Summary:

- Advanced Micro Devices, Inc.’s recent acquisition of ZT Systems is a strategic move in my view that will bolster its AI capabilities substantially.

- It will help it to strengthen its AI product lineup (especially in the data center AI accelerator space) and better compete with Nvidia.

- Market consensus has not fully captured the potential impact here.

courtneyk

My last article on Advanced Micro Devices, Inc. (NASDAQ:AMD) focused on the insider transactions and technical trading patterns surrounding the stock. That article, published in earlier August before AMD reported its Q2 earnings, was titled “AMD: Don’t Overlook The Insider Transactions Before The Q2 Earnings (technical analysis).” In that article, I cautioned investors about the price volatility that the Q2 earnings report could cause. More specifically, I argued that:

Insider activities preceding the release of its Q2 ER were dominated by selling. In particular, many batches were sold between $160 to $180, a key support level that will take a while for AMD to regain.

The stock prices have indeed corrected to as low as ~$130 shortly afterward. Now, with the jitter caused by the earnings season behind us, I want to reexamine the stock with a focus on its business fundamentals. Among key developments since then, the top one on my mind was AMD’s acquisition of ZT Systems. More details of the acquisition are quoted below (with emphasis added by me):

AMD press release (Aug 19): AMD has agreed to acquire ZT Systems in a cash and stock transaction valued at $4.9 billion, inclusive of a contingent payment of up to $400 million based on certain post-closing milestones. AMD expects the transaction to be accretive on a non-GAAP basis by the end of 2025. Strategic acquisition to provide AMD with industry-leading systems expertise to accelerate deployment of optimized rack-scale solutions addressing $400 billion data center AI accelerator opportunity in 2027.

In the remainder of this article, I will explain A) why I see this acquisition as a key step for AMD to strengthen its position in the AI space, and B) why I don’t think the market’s valuation has fully priced in such an improved positioning yet.

AMD stock: ZT acquisition impacts

To start, as outlined in the above press release, AMD now sees an addressable market of $400 billion by 2027. It is of course difficult to make projections in a sector that is undergoing rapid and nonlinear changes. There are other projections that point to either higher or lower market sizes.

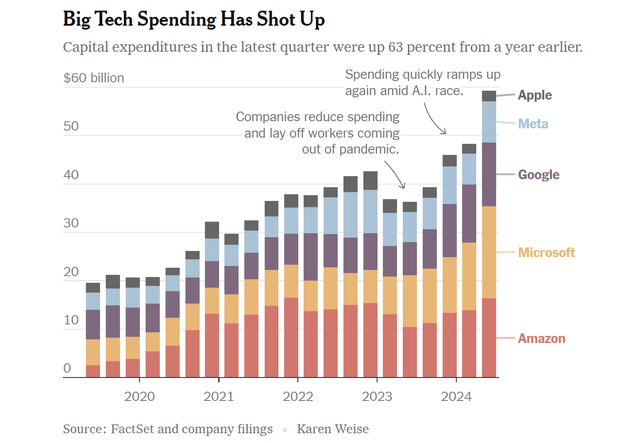

So here, I will rely more on what has already happened thus far. First, it is a fact that all major tech companies have drastically increased their AI-related expenditures. According to the following statistics provided by The New York Times, capital expenditures in the second quarter of 2024 went up 63 percent from a year earlier. The total expenditures from 5 companies alone (Apple, Amazon, Meta, Microsoft, and Google) totaled almost $60 billion in that quarter (i.e., about $240 B already per year when annualized at this level). Thus, judging by the magnitude and growth rate of such expenditures, I won’t be surprised if the market size indeed reaches $400 B by 2027 as AMD sees.

Next, by incorporating ZT Systems’ expertise and product lineups, I expect AMD to significantly strengthen its positioning on the AI front. More specifically, I expect it to improve system-level integration and reduce time-to-market for its AI solutions. Furthermore, I believe this acquisition will also allow AMD to expand its reach into the hyperscale market, leveraging ZT Systems’ existing customer base and technological know-how. As such, I expect AMD to be much better positioned to compete against Nvidia (NVDA).

