Summary:

- At the time of writing, Advanced Micro Devices, Inc. stock is in a 15% correction from its all-time high. Why it’s correcting and should you buy the dip? Read on for my view.

- In the long term, I don’t have enough evidence to question AMD’s business growth. However, business growth is not the same as stock growth.

- As far as I see it, AMD appears to be overvalued by 11.3% from the current price even under one of the most optimistic assumptions regarding business growth.

- Perhaps buying the dip will make sense after a further 15-20% decline with fundamentals holding steady, but now it seems like a reckless idea to me.

- For now, I reiterate my previous “Hold” rating for AMD stock.

JHVEPhoto

Introduction

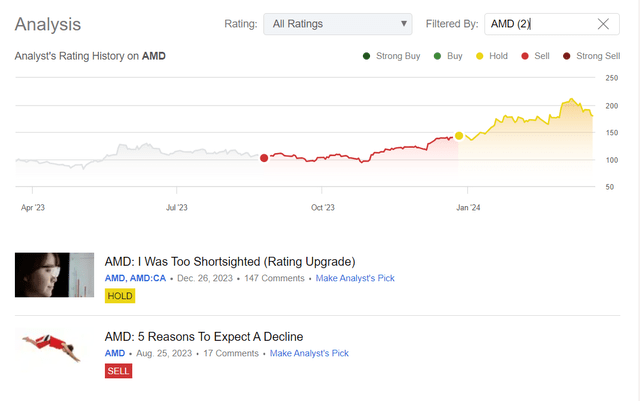

I initiated coverage of Advanced Micro Devices, Inc. (NASDAQ:AMD) stock in August 2023 and rated it a “Sell” at the time. However, the market had its own opinion on the company, so the stock continued to rise despite being overvalued (based on almost every single multiple). More than three months ago, I upgraded the stock to “Neutral,” citing AMD’s strategic focus and strong balance sheet position, which combined should give the company a long-term potential for AI success.

Seeking Alpha, author’s coverage of AMD

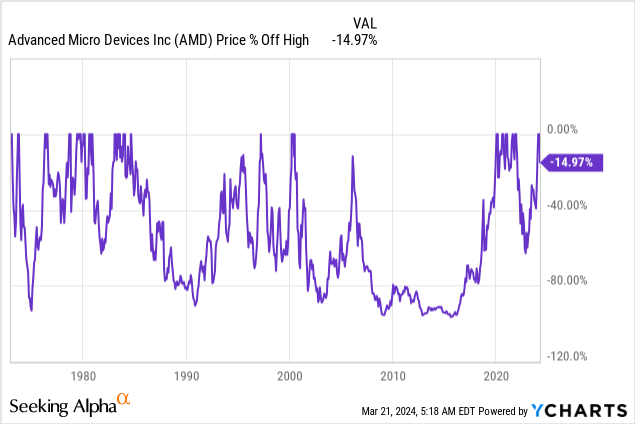

In recent weeks, the company was able to present its Q4 FY2023 report and the stock price went even higher, crossing $210 at some point. However, such strong growth does not last forever – at the time of writing, AMD is in a 15% correction from its ATH:

A logical question follows from all this: How much strength does AMD stock still have to continue its rally? Let’s attempt this question together.

AMD’s Recent Financials And Developments

Let’s first take a quick look at the company’s latest results. AMD’s 10-K report was released on January 31, 2024, so given the many articles on Seeking Alpha, you’ve probably already seen numerous financial breakdowns of it. I’d like to draw your attention to just a few key figures.

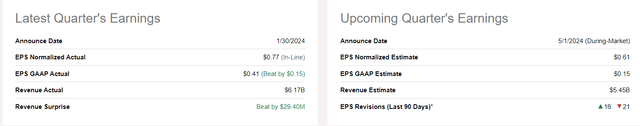

In Q4 FY2023, Advanced Micro Devices reached $6.17 billion in sales, marking a 10% increase YoY (+6% sequential growth) – this exceeded both the midpoint of the management guidance range and the Wall Street consensus estimate. Non-GAAP profit per diluted share stood at $0.77, up 11% from the previous year – in line with the consensus view.

The company’s revenue forecast for Q1 2024 [$5.1-5.7 billion] indicated a QoQ decline of -12%, with expected annual growth of just +1%. The management hinted at some weakness in Gaming and Embedded Processing going forward, seeing gradual recovery throughout FY2024 (particularly in the Client and Data Center segments). The stock initially reacted lukewarmly to this guidance, but market strength eventually enabled AMD to continue its growth and follow the rest of the semiconductor industry.

