Summary:

- Despite last week’s massive 18% dip, AMD’s stock remains overvalued. The premium doesn’t seem justified as the company continues to struggle against Nvidia.

- The stock’s likely overvaluation is evident from insiders selling throughout the last 12 months, including aggressive sales by the CEO in the past 6 months.

- AMD’s performance across key P&L metrics in the next three quarters is expected to lag behind Nvidia, allowing Nvidia to amass more resources for increased R&D spending.

- My valuation analysis suggests that the stock is 14% overvalued, even with aggressive growth assumptions.

JHVEPhoto

Investment thesis

My previous bearish thesis about AMD (NASDAQ:AMD) aged decently as the stock substantially lagged behind the broader U.S. market since April with a negative share price change.

Today, I want to explain why I remain quite bearish about AMD, especially in light of the upcoming Q2 earnings release. Valuation still looks like a problem as AMD’s valuation ratios are sky-high and my optimistic DCF model suggests that the stock is 14% undervalued. The fact that AMD is likely overvalued is also backed by insiders, who were only selling the stock over the last 12 months with no buys. AMD’s financial performance is poised to continue substantially lagging behind Nvidia (NVDA) in the next few quarters, which will mean that the company’s major rival will likely be able to ramp its innovation spending much faster. All in all, I reiterate my “Sell” rating for AMD.

Recent developments

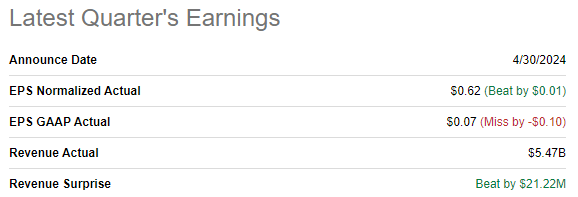

The company released its latest quarterly earnings on April 30, surpassing consensus and adjusted EPS estimates. Revenue’s growth pace in Q1 was behind the U.S. inflation with a very modest 2.24% YoY increase. The adjusted EPS expanded from $0.60 to $0.62 YoY.

Seeking Alpha

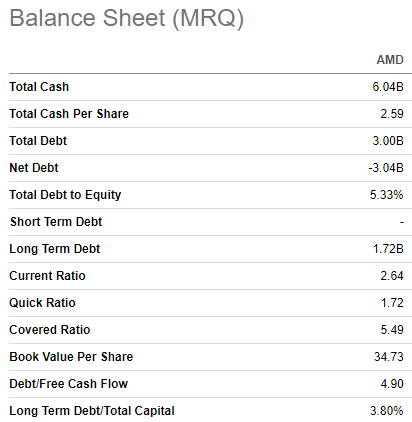

While the adjusted EPS expansion is generally good, the Q1 2024 bottom line was far lower compared to Q1 2022 level, which was at $1.13. Nevertheless, AMD’s free cash flow [FCF] is positive. The levered FCF generated during Q1 2024 was $884 million, which contributed to the company’s robust balance sheet.

Seeking Alpha

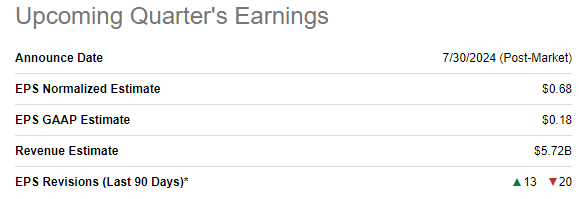

The upcoming Q2 earnings release is scheduled for July 30. Wall Street analysts forecast Q2 revenue to be $5.72 billion, which will be around 6.7% YoY growth. The adjusted EPS is projected to expand from $0.58 to $0.68. Wall Street’s sentiment around the upcoming earnings release appears to be mostly negative with notably more EPS downgrades than upgrades over the last 90 days.

Seeking Alpha

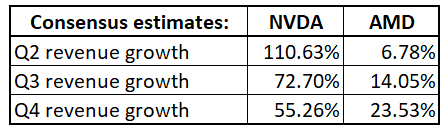

AMD’s modest revenue growth despite massive AI tailwinds is a warning sign, in my opinion. According to quarterly consensus estimates, AMD’s revenue is expected to notably accelerate by Q4 2024. However, figures do not tell much without context. Using Nvidia’s expected revenue growth for the next three quarters looks like a sound benchmark. AMD and NVDA have different fiscal year ends, so to make it simple I will name the upcoming three quarters just like Q2, Q3, and Q4.

