Summary:

- I decided to upgrade AMD to “Buy” due to its relative underperformance and potential growth in data centers and AI products. Read on.

- AMD’s Q2 FY2024 showed strong revenue growth in Data Center and Client segments, despite declines in Gaming and Embedded products.

- AMD’s liquidity remains strong with $5.3 billion in cash, significant free cash flow, and strategic acquisitions like Silo AI to enhance AI capabilities.

- AMD’s revenue structure shift is causing a low base for future comparisons. I think the current stock price doesn’t fully reflect the company’s growth potential.

- If AMD achieves the EPS that consensus forecasts predict, and its P/E valuation multiple aligns with where I think it logically should be, the stock could see a 75% increase in price over the next 2 years, based on my calculations.

JHVEPhoto

My Coverage History & Updated Thesis

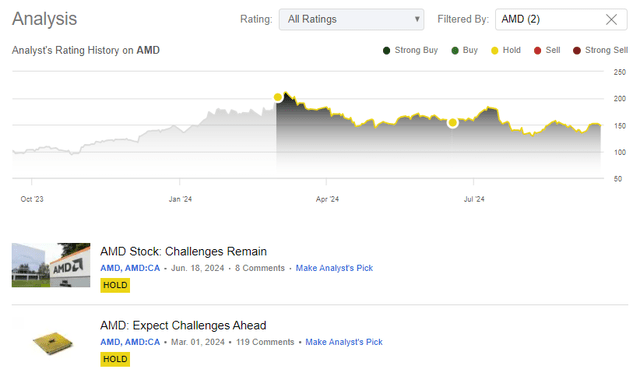

I initiated coverage on Advanced Micro Devices, Inc. (NASDAQ:AMD) stock on March 1, 2024, with a “Hold” rating, outlining my concerns about the sustainability of the stock’s rally at that time. Since then, AMD has declined by about 27.7%, while its direct peer, NVIDIA Corporation (NVDA), has managed to grow significantly over the same period. In June 2024, I reiterated my “Hold” rating again, citing that risks for AMD remain despite the firm’s meaningful dip (both on an absolute basis and relative to its main peer); since my previous rating update, the stock has been down ~5.5% while the S&P 500 index (SPY) (SP500) managed to gain 2.6% over the same time.

SA, Oakoff’s coverage of AMD stock

Apparently, I was lucky with my timing to warn investors that the risk of buying AMD was asymmetrically higher at the time of my updates. However, I have now decided to upgrade AMD due to its relative underperformance, which, I believe, should evaporate as cyclicality in its diversified segments improves, and new AI products are monetized shortly.

My Reasoning

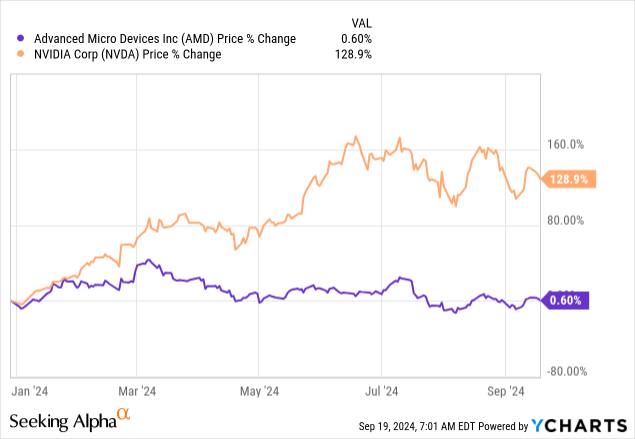

Surprisingly, all the hype around AI and related topics since the beginning of the year has bypassed AMD, which, it seems, is an integral part of the industry and one of Nvidia’s most obvious competitors:

