Summary:

- Since my last article update, AMD stock has remained at roughly the same level amid the S&P 500 index surfing new all-time highs.

- I like AMD’s recent financials and the strategic approach to business development that management has taken in recent quarters, particularly the focus on data centers.

- From what I see, it’s plausible that AMD will beat the current Q2 consensus estimate – this is as my base-case scenario.

- Despite AMD’s about flat price performance over the past quarter and new growth prospects, the stock became just about-fairly valued right now.

- Regardless of my initial inclination to upgrade AMD and despite the numerous AI tailwinds around it, I feel compelled to maintain a neutral rating for now.

JHVEPhoto

Introduction

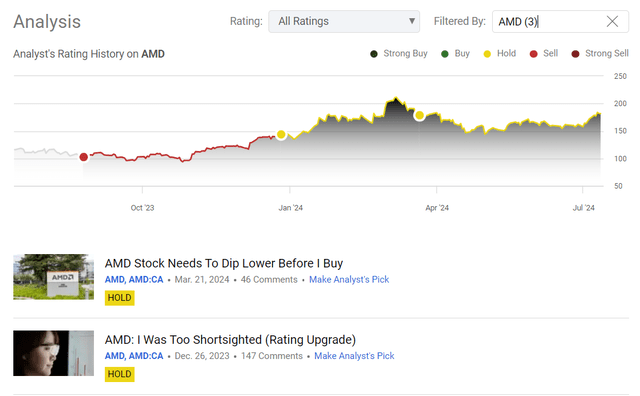

After first writing about Advanced Micro Devices, Inc. (NASDAQ:AMD) stock with a “Sell” rating in August 2023, I admitted my mistake later that year (December 2023) and upgraded AMD to “Neutral”. In March 2024, I updated this rating, noting that the stock would need to fall further before becoming truly attractive to me. Since then, the stock has indeed fallen, first by 10%, then the dip accelerated to -15%, and the downtrend continued for a while. Since then, however, AMD stock has gradually recovered, and since my last article update, the stock has remained at roughly the same level. This is in contrast to a very fast-growing broader stock market that has delivered above-average returns over the last three months, judging by the S&P 500 (SPY) (SP500) index’s performance.

Seeking Alpha, my coverage of AMD stock

The reasoning in my last article was largely based on an analysis of the company’s prospects against the backdrop of its seemingly high valuations. I did all the DCF valuation modeling in the classic way, using consensus forecasts and my own inputs. I concluded that the company was overvalued by about 11-12% in the base case scenario. Therefore, when the stock price fell by 15%, I should have upgraded my thesis, which unfortunately I didn’t do because too little time had passed. Maybe now I have the opportunity to correct this? In about 2 weeks the company should report its 2nd quarter results, so let’s take a look together at how attractive AMD looks from a valuation and growth perspective after its flat performance over the last quarter, and how likely they are to beat current analyst forecasts.

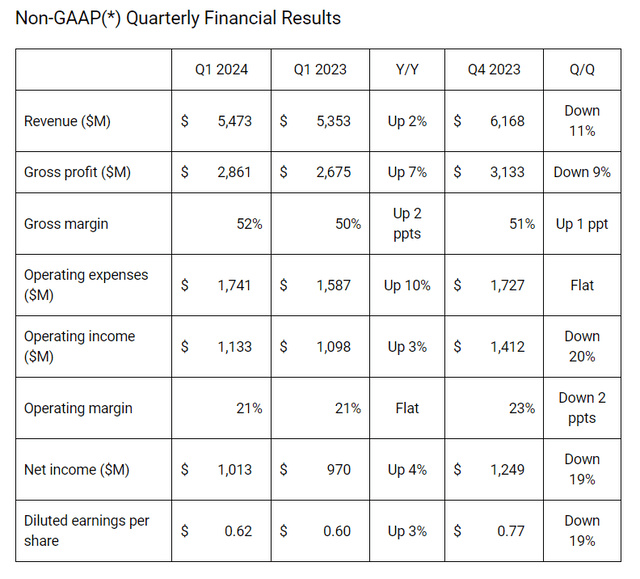

AMD’s Q1 FY2024 Overview

In Q1 FY2024, AMD’s revenues amounted to ~$5.47 billion, marking a 2% YoY increase, though it was down 11% on a QoQ basis (the Q4 FY2023 earnings report was quite strong). AMD continued to experience demand acceleration, but it wasn’t universal across all its business segments. Notably, the data center segment saw significant growth, reaching a record $2.3 billion (>80% YoY), driven by the ramp-up of AMD Instinct MI300X GPU shipments and increased server CPU sales. Anyway, AMD’s Q1 top-line figure exceeded the internal guidance midpoint of $5.4 billion and beat analysts’ expectations of $5.46 billion, according to Seeking Alpha data. Looking at the non-GAAP figures, the company’s gross margin improved by just 1% compared to the previous year. However, operating expenses increased by 10% YoY, so as a result, operating profit increased by 3% YoY, with the EBIT margin remaining unchanged. Due to lower non-OPEX, net income increased by 4% YoY; so AMD’s non-GAAP EPS came in at $0.62, which is 4% higher than the previous year (and slightly above the analysts’ forecast of $0.61) but $0.14 lower than the previous quarter.

