Summary:

- Advanced Micro Devices, Inc.’s AI revenue growth appears impressive only until Nvidia enters the conversation.

- AMD’s inventory issues are snowballing, and the company plans a 4% workforce reduction, contrasting Nvidia’s aggressive headcount expansion.

- AMD is significantly overvalued with a fair share price of $87, while the current price is $139, indicating a 37% downside potential.

Pavel Byrkin

Introduction

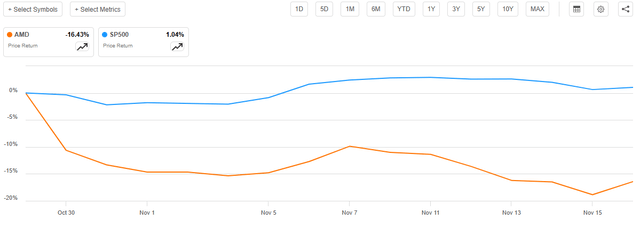

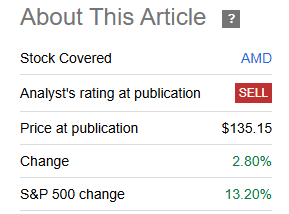

The last time I updated my Advanced Micro Devices, Inc. (NASDAQ:AMD) thesis was August 6. It was another “Sell” recommendation, which aged mixed. On the one hand, the stock was significantly behind the S&P 500 index (SP500) since early August. On the other hand, the share price change was positive, a 2.8% gain.

SA

I think that there are still not many reasons to become bullish. There were no big positive surprises during the latest earnings call, and this is explained by fierce competition from Nvidia (NVDA). AMD’s AI revenue demonstrates impressive growth, but it only looks impressive if we do not bring Nvidia’s data center revenue growth to the table. Two out of four segments demonstrate weak sales dynamics, which significantly offsets soaring AI revenues. The inventory problem is still snowballing, and the valuation is still far from being attractive. Taking all these unfavorable factors into account, AMD remains a “Sell” in my opinion.

Fundamental analysis

According to the fresh technical analysis from financial-services firm Oppenheimer, AMD is a sell. I prefer to focus on fundamentals before I make my investment decisions, but such an opinion from the prominent Wall Street name is also worth mentioning.

The biggest event that happened to AMD over the last few weeks is its Q3 earnings release. Despite it being a dual beat against consensus, the stock tanked by 16% since October 29. The broad stock market was stable over the same period, with no sharp movements.

Therefore, the weak sentiment around AMD is highly likely explained by company-specific issues. It appears to me that investors expected the management’s forecasts around AI revenue to be more aggressive. AMD expects to generate $5 billion in AI GPUs revenue in FY2024. It is around $500 million higher compared to the previous guidance from the management. The half-a-billion AI revenue guidance boost apparently did not impress investors of a company that was worth more than $260 billion before the Q3 earnings release.

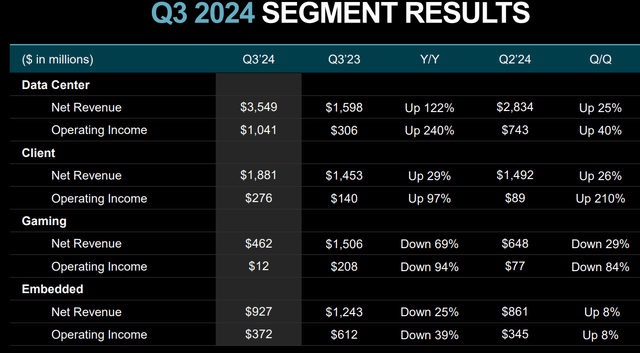

Another bearish sign is AMD’s revenue mix. The Gaming segment’s net revenue has nosedived by 69%, or more than a billion USD in absolute terms. The Embedded segment’s sales also demonstrated a sharp drawdown, with a 25% year-over-year decrease. The weak performance of these two segments ate up the lion’s portion of growth delivered by Data Center sales. Two out of four segments’ revenues rapidly shrinking is quite a bad sign, in my opinion.

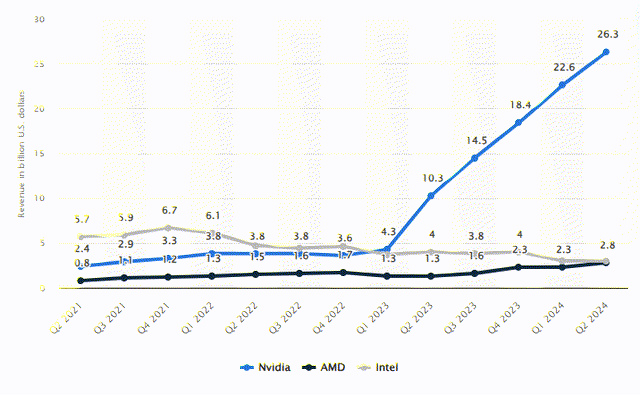

When we speak about AMD, we cannot ignore the context of Nvidia. The 122% year-over-year growth in Data Center sales delivered by AMD in Q3 is impressive, but only if we ignore Nvidia. The below chart from Statista clearly demonstrates that it is a David versus Goliath situation. Before the generative AI craze, Nvidia’s data center revenues were around three times higher than AMD’s. Nvidia is still to report its calendar Q3 2024 earnings, but in Q2 2024 it was ahead of AMD in terms of data center revenue by almost 10 times. I think that the below chart looks absolutely not optimistic when we speak about AMD’s ability to compete with Nvidia in data centers.

