Summary:

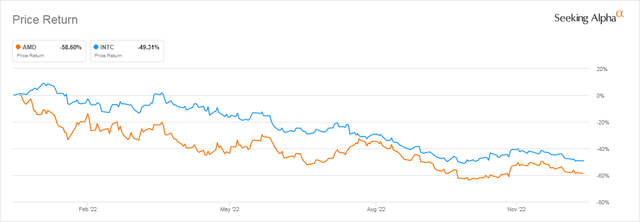

- AMD’s share price is down more than 58% and Intel’s is down more than 49% over the year.

- Intel has a substantial 5.6% dividend.

- Both companies have a bright future over the next few years.

sankai

Advanced Micro Devices, Inc. (NASDAQ:AMD) and Intel Corporation (NASDAQ:INTC) are well-known chip producers that compete in some areas and not in others.

Intel is a much larger company with revenues of $70 billion TTM (Trailing Twelve months) compared to AMD’s $23 billion.

However, price-wise, both companies have suffered over the last year with Intel dropping 49% and AMD a breathtaking 59%.

Seeking Alpha

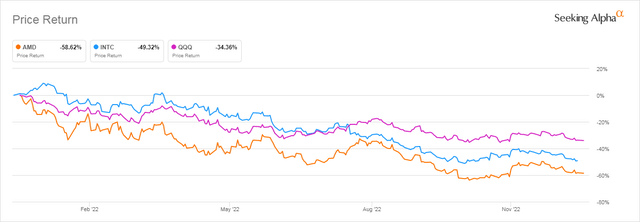

To see how bad it has been for tech stocks since the beginning of the year, the next chart adds Invesco QQQ Trust (QQQ) as a proxy for the tech market in general.

Seeking Alpha

QQQ has done better than AMD and Intel but was still down a significant 34%.

In this article, I will compare AMD to Intel to see which one is the best investment at the current time.

AMD And INTC Stock Key Metrics

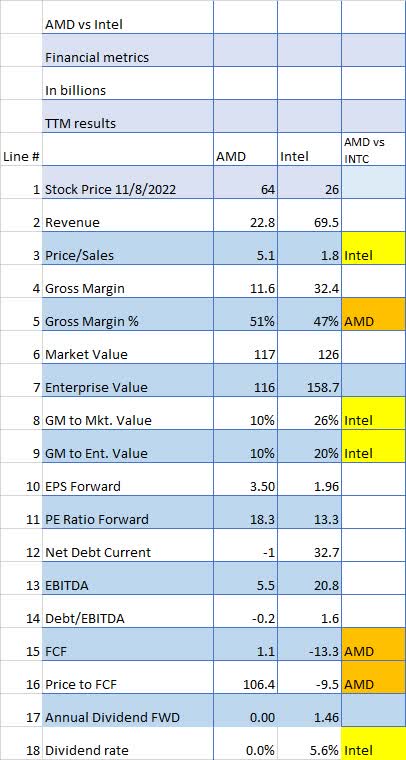

As you can easily see Intel is a much larger company based on revenue (Line 2). But when it comes to Price/Sales (Line 3) Intel appears to be a much better value with a ratio of 1.8x versus AMD’s 5.1x.

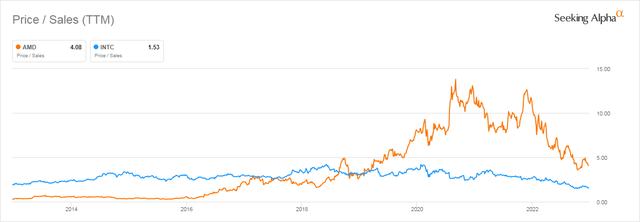

Historically, AMD has had a much higher value than Intel based on sales. This would imply that if AMD were to return to its historical price/sales levels it could have considerable upside in the future.

Seeking Alpha

As you can easily see in the table below, Intel is a much larger company based on revenue (Line 2). When it comes to Price/Sales (Line 3) Intel appears to be a much better value with a ratio of 1.8x versus AMD’s 5.1x.

