Summary:

- Data Center revenue hit $3.5 billion in Q3 2024, growing 122% year-over-year, fueled by AI demand.

- Ryzen processors drove Client segment revenue to $1.9 billion, a 29% year-over-year increase, bolstering AMD’s profitability.

- Data Center operating income soared 240% to $1.041 billion, reflecting strong margins and high-demand products like EPYC CPUs.

- Gaming revenue dropped 69% to $462 million, while Embedded fell 25%, impacting AMD’s growth diversification.

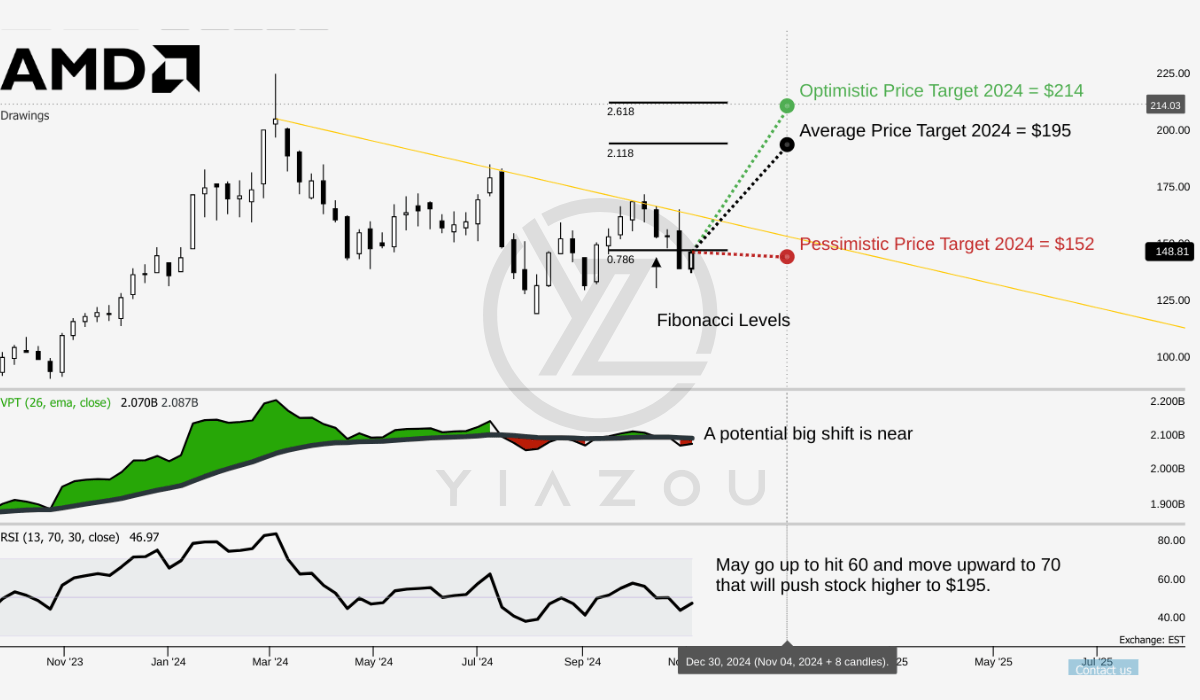

- AMD trades near $140, with a technical target of $196, bolstered by November’s favorable seasonality and momentum indicators.

da-kuk/E+ via Getty Images

Investment Thesis

Since our last coverage, Advanced Micro Devices, Inc. (NASDAQ:AMD) has retreated to $140, entering our buying zone. I have taken this opportunity to double down on my position, with AMD’s technical target at $196, with strong support around $152. Key technical indicators hint at an upward trajectory if current momentum holds, particularly with November’s favorable seasonality.

Fundamentally, AMD’s data center revenue has soared 114.4% since Q4 2022, fueled by surging AI demand. This growth underscores AMD’s advantage as tech giants increasingly adopt EPYC CPUs and MI300X accelerators for high-performance AI applications. Positioned prominently within the expanding AI infrastructure market, AMD is solidifying its role as a core technology provider and capturing critical market share in next-generation AI-driven solutions.