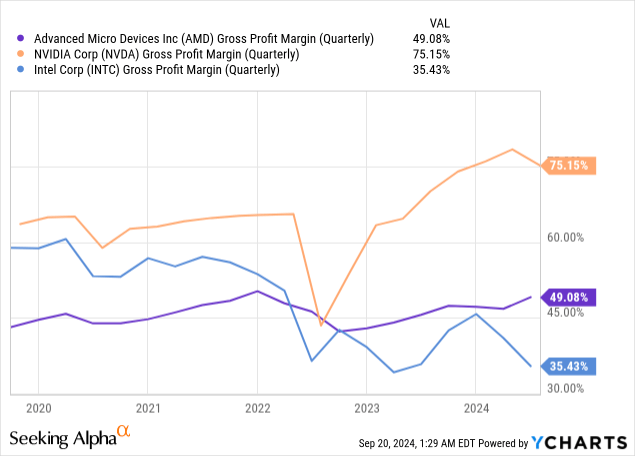

At the same time, in my opinion, one of the main reasons for the lag is AMD’s momentum in terms of marginality. Although this lag can’t be compared to the performance of Intel Corporation (INTC):

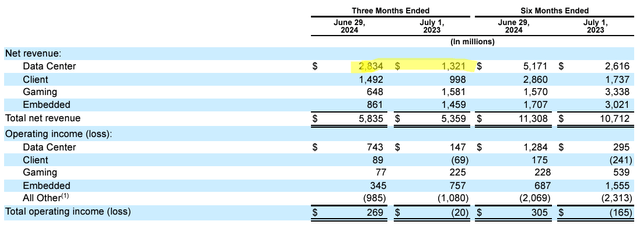

AMD’s Q2 FY2024 gross revenue grew year-over-year by 8.8% to $5.8 billion, with higher sales of Data Center and Client compensating for declines in Gaming and Embedded products. The Data Center unit, in particular, delivered a 115% revenue jump to a new record of $2.8 billion thanks to the Instinct MI300 GPU shipment ramp-up and the “meaningful growth” of EPYC CPU sales. The Client segment was also strong with revenue up 49% YoY to $1.5 billion, driven by strong Ryzen processor sales, and operating income was up to $89 million from a loss a year ago. The Gaming segment saw revenue decline 59% to $648 million, thanks to “reduced demand for semi-custom SoCs as the console cycle matures”, the management noted during the earnings call. And finally, the Embedded segment saw revenue down 41% to $861 million, as “customers continued to reduce inventory.” Overall, little has changed over the past few quarters in terms of AMD’s “over-diversification revenue structure issue” so to speak – with some of its business segments lagging significantly, the company continues to fall short of its true potential that could have been created by today’s AI craze. However, in my view, the data center growth we saw in Q1-Q2 of this fiscal year is capable of eclipsing any headwinds in other end markets.

Ultimately, the strength in this segment should lead to an overweighting of Data Center sales in the revenue structure, and if at least some of the growth rates we see today are maintained, AMD’s business should eventually begin to boom.

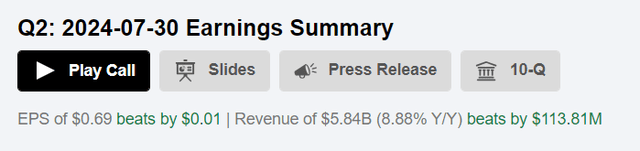

Going down the income statement, I see that AMD’s gross margin increased over 300 basis points to 53%, and EPS grew by 19% to $0.69 thanks to the strong performance of the two core segments. So in general, AMD showed a double beat of the consensus estimates for Q2, according to Seeking Alpha:

Speaking about liquidity, AMD has $5.3 billion in cash & equivalents; it generated $593 million in cash from operations and $439 million in free cash flow during the quarter. Inventory was increased “to drive the launch of GPU products for data centers”, so without that inventory increase the FCF would have been even bigger. AMD returned $352 million to shareholders through share repurchases and repaid $750 million in debt. Therefore, even taking into account the large investments in expansion and the grandiose development plans (more on this below), the management does not forget to reward investors for their patience and faith in the company, and at the same time it tries to control the leverage, which is a good thing.

