Summary:

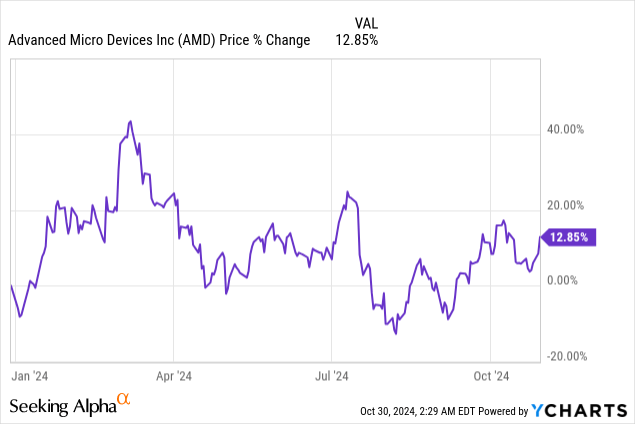

- AMD shares dropped 8% post-earnings despite beating top line estimates due to weak Q4 guidance.

- AMD saw a revenue acceleration of 10 PP in Q3’24 driven by strong demand for AI chips from the Data Center segment.

- Free cash flows also surged and gross margins expanded 3% Y/Y. On the negative side, then company’s guidance for Q4 disappointed.

- AMD’s valuation remains attractive for long term investors, and I see no fundamental reason for investors to sell.

- New product releases next year and strong demand from Data Centers should support AMD’s business expansion and the risk profile is skewed to the upside.

JHVEPhoto

Shares of AMD (NASDAQ:AMD) sank 8% in extended trading after the semiconductor company reported earnings for its third fiscal quarter that met expectations but that failed to excite investors. AMD also reported a considerable ramp in Data Center-related revenue which was the second quarter in a row for the company in which its Data Centers generated triple-digit top line growth Y/Y. Although the company managed to beat top line estimates, the guidance for its fourth fiscal quarter was disappointing. I believe AMD is set for strong long term growth in the Data Center business amid a ramp in MI300X shipments and the growing pipeline of AI accelerators could turbo-charge the company’s growth in FY 2025!

Previous rating

I rated shares of semiconductor company AMD a strong buy last month as the firm was set to benefit from Nvidia (NVDA)’s problems to manufacture as many Blackwell GPUs as demanded by the market. AMD’s pipeline for AI accelerators is also attractive and indicates potential for a revenue acceleration next year. I quite frankly believe that the market is overreacting to AMD’s third-quarter earnings sheet and I would recommend to buy the drop here as the company is still seeing very solid growth in its Data Center segment.

AMD beats revenue estimates, solid FCF and margin gains

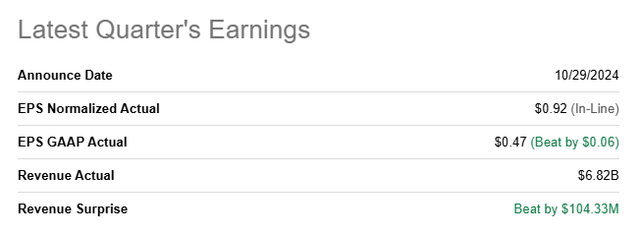

The semiconductor company had adjusted earnings of $0.92 per-share which met consensus expectations exactly. The company’s top line came in at $6.82B which beat the average prediction by $104M. While the earnings release was good, it was nothing like what investors have gotten used from Nvidia (NVDA) in terms of EPS or revenue out-performance in the last several quarters.

Seeking Alpha

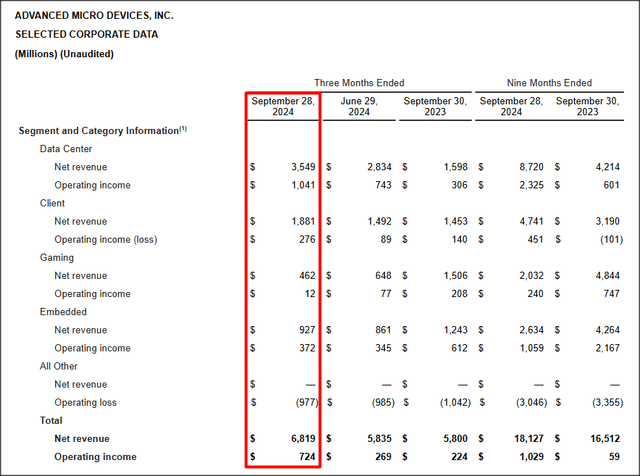

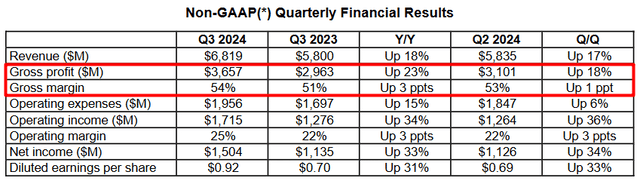

AMD generated $6.82B in revenue, showing 17% quarter-over-quarter growth as well as a 10 PP revenue acceleration, Q/Q, compared to the previous quarter. Data Center revenues were the most important figure to watch in AMD’s third-quarter earnings release and this number came in at $3.5B, showing 122% Y/Y growth and a 7 PP acceleration compared to Q2’24. Client segment revenues surged 29% year-over-year to $1.9B while gaming segment revenues totaled $462M, down 69% due to lower semi-custom revenues.

