Summary:

- Advanced Micro Devices, Inc. stock has historically shown periods of rapid growth followed by consolidation, with current indicators suggesting another growth phase soon.

- Recent product advancements, partnerships, and market share gains in AI and Data Center markets position AMD for future growth.

- Valuation analysis indicates AMD stock is currently undervalued, providing a buying opportunity with a year-end target of $193-213.

RiverNorthPhotography/iStock Unreleased via Getty Images

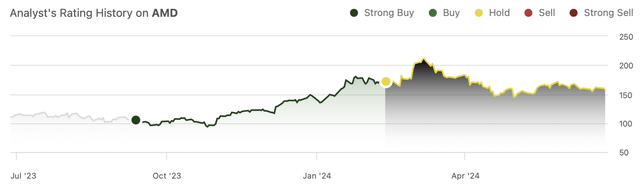

Over the last 7 years since I started covering Advanced Micro Devices, Inc. (NASDAQ:AMD), the stock has been consistently moving somewhat independently of the broader market. This has repeatedly made many analysts skeptical about the company during periods of consolidation, and I see a similar trend on Seeking Alpha now: out of the last eight articles on AMD, six are Hold and one is Strong Sell. However, based on my analysis, AMD is now set up perfectly for another period of growth. And with the stock price dipping below the fair value, it deserves an upgrade to Strong Buy once again.

Rapid recap

As I wrote in my September 2023 article, which gave AMD a Strong Buy rating, the stock has a history of being overlooked by investors, and it tends to move in fast jumps followed by periods of consolidation. My analysis turned out to be correct, and AMD has surged 65% since that article.

In February this year, I reevaluated the stock and downgraded it to Hold. This was based entirely on valuation: my discounted cash flow (“DCF”) analysis showed the stock’s fair price range was $149-154, versus the $171 it traded at the time of the analysis. Again, the history repeated itself and AMD stock went into a consolidation mode that has continued until today.

The slow period should be over soon thanks to AMD’s product advancements

Now, there are multiple factors suggesting AMD might enter another period of rapid growth in the near future. One of them is AMD’s product advancements and rollouts.

At Computex 2024, AMD revealed a slate of new Data Center and PC chips, namely the new Instinct, Ryzen, and EPYC processors. One of the most important developments here is AMD’s expanded roadmap for AI accelerators, which now sets an annual cadence for generative AI-focused offerings. This provides much-needed clarity on AMD’s future in the area of AI. The roadmap includes:

- Instinct MI325X accelerators, which should become available in Q4 this year.

- Next generation MI350 series, powered by new CDNA 4 architectures, expected in 2025.

- Future MI400 series, powered by CDNA “Next,” planned for 2026.

Many players, like Lenovo (OTCPK:LNVGY) or Microsoft (MSFT), have expressed their notable optimism about AMD’s current Instinct MI300X accelerators, (more on the partnerships later) and it is likely with even better performance, the upcoming products will continue to deliver.

Additionally, on the enterprise front, AMD’s 5th generation EPYC processors, based on the Zen 5 core and code-named “Turin,” were previewed at Computex. The company plans to make the chips available in the second half of 2024. New generations of EPYC processors have had a tendency to boost AMD’s Data Center revenue significantly in the past.

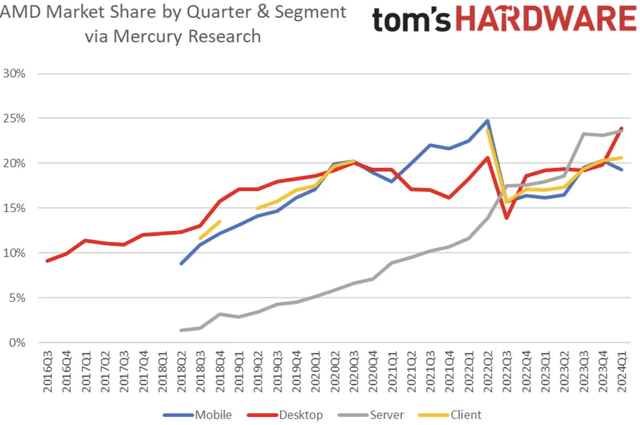

Importantly, the new Enterprise products should help AMD continue its streak of increasing Server CPU market share. In Q1 2024, the company held a 23.6% share in this market, up from 18% in the same period a year ago. The increase in market share is likely to continue in the near future, with a potential boost from the new generation of EPYC processors.