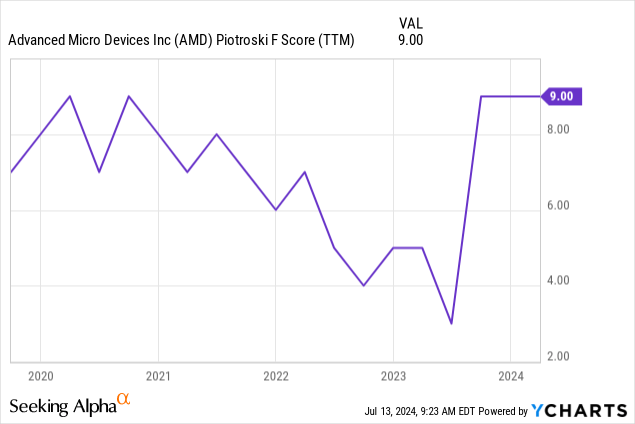

AMD has transformed itself from net debt to net cash and increased shareholder returns, helped by the acquisition of Xilinx, as it added approximately $2.2 billion in net cash, based on Xilinx’s 2021 year-end balance sheet. So AMD’s cash balance increased from $5.87 billion at the end of 2023 to $6.02 billion at the end of Q1 2024. Meanwhile, AMD’s total debt was $2.53 billion in Q1 2024, which is consistent with $2.47 billion at the end of 2023. Also important to note that the company generated 7.2% more operating cash flow in the last quarter than in the previous year. This increase in Q1 FY2024 CFO occurred despite seemingly significant negative impact of account payables, so from a cash flow generation perspective, I’m satisfied with this development, particularly in view of the improved balance sheet, as all this reflects the improved creditworthiness and liquidity compared to the recent past. My conclusions are supported by Piotroski’s F-score, which remains at 9 out of 9 points, indicating that the company continues to enhance its internal metrics, including profitability, margins, growth, and the quality of AMD’s balance sheet.

Comments during the latest earnings call revealed that AMD had ambitious plans for the second quarter and beyond: the company wanted to increase production of its AMD Instinct GPUs and was targeting data center GPU sales of more than $4 billion by FY2024. It also planned to launch the next generation of EPYC processors in the Turin family, which promises greater performance and efficiency. AMD also wanted to strengthen its connection to cloud and enterprise clients through focusing on AI hardware and software innovation. The Ryzen mobile processors, code-named Strix, have raised high expectations in the client segment and should show significant improvements in both performance and energy efficiency. Moreover, they are advancing AI PC adoption with enterprise refresh cycles anticipated from over 150 ISVs developing for AMD’s AI PCs by the end of the year.

To counteract declining gaming sales, AMD was going to expand the Radeon 7000 Series and also “introduce new technologies”. The company wanted to manage inventory levels in the embedded segment and expected a gradual recovery, especially in the second half of 2024. As AMD sees AI as a key growth driver, the company will likely invest more in AI hardware, software, and market activities (I think you should read it as “less FCF going forward, but maybe more growth in the top-line”). As an example of higher CAPEX, AMD noted it’ll develop cutting-edge AI solutions such as the adaptive Versal SoCs, which have already attracted major customers such as Subaru. These strategic moves should, in my opinion, position AMD for strong growth and an expanded market presence in 2024 and beyond. The Data Center segment now consists of EPYC server CPUs, GPUs, DPUs and some FPGA as well as SoC families from Xilinx following the company’s acquisition. Sales of server CPU reached all-time high in recent quarter and year due to increased demand for 3rd and 4th gen EPYC processors.

Overall, I like the strategic approach to business development that management has taken in recent quarters, particularly the focus on data centers. This is a good tactic, as I pointed out in my earlier article, where I cited several examples and concluded that data centers are likely to account for a much larger share of AMD’s revenue over the next 2-3 years. Given the higher margins and growth rates in this segment, this shift will ultimately make the company less diversified – in a positive sense. The factors that have hampered the company’s growth to date, such as its dependence on consumer cycles, will diminish. So this should be theoretically extremely beneficial for investors. The key question now is how much of this potential is already priced-in and whether the market’s expectations are fair. Let’s take a closer look and find out together.

