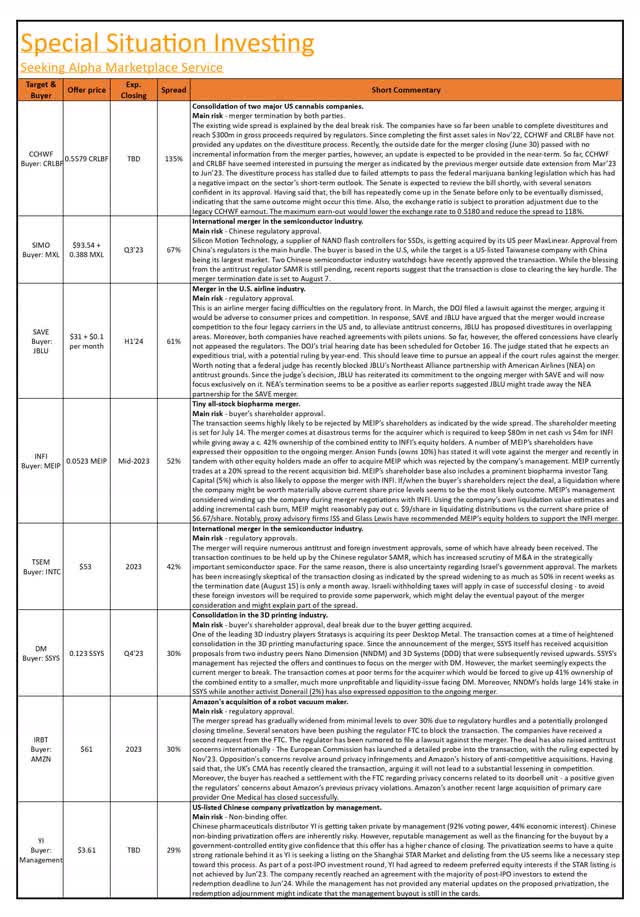

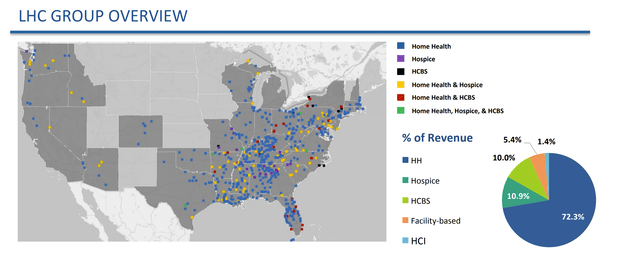

Summary:

- Merger arbitrage spreads are wide.

- A number of opportunities with spreads from 9% to 135%.

- Below you’ll find a review of the most interesting setups in the merger arbitrage space.

Maksim Labkouski

Merger arbitrage is an event-driven investment strategy focused on betting on the successful takeover of a publicly-listed company. Generally, upon a merger announcement, shares of the target price trade below the offer price levels. This difference, referred to as a spread, reflects potential risks that the market sees to the transaction closing. There are several things that could go wrong and mess up the merger, like shareholders saying “nope,” regulatory hurdles, or even the buyer having second thoughts. Once the merger is completed, the spread closes, and the clever arbitrageur pockets the spread as a reward for taking on the risk of the deal falling apart.

Merger arbitrage ranks high on my list of top investment strategies. Why? Well, merger arbs are characterized by 1) a clear binary outcome (makes it easier to assess the odds), 2) a relatively short investment timeline and 3) frequent instances of market inefficiencies. Moreover, merger arbs offer returns that are uncorrelated with the general market, allowing investors for greater portfolio diversification.

Below are 17 actionable merger arbitrage opportunities with the widest spreads in the market. The list includes my brief analysis of each situation and the factors explaining the wide spreads. Also, you can access a downloadable PDF containing all the key information on these merger arbitrage opportunities.

Which of these situations do I think are the most attractive from the risk/reward perspective? I think it’s important to make a distinction between large-cap and smaller M&A transactions. When it comes to big mergers, they usually attract a lot of attention from professional analysts, and the spread tends to reflect the risks pretty accurately. For this reason, I find smaller-cap M&A transactions much more intriguing as they tend to fly under the radar much more often. Unlike large-cap arb plays that tend to be priced efficiently, in small-cap arbitrage, individual investors willing to dig deeper can have an edge. Smaller deals covered in this review that I particularly like at the moment are:

- YI (29% spread) is an example of such interesting and readily actionable small-cap merger arb. This an ongoing Chinese company management privatization where the reputation of the buyer consortium and financing provided by government-controlled entity give confidence that this offer has a high chance of closing. The situation has been highlighted to Special Situation Investing subscribers.