Gross Margins (Lines 5, 8 and 9) are also interesting with AMD having a slightly better gross margin overall (Line 5) 51% to 47%, but much lower GM (Line 4) when compared to Market Value (Line 8) and Enterprise Value (Line 9).

This could imply that Intel is underpriced compared to AMD.

The PE Ratio (Line 11) is closer than the historical comparison because AMD has suffered a severe fall in price since the first of the year.

Seeking Alpha and author

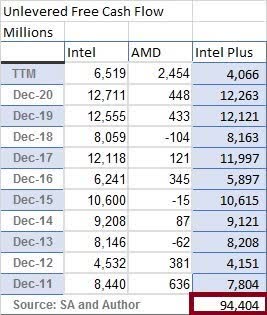

The FCF lines 15 and 16 are a bit distorted by Intel’s current huge CAPEX spending to expand its fabs. Historically, Intel has had, and I think will continue to have a huge FCF (Free Cash Flow) advantage over AMD.

Seeking Alpha and author

Based on financial metrics, Intel has better numbers than AMD.

Is AMD A Direct Competitor To Intel?

Intel and AMD’s competition goes all the way back to 1981 when IBM selected little-known Intel to be the main manufacturer of the PC’s CPU chips. However, IBM insisted that they have a backup plan in case Intel did not do the job and selected AMD. Since that time both companies have shared the IP associated with the X86 chips originally used in the IBM PC.

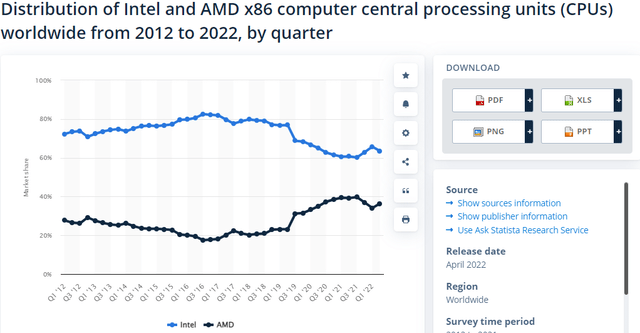

Fast forward to today and both companies compete vigorously in both the PC/laptop market and the server market. In recent years, AMD’s server technology has proven to outperform Intel’s and has allowed AMD to gain market share in both the desktop/laptop and the highly profitable server market.

As the chart below shows, AMD’s share has increased pretty steadily since 2019.

Statista

How Are Intel And AMD Stock Different?

The biggest difference between AMD and Intel revolves around FABS (microprocessor Fabrication plants). Intel manufactures its own CPU’s in its own FABs while AMD is what is known as “fabless” i.e., AMD subcontracts their production to other companies, in AMD’s case mostly to Taiwan Semiconductor Manufacturing Company (TSM).

Intel intends to expand its own manufacturing for others by spending $10s of billions building new fabs and will at that time be more of a competitor to TSM than they are now. In fact, I would not be surprised if Intel manufactures some of AMD’s chips in the future.

I wrote about the Intel/TSM competition in this article. “Intel Vs. Taiwan Semiconductor: Which Giant Chip Company Is The Best Investment Choice By The End Of 2025?”.

Are These Stocks Fairly Valued?

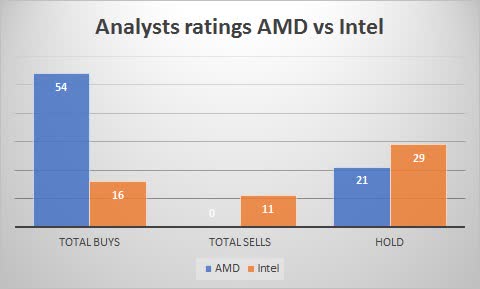

If we look at analysts’ ratings for both stocks we see that AMD is highly rated and Intel not so much. AMD has 54 Buy recommendations and zero, none, nada Sell recommendations. That is impressive.

Intel on the other hand has 16 Buys but a bothersome 11 Sell recommendations. Obviously, analysts are less than enamored with Intel’s plans and performance.