AMD’s Valuation Update

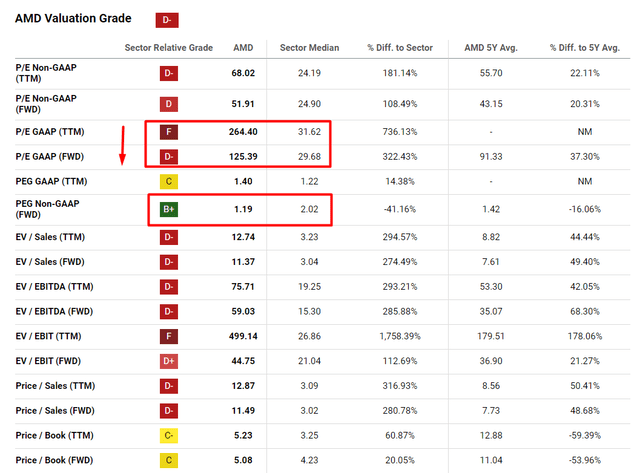

Seeking Alpha’s Quant rating currently assigns AMD a “D-” Valuation score – this suggests that compared to the information technology sectors‘ norms (i.e. median values) AMD stock is significantly overvalued. However, it’s important to note the sector’s heterogeneity; different industries within IT can have very different valuation metrics. For instance, semiconductor companies can vary greatly in composition to, say, electronic manufacturing services stocks. Looking at specific multiples, AMD’s trailing twelve months P/E ratio stands at 206.4x under GAAP calculations, significantly higher (by about 7 times) than the sector’s norm. Looking at the forwarding GAAP P/E ratio, we see it drops to 125.4x, indicating expectations of strong EPS growth according to consensus forecasts. Additionally, the FWD PEG ratio currently stands at 1.19, which is 41% lower than the sector median, suggesting potential undervaluation relative to expected growth.

Seeking Alpha, AMD, the author’s notes

In reality, these metrics offer limited insight, as deciding whether a P/E ratio of 125x or more is excessive, depends on the market’s willingness to pay a premium for the stock. Instead, I think we should build a DCF model, focusing on the company’s prospects for future business recovery, as economic cycles progress, and the potential monetization of technologies such as AI and chips that could drive future top-line and margin expansions. So while this approach differs from traditional methods of valuing growth stocks, I find it appropriate in this case. In the past, I’ve been able to use similar modeling to predict AMD’s overvaluation, which then came true and the stock really fell near my estimate of overvaluation. Therefore, I think it makes sense to update my DCF model today (even if you don’t believe in this valuation method regarding AMD in particular, it might interest you).

As last time, I take the current consensus revenue forecasts and add a growth premium of about 1% annually. This is in line with the relatively consistent history of AMD surpassing the market expectations to the upside in recent years.

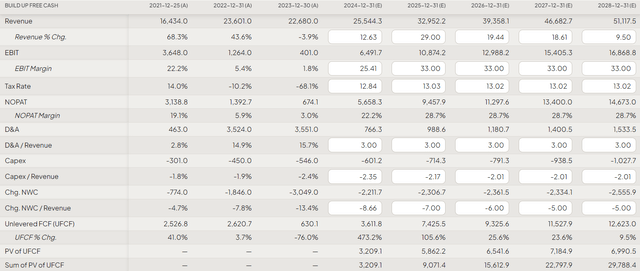

As I suggested in my previous article, I expect AMD’s EBIT margin to reach 33% in FY2025 and remain constant until the last forecast year (FY2028). I suggest assuming that D&A accounts for ~3% of the company’s revenue in all forecast years. Also, I still think AMD’s CapEx should increase, but this growth will also be fully offset by sales growth, so CAPEX/sales will have to remain at about the current level of 2%. So here are my key operating model assumptions:

FinChat, the author’s notes added

I suggest assuming a potential cost of debt of 5% for AMD, as the risk-free rate is ~4.2% as of today, so there should be a reasonable market spread. Assessing the market risk premium (MRP) at 5% and take into account AMD’s tax rate of ~13%, we arrive at a WACC of ~12.6%. While this may seem a little high, it represents a conservative approach and ensures that our model reflects reality more closely.

