Summary:

- Advanced Micro Devices, Inc. stock remains a Strong Sell despite a 6% price drop since my last call, with significant reaction expected to Q3 earnings on October 29.

- AMD’s new AI products, including Turin EPYC CPUs and Instinct MI325x AI accelerator, failed to excite investors, leading to a stock price decline.

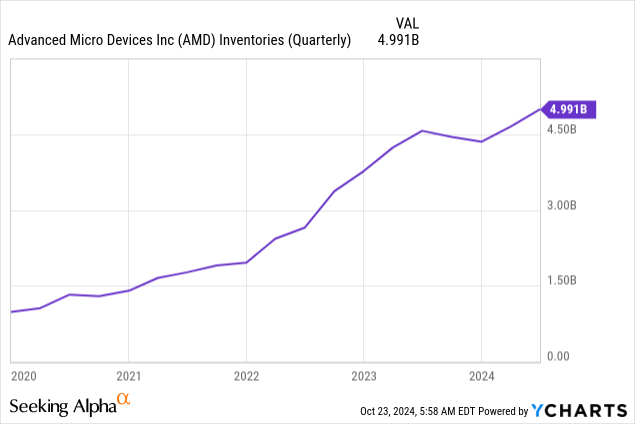

- AMD’s inventory has grown to nearly $5 billion, representing 21% of TTM revenue, a concerning level compared to Nvidia’s 7% ratio.

- The upcoming earnings release is crucial for AMD investors, especially after the underwhelming response to the recent AI product unveiling.

JHVEPhoto/iStock Editorial via Getty Images

My thesis

Advanced Micro Devices, Inc. (NASDAQ:AMD) (NEOE:AMD:CA) stock still appears to be a Strong Sell. This is despite the stock becoming cheaper after it declined by 6.5% since I shared my previous analysis. The new earnings release is expected next week, and there are several warning signs indicating that Q3 earnings might disappoint investors.

According to my discounted cash flow model, the stock is significantly overvalued, and weak earnings could serve as a major negative catalyst for the share price. The inventory problem continues to mount despite positive revenue dynamics over the last few quarters. After AMD recently released various new products, it is highly likely that the existing inventory is now obsolete, forcing the company to sell them at large discounts, which will pressure profitability.

AMD stock analysis

Today I want to focus on AMD’s upcoming earnings release because growth stocks usually tend to react significantly to beats or misses against consensus. According to the official information from AMD, the company will release its Q3 earnings on October 29, after the close of the market. This is highly likely the biggest event for investors that is left in 2024 because on October 10 the company already made a presentation where it unveiled its new AI chip.

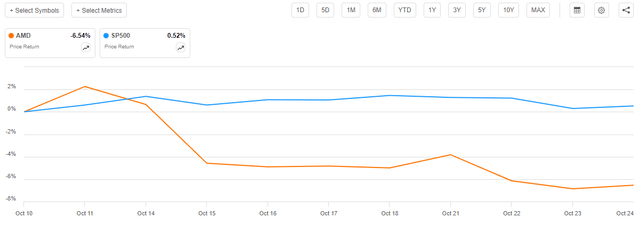

During the event, AMD unveiled new Turin EPYC data center CPUs and an Instinct MI325x AI accelerator. The company also unveiled Ryzen AI PRO 300 Series, the first Microsoft (MSFT) Copilot+ laptops designed for enterprise. Despite the company rolled out various new products with AI exposure, it appears that investors were not excited much. The stock price dropped notably after the event, even despite the S&P 500 (SP500) demonstrated positive dynamic over the same period.

Since my previous analysis was published before the Q2 earnings release, I want to refer to one of the fundamental issues related to the latest quarterly financial report. In my previous thesis, I emphasized that AMD’s inventory grew significantly over the last couple of years. As we see below, the problem became even larger during the previous reportable quarter as inventory grew to almost $5 billion. This is around 21% of AMD’s TTM revenue, which is a substantial level. For example, NVIDIA’s (NVDA) inventory was $6.7 billion as of the latest reporting date. This is higher compared to AMD in absolute terms, but Nvidia’s TTM revenue is $96 billion, meaning that the inventory to TTM revenue ratio is around 7%.

