Summary:

- AMD stock has declined by 13% in the last three months, with more negatives than positives surrounding the company.

- AMD’s generous premium over its fair value does not seem sustainable, given its strategic weaknesses in GPUs compared to Nvidia and mounting inventory problems.

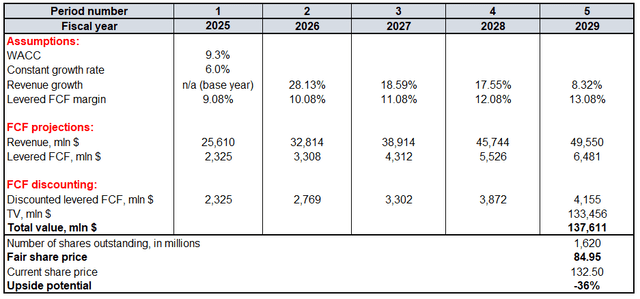

- AMD’s valuation ratios are unjustified, with a DCF model indicating a fair price of $85, 36% lower than the current share price.

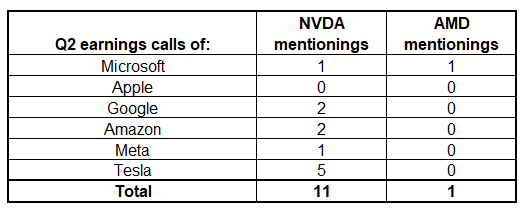

- Most prominent clients find Nvidia’s products more appealing than AMD’s, as evidenced by Big Tech companies mentioning Nvidia’s GPUs eleven times more frequently than AMD’s in their latest earnings transcripts, indicating Nvidia’s superior position in the AI race.

JHVEPhoto

Introduction

I had a Sell-rated thesis about Advanced Micro Devices (NASDAQ:AMD) in May, and the stock has declined by 13% over the last three months, compared to +2.5% from the S&P 500 (SP500). AMD delivered its Q2 report recently, which had some positive moments, but I still think that there are more negatives than positives around AMD. There is not much I can say optimistic about the company’s segments apart from Data Centers enjoying strong AI momentum. On the other hand, I think that AMD’s potential in AI is quite limited as it competes with Nvidia (NVDA), which is miles ahead.

The sky-high inventory problem continues mounting as the balance grew by around $350 million sequentially, further increasing risks of inventory impairment and recording multi-billion P&L charges in the foreseeable future. The stock currently trades around 40% cheaper than its March 2024 peaks, but my analysis suggests that valuation is far from being attractive. All these unfavorable factors mean that I am inclined to reiterate a “Sell” rating for AMD. The extent of overvaluation, which is 36%, makes me think that there is still a lot of space to fall further. Therefore, it appears to be risky to buy or even hold this falling knife (stock price deteriorated by 6% over the last five trading days).

Fundamental analysis

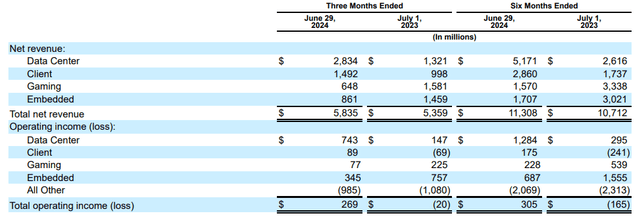

AMD released its latest 10-Q report on July 31, and I want to focus on it first. Revenue grew by 8.9% YoY in Q2 2024. Revenue growth was quite uneven across the company’s segments. Data Center segment continues capitalizing on massive AI tailwinds as its sales more than doubled YoY in Q2. The segment’s growth was mostly driven by higher sales of AMD Instinct GPUs and 4th Gen AMD EPYC CPUs.

The Client segment (‘PC’) also demonstrated strong 50% YoY growth in Q2. On the other hand, I am not as optimistic about the Client segment because comparative figures were quite low. For example, the segment generated $2.2 billion revenue in Q2 2022 meaning that sales still did not recover compared to historical highs.

Two other segments disappointed significantly, in my opinion. Gaming revenue more than halved due to a decrease in semi-custom revenue. Embedded revenue also decreased sharply on a YoY basis in Q2, as customers continued normalizing their inventory levels.

