Summary:

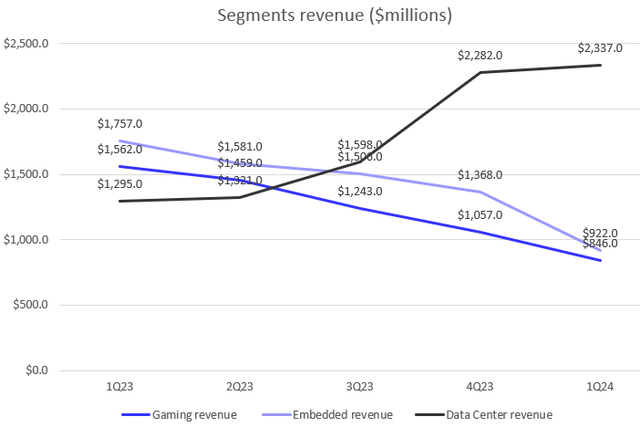

- Despite 80% YoY increase in Data Center revenue, driven by strong demand for AI computes, the total revenue only grew 2.2% YoY in 1Q FY2024.

- Management expects a slower recovery in the Embedded and Gaming segments in FY2024 following nearly a 50% YoY revenue decline in Q1 FY2024, which continues to impact its revenue growth.

- A tailwind of gross margin expansion was largely offset by strong growth in SG&A expenses, resulting in a muted EBIT margin outlook.

- Despite anticipated earnings rebound in FY2024, AMD’s non-GAAP P/E fwd remains high at 46.8x, comparable to NVIDIA’s 47.3x, and it also sits 38% above the SOXX index.

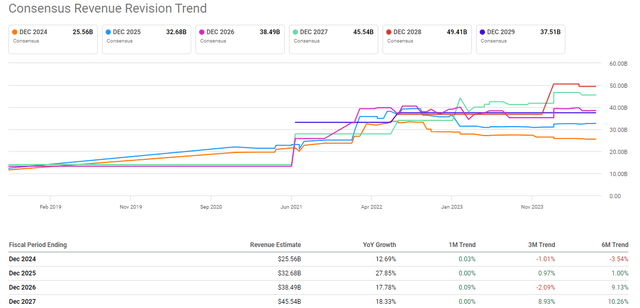

- AMD stock appears overvalued, as supported by the increase in its valuation multiple alongside downward revisions in revenue and EPS in FY2024 and muted consensus in FY2025.

JHVEPhoto

Investment Thesis

Advanced Micro Devices’ (NASDAQ:AMD) stock has rallied 24% since the beginning of this year. Despite strong growth in AMD’s Data Center, the company’s overall revenue growth has been muted, largely driven by a significant decline in its Gaming and Embedded segments. These two segments accounted for 50% of AMD’s total revenue in FY2023. Management expects continued YoY growth declines and gross margin contraction in the Gaming segment for the remaining quarters of FY2024 due to persistent demand weakness.

Meanwhile, AMD’s EBIT margin remains flat on a YoY basis, delaying a rebound in earnings growth. The stock trading at 10.3x EV/Sales forward and 47x non-GAAP P/E forward, combined with downward revisions in revenue and EPS for FY2024, indicates an overvalued level. Therefore, I initiated a sell rating on the stock. Although the strong Data Center outlook will boost the company’s top-line growth, it will be largely offset by significant declines in the Gaming and Embedded segments.

Strong Data Center Growth is Not Enough

While AMD has achieved an 80% YoY revenue growth in Data Center segment, driven by the strong AMD Instinct MI300X GPU shipments and a double-digit growth in server CPU sales, the company’s overall revenue growth has been significantly impacted by a sharp decline in the Gaming and Embedded revenue segments. In Q1 FY2024, the company slightly topped revenue and non-GAAP EPS consensus. However, its total revenue grew by only 2.2% YoY, indicating a slowdown on a QoQ basis compared to the 10.2% YoY in Q4 FY2023.

As shown in the chart, AMD generated $739 million in incremental revenue ($2,337 – $1,598) from the Data Center over the past two quarters but lost $981 million in incremental revenue from the Gaming and Embedded segments. Additionally, during the 4Q FY2023 earnings call, the CEO Lisa Su indicated strong headwinds in the Gaming segment, entering the fifth year of a gaming cycle, with consumers having built up significant inventory. She anticipated a recovery in the Embedded business as the industry was going through a bottoming process. However, in the 1Q FY2024 earnings call, the management expected a more slowed recovery in the Embedded and Gaming segments in 2H FY2024, as consumers continued to focus on reducing excess inventory. I believe that this indicates a continued revenue decline on a YoY basis in the coming quarters. Therefore, despite a guided double-digit QoQ growth in Data Center in 2Q FY2024 (implying at least 95% YoY growth, conservatively assuming 10% QoQ growth in 2Q FY2024), I do not see clear upside momentum in AMD’s overall top-line growth in the near term.