A high inventory level presents a significant fundamental issue for the company, as nearly $5 billion of its assets are tied up in inventories. These inventories appear to be slow-moving, given that their balance continues to grow, even despite AMD’s revenue returning to the growth path during recent quarters. This high inventory level is likely to be a long-lasting headwind for profitability because the outstanding balance is not much lower compared to quarterly sales over several past quarters.

Additionally, we should not forget that AMD consistently rolls out new, upgraded versions of its products. With that being said, the inventory will highly likely sell off slowly and potentially at a large discount, as demand for older versions diminishes notably once new versions appear.

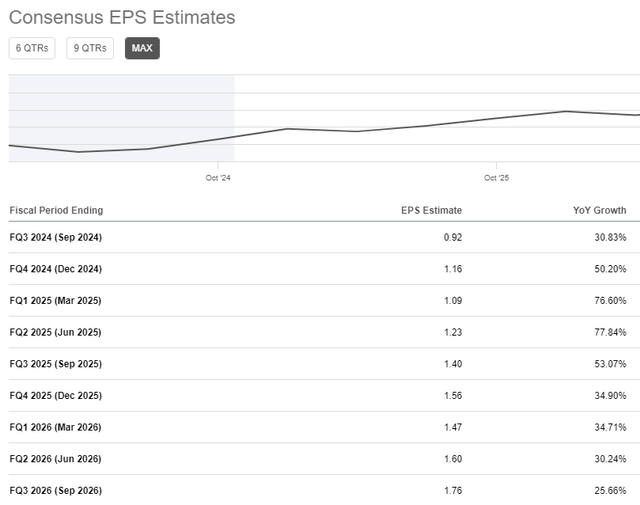

According to quarterly consensus estimates, analysts expect a 31% YoY adjusted EPS growth. This is notably ahead of the expected 16% YoY revenue growth. Furthermore, for the quarters beyond fiscal Q3 2024, analysts project a substantial acceleration in EPS growth. However, given the significant inventory issue, these EPS growth forecasts might be overly optimistic. Therefore, there is a considerable risk of AMD missing Q3 EPS consensus estimates and potentially downgrading its outlook.

As I mentioned in my previous AMD coverage, growth in Data Center revenue was the only strong revenue growth driver over the last few quarters. However, in this market, AMD competes with Nvidia. Due to its smaller scale and much weaker financial position compared to Nvidia, it is very difficult for AMD to compete in data centers. Nvidia’s hottest offering for data centers is its new Blackwell GPU. According to the management, the supply of Blackwell is already sold out for the next 12 months. Furthermore, analysts from Morgan Stanley (MS) believe that Nvidia is likely to expand its market share in AI processors in 2025. Since AMD is the second-largest player in the market, it is highly likely that Nvidia’s potential 2025 market share expansion will happen at AMD’s expense.

Due to all these factors, I am quite pessimistic about AMD’s upcoming Q3 earnings release. Inventory is a strong headwind for profitability, and fierce competition from Nvidia’s Blackwell means that AMD’s management is unlikely to boost its AI revenue projections for 2025.

Intrinsic value calculation

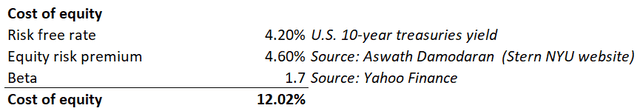

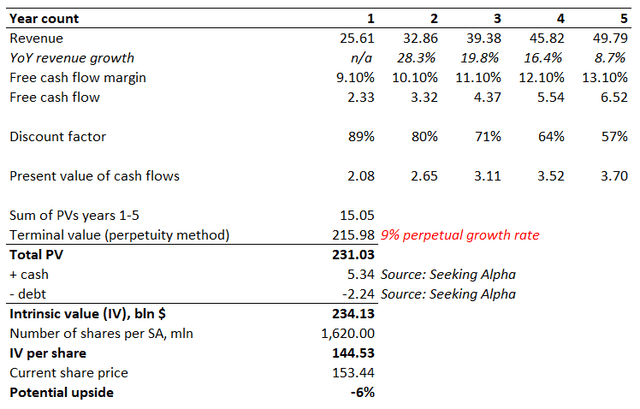

AMD leverage ratio is low, meaning that using cost of equity is a fair choice to be used as a discount rate for my discounted cash flow (DCF) model. The below working demonstrates why the discount rate is 12.02%.