Increasing market share usually means higher pricing power and therefore higher margins, other things being equal. AMD’s Data Center revenue already soared by 80.5% in the latest quarter. With 43% of AMD’s revenue now being generated by the Data Center segment, based on Q1 2024 results, the effects of increasing sales coupled with higher margins should become even more visible in the near future.

Moreover, AMD unveiled several new PC-focused chips, which will be based on the Zen 5 core as well. What makes these appealing is integrated AI capabilities for “local” processing. According to AMD, the company’s partner Microsoft highlighted that “AMD Ryzen AI 300 series processors exceed Microsoft’s Copilot+ PC requirement.” In other words, the chips seem to be powerful enough for the years to come, which should boost AMD’s sales in the Client segment even further.

Additionally, I expect some resurgence of the Semi-Custom sub-segment (part of the Gaming segment now) in the near future. Here, there are multiple potential catalysts. Some of them are still in the rumors stage, which makes them somewhat hidden from the majority of investors and analysts, leading to underappreciated revenue estimates:

- Reportedly, Sony (SONY) is getting ready to launch PlayStation 5 Pro, a more powerful version of the current generation of their console. The new console will use an enhanced AMD chip, which, according to reports, might receive an AI boost with a dedicated Neural Processing Unit from AMD. With enhanced chip capabilities, it is probable that AMD will increase pricing and therefore margins from the chip used in PS5 Pro compared to the current version of PS5.

- Sony’s console competitor, Xbox, might also have a couple of products ready to be released: an Xbox handheld device and an enhanced main Xbox console to rival PS5 Pro.

- Valve’s Steam Deck, which also packs an APU from AMD, was updated with a new OLED version at the end of last year. The portable computer/console seems to have gained significant popularity, which means other companies might place a higher focus on developing similar portable devices. With the holiday season approaching, AMD might gain a boost from this type of device as well.

AMD’s decreasing Gaming revenue was the major issue overshadowing Q1 results, as this segment’s sales plummeted 47.5% year-over-year. If the new gaming devices powered by AMD’s chips launch and gain popularity, the company might quickly return to “normal” in this area. In that case, the high double-digit growth in the Data Center and Client segments will make an even bigger impact, helping AMD easily beat its somewhat low revenue growth estimates.

AMD’s AI server partnerships are growing without much attention

Another common pattern that I have observed several times in the past, and that seems to occur again, is AMD’s notably quiet expansion of its partnership network. You can read my December 2017 and June 2018 articles for some historical perspective; AMD’s stock price at the time of publication was $10 and $15.7, respectively.

This time, the partnership expansion happens in the area of AI server chips; I say it appears unnoticed because I still read plenty of comments here on Seeking Alpha in the likes of “Nvidia has captured the entire market” and “no AI-related company would switch to AMD due to Nvidia’s (NVDA) superior software.”

Despite the skepticism, there are multiple major players actively offering AI solutions based on AMD’s chips. From the Q1 earnings call:

We have over 100 customers that we’re engaged with in both development as well as deployment. So overall, the ramp is going really well.

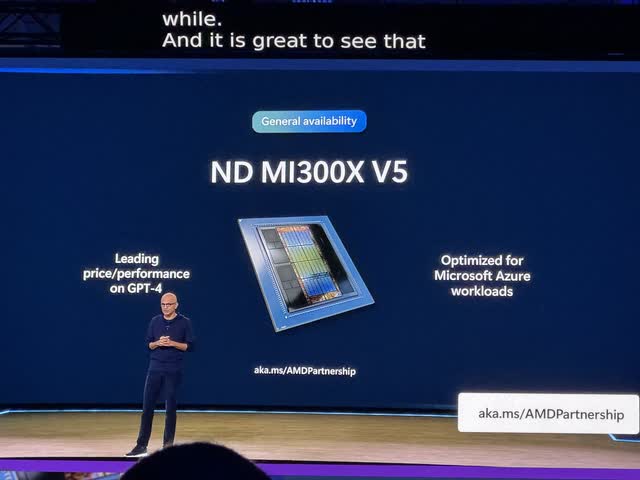

One of the largest partners here is Microsoft, who also appear the most positive about AMD’s AI products. Satya Nadella himself claimed MI300X offers the best price to performance on GPT-4. The company now offers AMD-based virtual machine series in its Azure cloud, with “optimizations across the entire hardware and software stack.” This will also become a part of the AI infrastructure platform that runs GPT-4 Turbo and powers Microsoft’s Copilot.