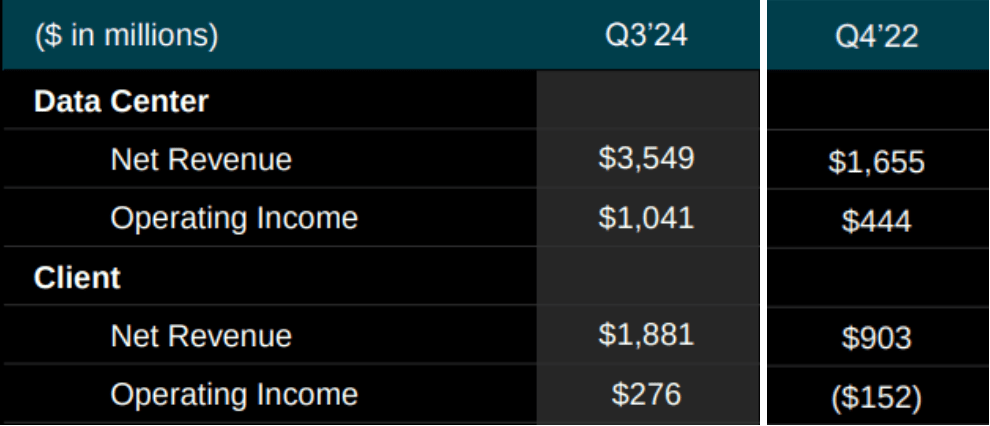

Massive Data Center Revenue Growth Since The AI Wave Started

AMD exhibits a solid growth trend, especially in its Data Center segment. Since the start of the AI wave (Q4 2022, launch of ChatGPT), its Data Center net revenue increased by 114.44%. Revenue grew sharply over eight quarters, from $1.655 billion in Q4-2022 to $3.549 billion in Q3-2024. This growth shows AMD’s capability to match AI and cloud market demand.

The Data Center segment saw stable quarter-over-quarter revenue increases, averaging 14.3% each period. Operating income for the Data Center segment increased even faster, rising by 134.46% since Q4-2022. It jumped from $444 million to $1.041 billion in Q3-2024. This income growth points to AMD’s sharp margin increase due to favorable pricing and high-demand products. Core products like AMD’s EPYC CPUs are boosting AMD’s standing in high-demand sectors.

AMD Q3 2024 and Q4 2023 Earnings Presentations

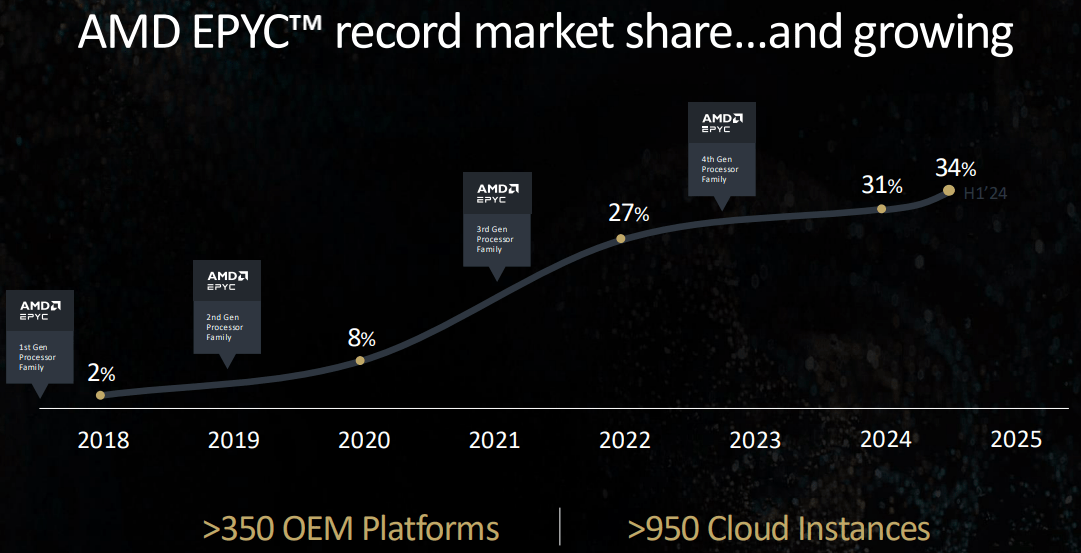

Moreover, AMD’s EPYC CPUs have a solid adoption rate in enterprise and cloud markets. Public cloud instances running on EPYC CPUs rose 20% year over year (YoY), hitting over 950. Meta has deployed over 1.5 million EPYC CPUs across its data centers, marking AMD’s boosted demand. The EPYC processors also show performance advantages, attracting major cloud providers like Microsoft (MSFT) and AWS (AMZN).