Rising SG&A Expenses for AI Opportunities While Reducing Capex

I admit that AMD’s gross margin has been resilient, showing strong expansion in the last quarter. The company expects further expansion in Q2 FY2024, guiding a 53% gross margin outlook. I believe this is largely due to strong growth in the Data Center and Client segments, which have offset the margin headwind in the Gaming and Embedded segments. However, the company’s operating margin remained flat on a YoY basis. I think a 150-bps improvement in gross margin was largely offset by a 23% YoY growth in SG&A expenses in the last quarter. Management explained that the company continued investing aggressively in R&D and marketing to address the significant AI growth opportunities.

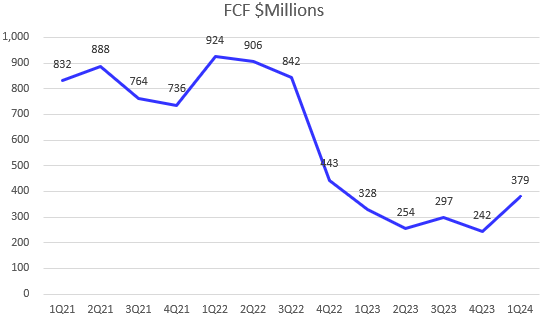

The company model

Despite an increase in operating expenses, AMD reduced capex by $16 million YoY in Q1 FY2024 due to energy efficiency and high core count. For example, regarding its EPYC processors, management indicated in the earnings call that they could deliver the same amount of compute with 45% fewer servers, cutting initial capex by 50%. However, while AMD is not increasing its capex, its FCF growth trajectory remains muted, with $379 million in Q1 FY2024 significantly below the levels in FY2022 and FY2021.

Downward Revenue Revisions Contradict the Multiple Expansion

According to Seeking Alpha’s Revenue Revision Trend, AMD’s revenue for FY2024 has been trimmed by 1% over the past 3 months and 3.5% over the past 6 months. This indicates that its top-line revenue growth trajectory has been disappointing to the market, despite the company’s guided a lower bound of 95% YoY revenue growth in the Data Center segment for Q2 FY2024. Additionally, the revenue outlook for FY2025 appears also muted, with only a 1% increase in consensus. Meanwhile, the market also cut its EPS consensus by 4.8% over the past 6 months. Therefore, I believe the expansion in its valuation multiple, coinciding with downward revisions in revenue and EPS, clearly suggests that the stock is overvalued. In contrast, NVIDIA’s (NVDA) revenue revisions for the current fiscal year have boosted by 30% over the past six months and are projected to raise by 46% in the next fiscal year. We should know that NVDA is currently trading at the same non-GAAP P/E fwd as AMD. I’ll explain in the next section.

Valuation

AMD is currently trading at a premium valuation driven by the AI boom. However, it’s important to note that the AI growth tailwind was only benefiting 50% of its total revenue mix in FY2023. In Q1 FY2024, we saw almost a 50% YoY decline in Gaming and Embedded revenue. As shown in the chart, its EV/EBITDA TTM and EV/Sales TTM multiples are very elevated, standing 30% above their 5-year averages according to Seeking Alpha.

The market consensus indicates low double-digit growth in revenue in FY2024, which keeps its EV/Sales fwd lofty. Meanwhile, its non-GAAP P/E fwd is at 46.8x, which is in line with NVDA’s P/E of 47.3x, despite NVDA achieving 262% YoY total revenue growth and 461.9% YoY growth in non-GAAP EPS in FY2025. Meanwhile, its P/E multiple is 38% above iShares Semiconductor ETF’s (SOXX) P/E as well. Therefore, I believe the 24% stock rally has been largely driven by market beta and the stock is currently overvalued.

2Q FY2024 Earnings Preview

AMD is set to report its Q2 FY2024 earnings results later this month. Management’s guidance for Q2 revenue is almost in line with market consensus. The stock has recouped its entire post-Q1 earnings selloff and rallied an additional 8%, suggesting that some of the good news from Q2 has already been priced in. However, I still believe AMD could post potential upside risk in the next earnings report. The key metrics to focus on are the revenue growth of the Gaming and Embedded segments and the comments about their inventory levels during the earnings call. If the recovery of these two segments is faster than expected, it’s possible that AMD’s top-line growth and gross margin will significantly improve in the near term, justifying its current valuation multiple. Nevertheless, I believe the recovery may begin in the 2H FY2024 instead of 2Q FY2024.

Conclusion

In summary, despite a strong growth in its Data Center, AMD faces challenges due to significant revenue declines in Gaming and Embedded, which together comprise half of its total revenue in FY2023. The company’s management anticipates continued weakness in these segments, impacting overall revenue and earnings growth forecasts for FY2024. Despite resilient gross margins, elevated SG&A expenses will impact its EBIT margin. Additionally, even if the company trims its capex outlook, we don’t see a strong rebound in FCF. Given the downward revisions in revenue and EPS consensus, coupled with the stock trading at a non-GAAP P/E fwd similar to NVDA level, the stock appears overvalued. Therefore, I have issued a sell rating on AMD.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.