Seeking Alpha and author

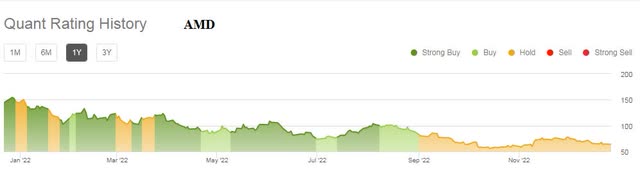

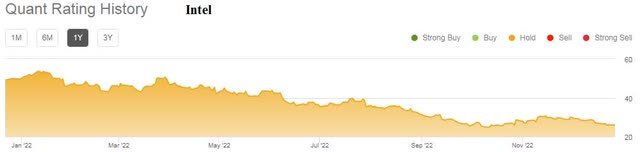

But looking at the quant ratings both companies currently have a Hold rating.

Do the quants know something the analysts don’t?

Seeking Alpha

Seeking Alpha

In my opinion, both these stocks are underrated based on historical performance and the inevitable turnaround in chip stocks will show up in the next year or two.

Is INTC Or AMD Stock A Better Long-Term Buy?

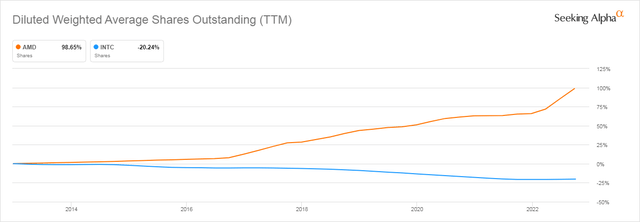

One of the advantages Intel has over AMD is the consistent share buyback plan that has been in place for years. Looking at the share comparison between the two companies we can see that Intel’s share count has dropped by 20% while AMD’s has soared by 98%.

Seeking Alpha

Of course, AMD’s increase was mainly due to its acquisition of Xilinx which I wrote about previously “AMD: Xilinx Deal Continues To Hold AMD’s Price Down“.

As we saw in the Financial metrics section above, Intel has a substantial advantage when it comes to the dividend with a current yield of 5.6% versus zero for AMD.

The future is bright for both companies because the pursuit and production of new, smaller, faster, smarter, and more useful chips are relentless and ongoing.

Some of the markets such as AI (Artificial Intelligence) are expected to grow at a 34% CAGR and brain-like chips by a staggering 94% CAGR.

The semiconductor market as a whole is projected to grow by $440 billion from 2021 to 2029.

AMD’s market is much smaller than Intel’s, but it has a very high margin, especially AMD’s server ships. AMD just last week announced Genoa, a new chip for its server line.

Intel’s goal to build new fabs all over the world will require massive CAPEX even more than their historically high CAPEX spending.

Intel’s massive CAPEX requirements for new fabs will most likely affect Free Cash Flow negatively until the fabs start producing in quantity.

The obvious investment question is whether now is the time to buy either AMD or Intel. Both have shown share price losses over the last 6-8 months in the face of continued logistics and market problems.

If you are looking long term, say five years, I think Intel’s future is very bright because of the huge number of chips required to be made in the future and the limited sources for those said chips. Intel’s profits could be huge.

AMD’s forte is new more powerful chips that power servers, PCs, laptops, and graphics. Competition in those areas will continue to mount with ARM chips becoming more and more competitive as witnessed by Amazon’s (AMZN) new ARM-powered servers.

In the graphics market, Nvidia (NVDA) is a huge competitor, as I wrote about here “Nvidia Vs. AMD: Is Either One Worthy Of Investment Right Now?”.

For long-term investors, I still believe Intel has a huge upside over the next five years, though the next two or three years could be volatile.

AMD is a leader in high-margin server chips, but faces increased competition every year in every one of its markets. However, over the next year or two, it may have a nice surge upward but not anywhere near its old high of $160.

At its current price, AMD is a Buy with a price target of $100 by the end of 2024.

Intel is a Buy for long-term investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.