Summary:

- Advanced Micro Devices, Inc. is positioned for high growth via AI products despite a recent 17% stock drop; 50%+ price growth is expected within 12 months, with high valuation and market volatility risks.

- AI-driven growth is fueled by record Q2 2024 data center revenue ($2.8B), strategic product launches (MI325X in 2024, MI350 in 2025, and MI400 in 2026), and innovations like glass substrates.

- AMD’s competition with Nvidia and Intel is significant; reliance on TSMC and high valuations create risks, but agility in execution offers strategic advantages amidst technological changes.

kentoh/iStock via Getty Images

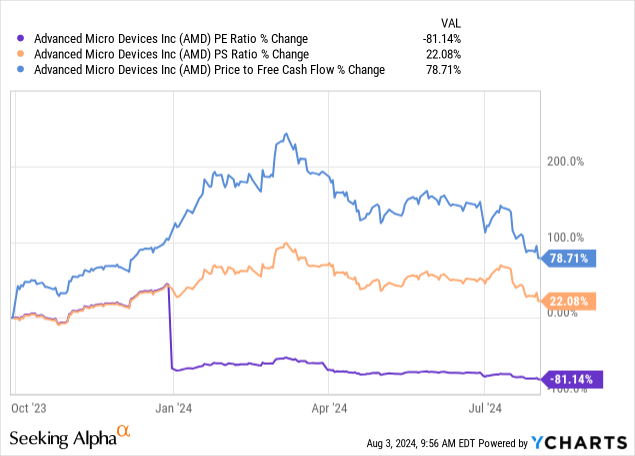

Advanced Micro Devices, Inc. (NASDAQ:AMD) has been overvalued for a while; my last analysis of the company was called “AMD: I’m Expecting Short-Term Volatility.” Since then, it has dropped nearly 17% in price. Now, I consider the stock more fairly valued, and I think it is positioned to deliver high growth, primarily through its AI-related offerings, through fiscal 2025 and 2026. My 12-month price target is price growth of 50%+; however, I have not issued a Strong Buy due to the bearish sentiment that could occur in the broader AI market based on high capex concerns and the volatility potential related to fundamental projections being missed. The valuation is still very high compared to other stocks in the industry apart from Nvidia (NVDA), so a smaller allocation may be suitable in a diversified portfolio.

AI And Data Center Expansion, Product Roadmap, And Technological Innovations Driving Growth

AMD’s data center segment achieved record revenue of $2.8B Q2 2024, marking a 115% increase YoY and accounting for nearly half of the company’s total revenue—this was driven by strong sales of the instinct MI300 GPUs and EPYC CPUs. The MI300 alone generated over $1B in sales during the quarter. The core reason to be bullish on AMD is its exposure to AI, as the rapid advancements in generative AI are driving significant compute demand. AMD’s AI-focused products are gaining substantial traction, and this is why the medium-term outlook is very favorable for the stock.

AMD plans to release new AI chips annually, with the MI325X set for late 2024, followed by the MI350 in 2025 and the MI400 in 2026. This should drive even further growth in the data center and AI markets. AMD also plans to incorporate glass substrates into its high-performance system-in-packages (“SiPs”) by 2025-2026. Glass substrates offer superior flatness, thermal properties, and mechanical strength, all crucial for advanced SiPs with multiple chiplets; this helps to enhance performance and reduce production costs, providing a competitive edge.

Furthermore, AMD’s client segment, which includes PC sales, saw a 49% YoY increase in revenue, totaling $1.5B. Largely, this was driven by the rising demand for AI PCs, and the strong sales of AMD’s Ryzen processors. On that note, AMD is continuing to invest in high-performance processors for laptops and desktops, which should be very accretive. I think the market for AI PCs is going to expand significantly. By 2027, IDC predicts that AI PCs will represent nearly 60% of all PC shipments, with shipments growing from nearly 50M units in 2024 to more than 167M by 2027. This market is expected to grow at 44% between 2024 and 2028, according to Canalys.

Fundamental Growth Estimates, Valuation Analysis, And 12-Month Price Target

The consensus is very bullish for AMD as a result of these growth prospects related to AI. In fact, AMD is competing directly with Nvidia, and I think AMD is more attractively valued right now. It is also exposed to a higher medium-term exponential growth curve, as Nvidia’s revenue growth rates look like they will begin to contract. For fiscal 2025, AMD is expecting 60% EPS growth, and in fiscal 2026, 35%, compared to 27.5% for fiscal 2024. This is a big reason to be bullish on AMD if the valuation is also appealing, which I think it is now.