AMD

AMD did make gains in its gross margin due to strength in Data Centers as well. Total gross profits increased 18% Q/Q (Q2: +8% Q/Q) and AMD generated gross margin growth as well. The gross margin, on a consolidated level, increased 3 PP Y/Y and 1 P Q/Q due to strength chiefly in the Data Center segment.

AMD

In terms of free cash flow, AMD had a solid quarter as well: the semiconductor company had total free cash flow in the third quarter of $496M which represented a 67% year over year growth rate. The free cash flow margin, however, fell 1 PP quarter over quarter to 7% and the total gain in FCF margins compared to the same quarter in the year-earlier period is 2 PP.

|

AMD, $millions |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

Y/Y Growth |

|

Revenue |

$5,800 |

$6,168 |

$5,473 |

$5,835 |

$6,819 |

18% |

|

GAAP net cash provided by operating activities |

$421 |

$381 |

$521 |

$593 |

$628 |

49% |

|

Purchases of property and equipment |

($124) |

($139) |

($142) |

($154) |

($132) |

6% |

|

Free Cash Flow |

$297 |

$242 |

$379 |

$439 |

$496 |

67% |

|

Free Cash Flow % Of Net Revenues |

5% |

4% |

7% |

8% |

7% |

+2 PP |

(Source: Author)

What slightly disappointed and what explains the drop-off in AMD’s share price in extended trading on Tuesday was the guidance for the fourth fiscal quarter. AMD expects to generate revenues of $7.5B +/- $300M which would imply 22% Y/Y growth (and 10% Q/Q growth). The lack of an acceleration in the fourth-quarter is likely what triggered investors here. Considering that AMD’s AI accelerator product line-up is going to refresh in FY 2025 and that its revenue growth accelerated in Q3’24, with improving margins, I believe investors are overreacting to the firm’s guidance, however.

AMD’s valuation and FY 2024 guidance

AMD has one of the best prospects for long term EPS growth as the semiconductor firm is ramping up its MI300X shipments. AMD also indicated that it had new AI chips lined up that are going to get released next year which may serve as an accelerant to the company’s top line growth.

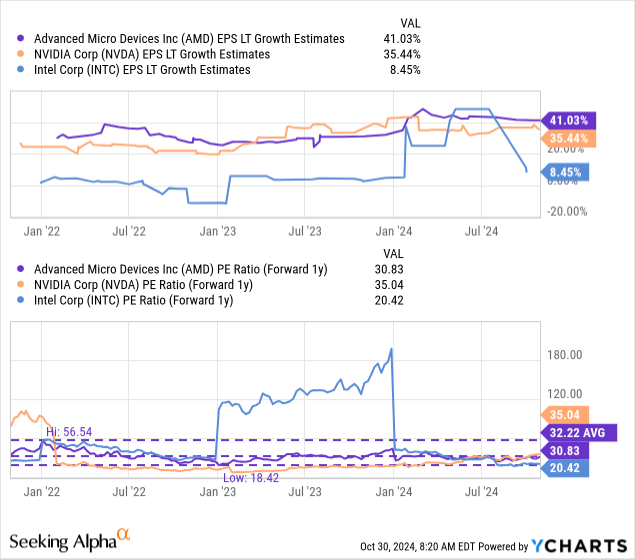

Nvidia is still leading the AI GPU market, but I believe AMD has a reasonable chance to make inroads here going forward. AMD has considerable catch-up potential as it released its MI300X AI accelerator a few quarters ago and it is this momentum that is responsible for AMD’s impressive upswing in Data Center revenues. Currently, shares of AMD are trading at a price-to-earnings ratio of 31X compared to Nvidia’s price-to-earnings ratio of 35X. Intel is by far the cheapest chip company, but Intel has issues of its own which I discussed here. However, Intel also has the option to seek strategic solutions for its business which I explained in my work: Intel’s Revival May Be Here Sooner Than You Think.

In my last work on AMD I stated that the semiconductor company had a fair value of $216-252 per-share depending on AMD’s earnings potential in FY 2025. I assumed full-year EPS of at least $6 per-share which still seems very reasonable to me considering that the chip firm is going to release new AI accelerators in FY 2025 (the MI325X and MI350 series AI accelerators). I don’t see any major reason why I would change my positive outlook on AMD given that the company expanded its gross margins, accelerated in growth in the Data Center segment and is seeing improving free cash flow.

Risks with AMD

The biggest risk with AMD, as I see it, is that the company could miss out on Blackwell-related upside in the Data Center business. In my last work on AMD I said that AMD could benefit from a shortage for Blackwell GPUs as corporations may just switch over to competing products from AMD. Therefore, what would change my mind about AMD is if the company were to see slowing demand for its AI accelerators or if AMD reported weakening gross and free cash flow margins.

Final thoughts

AMD’s shares should not have skidded 8% in extended trading after the company’s submission of the third-quarter earnings release and Wednesday will likely be weak as well. However, it was overall a quite decent Q3 earnings release, though it didn’t rise to the high standards that have previously been set by Nvidia: AMD beat top line expectations, reported strong free cash flow year-over-year growth of 67% and for the second time in a row doubled its Data Center-related revenues on a Y/Y basis. On the negative side, the fourth-quarter guidance did not exactly dazzle which is likely what caused some investors to sell in the after-hours market. I believe AMD’s business trajectory is overall looking good and I don’t see a fundamental reason why investors would want to sell their shares. I am buying the crash and continue to see a favorable risk profile for long term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.