- INFI/MEIP (52% spread) – another noteworthy small-cap merger arb discussed below. However, there’s a bit different angle to this situation which makes it particularly interesting. The transaction is likely to break and, given that MEIP is trading at a wide discount to net cash while there are several activist investors on its register, an outright company liquidation might ensue.

Having said that, it is still very important to regularly review the heavyweight space as some interesting merger arbitrage plays might pop in there as well, such as AMED (12% spread).

Amedisys (NASDAQ:AMED)

- Buyer: UnitedHealth Group (NYSE:UNH)

- Consideration: $101/share

- Spread: 12%

- Exp. Closing: 2024

- Main Risk: Antitrust approval.

This bidding war in the home healthcare industry might be approaching its finale. In early May, home healthcare and hospice service provider Amedisys agreed to merge with home infusion services provider Option Care Health (OPCH) in an all-stock transaction valuing the target at 3.0213 shares of OPCH per each AMED or c. $99/share at the time of the announcement. I covered the merger on Seeking Alpha here. A month later, AMED became a target of healthcare insurance giant UnitedHealth Group which sent a non-binding bid to acquire the company for $100/share in cash. Shortly after, AMED scrapped the merger with OPCH and agreed to combine with UNH in a merger valuing the target at $101/share. With OPCH out of the bidding process and no publicly-announced offers from other industry players, the merger seems likely to close on current terms. The transaction will require approvals from AMED’s shareholders and regulators. The buyer is unlikely to walk away given its reputation and the fact that the merger is highly strategic for UNH, allowing it to further expand in the fast-growing home healthcare space.

I think approval from AMED’s shareholders is likely given the offer’s fair valuation. At $101/share, AMED is valued at 15.4x 2023E adjusted EBITDA. Here’s how the offer’s valuation of AMED stacks up against competitors and recent industry transactions:

- The closest publicly-listed peer EHAB is currently valued at 8.6x NTM adjusted EBITDA. Though the peer is significantly smaller ($1.1bn EV vs $3.6bn for AMED), it has operated with similar adjusted EBITDA margins (14% in 2022 vs 13% for AMED).

- Humana’s acquisition of the largest home health and hospice provider in the US, Kindred At Home, in 2021 valued the target at a reported 11x-12.5x EBITDA multiple. However, industry analysts have described Kindred’s sale as a “relative steal” for Humana given that the acquisition price tag was based on a built-in put option.

- UNH’s merger with another large home healthcare provider LHC Group was completed last year at a 21x NTM adjusted EBITDA multiple. AMED and LHC Group have boasted similar revenue growth rates and adjusted EBITDA margins in recent years.

All of this is to say that while the offer’s valuation of AMED is not necessarily hefty, it does seem reasonable, suggesting any pushback from equity holders is unlikely. AMED’s shareholder base includes a number of institutional investors (40% combined stake), including JP Morgan Chase (owns 5%), BlackRock (13%), Wellington Management (9%), Vanguard (10%), and Ameriprise Financial (3%). Management owns 2%.

The current spread seems to be primarily explained by regulatory risks as AMED is one of the largest home healthcare providers in the US while UNH has a significant presence in the space after its acquisition of LHC Group. Industry analysts have noted (here and here) that the current deal is likely to see scrutiny and receive a second request from the FTC given that the antitrust regulators have challenged UNH’s other acquisitions, including LHC Group (second request was issued by the FTC) and Change Healthcare (lawsuit was filed by the DOJ).

