Summary:

- Advanced Micro Devices, Inc. shares are flat YTD and are underperforming against Nvidia, which saw its stock appreciate over 100% since the beginning of the year.

- At the same time, AMD’s stock appears undervalued, with a fair value of $170.63 per share, representing a potential upside of over 15%.

- However, AMD’s growth is not guaranteed due to the rising challenges, such as increased competition from Nvidia, declining gaming revenues, and potential macroeconomic headwinds.

nantonov

Despite being one of the main designers of AI GPUs and CPUs across the globe, Advanced Micro Devices, Inc.’s (NASDAQ:AMD) shares have failed to gain momentum recently, even after the company reported decent earnings results a few weeks ago. Unlike Nvidia (NVDA), which saw its shares appreciate by over 100% since the beginning of the year, AMD’s shares are currently flat for the year. There’s a possibility that AMD shares will continue to underperform against major peer Nvidia and the broader market.

The only positive thing that AMD has going for it is the fact that its stock appears to be undervalued at the current price. But there are no guarantees that it will appreciate closer to its fair value anytime soon, since the underlying business continues to face major challenges that could undermine its growth story.

So Far, So Good

Back in June, I stated that while AMD’s shares are no longer overvalued, the company continues to face challenges in competing with Nvidia in the AI GPU market. The latter company has been dominating thanks to the release of its flagship GPUs H100 and H200 recently. Since the publication of my recent article on the company, AMD’s shares depreciated by nearly 10% and underperformed against the broader market.

Even though AMD managed to report decent Q2 earnings results a few weeks ago, showing that AMD revenues were up 9% Y/Y to $5.84 billion and beat expectations by $120 million, it was not enough for the stock to properly regain momentum. Despite this, the company nevertheless has several major catalysts going for it that at the very least could help it continue to exceed expectations in the future.

First, AMD’s flagship chips from the MI300 series were able to generate over $1 billion in revenues for the first time in Q2, which indicates that the demand for its products remains relatively strong. At the same time, during the recent earnings call, AMD’s management noted that Microsoft (MSFT) is now using the company’s MI300X AI GPUs to power its generative AI tools and platforms, which is another positive development. What’s more, is that AMD now expects its data center revenues to be over $4.5 billion in the current fiscal year, above the previous forecast of $4 billion.

On top of all of that, AMD’s client business was also able to show impressive results in Q2. It will likely retain its momentum in the following quarters, as the company is preparing to ramp up the production of its recently released Zen 5 CPUs in Q3.

All of this shows that AMD’s growth story is far from over. Thanks to the expected continuous rise in demand for AI GPUs and CPUs, the company has recently increased its Q3 revenue forecast to $6.7 billion, which is above the consensus of $6.61 billion. Therefore, it’s safe to assume that AMD will continue to grow at a decent rate going forward.

On top of all of that, it also appears that AMD is a much better investment at the current price. Back in June, my discounted cash flow (“DCF”) model which was highlighted in a recent article on the company showed that AMD’s fair value is $166.81 per share. Given that AMD was already trading around that price, its shares offered little margin of safety to investors. However, now that the shares have depreciated to much lower levels while the company reported decent earnings results last month, it makes sense to update my model to include the new numbers and guidance.

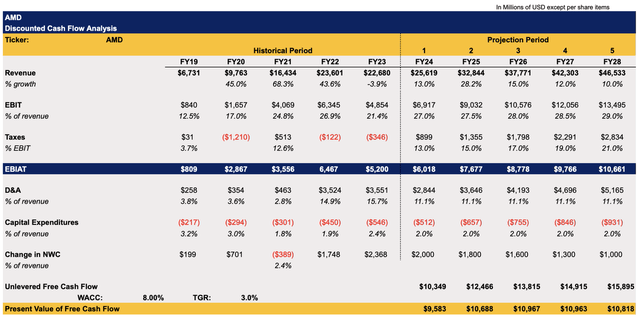

In the updated model, I’ve revised upward the revenue assumptions for the current and the upcoming fiscal years. This is primarily due to the decent performance in the recent quarter and the expected increase in demand for hardware that powers the ongoing generative AI revolution. The revenue assumptions for FY24 and FY25 also closely correlate with the overall expectations. Closer to the terminal year, I expect a stabilization of the growth rate.

The assumptions for other metrics mostly remained the same as before and closely correlated with the company’s historical performance. The WACC in the model is 8%, while the terminal growth rate is 3%. Both of those rates closely correlate with the market’s average, and I also used them for valuing Nvidia as well.

AMD’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

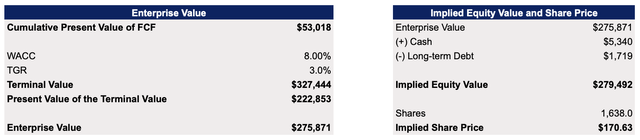

Thanks to the upward revisions of some assumptions that were caused by the better-than-expected performance in Q2, the updated model shows that AMD’s fair value is $170.63 per share, which represents an upside of over ~15% from the current market price.

AMD’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Upside Is Not Guaranteed

Even though AMD looks like an attractive investment, especially at the current price, the company nevertheless faces several challenges that could prevent the rapid appreciation of its stock in the foreseeable future.

First, the company’s flagship AI GPUs appear to underperform against Nvidia’s chips. As such, it’s difficult to see how AMD will be able to capture a portion of the market share from Nvidia, which currently owns as much as 90% of the AI processor market. Even though AMD’s GPUs are cheaper in comparison to Nvidia alternatives, the company is still unable to establish a strong presence in the market. While AMD expects to generate over $4.5 billion in data center revenues this year, Nvidia can generate over $20 billion in data center revenues in a single quarter and has been doing so for a couple of quarters already.

In addition to that, AMD’s gaming revenues in the recent quarter declined by 59% Y/Y to $648 million, while Nvidia’s gaming revenues were up 16% Y/Y to $2.9 billion. This indicates that AMD might not be the best chip designer to invest in right now.

When it comes to valuation, both companies trade at ~45 times their forward earnings. Therefore, one might wonder what’s the point of investing in AMD when its biggest competitor trades at the same multiples but offers greater growth opportunities.

On top of all of that, the potential worsening of the macro environment could also undermine AMD’s momentum in the foreseeable future. Earlier this month, the unemployment numbers triggered recession fears. Although the imminent recession is not around the corner, there’s an indication that the overall growth of the economy is slowing down, which could hurt GPU sales and negatively affect AMD’s performance over time.

The Bottom Line

While AMD is fundamentally undervalued, there’s no guarantee that its shares will appreciate closer to its fair value anytime soon, given the number of challenges and the rising pressure from the competition that it faces. Even after releasing a decent earnings report recently, AMD’s shares failed to gain proper momentum and are currently flat YTD.

The last time I bought the company’s shares was in 2023, when they were trading at around $70 per share, when the risk/reward was much more attractive. If Advanced Micro Devices, Inc.’s shares experience another major pullback, then I might be interested in reentering a long position. Until then, I believe that it’s best to continue holding Nvidia, which has a far superior offering and can better scale the production and sales of its AI GPUs at the same time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.