Summary:

- AMD is undervalued and poised for growth, especially in the AI segment, with the potential for better-than-expected Q3 earnings and robust future guidance.

- Despite recent volatility, AMD trades at an attractive valuation, around 29 times next year’s EPS estimates, and is 33% off its 52-week high.

- AMD’s AI chips, designed to compete with Nvidia’s, are expected to drive significant revenue growth, narrowing the market share gap in the AI data center space.

- Risks include intense competition from Nvidia and Intel, but AMD’s continuous innovation and strong growth potential make it a compelling investment.

BlackJack3D

In a previous article, we discussed Advanced Micro Devices (NASDAQ:AMD) and I stand by my bullish thesis. AMD deserves special attention as it moves closer to its crucial earnings on October 29th. Despite its enormous potential in the ultra-lucrative enterprise AI segment, the market has underappreciated AMD.

While Nvidia (NVDA) and other high-quality chip stocks have appreciated considerably, AMD’s YTD return is flat, illustrating its relatively low-profile nature. Additionally, AMD’s AI-related prospects have improved, and it could surprise the market with better-than-expected results and more robust guidance when it reports its Q3 earnings in several weeks.

Moreover, AMD’s Instinct MI300 accelerator is designed to compete directly with Nvidia’s influential H100 AI chip. AMD should continue generating more revenues as it moves closer to Nvidia in the AI chip race. AMD also has plans to release new highly capable AI chips annually to continue competing with Nvidia and other industry leaders at the highest levels.

Meanwhile, despite its massive potential, AMD’s stock has been volatile recently and remains relatively inexpensive, trading around 29 times next year’s EPS estimates. Also, AMD is about 33% off its 52-week-high, and it is likely to outperform future forecasts. Therefore, AMD is set up well going into October earnings, making it a strong buy here, in my view.

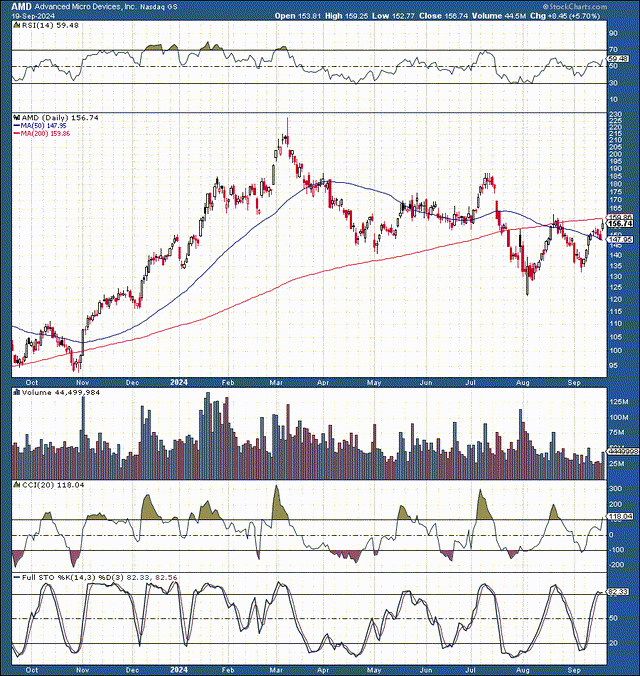

The Technical Image: Long-Term Pullback

AMD had a robust rally from the correction low of about $95 late last year to a high of approximately $230 in early March. However, AMD’s stock got ahead of itself during this stellar run-up, resulting in a blow off the top and a long-term pullback/consolidation process.

Whether AMD has bottomed remains to be seen, but if AMD put in the low at around $120, it was roughly a 48% correction from AMD’s ATH. Also, despite the recent rebound, AMD is still about 33% below its high.

More recently, we’ve seen lower highs and lower to higher lows, suggesting AMD is consolidating, and the stock will likely break out or break down soon. A breakout above $150-160 resistance may be the path of least resistance, and I expect AMD to be around $180-200 by year-end.

From a negative technical standpoint, AMD continues making lower highs, and the 50-day MA has crossed below the 200-day MA, suggesting sluggish momentum. Nonetheless, AMD could have established a long-term bottom around the early August panic low and may be setting up for another considerable move higher into Q3 earnings and year-end.

AMD – An Underappreciated AI Leader

YTD, Nvidia is up by about 130%, Broadcom (AVGO) is up by about 45%, and despite the recent volatility, many other top AI-related chip stocks have done very well in 2024. Yet, AMD’s stock remains approximately flat YTD. Partly, it’s because AMD had a monster rally late last year and in early 2024. Therefore, the recent correction has been more profound and has taken longer than anticipated.