AMD’s Turin family EPYC processors have hit over 130 records across areas like virtualization and AI. For instance, Oracle’s EPYC-based instances offer 35% better performance per core and faster memory speeds. These performance-related improvements may continue to boost AMD’s product demand based on the efficiency required for cloud-native and enterprise workloads. Additionally, AMD’s Data Center GPU revenue growth supports its strong growth projection. Here, this revenue may stand at ~ $5 billion in 2024, up from $2 billion in 2024’s start. AMD’s clients like Meta (META) and Microsoft now rapidly use the MI300X accelerators for large-scale inferencing, pointing to AMD’s strong standing in the AI infrastructure market.

Further, the MI300X series has stably boosted performance (with ROCm stack updates), doubling inferencing and training capability. These performance increases meet the expanding AI workload demand and mark that AMD products are a strong fit for AI markets. AMD also recently had a new lead in AI infrastructure with its ZT Systems acquisition, advancing AMD’s rack and cluster-level hardware capabilities for hyperscale clients. With that, AMD’s market opportunity is vast, as the global AI accelerator market is projected to grow over 60% annually to hit $500 billion by 2028.

For instance, AMD’s EPYC processors have become integral to major cloud providers like AWS, Microsoft, and Meta, and its expanding partnerships are driving massive adoption across enterprise and cloud-native applications. With over 950 public cloud instances powered by EPYC and advanced product offerings like the MI300X accelerators, AMD addresses the computing power and efficiency demands vital for AI applications to capture growing market share.

Advancing-AI-2024

Similarly, AMD’s Client segment had solid growth and stability based on its Ryzen processors. Since Q4-2022, revenue in this segment rose by 108.31%, hitting $1.881 billion in Q3-2024. This growth is matched by AMD’s Ryzen 9000 series performance boost, leading to stable profit margins. Operating income rose from a loss of -$152 million in Q4-2022 to a gain of $276 million in Q3-2024, marking AMD’s boost in Client segment profitability.

The Ryzen 9000 series has gained stable demand across gaming and productivity markets. AMD has successfully aligned with the demand for high-performance gaming and content creation systems. Ryzen AI Pro 300 Series CPUs now offer sharp security features suited for business users, marking AMD’s product expansion in the commercial sector. AMD’s broad partnerships and core collaborations strengthen its lead. Meta’s use of MI300X accelerators and Oracle’s upcoming fifth-gen EPYC instance reflect the market lead of AMD’s products. AMD’s progress with ZT Systems extends its lead in AI, matching hyperscale data center requirements.

Overall, these partnerships reflect AMD’s solid presence in data centers and AI markets. AMD’s Ryzen processors have also boosted the Client segment, with a Ryzen AI Pro 300 Series product stack providing sharp features for commercial clients. These features match the needs of enterprise markets, marking AMD’s product expansion. AMD’s AI and Data Center segments strongly align with its targets. These segments derive AMD’s consolidated growth potential, meeting sharp demand in AI-driven sectors. The Client segment also shows stable growth, with Ryzen products adding value to AMD’s stock.

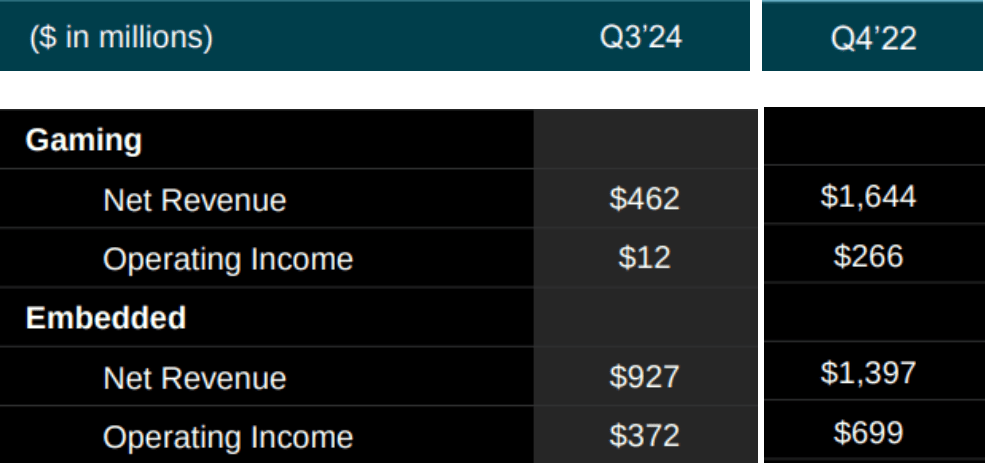

AMD’s Gaming and Embedded Struggles: Declining Revenue and Profitability Signal Challenges Ahead