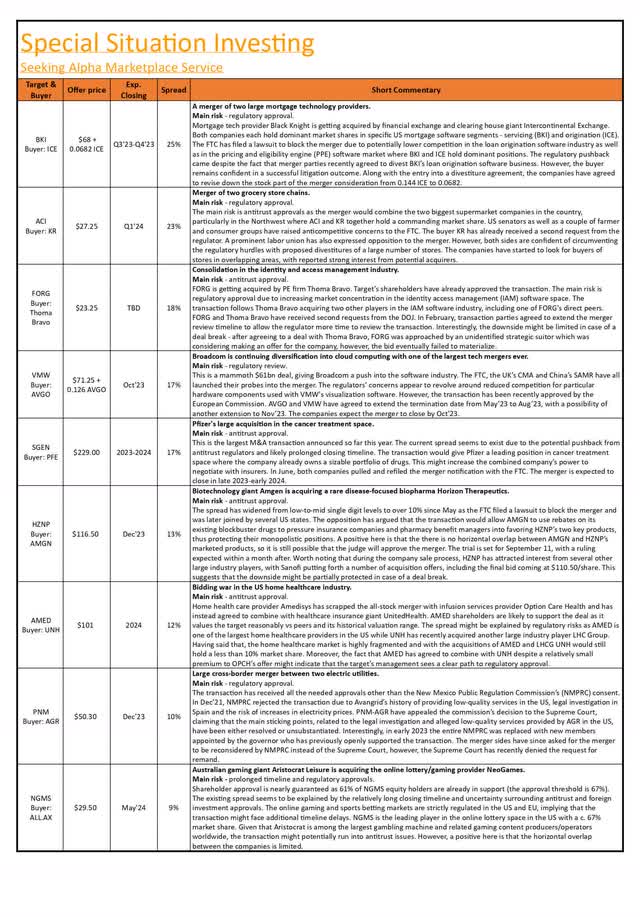

While regulatory approval is by no means guaranteed, I believe that several arguments suggest that UNH-AMED merger is likely to eventually close. Firstly, the US home healthcare and hospice markets are highly fragmented, with a large number of small industry players and the largest service providers occupying relatively tiny market shares (see table below). As of 2020, AMED occupied 5% and 2.9% market shares in the home health and hospice markets respectively. LHC Group captured 4.4% of the home healthcare industry while holding a less than 1% share of the hospice provider market. What this means is that even after the addition of AMED to its home healthcare and hospice services portfolio, UNH would still occupy a lower than 10% market share in both markets.

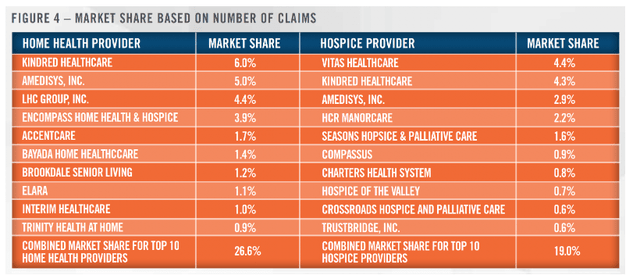

HealthCare Appraisers

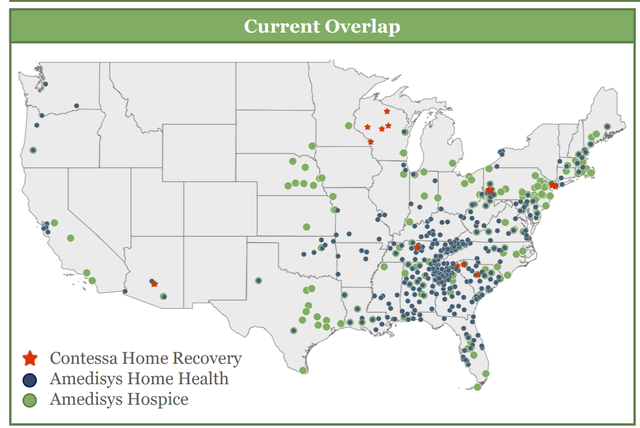

Secondly, the transaction seems unlikely to raise anti-competitive concerns in individual markets. Analysts have noted that AMED and LHC would not have a material market share in most of the markets other than in several geographies. While a glance at the home health and hospice locations of AMED and LHC Group companies (see charts below) indicates that both are concentrated in the Southeast of the US, other largest competitors Kindred at Home and EHAB are also generally focused on the same geographic region. Several states where LHC and AMED would have significant overlapping presence are Georgia (~90% of all Medicare-registered home health agencies), Tennessee (~90%), Kentucky (~70%) and Alabama (~70%). However, these states are relatively tiny in terms of the number of home health agencies, ranking 20th or lower among all US states. Plus, the total agency number used to calculate AMED and LHC’s combined market shares includes only Medicare-registered providers whose count stands at ~12k compared to a rough estimate of ~35k+ including non-licensed agencies. I think that even if the transaction raises antitrust concerns in specific geographies, asset divestitures are likely to appease the regulators.