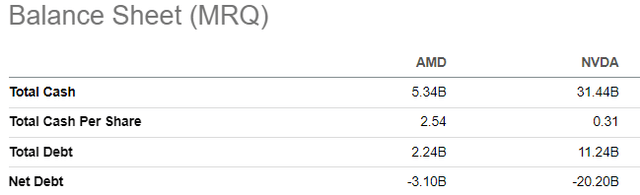

The operating margin improved on a YoY basis from -0.4% to 4.6%. Any improvement in this metric is a good sign, but Q2’s operating margin is still far below the company’s historical peaks. Sky-high inventory levels are still a big problem weighing on profitability. The problem continues mounting since inventory balance was around $350 million higher sequentially. During the Q2 earnings call, the management explained this increase by the necessity to address spiking demand from data centers. However, nothing was said about $4.5 billion worth of inventory that was accumulated during 2022-2023.

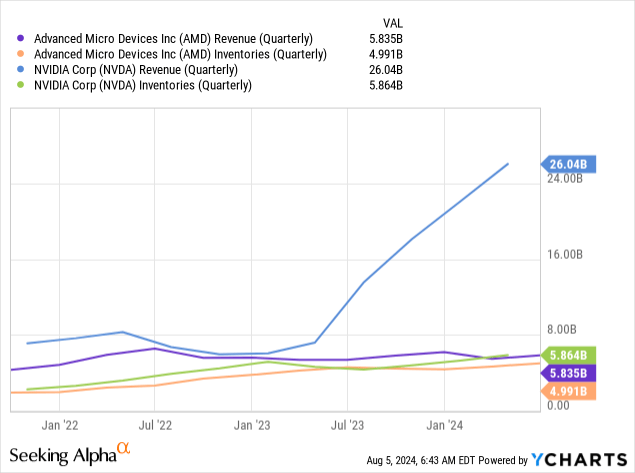

With such a warning trend, there is a significant risk AMD’s warehouses might become full of obsolete products over these nine quarters because of the rapid pace of innovation in the industry. To understand how deep the inventory problem is for AMD, please look at the below chart. Nvidia generates more than four times higher quarterly revenue, but its inventory levels are comparable to AMD.

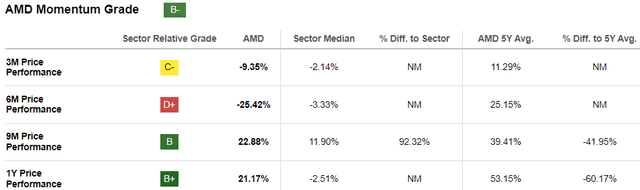

Another bearish indicator is weakening momentum. If we look at AMD’s SA Quant Momentum page, we see that the momentum is certainly cooling down. More recent timeframes demonstrate much weaker dynamics compared to older timeframes. To me, this is a clear indication that an unjustified hype around AMD is cooling down.

Recent developments were mostly positive, but it is difficult to consider them as strong catalysts for the stock price. In July, the company announced that it acquires Silo AI to improve its offerings in enterprise AI solutions. The deal size of $665 million does not look significant compared to AMD’s scale, therefore at the moment it is difficult to say that benefits or risks are game-changing in this case.

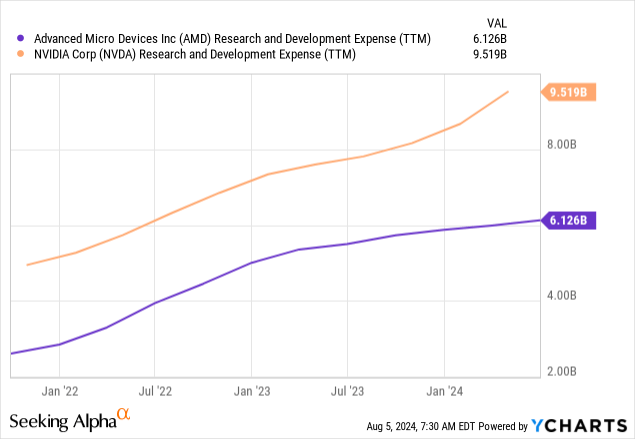

During the Computex 2024 event, AMD revealed its roadmap for Instinct accelerators, including the new MI325X accelerator, which is expected to be available by the end of 2024. AMD is well-known for its consistent commitment to innovation and rolling out improvements to its stellar products, but comparisons with Nvidia are inevitable.