FinChat, the author’s notes added

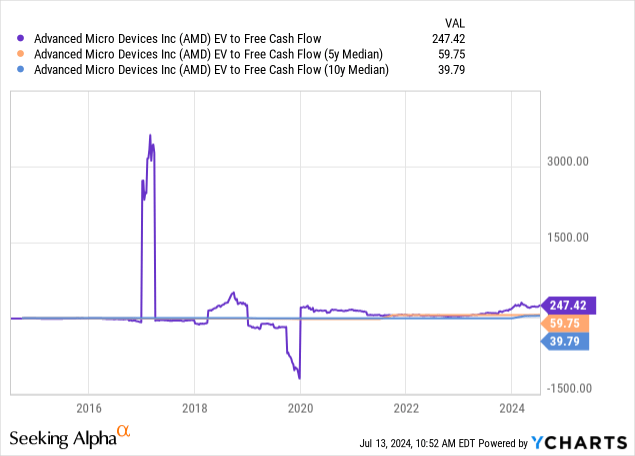

As I mentioned in a previous article, my DCF models utilize the EV/FCF ratio rather than the traditional EV/EBITDA for terminal value calculation. Currently, AMD’s EV/FCF ratio is around 247x, which is well above the 10-year median of ~39.8x. This historical median of around 40x will be my main assumption today.

Here I must emphasize a crucial point. In my April article, I used an EV/FCF exit multiple of 27.5x. This time I’m using a much higher multiple because I believe the market will demand a premium if the company maintains higher margins (as I expect) and meets its growth estimates. This premium will probably be at least in line with the ten-year median. As far as I can see, this should be the main difference from my previous forecasts, apart from the adjusted top-line growth rate based on the recent consensus changes.

Nevertheless, with the higher multiple assumption, the overvaluation amounts to just 4.4%, which I perceive as a minor margin of error, reflecting the sensitivity to scenarios that could potentially adjust its current estimation. So after AMD’s about-flat price performance over the last 3 months, it became about-fairly valued, in my view.

FinChat, the author’s notes added

AMD’s Odds Of Beating Q2 FY2024 Earnings

The company expects its revenues for Q2 FY2024 to be around $5.7 billion in Q2 2024, which corresponds to growth of 8% YoY and 6% QoQ. As Ardus Research analysts noted a few months back (proprietary source, May 2024), this guidance may intentionally underestimate the potential growth in the core PC and data center markets, as the continuous weakness in gaming and embedded processing segments should be still there in H1 FY2024 and will only gradually recover in H2 FY2024. The majority of AMD’s revenue growth in 2024 is expected to come from its client business and especially its data center business (AMD’s key AI opportunities). We can observe that the market’s expectations align closely with management’s forecasts, particularly regarding revenue: The market anticipates $5.72 billion in Q2, reflecting a year-on-year growth rate of about 6.73%.

Seeking Alpha, AMD’s revenue consensus

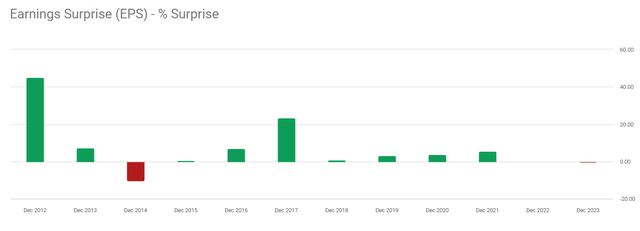

From this, I can conclude that if management correctly assessed AMD’s opportunities at the end of the last quarter, they should at least meet current expectations for Q2. However, I still think it’s plausible that they will beat the current consensus forecast as a base case scenario. This optimism stems from two factors: first, the company has beaten forecasts in 75% of the last 8 quarters, which is promising (although the past is the past, with no influence on the future). Second, the market’s expectations seem reasonable and not too ambitious, which increases the AMD’s chances of a successful positive surprise.

The Verdict

To be honest, when I started writing this article, I felt that AMD deserved a rating upgrade as its performance in recent months has been seemingly unfairly flat amid the broad market’s strength. However, even given AMD’s strong growth prospects, an upgrade doesn’t seem fair today. According to my findings, the company has a good chance of beating current Q2 consensus estimates, as expectations haven’t risen significantly in recent months and are closely in line with management’s guidance. Given the increasing demand for AI and chips, AMD is likely to exceed expectations. However, with a slightly more optimistic assumption for my updated DCF model, AMD appears to be fairly valued rather than undervalued, which is disappointing. Despite my initial inclination to upgrade and despite the numerous growth prospects, I feel compelled to maintain a neutral rating for now. I look forward to AMD’s second quarter results to confirm these views.

Investors should closely monitor management’s guidance for the quarter to see how actual results compare to previous guidance and to what extent AMD exceeds (or falls short of) the current expectations.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!