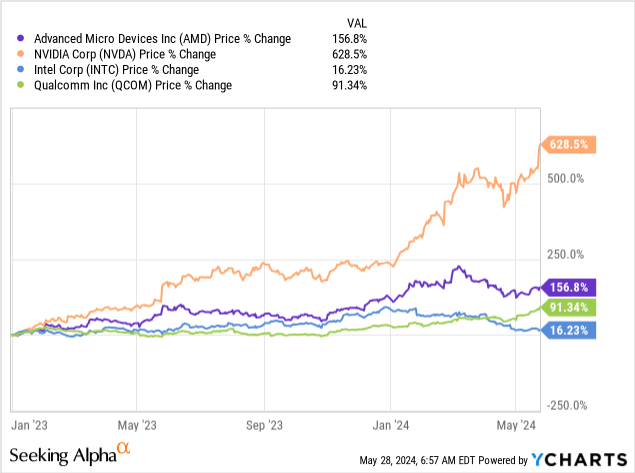

Amid the rapid development and the trend towards scaling of artificial intelligence through an increasing number of economic verticals, AMD appears to be one of the main players to reap the benefits of it. The launch of the ChatGPT initiated a new billion-dollar TAM for the company; however, looking at the chart with price performance below, AMD remains further and further in the slipstream of Nvidia Corp. (NVDA).

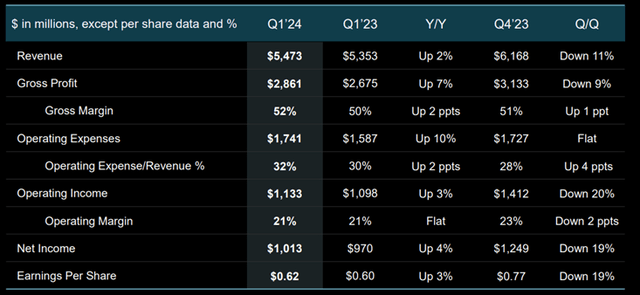

Following the first quarter financial results, it doesn’t seem that investors remain that optimistic as they enter 2024. AMD delivered $5.5 billion in revenue for the quarter, which turns out to be 11% lower on a sequential basis. The data center segment grew 2% on a quarterly basis (+80% YoY due to the low base effect), but not enough to offset the weak performance in other segments. Add to that the somewhat lackluster overall guidance, despite the fact that executives now expect 2024 data center revenue to exceed $4 billion from the $3.5 billion January outlook.

Q1 2024 financial results (company presentation)

Clearly, Nvidia dominates the data center AI accelerator area due to the high demand for Hopper infrastructure and its technology leadership with the upcoming Blackwell GPUs. In gaming and visualization, NVDA also leads the market for discrete AIB GPUs, while in the desktop and notebook CPU markets, Intel (INTC) is taking the lion’s share.

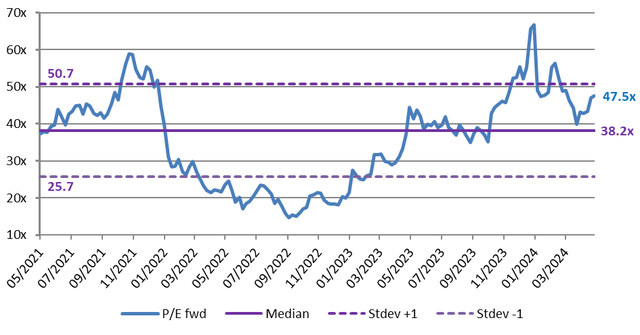

Forward P/E valuation (prepared by author)

Looking at the valuation, the picture doesn’t look more optimistic. AMD is currently trading at a 47.5x forward P/E ratio, which is around 24% above its 3Y median of 38.2x. We can notice that the ratio broke the Stdev +1 line (one standard deviation above the median) at the beginning of the year, then fell toward the median close to the Q1 earning date, and is now gaining back.

With this in mind, it appears that AMD is not a good bargain unless the company returns to its growth path. Where could these growth prospects come from? This is the main purpose of the article, so let’s start with the data center market.

Nvidia holds more than 90% market share in data center GPUs, according to different reports. And although the AI technology is still in the early stages of development, we have already reached the point where the inferencing part accounts for about 40% of the data center market, as evidenced by Nvidia’s recent earnings call. We already witnessed a significant amount of investment in AI chips, and to sustain these numbers, it’s obvious that all these investments should start bringing profit to the bottom line for companies making these outlays. The focus is now shifting towards making money from the AI (or inferencing), rather than in training own models. Although I wrote in my latest article on NVDA that:

model training is a continuous process that should be run consistently due to the rising sophistication, upgrades, and bug elimination. So, the more data is generated through the inference, the more data should be processed by the model, and the more powerful GPU solutions are required.

The point is that going forward, I believe that inferencing will grow at a faster rate, which is the area where Nvidia could be challenged. In particular, MI300X has an advantage over Hopper in memory-intensive tasks, delivering leadership-inferencing performance according to AMD’s benchmarks. Specs comparison reveals that MI300X contains 192GB of HBM3 memory and 5.3TB/s of memory bandwidth vs. 141GB of GPU memory with 4.8TB/s bandwidth in the upcoming H200. Moreover, the Instinct offering has room for improvement, as AMD has yet to incorporate the latest HBM3e memory chips used in the soon-to-launch H200.