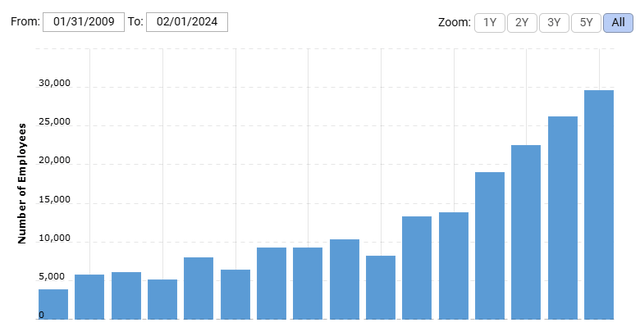

Another piece of screaming evidence that AMD struggles to compete is that the company recently decided to reduce nearly 4% of its workforce “to target growth opportunities.” I believe that this statement contradicts itself, as companies that expect aggressive growth usually hire more people to handle growth instead of cutting the headcount. For example, Nvidia’s CEO Jensen Huang plans to increase his company’s headcount to 50,000. Since Nvidia’s current headcount is around 30,000, the planned growth will be significant.

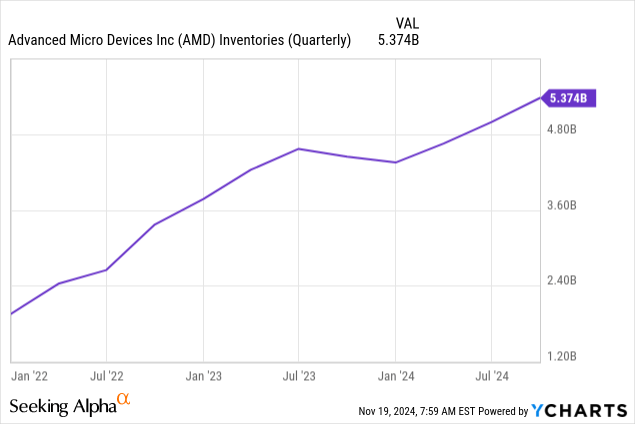

AMD might save payroll costs after the planned 4% headcount cut, but I believe that there is a much bigger problem that the management still has not resolved. In my previous thesis, I emphasized that AMD’s inventory level is sky-high, and there was no good news from the latest balance sheet. AMD’s inventory balance as of the end of Q3 was higher by one billion USD compared to the beginning of FY2024, and around half-a-billion higher sequentially. In one of the above charts, we saw that Nvidia’s data center revenue is around 10 times higher compared to AMD’s. But from the inventory balance perspective, these companies are relatively close to each other, since Nvidia had $6.7 billion inventory balance as of the latest available reportable date. The inventory issue looks big, and the trend is quite warning.

So, what do we have at the end of the day? Two out of four segments are underperforming, which diminishes the rapid growth in Data Center revenue. While AI revenue shows robust growth, it appears less impressive when compared to Nvidia’s data center revenue. The inventory problem remains unresolved and seems to be snowballing. Additionally, AMD is reducing its workforce, whereas Nvidia plans to increase its headcount significantly. This set of fundamental developments appears quite bearish.

Valuation analysis

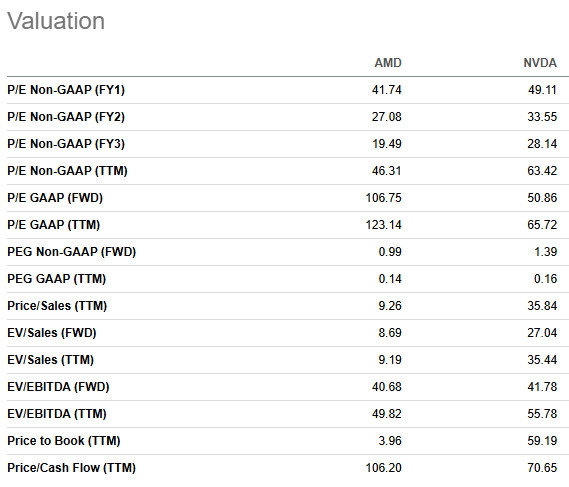

I think that it is also useful to compare AMD versus Nvidia when performing valuation analysis. As we see, AMD is substantially pricier than Nvidia in terms of the Price/Cash Flow TTM ratio.