LHC Group Investor Presentation, May 2019

Amedisys Investor Presentation, June 2021

Thirdly, the fact that AMED has agreed to combine with UNH despite a relative small premium to OPCH’s offer might indicate that the target’s management sees a clear path to regulatory approval. As part of the OPCH merger termination, AMED has agreed to pay $106m or $3.26/share in termination fees to the previous suitor. In other words, the termination fee is greater than the UNCH’s offer premium vs OPCH’s bid (based on pre-announcement OPCH share price). This suggests that if the UNH-AMED merger had serious regulatory risks, the target’s management might have been unlikely to accept the bid coming only at a tiny premium to OPCH’s offer.

The main risk here appears to be the possibility of the transaction getting blocked on vertical integration grounds as UNH, given its already massive insurance operation, would have more control over both insuring and providing healthcare to patients. However, a glance at the FTC and DOJ’s rulings in recent years indicates that this risk is lower than it might appear initially. Analysis from Reuters shows that in recent years the antitrust agencies have had little success in blocking mergers on vertical integration grounds. The FTC and DOJ only won two vertical integration cases where the merger parties abandoned the deal, including Lockheed Martin-Aerojet Rocketdyne and Nvidia-Arm. Both of these transactions involved larger target companies operating in seemingly strategically more sensitive defense and semiconductor industries respectively as opposed to AMED. With this in mind, even in case of any pushback on vertical integration grounds, the merger parties might be likely to prevail in court if the regulators decide to file a lawsuit.

Columbia Care (OTCQX:CCHWF)

- Buyer: Cresco Labs (OTCQX:CRLBF)

- Consideration: 0.5579 CRLBF stock

- Spread: 135%

- Exp. Closing: TBD

- Main Risk: Merger termination.

Consolidation of two major US cannabis companies. The shareholder approval has already been received. The existing wide spread is explained by the deal break risk. The companies have so far been unable to complete divestitures and reach $300m in gross proceeds required by regulators. Since completing the first asset sales in November ’22, CCHWF and CRLBF have not provided any updates on the divestiture process. Recently, the outside date for the merger closing (June 30) passed with no incremental information from the merger parties, however, an update is expected to be provided in the near-term. So far, CCHWF and CRLBF have seemed interested in pursuing the merger as indicated by the previous merger outside date extension from March ’23 to June ’23. The divestiture process has stalled due to failed attempts to pass the federal marijuana banking legislation which has had a negative impact on the sector’s short-term outlook. The Senate is expected to review the bill shortly, with several senators confident in its approval. Having said that, the bill has repeatedly come up in the Senate before only to be eventually dismissed, indicating that the same outcome might occur this time. Also, the exchange ratio is subject to a proration adjustment due to the legacy CCHWF earnout. The maximum earn-out would lower the exchange rate to 0.5180 and reduce the spread to 118%.

Silicon Motion Technology (SIMO)

- Buyer: MaxLinear (MXL)

- Consideration: $93.54 + 0.388 MXL stock

- Spread: 67%

- Exp. Closing: Q3’23

- Main Risk: Chinese regulatory approval.

International merger in the semiconductor industry. Silicon Motion Technology, a supplier of NAND flash controllers for SSDs, is getting acquired by its US peer MaxLinear. Approval from China’s regulators is the main hurdle. The buyer is based in the U.S, while the target is a US-listed Taiwanese company with China being its largest market. Two Chinese semiconductor industry watchdogs have recently approved the transaction. While the blessing from the antitrust regulator SAMR is still pending, recent reports suggest that the transaction is close to clearing the key hurdle. The merger termination date is set to August 7.

Spirit Airlines (SAVE)

- Buyers: JetBlue Airways (JBLU)

- Consideration: $31/share + $0.1 per month ticking fee from Jan’23 until closing.

- Spread: 61%

- Exp. Closing: H1’24

- Main risk: Regulatory approval.