Also, AMD has not had its “Nvidia moment.” It has failed to provide a blowout quarter, preannouncing or showing much stronger AI demand than the market expects. However, just because AMD hasn’t illustrated its extraordinary AI-related growth yet doesn’t mean it won’t announce a better-than-expected quarter, illustrating excellent demand for its AI chips.

AMD’s GPUs and APUs power the AI segment at the base, where enormous computing power is required to run the massive AI servers and supercomputers. Despite lagging Nvidia, AMD remains a top “picks and shovels” player, doing the heavy lifting in the AI space. Moreover, the Nvidia/AMD gap in the AI space could narrow as we progress.

In Q2, nearly half of AMD’s revenues came from the AI data center division. Moreover, AMD’s data center sales could be higher as demand is highly robust, yet supply remains tight. Nonetheless, CEO Lisa Su said that the Instinct MI300 accelerator, AMD’s flagship data center AI processor, made over $1B in sales in Q2.

Like Nvidia, AMD plans to release new AI chips annually due to the enormous success, sales, and long-term profitability potential in the data center space. Furthermore, Lisa Su said the MI350 should be “very competitive” with Nvidia’s Blackwell, suggesting that AMD could potentially close the data center Nvidia gap in time.

We must consider that Nvidia’s data center revenue was around $22.6B in its previous quarter, while AMD’s data center sales were only around $2.8B. This dynamic illustrates about an 11%/89% market share in Nvidia’s favor. However, we can see AMD’s market share increase, leading to substantially higher sales and more profitability in the coming years.

AMD Is Relatively Cheap And Could Outperform

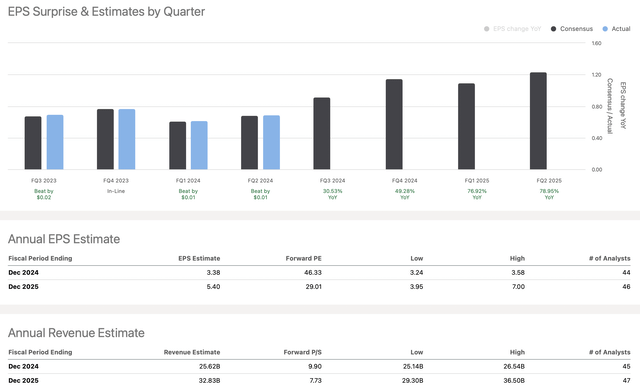

EPS vs. estimates (seekingalpha.com )

Despite the solid rebound, AMD remains inexpensive. It trades at only about 29 times next year’s consensus EPS estimates. Also, higher-end EPS estimates go up to $7, and 2026 EPS could be in the $7.50-$10 range. Therefore, in a bullish case scenario, AMD may be around 22 times next year’s EPS estimates and as low as 20–15 times relative to its 2026 earnings potential. In addition to the possibility of higher EPS adjustments, AMD could outpace its EPS targets, earning more than the market expects in future quarters and years.

Where AMD’s stock could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue (in billions) | $26 | $34.6 | $42.2 | $50 | $58 | $67 | $76 |

| Revenue growth | 15% | 33% | 22% | 19% | 16% | 15% | 14% |

| EPS | $3.50 | $6.20 | $8.70 | $11 | $13 | $15 | $17 |

| EPS growth | 32% | 77% | 40% | 26% | 18% | 16% | 14% |

| Forward P/E | 31 | 32 | 32 | 33 | 32 | 31 | 30 |

| Stock price | $195 | $278 | $352 | $429 | $486 | $552 | $615 |

Source: The Financial Prophet

AMD’s stock could increase considerably as the company aggressively expands revenues and increases EPS due to growing demand in the AI data center space and other segments. In a bullish case scenario, AMD could achieve higher end estimates, which could lead to multiple expansion, and a higher stock price in future years.

My AMD one year target range remains $225 – $250

Risks to AMD

Despite my bullish assessment, an investment in AMD comes with risk. One significant risk is the competition from Nvidia. AMD is chasing Nvidia in the AI data center market and must close the gap to increase market share, sales, and profitability. On the other hand, AMD faces a resurgent Intel, intent on clawing back some of its lost territory in the CPU space and other segments. AMD must innovate continuously, maintain growth, and move forward with a relatively high level of profitability. Please consider these and other risks before investing in AMD.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!