Shortly, the company plans to increase its product portfolio and ramp up its AI capabilities. AMD’s next-generation AI products include the launch of the MI325X AI accelerator towards the end of this year and the MI350 series in 2025, both of which will boost AMD’s AI performance and efficiency leadership.

The AMD CDNA 4 architecture, planned for 2025, which will power the AMD Instinct MI350 series accelerators, and deliver up to a 35x increase in AI inference performance compared to CDNA 3.

Source: wccftech data

In July 2024, the company also signed a definitive agreement to acquire the software company Silo AI, one of the largest AI development centers in Europe, for ~$665 million. Based on the description of Silo and its solutions and reach, I think this should be a great addition to what AMD already has, and it should also accelerate the transition to a primarily data-center-focused status for AMD.

Based in Helsinki, Finland, with operations in Europe and North America, Silo AI specializes in end-to-end AI-driven solutions that help customers integrate AI quickly and easily into their products, services and operations. Their work spans diverse markets, with customers including Allianz, Philips, Rolls-Royce, and Unilever. Silo AI also creates state-of-the-art open-source multilingual LLMs, such as Poro and Viking, on AMD platforms in addition to its SiloGen model platform.

For Q3 2024, AMD projected revenue to be ~$6.7 billion (+15% QoQ) driven by strong growth across Data Center and Client segments (effectively, the management increased its guidance for the DC sales for FY2024, from $4 billion to $4.5 billion). The Embedded segment sales should increase while the Gaming segment’s revenue is projected to decline – still. AMD projects non-GAAP gross margin to be 53.5% and non-GAAP operating expenses to be $1.9 billion.

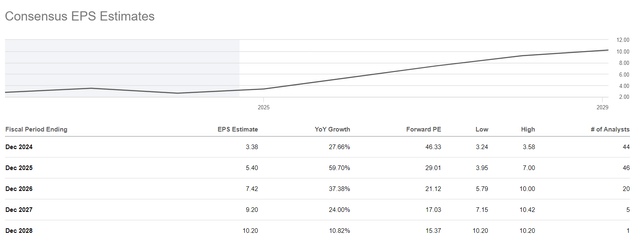

Honestly, I’d like to see a much higher gross margin – maybe not as high as NVDA, but in the 55-58% range would make me feel much better. However, with the decline in the gaming segment that we have seen in recent quarters, AMD has created a pretty low base for itself – that is, from current levels, the revenue decline in the gaming unit, even at a double-digit rate, will not be felt as painfully as before. Last year, the gaming unit accounted for 29.5% of total revenue, but now it only accounts for 11.1% – we have seen an almost threefold drop in the share of this segment in just one year. I therefore think that the analysts’ current EPS forecasts are at least not far from the truth.

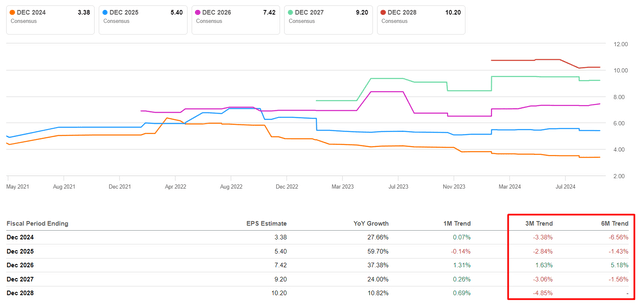

They can probably even be described as underestimated because although AMD has beaten on both the top and bottom lines in most of the past 8 quarters, AMD’s earnings revisions have become noticeably more negative recently:

Seeking Alpha, AMD, notes added

In my opinion, with the rapid advance of generative AI and the growing demand for computing power, AMD sees tremendous growth opportunities for years to come as its revenue structure further shifts towards data centers.