The core concerns are declining performance in the Gaming and Embedded segments, AMD’s high valuation relative to the sector, and slower-than-usual revenue and EPS growth rates. These factors suggest structural and market-driven weaknesses that could limit AMD’s expansion. The gaming segment experienced a considerable drop in revenue and operating income. Gaming revenue fell from $1.644 billion in Q4-2022 to $462 million in Q3-2024, which reflects a sharp 71.9% decrease. This constant revenue decline suggests AMD struggles to gain market share and retain demand in gaming.

As gaming remains a core segment for semiconductor firms, AMD’s reduced revenue may emerge from rising competition, mainly from NVIDIA (NVDA), which dominates the high-end GPU market. The Gaming segment’s profitability has also sharply dropped. From $266 million in Q4-2022 to $12 million in Q3-2024, there is a fall of 95.49%. AMD’s profit margins are weakening due to lower pricing and higher costs. If profitability declines, AMD may lack funds for new gaming advancements, weakening its market lead.

Further, the Embedded segment, another core revenue source, also shows downward trends. Embedded revenue declined from $1.397 billion in Q4-2022 to $927 million in Q3-2024, with a 33.64% drop. This decline suggests AMD may lose influence in this sector due to specialized competitors and weaker demand for its products in core markets.

As embedded applications grow, AMD’s reduced influence may limit its gains in automotive and industrial IoT areas. Embedded segment profitability also shows pressure, with operating income down 46.78%, from $699 million in Q4-2022 to $372 million in Q3-2024. The decline is sharper than revenue loss, which may indicate an ineffective cost structure and weak pricing. If these trends persist, AMD’s capacity for Embedded-specific R&D may decline, risking AMD’s lead in this critical market.

Nevertheless, AMD’s Gaming and Embedded segments contribute only around 21% of total revenue, with Gaming at 7% and Embedded at 14%. In contrast, the Data Center segment alone makes up over 50%, underscoring that AMD’s primary growth is driven by its AI and data center markets, lessening the impact of challenges in Gaming and Embedded.