The company’s R&D spending looks incomparable, which puts AMD in a weaker position against Nvidia in terms of innovation. Apart from incomparable TTM free cash flow of these two companies ($2 billion generated by AMD versus $29 billion generated by NVDA), accumulated financial resources also cannot be compared. That said, investors should not forget that AMD competes against a true monster from the financial strength perspective.

Compiled by the author

Last but not least, there is a remarkable fact that during this earnings season. Big Tech companies mentioned NVDA and its GPUs much more frequently than they mentioned AMD or any of its products. I have analyzed all the latest earnings transcripts from the biggest and most technologically advanced U.S. companies, and it was eleven NVDA mentions versus only one AMD mention. I think that this fact clearly indicates the positioning of these two semiconductor companies in the AI race, where Nvidia is miles ahead.

Valuation analysis

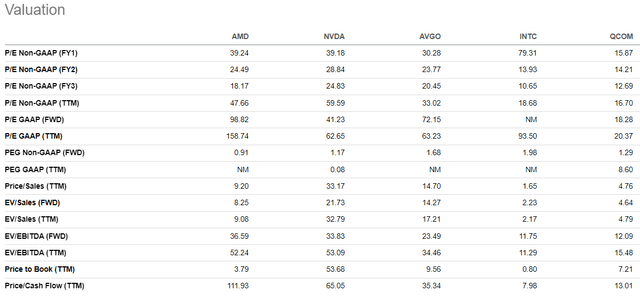

Based on the peer analysis of valuation ratios, AMD appears to be one of the most expensive semiconductor stocks now. Its TTM P/E ratio is by far the highest compared to other prominent chip companies, and its forward P/E ratio is more than two times higher compared to Nvidia’s. Its forward EV/EBITDA ratio is also extremely high compared to rivals. Considering the company’s fundamental weaknesses I have outlined in fundamental analysis, I consider AMD’s valuation ratios as unjustified.

However, AMD’s valuation ratios have been historically elevated and looking at them might not be enough for a fair view. Therefore, I am running a discounted cash flow (“DCF”) model with a 9.3% WACC. For revenue between FY 2024-2028 I rely on consensus estimates because projected growth rates appear realistic to me. I incorporate a 9.08% TTM levered FCF margin and expect that the FCF margin will expand by one percentage point as the top line grows. For the terminal value (“TV”) calculation, I implement a generous 6% constant growth rate because of the robust AI secular shift in the industry. According to SA, there are 1.62 billion AMD shares outstanding.

Even with an extremely high 6% constant growth rate, AMD’s shares are substantially overvalued. According to my DCF model, the stock’s fair price is around $85. This is 36% lower than the current share price, which means there is a substantial downside potential.

Mitigating factors

Nvidia releases its Q2 earnings on August 28, and it is the event that will not only affect Nvidia’s stock price. As an undisputed leader in the GPU field, Nvidia is a trendsetter, and its earnings are likely to affect share prices of its closest competitors as well. Should NVDA deliver another staggering quarter, this will likely lead to a new rally in all prominent semiconductor names, including AMD. This will not be a fundamental reason for AMD’s rally, but still, I would better warn readers that such an opportunity exists.

Another prominent player is semiconductor industry, Intel (INTC) is struggling as it has released weak Q2 report and guidance. Since AMD and Intel are also fierce rivals, if Intel’s struggles continue for longer, it might be good for AMD from the strategic perspective. Gaining market share in semiconductors ex-GPUs (for example, CPUs) might be quite a positive development and catalyst for AMD.

Conclusion

AMD continues to desperately pursue Nvidia in the AI revolution in GPUs, but it appears that the technological gap is unlikely to narrow in the foreseeable future. The valuation is still very unattractive, especially considering AMD’s weak strategic positioning against its biggest rival.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.