As Microsoft’s Copilot technology becomes more widely adopted among its more than 340 million users, the demand for AMD’s chips is likely to continue increasing in the near future.

The list only goes on from here:

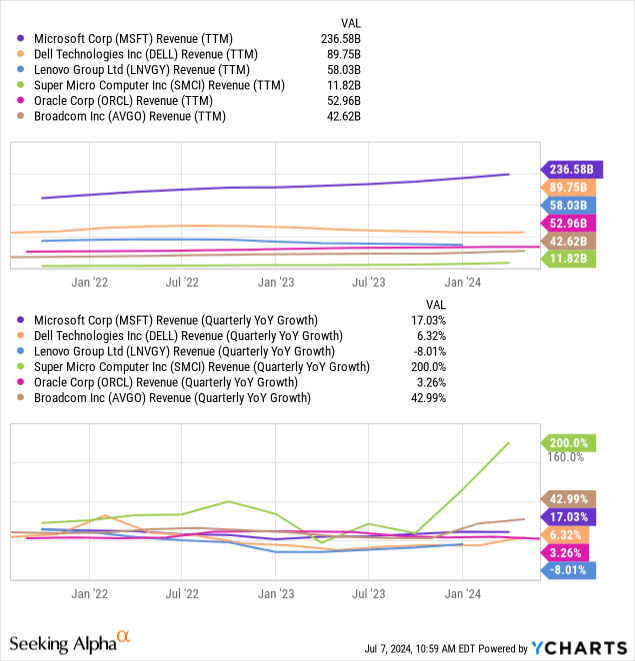

- Lenovo (LNVGF) offers PCs and servers powered by AMD’s Ryzen AI chips and Instinct accelerators. The company’s president expressed especial optimism about AMD and stated the company’s chips would achieve even more massive adoption with lesser delivery times.

- Dell (DELL) offers a set of PowerEdge servers fitted with AMD accelerators. Importantly, the two companies have also partnered to introduce a new standard for Generative AI, providing a set framework that emphasizes the use of AMD ROCm powered AI packages and APIs. This shows AMD is actively working on improving its software ecosystem as well; a solid software ecosystem is often regarded as a winning point of Nvidia’s products.

- HPE (HPE), Super Micro (SMCI), and Oracle (ORCL) have offerings based on AMD accelerators.

- TensorWave’s AMD-powered AI data centers are reported to experience surging demand.

- Eviden of Atos SE (OTCPK:AEXAY) has announced the release of the BullSequana AI 600, a “mid-range artificial intelligence server family” featuring AMD’s MI300X.

As the aforementioned partner’s revenues continue to increase, thanks in part to the AI-driven demand, AMD should profit from the deals significantly, even if the company gains only a small share of the AI market.

Valuation update: AMD’s recent consolidation created a solid risk-reward opportunity

Regarding valuation, AMD stock price has now dipped below the fair value, providing a margin of safety for investors. This is based on my DCF analysis, the same model I used in my February article, where I deemed the stock overvalued.

Here, most assumptions remain similar to the ones I made at the time of the previous article. A few slight adjustments, made in light of the company’s recent performance and the new data, include:

- Two percentage points higher revenue growth assumption (32% vs. 30% prior) for 2025 in light of the new roadmap and AMD’s increased outlook for MI300 sales this year.

- Slight changes to the cash and debt positions to incorporate the latest quarterly report.

- Lowered 5-year average PP&E growth projection to 14%, with a 10% growth this year. It seems AMD is not making huge investments there currently, based on the Q1 results.

From there, AMD’s current fair price range is about $178-184, slightly higher than the current stock price and a 12% increase from the previous analysis. The increase is mostly driven by the time value of money. In other words, the fair value just “caught up” with the stock price after the recent consolidation. The year-end target is, therefore, $193-200.