SA

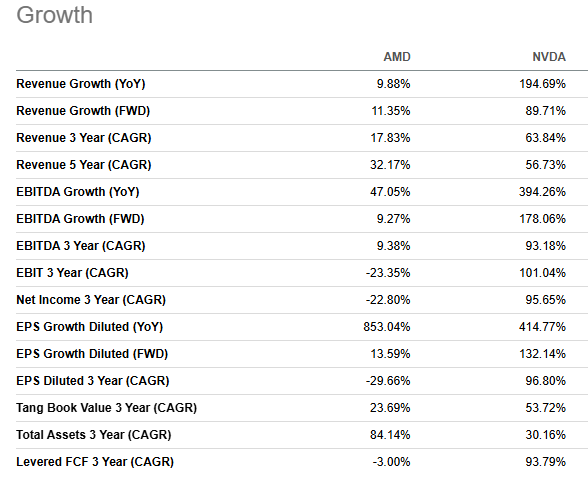

AMD’s forward non-GAAP P/E ratios are lower than Nvidia’s, but the difference does not look dramatic to me. Moreover, let us not forget that Nvidia demonstrates exponential growth across all key P&L metrics. At the same time, AMD’s growth is much more modest. Nvidia’s 3-year EBITDA CAGR is close to 100%, while AMD’s was not even in double-digits. Therefore, AMD actually looks expensive based on comparative valuation ratios analysis.

SA

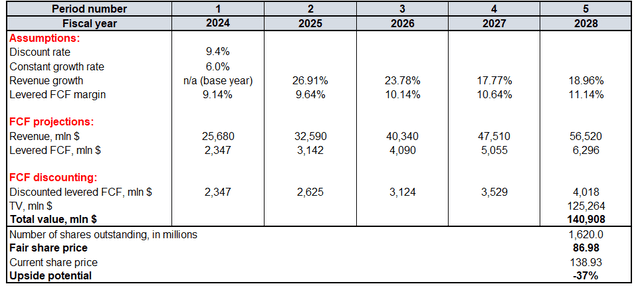

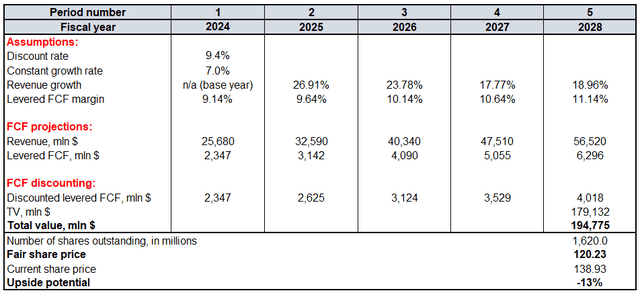

The discounted cash flow (“DCF”) model will give us more answers. A 9.4% WACC is used to discount AMD’s future cash flows. Revenue projections for the next five years rely on consensus. The TTM levered FCF margin is 9.14%, which is lower compared to the last five years’ average. Therefore, incorporating an aggressive FCF margin expansion will be unfair. I think that a 50 basis points yearly improvement in the FCF margin is fairly conservative. Due to AI tailwinds, I reiterate an aggressive 6% constant growth rate. According to SA, there are 1.62 billion AMD shares outstanding.

AMD’s fair share price is $87, as suggested by my DCF model. The current share price is close to $139, 37% higher than the fair share price. The downside potential is quite wide, which adds more conviction to my bearish opinion. Even a 7% constant rate does not save the situation, as the stock is 13% overvalued in the second scenario, which is outlined below.

Mitigating factors

The fact that AMD is a big laggard in the data centers race does not mean that it is a weak company. Despite inventory problems, AMD’s balance sheet is still strong, with a $2.3 billion net cash position. This gives solid financial flexibility to develop new, potentially disruptive technologies. CEO Lisa Su might not be as popular as Jensen Huang, but she is also considered one of the most successful CEOs of the last decades. The stock was performing quite poorly against the S&P 500 until 2014, when she took over the CEO role at AMD, but she was highly successful in regaining investors’ confidence in the company. When a company has strong financial flexibility and a successful leader, there is always some probability to unlock new unexpected growth drivers.

AMD is significantly overvalued despite quite questionable fundamentals. The reason for such a generous premium over the stock’s fair value is likely explained by Nvidia’s soaring share price. Therefore, Nvidia’s upcoming earnings release can be another positive catalyst for all big semiconductor names. Nvidia releases its earnings on November 20, and this might be a big day for AMD investors as well if Nvidia delivers another jaw-dropping beat or guidance boost.

Conclusion

AMD is significantly overvalued, and there are several major fundamental issues that remain unresolved, perhaps forever.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.