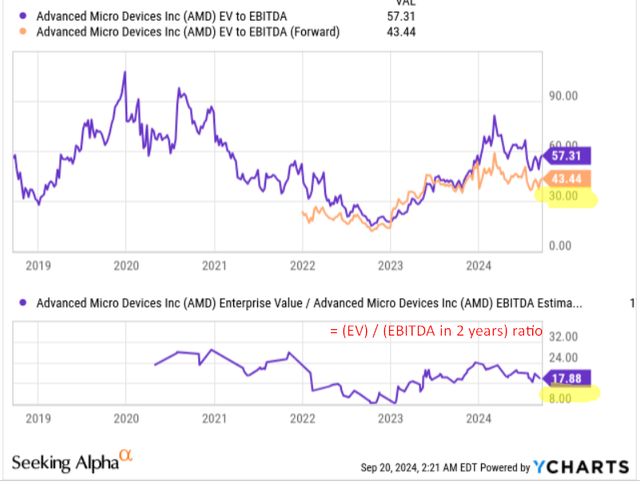

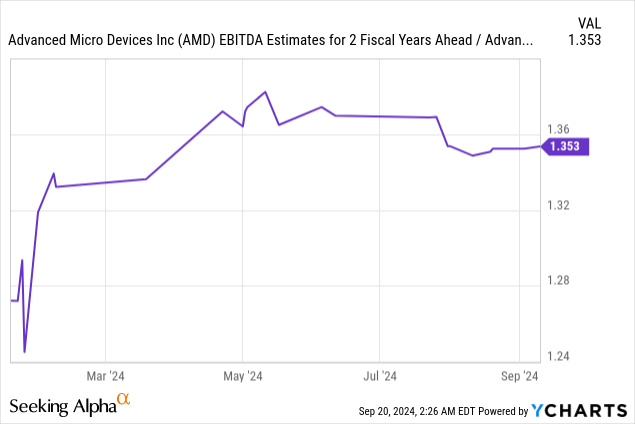

AMD’s growth may seem priced in today, but I believe the company has long-term growth potential due to its projected growth rates. The market currently values AMD’s EV/EBITDA (TTM) at around 57x, which is insanely high. But in just 2 years, this ratio should fall to ~18x, assuming the current stock price remains flat.

At the same time, the EBITDA growth forecast in 2026 is around 35%, and this forecast has increased significantly in recent months, according to YCharts data:

Even assuming the current EPS estimates are correct, I think a fair multiple for AMD should be a PEG of 1 (according to Seeking Alpha, the FWD PEG is currently 1.06). That is, I assume that the EPS growth rate will likely stay “identical” to the P/E ratio in a few years. Then AMD’s P/E ratio in FY26 should be about 37x, which at the current level of projected EPS ($7.42) gives me a medium-term price objective of $274.5/share, which is 75% above today’s stock price.

Based on all of the above, I’d like to upgrade AMD to “Buy” this time around.

Risks To My Thesis

In the short term, I think a general economic slowdown and lower technology hardware sales are a risk for AMD and other semiconductor companies. AMD is a financially strong and leading company with high growth characteristics that I think will position it well to weather this storm and be an even stronger player on the other side. But again, I can’t be 100 percent sure that AMD’s growth won’t slow down.

If AMD’s profit margin doesn’t increase enough over the next few years to justify the priced-in EPS expansion, I risk being wrong in my assumptions about undervaluation. The 57x TTM EV/EBITDA ratio we see today does indeed seem too much to me, and if the company doesn’t grow its EPS as expected, we’ll likely see a continuation of today’s stock price weakness over the next few quarters.

Your Takeaway

Despite the risks associated with investing in the stock today and despite AMD’s slower growth compared to its closest peer Nvidia, I believe the current shift in AMD’s revenue structure is setting a low base for future comparisons. The emergence of data centers as a key component of AMD’s business will be crucial for its future development. In my view, with all the initiatives the firm keeps working on, the current stock price doesn’t fully reflect the company’s growth potential.

If AMD achieves the EPS that consensus forecasts predict, and its P/E valuation multiple aligns with where I think it logically should be, the stock could see a 75% increase in price over the next 2 years, based on my calculations. That’s why I have decided to upgrade my rating from “Hold” to “Buy” today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.