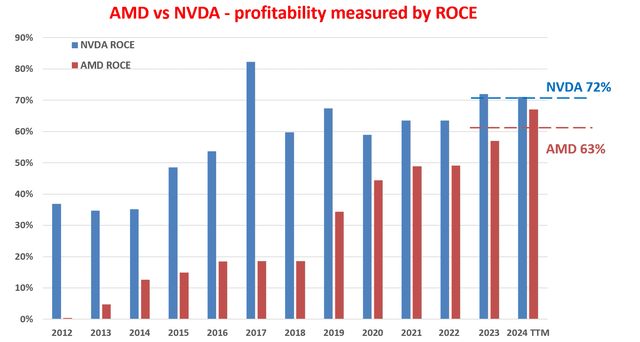

AMD has been lagging NVDA both in AI market share and also overall profitability in the past. However, the gap is closing in my view. As an example, the next chart compares the ROCE (return on capital employed) for both companies in the past. As seen, since 2012, NVDA has consistently maintained a higher ROCE compared to AMD. In particular, NVDA’s ROCE has seen a significant surge in the recent 1~2 years from its already remarkable levels and exceeded 70% in 2023 (and averaged about 72%) thanks to the rapid expansion of AI technologies. AMD’s average ROCE in the past 2 years was “only” bout 63%, noticeably lower than NVDA. However, the gap is closing, as you can see. And for the reasons above, I expect the gap to further narrow going forward thanks to the ZT acquisition.

AMD stork: AI demand expected to remain strong for years

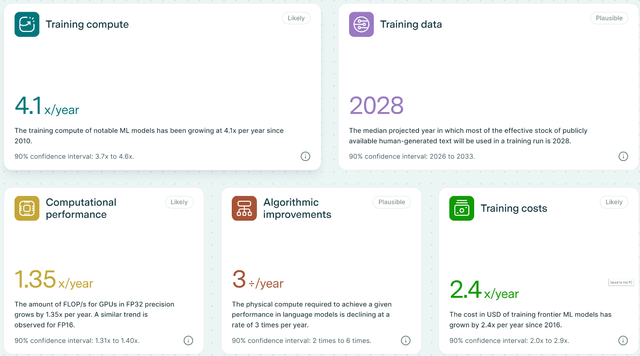

Another catalyst that made me optimistic about AMD’s acquisition and projection of the addressable market is the acceleration of demand for developing and deploying LLMs (large language models). The demand has been growing at exponential rates for years already and the trend is still holding up judging by the latest data such as those provided by EpochAI below. To wit, the computation requirements for training machine learning models have been increasing at 4.1x per year since 2010. Notably, the median projected year in which most of the effective stock of publicly available human-generated text will be used in a training run is 2028. To meet this mind-boggling demand, I think it is very likely that the computation costs, both measured in CUP/GPU hours and also dollars, will continue their exponential growth for the next few years, providing a strong tailwind for AMD.

Readers new to the topic might find it difficult to believe something can grow at 4.1x per year for years. Indeed, such growth means doubling about every 6 months and is mind-boggling. However, with a broader context (quoted from my earlier article), it becomes much more plausible.

LLMs are the cornerstone for generative AI applications. So far, the trend is that larger models with more parameters can lead to improved accuracy and a wider range of applications. Current models feature parameters on the order of ~2 trillion. As a reference point, the human brain has over 100 trillion synaptic connections and it will take a few more doublings before we can get our AI algorithms to remotely resemble true intelligence.

Other risks and final thoughts

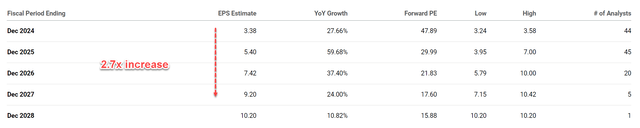

In terms of downside risks, the stock is trading at an elevated P/E of almost 48 on FY1 EPS, as seen in the chart below. With such a heightened P/E, investors could suffer sizable near-term price corrections (like those I cautioned in my previous article). However, over the longer term, AMD’s EPS is expected to experience significant growth, thus the P/E ratio should shrink rapidly. Notably, between 2024 and 2026, AMD’s EPS is anticipated to increase by a remarkable 2.7 times. Currently, the forward P/E ratio based on FY 2024 EPS stands at ~48 as just mentioned. As the EPS estimates increase, the forward P/E ratio is projected to decline to about 30 in FY 2025 and below 20 in FY 2027.

As another downside risk, while I am optimistic about the long-term synergies between AMD and ZT systems, the acquisition might create near-term profit pressure. Besides the cash and stock needed to finance the deal, I also anticipate some additional operating and integration expenses after the deal is closed before the acquisition can become EPS accretive by 2026. However, these profitability headwinds are only temporary.

To conclude, my verdict is that the positives outweigh the negatives and I thus see an asymmetric return/risk profile under current conditions. In particular, I expect the ZT acquisition to substantially strengthen AMD’s strategic position on the AI front to compete with NDVA in the upcoming years. Market consensus expects a 2.7x EPS increase between now and FY 2027. I don’t think this projection fully captured the potential here, judging by the factors analyzed in the article. These include AMD’s potential to expand ROCE, strengthen its data center AI accelerator lineup, and ride on the robust demand from LLM.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.