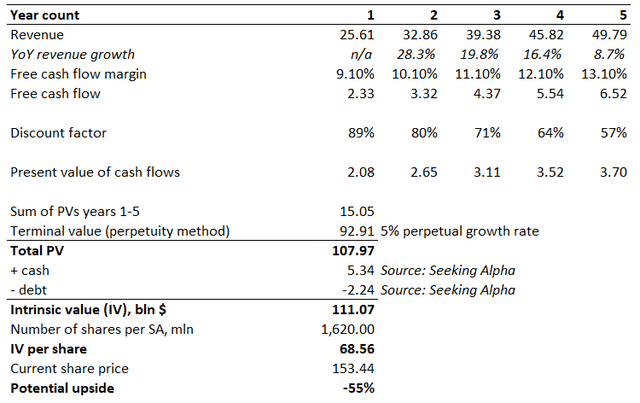

According to consensus, the revenue CAGR for years 1-5 is around 18%. This is an aggressive assumption, but using an optimistic forecast as the first scenario looks reasonable to balance out my bearish stance. Therefore, the perpetual growth rate is also aggressive at 5%. The levered TTM FCF margin is 9.1%. This is my year 1 FCF assumption, with expected growth of the metric by 100 bps annually. I use levered FCF margin because cost of equity is the discount rate.

AMD’s intrinsic value per share is $69. This target price is significantly lower compared to the current share price of $153.44. The valuation is very generous because only a 9% perpetual growth rate more or less justifies the current share price.

What can go wrong with my thesis?

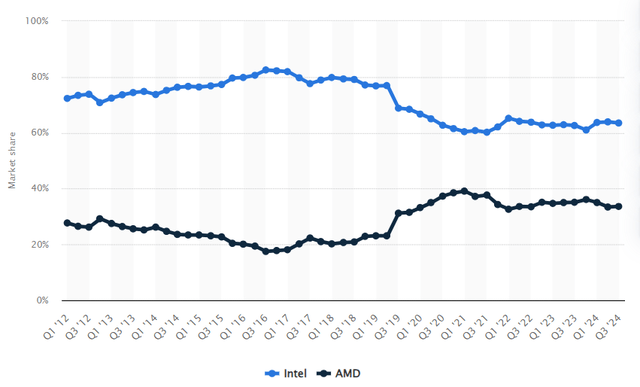

While I do not see opportunities for AMD to compete with Nvidia in AI processors, the company has successfully played its ‘David versus Goliath’ role in the past against Intel (INTC). Less than ten years ago, there was a massive gap between Intel’s and AMD’s market shares in x86 computer CPUs. According to Statista, AMD has significantly narrowed this gap recently, and Intel’s position no longer appears unassailable. Therefore, AMD’s management has experience in successfully competing with larger competitors.

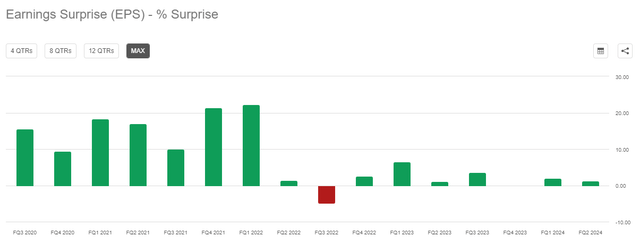

Despite I am pessimistic about AMD’s ability to beat consensus EPS estimates, its recent earnings surprise history is quite strong. According to Seeking Alpha’s chart, there has been only one negative EPS surprise over the last sixteen quarters, which is a strong track record suggesting that I might be underestimating the company’s ability to deliver positive surprises.

Summary

I am quite pessimistic about AMD’s approaching earnings release due to a few (but big) warning signs. In addition, the stock appears significantly overvalued.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.