AMD Q3 2024 and Q4 2023 Earnings Presentations

Growth Expectations Under Pressure as Momentum Slows

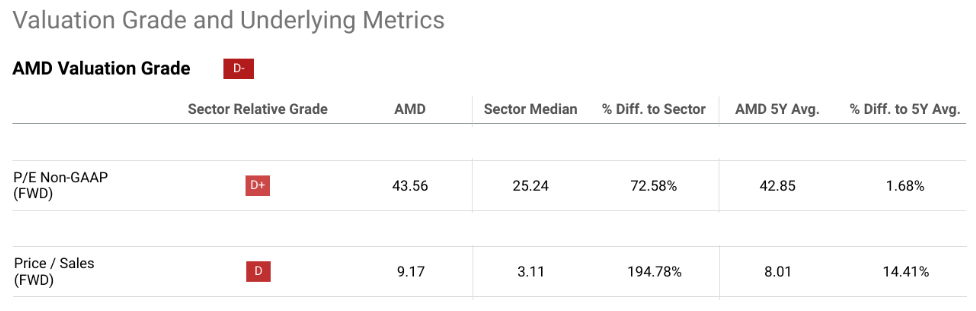

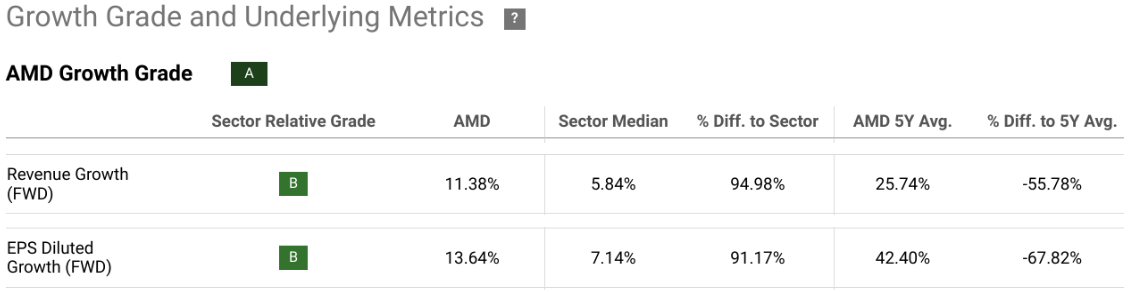

AMD’s valuation metrics reveal an overvaluation against the sector median and AMD’s past averages. This high valuation may deter value-oriented heightened expectations, adding risks if growth slows. AMD’s forward price-to-sales (P/S) ratio is 9.17, 194.78% higher than the sector median of 3.11. This premium implies that one has to pay substantially more for AMD stock than peers, potentially due to optimism around AI-related advancements. However, if AMD’s growth stalls or say misses high expectations, the stock may face downward pressure.

Furthermore, AMD’s P/S ratio also stands 14.41% above its five-year average of 8.01, marking an overvaluation relative to its past levels. AMD’s forward price-to-earnings (P/E) ratio of 43.56 is considerably above the sector median of 25.24, a 72.58% premium. This high P/E ratio implies street confidence in AMD’s earnings growth, yet it carries a higher risk if earnings fall short. The current value is a bit undervalued against the stock’s five-year average P/E of 42.85. However, this may be insufficient if AMD’s core segments, like Gaming and Embedded, continue facing top- and bottom-line performance issues.

seekingalpha.com

Finally, AMD’s revenue and earnings growth are weaker than those of its past levels, indicating possible limits in growth momentum. Although AMD’s growth rates exceed the sector median, the slowdown from past performance is considerable. AMD’s forward revenue growth rate is 11.39%, nearly double the sector median of 5.8%, but down from AMD’s five-year average of 25.74%. This 55.74% drop shows AMD’s expansion is slowing, potentially due to difficulties in Gaming and Embedded.

A slower growth rate may make AMD less attractive as a growth stock, especially with its high valuation, and could unsettle the market expecting faster growth. AMD’s forward EPS growth rate is 13.7%, surpassing the sector median of 7.44%. However, it’s a sharp drop from AMD’s five-year average EPS growth rate of 42.46%, a 67.73% decrease. The slower earnings growth may limit AMD’s capacity to match the street expectations, especially if EPS growth fails to rise alongside revenue growth in high-potential areas like Data Centers and AI. This trend also suggests AMD’s profit improvements may not be sustained at earlier levels, affecting stock’s valuations.

seekingalpha.com

2024 Technical Target of $196 with 66% November Upside Probability

AMD’s current price is $150, close to the pessimistic price target of $152, which aligns with the 0.786 Fibonacci level. This proximity suggests a risk of price retracement if market conditions weaken, especially with bearish divergences observed in the RSI, which is currently at 46.97 and indicates potential downward pressure. However, an upward trend in the RSI line could signal recovery if the stock sustains momentum and crosses the 60 mark, a level often associated with stronger buy signals.

The Volume Price Trend (VPT) line, currently at 2.07 billion, is already showing an upward trend, hinting at demand support. The VPT’s proximity to its moving average of 2.09 billion suggests that, with sufficient volume, the stock may break above this threshold, potentially strengthening bullish momentum. The VPT crossing of the moving average with the price crossing the yellow trend line could support a long setup, leading to rapid, short-term gains.

Moreover, the average and optimistic price targets of $195 and $214 align with Fibonacci levels 2.118 and 2.618, which suggest potential resistance if the price ascends. Current conditions are cautiously optimistic, with a 66% likelihood of a positive return based on November’s seasonality. However, the RSI’s bearish divergence and price sensitivity near Fibonacci levels indicate AMD’s trajectory may face resistance unless volume trends bolster demand. Thus, while the overall outlook leans slightly bullish, traders should watch for sustained upward movements in RSI and VPT as confirmation of any breakout potential.

Yiazou (trendspider.com)

Takeaway

AMD has pulled back to $140, entering a buying zone with a technical target of $196. Driven by a 114.4% data center revenue surge, AMD is well-positioned in the AI market, capturing share from cloud giants. Challenges in the Gaming and Embedded segments remain, but they represent only a small portion of revenue, with Data Center and Client segments driving the bulk of AMD’s growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.