Summary:

- After a 25% pullback from the July high, AMD saw a 5% rally following solid 2Q results and a positive 3Q outlook, but the stock remains below the 200-day moving average.

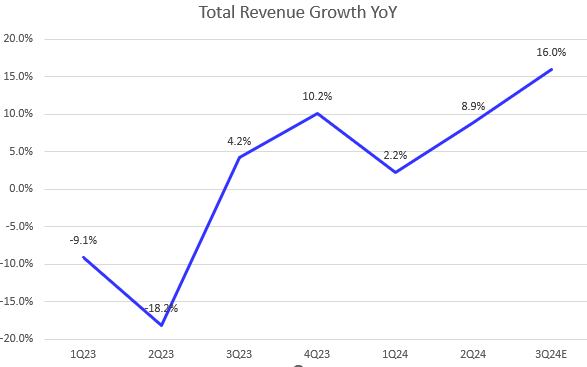

- AMD’s Data Center segment showed strong growth acceleration, leading to a 16% YoY revenue growth outlook for 3Q FY2024, up from 2.2% YoY in 1Q FY2024.

- The management indicates that Data Center and Client segments could more than offset the slower performance in the Embedded and Gaming segments.

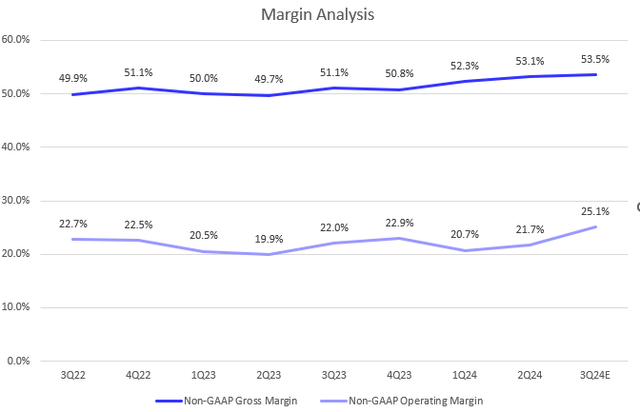

- The company shows consistent margin expansion, with the 3Q guidance indicating at least a 25.1% non-GAAP operating margin – an increase of 340 basis points from the previous quarter and the highest level since 2Q FY2022.

- Due to the recent deep selloff, AMD stock’s valuation has been reset, and with an improving earnings growth, its forward non-GAAP P/E is currently below its 5-year average, indicating a buy signal.

JHVEPhoto

What Happened

Advanced Micro Devices’ (NASDAQ:AMD) stock had a strong rebound following its 2Q earnings report. Initially, the stock rallied by 12%, but the gain moderated to 7% the next day. This intraday pullback was even more overshadowed by NVIDIA’s (NVDA) 12% rally. This indicates less robust upside momentum for AMD, as the stock has remained below the 200-day MA. In my previous coverage, I issued a sell rating on the stock due to concerns that the company’s strong growth in the data center segment would be offset by a delayed recovery in its Embedded and Gaming businesses, leading to low single-digit growth amid a premium valuation. Since then, the stock declined by 25% over two weeks before the 2Q earnings result, significantly underperforming iShares Semiconductor ETF (NASDAQ:SOXX) by 10%.

However, the company exceeded both revenue and non-GAAP EPS expectations in 2Q, largely driven by strong growth acceleration in Data Center segment. The recovery in the Embedded segment is taking longer than anticipated. It’s encouraging to see a mid-double-digit YoY growth outlook in overall revenue for 3Q, along with margins expansion, supported by a potential QoQ growth in Data Center revenue growth. Despite the post-2Q earnings rally, the stock is still down 17.4% since my last coverage. Although the stock continues to trade at a premium valuation, I am upgrading it from a sell to a buy to reflect a reset in market expectations.

AI Business Continues Accelerating

The company model

The company’s Data Center segment continued its acceleration in 2Q FY2024, growing 115% YoY, up from 80.5% YoY in the previous quarter. According to the Press Release, this significant growth was driven by a steep ramp-up in AMD Instinct GPU shipments and strong sales of 4th Gen AMD CPUs. It’s a bullish signal that management has guided for roughly 16% YoY growth in overall revenue for 3Q FY2024, indicating continued acceleration.

As shown in the chart, AMD’s overall revenue growth has rebounded significantly compared to my last article, where top-line growth was only in the low single digits. During the 2Q FY2024 earnings call, the management stated, “we expect embedded segment revenue to be up and the gaming segment to decline by a double-digit percentage.” This actually reflected my previous concern that a slower recovery in the Embedded and Gaming segments in FY2024 would offset strong growth in the Data Center segment, leading to a continued single digit growth in overall revenue in the near term.