Compiled by the author

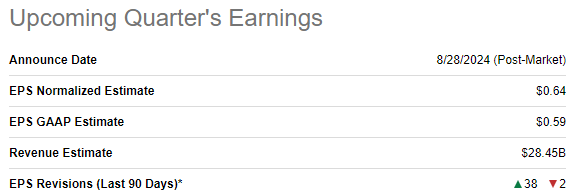

As shown above, AMD’s projected revenue growth is nowhere near NVDA’s. Moreover, let us not forget that Nvidia’s revenue is already extremely high compared to historical levels as its TTM $80 billion revenue is around three times higher compared to the 2022 revenue [out of 12 months of FY 2023, 11 were in calendar year 2022]. At the same time, AMD’s TTM revenue is still lower compared to FY 2022 revenue. That said, it is apparent that the gap between NVDA and AMD in the AI market positioning will continue to expand further. Moreover, Wall Street analysts are much more optimistic around NVDA’s upcoming quarter’s earnings release with 38 EPS upgrades over the last 90 days and almost no downgrades [see below].

Seeking Alpha

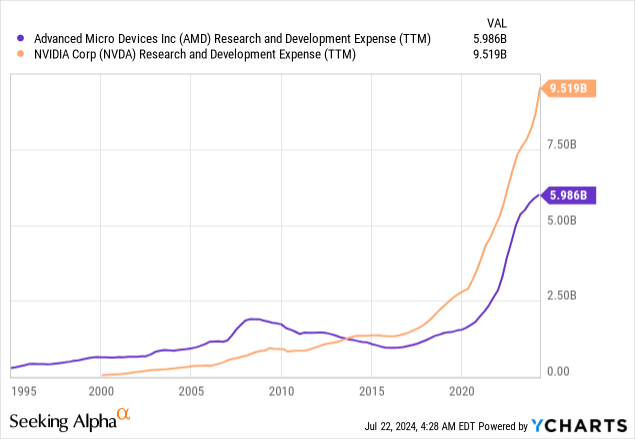

I am highly confident that the gap between NVDA and AMD will continue to widen because the GPU leader is already dream away in terms of the R&D spending. With NVDA’s key P&L metrics expected to significantly outpace AMD, the same will likely happen to R&D.

Valuation update

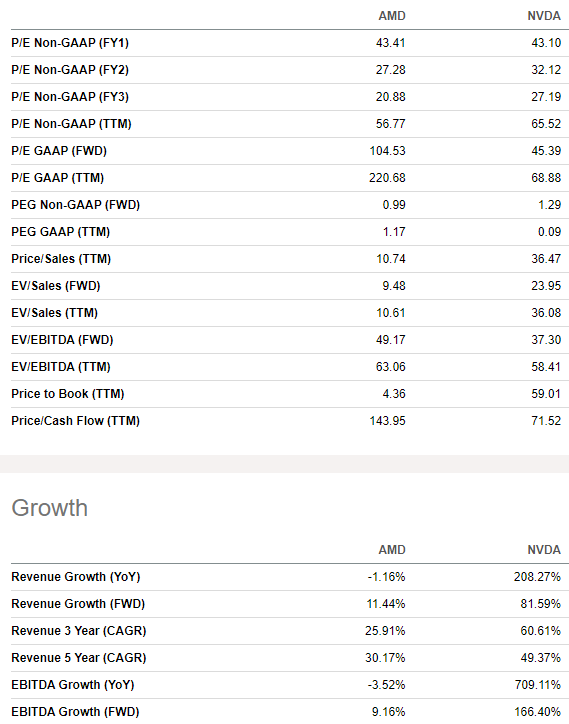

The stock rallied by 30% over the last 12 months, notably outperforming the broader U.S. market. From the YTD perspective, AMD is well behind the S&P 500 with a modest 3% share price increase. AMD has a low “D-” Seeking Alpha Quant valuation grade because most of its multiples are high compared to both sector median and historical averages.

Another factor that underscores AMD’s overvaluation is the comparison of its valuation ratios to Nvidia’s. As we see, most of the ratios are comparable and some of AMD’s multiples are even higher compared to NVDA. This looks unfair to me because AMD’s growth across key P&L metrics is not even close to NVDA.

Seeking Alpha

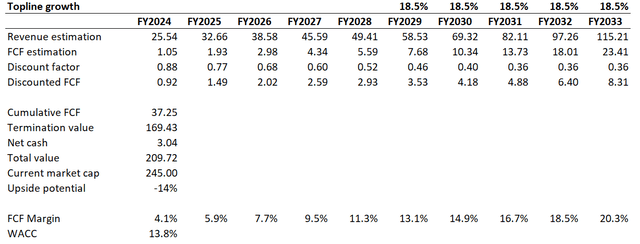

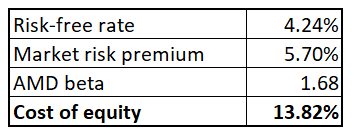

Looking only at valuation ratios is unlikely to be sufficient. Therefore, I must simulate the DCF model. To figure out the discount rate for AMD, I ignore the cost of debt for AMD because its total debt is quite insignificant compared to the company’s market cap. Therefore, the discount rate will be equal to AMD’s cost of equity, which is figured out in the below table using the CAPM approach. All variables are easily available on the Internet.