It should be noted the analysis is done with the current risk-free rate in mind, (10-year Treasury yield) which gives extremely conservative results. If the FED starts cutting interest rates, it should positively impact the fair stock price. For instance, with a 2% risk-free rate, AMD’s fair price range goes up to $191-198, with a year-end target of $205-213. I find this target to be more realistic than the conservative estimate.

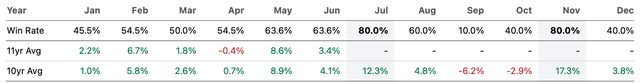

As a result, the current consolidation provides yet another opportunity to buy AMD with a margin of safety. As an additional note, July seems to be historically a strong month for the stock, based on the seasonality data from Seeking Alpha.

Risks and competition

Despite the plethora of factors suggesting AMD might enter a period of rapid growth, we need to acknowledge certain risks.

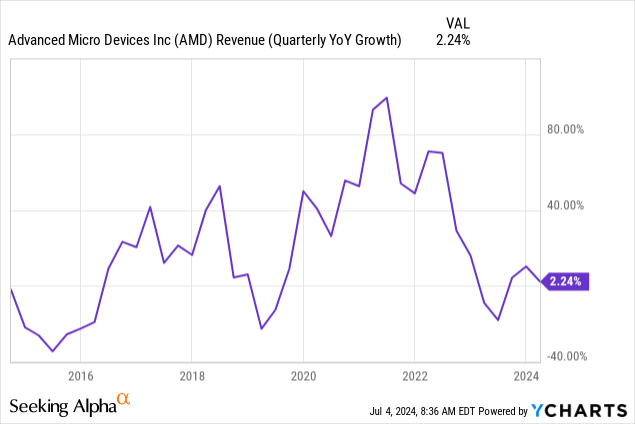

AMD’s AI roadmap looks encouraging and does provide some certainty on how the company will develop in this area. However, the competition continues to advance as well. While the adoption of MI300 and MI300X has been strong so far, it still does not reach the same level of growth as the products from Nvidia. The latter’s revenue is about six times higher than that of AMD, and the growth is significantly more apparent: Nvidia’s sales surged 262% in the latest quarter, while AMD’s grew by only 2%.

Moreover, AMD is going to report its Q2 results soon (est. July 30, 2024). In my experience, the stock tends to demonstrate increased volatility after earnings, often with a downward initial move. While the potential drop might provide a buying opportunity, investors should still be aware of the underlying risks here. It should be noted, AMD’s competitors like Intel (INTC) and Arm Holdings (ARM) are also reporting around that time, (July 25 and July 31, respectively) which can cause AMD stock to move in either direction as well.

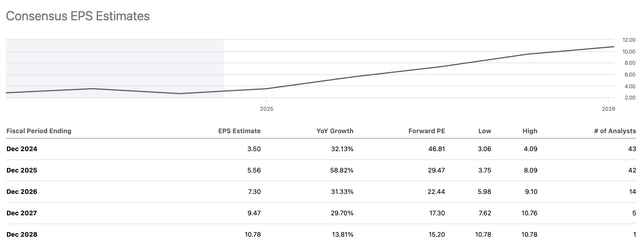

Additionally, AMD’s valuation multiples are currently still on the higher side, even if a deeper cash flow analysis reveals undervaluation. To support these multiples, AMD needs to execute perfectly, both financially and its business strategy, to achieve and surpass the 59% EPS growth projected by the market for 2025.

Key takeaways

Over the last years, AMD has gone through multiple, very similar cycles in terms of business growth and consequent stock price development. Despite some skepticism from analysts and investors, the company continues to iterate on its strong product line-up and actively gains new partnerships, especially in the areas of AI and Data Center solutions. With other segments like Gaming eventually catching up after an inevitable market normalization, AMD’s revenue should enter a period of rapid growth once again.

Therefore, Advanced Micro Devices, Inc.’s recent stock price consolidation seems to be another stage of the observed cyclicality, and it is likely the stock will enter a growth stage in the near future. This is supported by the DCF analysis, which shows AMD stock has dipped below its fair value, even under conservative assumptions. Based on the analysis, the year-end target for AMD is $193-213, with a higher-end target being more likely, in my opinion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, DELL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.