However, management indicated that growth in the Data Center and Client segments could more than offset the slower performance in the Embedded and Gaming segments, leading to a 16% YoY growth in overall revenue in 3Q. Therefore, I believe Data Center revenue growth in 3Q could be even higher than the 115% YoY seen in 2Q FY2024.

Lastly, the CEO Lisa Su is also optimistic about growth outlook in 2H FY2024, as she expects MI300 revenue (which exceeded $1 billion in 2Q) to continue ramping up in 3Q and 4Q. She also anticipates better seasonality in PC market later this year.

Growth Rebound Led to A Margin Expansion

AMD’s non-GAAP gross margin has been expanding since 4Q FY2023, primarily driven by strong growth in the Data Center segment. With management implying sequential QoQ growth in the Data Center for 3Q FY2024, the company has guided a 53.5% gross margin for 3Q FY2024, showing further QoQ improvement. Additionally, I believe the company will continue to improve its gross margin as the Embedded segment gradually recovers in 2H FY2024.

Most importantly, the company forecasts $1.9 billion in non-GAAP operating expenses. Assuming guided overall revenue of $6.7 billion and a 53.5% non-GAAP gross margin, we can calculate that non-GAAP operating margin is projected to be at least 25.1% in 3Q FY2024. This represents a 340 bps increase from 2Q FY2024, marking the highest margin level since 2Q FY2022. Therefore, a significant rebound in overall revenue, coupled with substantial margin expansion in 3Q, indicates a strong YoY growth in non-GAAP EPS. This will likely lower AMD’s forward P/E as more analysts potentially raise their forward earnings consensus.

FCF Profile Is Improving

The company model

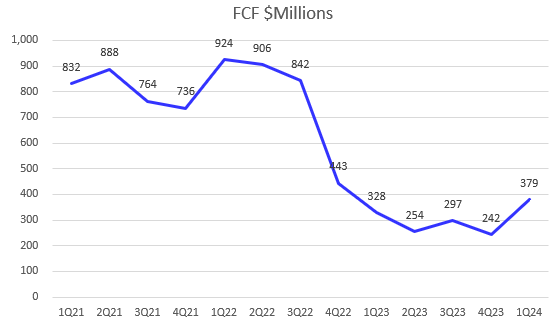

While AMD continues to increase its capex amid the current GenAI boom, growing 8.5% QoQ, the company generated $439 million in FCF in 2Q FY2024, reflecting a 15.8% QoQ increase. During the earnings call, CEO Lisa Su addressed an analyst’s question about the industry debate on AI monetization and ROI for customers, emphasizing the necessity of investing in AI due to its substantial future benefits for enterprises. Meanwhile, CFO Jean Hu highlighted that the company remains focused on investing in R&D to capitalize on significant AI growth opportunities.

Valuation

Despite a 5% rally in the stock following the 2Q earnings, AMD is still down 21% from its July peak and 17.4% since my last sell rating. While some investors may argue that AMD’s strong growth in the Data Center segment makes its stock an attractive buying opportunity, it’s crucial to keep in mind that a great company does not necessarily mean a great stock.

Due to the recent significant pullback, AMD’s EV/Sales TTM has dropped to 9.5x, only 9% above its 5-year average. The forward 12-month multiple is expected to decrease to 8.6x, still indicating a premium valuation. Meanwhile, the stock is currently trading at 39.7x non-GAAP EPS forward, which is 8% below its 5-year average, suggesting that investors have reset their expectations for AMD. Given AMD’s improved overall revenue outlook to mid-double-digit growth and its margin expansion trajectory, I believe it’s time to be bullish on the stock after a slight retracement following a strong 2Q earnings report.

Conclusion

In sum, AMD’s nearly 25% pullback since its July high reflected potential growth concerns and a drop below all major moving averages. However, the company not only achieved strong 2Q earnings, driven by significant acceleration in the Data Center segment, but also presented a positive outlook for 3Q. Management’s guidance for roughly 16% year-over-year growth in overall revenue, along with strong margin expansion offsetting a delayed recovery in the Embedded and Gaming segments, shows an improvement in fundamentals. While the stock is still trading at a premium valuation, its forward non-GAAP P/E has dropped below 5-year averages and its EV/Sales TTM has fallen below 10x, indicating a reset in expectations. Therefore, I upgraded the stock to buy from sell.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.