Now, let’s discuss some numbers. The estimated TAM for AI chips was $45 billion, which could reach $180 billion by 2027, according to BofA, implying a 38% CAGR. And if we suppose that inferencing is shaping 40% of the market currently, I believe that it could double in the following 3 years, as the rapid proliferation of generative AI will bring the technology to other verticals beyond cloud service providers. And given the rumors that MI300X costs at least half of the Hopper price tag, the former could have a prominent TCO advantage, which is especially relevant in the conditions where enterprises are optimizing for costs. As a result, I believe that the landscape is shaping favorably for AMD to gain up to 10% market share of the data center GPU market by 2027 from about 3% at present. With this in mind, the company’s data center segment could grow at a faster pace than the implied 38% CAGR for the market.

Moving to the gaming segment, the balance of power is quite the same. Still, AMD gained ground on Nvidia to shape 19% of the market for AIB. Taking the consumer point of view, NVDA clearly has an advantage in the top-tier segment due to the unmatched ray tracing performance of the RTX 4080/4090 series. In the budget segment, Nvidia has an upper hand over AMD due to its superior DLSS upscaling technology. Even budget gamers can now opt for RTX 4050/4060 and enjoy the latest games on ultra-settings. And ultimately, we are transiting to the mid-range, which is the most important in my view. Traditionally, gamers are targeting this range, as the GPUs here could provide a high-quality experience with 4K resolution. Benchmarking the Radeon RX 7900 XT card, which costs $699, we can say that it delivers on average higher rasterization performance at 4K ultra settings compared to the Nvidia newest RTX 4070 Ti Super, which is $100 cheaper. You may say that with ray tracing, the RTX card will deliver higher performance, and you will be right. However, with the RT on, you can content only with below 60 FPS on average. Now, you may go ahead and claim that frame generation [FG] could secure that level of frames. However, FG technology could add interpolated in-between frames, but it doesn’t increase fluidity because the gamers can’t see those additional frames. As a result, you’re getting the downside of the technology, which compromises the gaming experience with increased input lag. And if we start researching the gaming community, we can find predominantly negative feedback from using the FG technology, describing the character in the game being “drunk”. Undoubtedly, the FG is useful for the budget segment, but in the mid-range GPUs, I believe that it’s not the case, which gives AMD growth prospects and opportunities to challenge Nvidia in this critical for gamers GPU price range.

Finally, we are arriving at the CPU market. Following the expended refresh cycle, triggered by COVID, 2024 is deemed to be the first chapter of the new AI-capable PC deployment. The AI desktop and laptop replacement cycle, especially in the enterprise segment, along with Windows 11 adoption, could drive overall PC shipment recovery in this year. And given that the current installed base is quite outdated, this represents a significant growth opportunity for AMD’s new Ryzen Pro 8000 and 8040 series processors. Currently, the market is in the seed stage, but AMD’s new APUs are estimated to run up to 54% faster in CPU and 30% in graphic performance on average compared to Intel’s Core Ultra vPro lineup. The market expects 50 million AI-capable PCs to be shipped in 2024, and at this point, I see this as a solid opportunity for AMD’s growth.

Risk factors

Among the main risks is a possible further tightening of monetary policy, which could constrain the corporate budget for generative AI investments. The recent growth of the AMD stock price has been fueled to a large extent by ambitious forecasts in the data center segment revenue. In the event that the market for the AI graphics accelerator fails to meet growth expectations, investors may significantly adjust their positions.

Investment conclusion

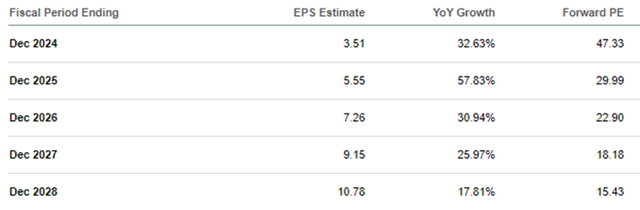

We can notice that the consensus expects a 33% EPS growth this year, which is largely in line with the ramping of Instinct GPUs and EPYC processor offerings. With this line-up, AMD is delivering leadership in inferencing and compute performance with substantial cost-per-token advantages.

Consensus EPS estimates (Seeking Alpha)

Going forward, the analysts anticipate a 58% EPS expansion in the forward fiscal year. With such growth numbers, I’m not worried about the above P/E chart, which depicts that the valuation of AMD is hanging around in the elevated area. The forecast is reasonable from my point of view, as the AI-capable hardware refresh cycle could be in full swing next year. Add to that, the management’s confidence in MI300X demand and the recovery of the embedded segment, and I believe that that company could easily achieve such growth rates.

As a result, the target price for AMD, implied by the $5.55 EPS forecast, stands at $263 per share, representing up to 50% upside potential from current market levels. Hence, I would rate the AMD stock with a Buy rating, neglecting the unimpressive Q2 guidance, as the inferencing business could offer a larger growth opportunity than training in the next few years, especially when the enterprises start commercializing the generative AI potential. This is the point where AMD could challenge Nvidia, namely in terms of less demanding, memory-focused computing resources. In addition, the APU market for AI-enabled computers is developing, offering AMD full potential to strengthen its growth potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.