Author’s calculations

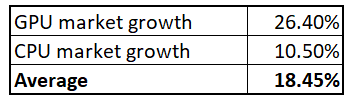

Revenue consensus estimates are available for only five upcoming years, so I have to build my own revenue growth forecast for the years beyond FY 2028. It is impossible to figure out from the company’s 10-K report the share of GPU’s and CPU’s it sells. The company disaggregates revenue by end markets, but not by product types. Given AMD’s quite diversified revenue mix, I think that a fifty-fifty mix would be fair for my estimations. It is crucial to understand shares of CPUs and GPUs in the company’s revenue mix because these products have very different growth prospects for the next decade. For example, GPUs are projected to compound with a 26.4% CAGR over the long term. On the other hand, CPUs are expected to demonstrate much more modest growth with a 10.5% CAGR.

Author’s calculations

Assuming that GPUs and CPUs are evenly split in the company’s revenue mix, an 18.5% CAGR projection for AMD’s revenue over the long run looks reasonable. I apply this revenue growth rate for the years beyond FY 2028.

Considering the mix of consensus projection for 2024-2028 and my assumptions regarding years beyond 2028, the next decade’s revenue CAGR is 18%. I use a TTM 4.1% FCF ex-SBC margin for the base year and forecast a 1.8 percentage point yearly expansion, which correlates with the projected revenue growth.

According to my DCF valuation, the business’s fair value is $210 billion. This is around 14% lower than the current market cap. That said, the stock looks quite overvalued in my opinion, especially considering optimistic revenue and profitability growth assumptions.

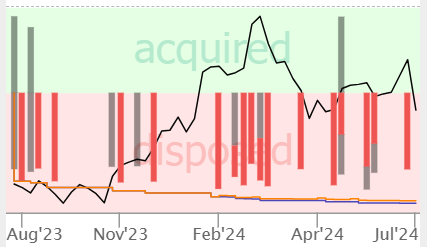

TrendSpider

The factor that I consider to be robust evidence that the stock is overvalued is the fact that insiders were only selling over the last 12 months. Lisa Su, the CEO, is likely to consider the stock overvalued as she has been selling aggressively in recent months with stock worth around $90 million sold over the last six months.

Risks to my bearish thesis

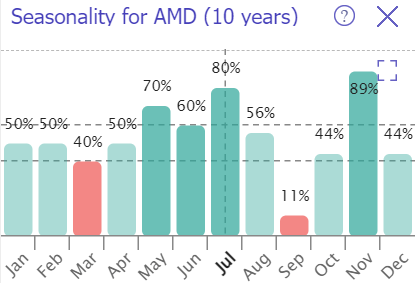

AMD has a robust historical stock performance in July and August, which we can see from the seasonality analysis below. This means that the stock might rally in the last few days of July and in August. However, it is also crucial to mention that September is the stock’s by far historically weakest month over the last decade.

TrendSpider

The market’s reaction on earnings release is difficult to predict. AMD might deliver above the consensus performance, but the market might consider even a slight downgrade in Q3 guidance as a disaster, and this might potentially lead to a sell-off. However, it also works the other way round as well. AMD might deliver relatively weak Q2 performance, but Lisa Su might announce a new jaw-dropping chip release which will be a potential threat to NVDA’s offerings. That said, there is a risk that earnings release can potentially be a positive catalyst for the stock price, even if financial performance will be nothing special.

AMD is one of the best-performing stocks of the past decade with a 3,900% total return. A lot of people who invested in AMD ten years ago became much wealthier thanks to this investment. Therefore, it is highly likely that the stock has an impressive base of fans who are ready to tolerate volatility and will be willing to buy any dip. This might support the stock price even further, despite the current overvaluation. Should this happen, my thesis is unlikely to age well.

It appears that all notable semiconductor names are likely to be moving in line with NVDA. For example, in “Valuation” we saw that AMD’s revenue and profitability growth is not even close to NVIDIA’s. However, AMD’s stock price increased by more than two times since January 2023, and I believe that the notable portion of AMD’s rally related to the big rally in NVDA. That said, a new rally in NVDA might boost AMD’s share price higher, even if the company’s fundamentals will not improve accordingly.

Bottom line

To conclude, AMD still looks like a “Sell”. The stock is still notably overvalued, which is a red flag, especially considering the weak Wall Street’s sentiment around the upcoming earnings release. The red flag which supports my opinion about the stock overvaluation is the fact that insiders were only selling the stock over the last 12 months. The gap between NVDA and AMD in the AI race is expected to widen further, which will highly likely undermine the company’s long-term growth potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.