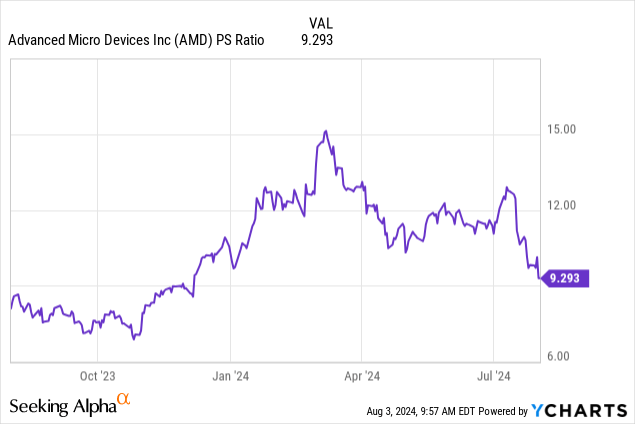

I think we could see the P/S ratio expand to 10 by the middle of fiscal 2025 due to higher sentiment as a result of the company reporting such high growth. I also believe, as is common with popular technology stocks, that its growth for the full year 2025 will be priced in early. Therefore, my target for August 2025 is a market cap of $328B, indicating a 12-month growth of 50%+ from the current market cap of $214.50B.

Despite this bullish perspective, AMD’s valuation is still incredibly high, with a forward P/E GAAP ratio of close to 100. That being said, its PEG ratio is just 0.91, making up for the value risk here. This is certainly not a value investment, and I would also not consider it a GARP investment; instead, this is a pure growth investment. This is a large part of why my rating is not a Strong Buy and is a Buy instead. If AMD fails to achieve its guidance or the consensus estimates, then the stock is prone to downside volatility. Furthermore, its exposure to AI can lead to a downside, even if it personally does not deserve it as a company.

It is conceivable that a bear run on Nvidia also rubs off on AMD stock, which could reduce sentiment even if AMD keeps its fundamental growth strong. If this latter situation arises, I would consider it a further buying opportunity for now.

Counterpoints & Risk Analysis

Despite AMD’s strengths, the major player in the AI and data center markets, Nvidia, poses a significant long-term threat, especially with its CUDA ecosystem and GPUs. While I think this is unlikely to inhibit AMD’s ability to scale in the medium term, it could offer large resistance over many years. Intel (INTC) is also making a comeback, including its line of GPUs and specialized hardware, so AMD is facing significant competitive pressure. That being said, this market for AI, data centers, and high-performance computing is large enough for many major players to capitalize on. However, AMD’s moat will not be as substantial as Nvidia’s, so we cannot expect the same growth we have seen with Nvidia with the next bull run for AMD.

AMD, like Nvidia, relies on TSMC (TSM) for the bulk of its chip manufacturing. As a result, it is more agile, but it also loses the potential economies of scale that could be commanded by Intel if it is successful with its 18A “leapfrog” strategy. However, the fabless model of AMD presents a free cash flow growth opportunity, which is more difficult for foundries like TSMC and Intel, as the capital intensity of manufacturing is high. This gives AMD more room to make strategic redirections, further strengthening my Buy thesis, as I highly value agility during this time of radical technological change and innovation, which will likely initiate new technology demand.

The success of the MI325X, MI350, and MI400 is heavily dependent on effective execution and technological innovation—delays in the pipeline or technological challenges, including recalls, could significantly affect revenue projections. Nvidia currently holds approximately 80% of the AI server semiconductor market share, so AMD is facing monopoly competition, which could cause it to cut corners for cost efficiencies, opening up the potential for technological difficulties to arise. Negative headwinds such as these could mean that the stock reacts with significant volatility due to its already very high valuation multiples.

Conclusion

Based on my prior research and analyses of AMD, it has been overvalued for quite some time. Now, it is much more reasonably valued after the recent decline in price. As a result, I consider the stock a Buy on high-growth estimates related to its AI and data center offerings in fiscal 2025 and 2026. I anticipate a 12-month price CAGR of 50%+. However, I am refraining from a Strong Buy rating due to the possibility of high volatility from revenue and/or earnings falling short of expectations. There is also the potential for the broader AI stock market to turn bearish as Nvidia’s growth rates slow and companies and investment banks begin to question the ROI of AI capex more.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.