Apparently, investors were primarily looking at the strength of Data Center: This revenue segment was up an impressive 38% YoY and 43% QoQ, driven primarily by robust demand for AMD Instinct GPUs and 4th generation AMD EPYC CPUs. The growing demand for AI, cloud computing, and high-performance computing applications, which only the lazy don’t talk about today, suggests that sales in this particular segment should continue to accelerate. The Client segment also recorded significant sales YoY growth of 62% and a slight QoQ increase of 1%, which was attributable to increased sales of AMD Ryzen 7000 CPUs. The Gaming segment, on the other hand, recorded a YoY decline in sales due to lower semi-custom sales.

Based on the revenue breakdown visualized by the RBC analysts [proprietary source], it is clear that the Data Center will most likely reduce the relatively broad diversification of the company’s business today, somewhat leveraging its comparable growth rates in the future.

RBC [March 2024 – proprietary source] RBC [March 2024 – proprietary source]![RBC [March 2024 - proprietary source]](https://static.seekingalpha.com/uploads/2024/3/21/49513514-17110157451170635.png)

![RBC [March 2024 - proprietary source]](https://static.seekingalpha.com/uploads/2024/3/21/49513514-17110156930884304.png)

To better understand what I mean, imagine a situation in which you have 3 different stocks in roughly equal proportions in your portfolio and do not rebalance it. Suddenly, one of your stocks starts to grow and doesn’t stop for a long time, so that instead of the previous 1/3 of the portfolio, it makes up 1/2 and then 2/3 of your funds. What happens to your portfolio? Its future returns are clearly skewed towards the largest stock, and if that stock maintains its growth rate as before, the portfolio grows many times faster than it did at the beginning of this example.

I expect the same to happen with AMD: gradual growth in the share of the Data Center segment, while the segment grows at a rate faster than the semiconductor industry average, will likely lead to higher overall revenue and earnings growth for the company.

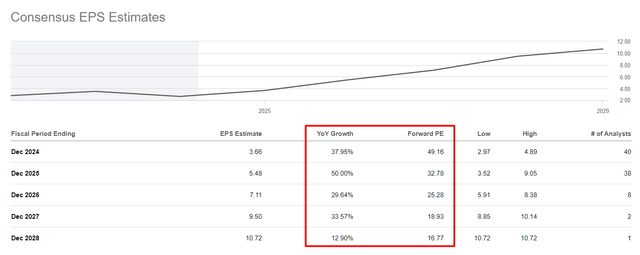

The problem for AMD here is that I’m not the only one who thinks this way. According to Seeking Alpha, AMD’s earnings per share have grown at a CAGR of about 7.47% over the last 7 years. But now Wall Street is forecasting an average growth rate of nearly 24% for the next 5 years, and the growth rate isn’t dropping by much in the latest forecast periods.

In the long term, I don’t have enough evidence to question AMD’s business growth. The March 6 news that AMD ran into U.S. resistance while trying to sell a specially designed AI chip in the Chinese market was probably the reason for the 15% correction AMD stock is still in today. However, I do not believe that the company will find a way out of this situation any time soon. AMD’s business will grow primarily due to the general trend of the industry and the company’s innovations in recent years, and temporary restrictions on the sale of products even for such an impressive market as China should not have a serious long-term impact in my opinion.

However, business growth is not the same as stock growth. In the case of AMD, I remain very skeptical because of its valuation – let me explain why.

AMD’s Valuation Analysis Update

I certainly understand the position of those who write in the comments that growth stocks cannot be valued using discounted cash flow (“DCF”) models – the actual financials of such companies can change radically within a very short period of time, making all the initial model inputs useless.

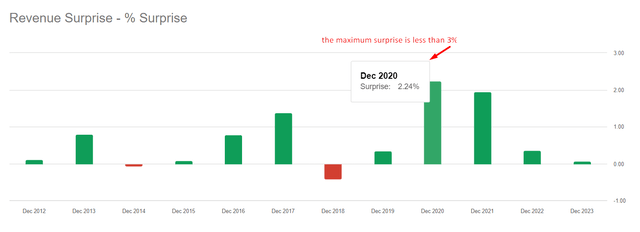

But firstly, this valuation method is still one of the highest quality ways to assess the fundamental growth potential of a stock based on the business forecast. Secondly, in the case of AMD, we are dealing with a very well covered company whose consensus revenue and EPS forecasts have deviated less and less from “the truth” in recent years.

Therefore, I think the use of DCF modeling is justified in the case of AMD – especially because I have not done such calculations for this company before. In addition, in order to satisfy the bulls, I will assume the most optimistic forecasts and give the current consensus sales estimates a significant premium.

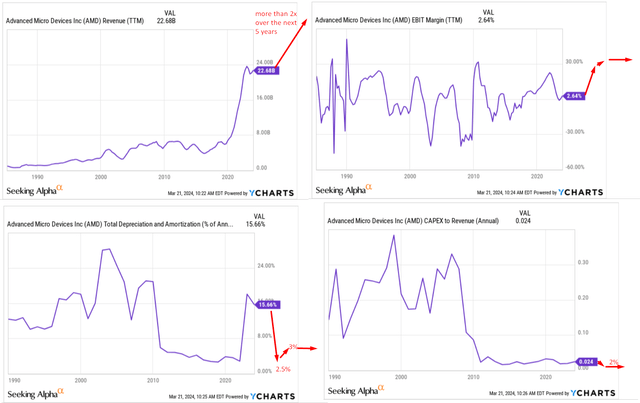

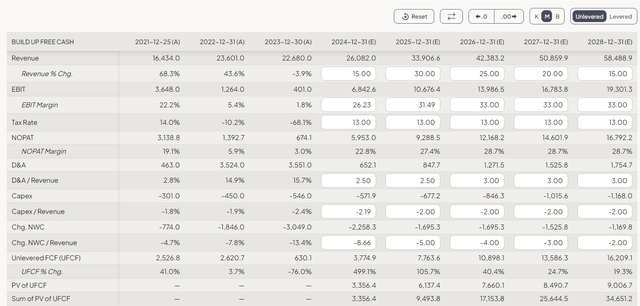

Despite the cyclical nature of the semiconductor industry, I expect AMD’s EBIT margin to reach 33% and remain constant until the last forecast year (FY 2028). D&A expenses as a percentage of revenue will need to decrease to 2.5% due to a relatively small increase in D&A expenses against the backdrop of rapid revenue growth. AMD’s capital expenditures will increase but this growth will also be fully offset by sales growth, so CAPEX/sales will have to remain at about the current level of 2%. These are my key assumptions:

I expect the company’s working capital to increase, but not as much as it has recently. That’s why I have this picture at the moment:

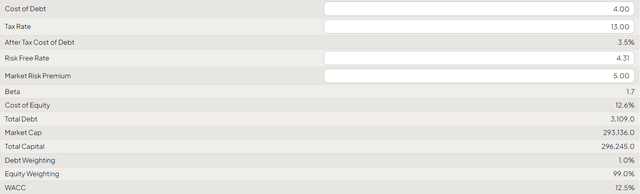

As for calculating the WACC, everything is quite simple: I assume a cost of debt of 4%, an MRP of 5% and a risk-free interest rate of 4.31%. This results in a WACC of 12.5%, as debt does not play a major role for AMD.

I use the EV/FCF ratio as the exit multiple for my model and assume that in the case of AMD this ratio will fall to 25-30x by the end of 2028 as a) the company grows out of its valuation and b) a natural market saturation occurs and the market refuses to give the business a higher valuation premium.

So what do I get in the end? As far as I see it, AMD appears to be overvalued by 11.3% from the current price even under one of the most optimistic assumptions regarding business growth.

Upside Risks To My Thesis

Just like a few months ago, I could be wrong again in thinking the company is overvalued – that’s what made me stay on the sidelines last time, and what makes me avoid AMD today. As the analysts at Argus Research write [proprietary source], AMD has significantly increased its global market share in CPUs for data centers and client applications, challenging Intel’s (INTC) dominance – now the company is taking aim at Nvidia (NVDA) in GPU computing for AI. So with leadership in console gaming and a strengthened embedded business, AMD is poised for strong long-term growth outpacing its industry peers.

Furthermore, my assumptions in the DCF modeling can be even more optimistic, which radically changes the whole outcome of the model. For example, I assume a WACC of 12.5%, which seems quite high even to me. If we lower it to 7.5%, we get an underestimation of AMD at a level of ~14.3%:

The Bottom Line

Despite the risks to my thesis, I hesitate to recommend buying AMD at its current price levels. Perhaps this will make sense after a further 15-20% decline with fundamentals holding steady, but now it seems like a reckless idea to me. If I were an investor, I would look closely at the dynamics of the company’s profit margins and growth and correlate these indicators with the stock price. I mean, once the stock experiences a sharp dip – with the current overheated stock market, that’s only a matter of time – and AMD’s margins remain resilient against a backdrop of stable business growth, I’d be willing to buy it.

But for now, I reiterate my previous “Hold” rating for Advanced Micro Devices, Inc. stock.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!