This is an airline merger facing difficulties on the regulatory front. In March, the DOJ filed a lawsuit against the merger, arguing it would be adverse to consumer prices and competition. In response, SAVE and JBLU have argued that the merger would increase competition to the four legacy carriers in the US and, to alleviate antitrust concerns, JBLU has proposed divestitures in overlapping areas. Moreover, both companies have reached agreements with pilots unions. So far, however, the offered concessions have clearly not appeased the regulators. The DOJ’s trial hearing date has been scheduled for October 16. The judge stated that he expects an expeditious trial, with a potential ruling by year-end. This should leave time to pursue an appeal if the court rules against the merger. It’s worth noting that a federal judge has recently blocked JBLU’s Northeast Alliance partnership (NEA) with American Airlines (AAL) on antitrust grounds. Since the judge’s decision, JBLU has reiterated its commitment to the ongoing merger with SAVE and will now focus exclusively on it. NEA’s termination seems to be a positive as earlier reports suggested JBLU might trade away the NEA partnership for the SAVE merger.

Infinity Pharmaceuticals (INFI)

- Buyer: MEI Pharma (MEIP)

- Consideration: 0.0523 MEIP

- Spread: 52%

- Exp. Closing: Mid-2023

- Main Risk: Buyer’s shareholder approval condition.

The situation was recently covered in more detail on my premium service Special Situation Investing.

This is a tiny all-stock merger between two early-stage biopharmas. The transaction seems highly likely to be rejected by MEIP’s shareholders as indicated by the wide spread. The shareholder meeting is set for July 14. The merger comes at disastrous terms for the acquirer which is required to keep $80m in net cash vs $4m for INFI while giving away a c. 42% ownership of the combined entity to INFI’s equity holders. A number of MEIP’s shareholders have expressed their opposition to the ongoing merger. Anson Funds (owns 10%) has stated it will vote against the merger and recently in tandem with other equity holders made an offer to acquire MEIP which was rejected by the company’s management. MEIP currently trades at a 20% spread to the recent acquisition bid. MEIP’s shareholder base also includes a prominent biopharma investor Tang Capital (5%) which is also likely to oppose the merger with INFI. If/when the buyer’s shareholders reject the deal, a liquidation where the company might be worth materially above current share price levels seems to be the most likely outcome. MEIP’s management considered winding up the company during merger negotiations with INFI. Using the company’s own liquidation value estimates and adding incremental cash burn, MEIP might reasonably pay out c. $9/share in liquidating distributions vs the current share price of $6.67/share. Notably, proxy advisory firms ISS and Glass Lewis have recommended MEIP’s equity holders to support the INFI merger.

Tower Semiconductor (TSEM)

- Buyer: Intel (INTC)

- Consideration: $53/share

- Spread: 42%

- Exp. Closing: 2023

- Main Risk: Regulatory approvals.

This is a cross-border acquisition in the semiconductor space – Intel is acquiring Tower Semiconductor. The merger will require numerous antitrust and foreign investment approvals, some of which have already been received. The transaction continues to be held up by the Chinese regulator SAMR, which has increased scrutiny of M&A in the strategically important semiconductor space. For the same reason, there is also uncertainty regarding Israel’s government approval. The market has been increasingly skeptical of the transaction closing as indicated by the spread widening to as much as 50% in recent weeks as the termination date (August 15) is only a month away. Israeli withholding taxes will apply in case of successful closing – to avoid these foreign investors will be required to provide some paperwork, which might delay the eventual payout of the merger consideration and might explain part of the spread.

Desktop Metal (DM)

- Buyer: Stratasys (SSYS)

- Consideration: 0.123 SSYS stock

- Spread: 30%

- Exp. Closing: Q4’23

- Main Risk: Buyer’s shareholder approval, deal break due to the buyer getting acquired.

One of the leading 3D industry players Stratasys is acquiring its peer Desktop Metal. The transaction comes at a time of heightened consolidation in the 3D printing manufacturing space. Since the announcement of the merger, SSYS itself has received acquisition proposals from two industry peers Nano Dimension (NNDM) and 3D Systems (DDD) that were subsequently revised upwards. SSYS’s management has rejected the offers and continues to focus on the merger with DM. However, the market seemingly expects the current merger to break. The transaction comes at poor terms for the acquirer which would be forced to give up 41% ownership of the combined entity to a smaller, much more unprofitable and liquidity-issue facing DM. Moreover, NNDM holds a large 14% stake in SSYS while another activist Donerail (2%) has also expressed opposition to the ongoing merger.

iRobot Corporation (IRBT)

- Buyer: Amazon.com (AMZN)

- Consideration: $61/share

- Spread: 30%

- Exp. Closing: 2023

- Main Risk: Regulatory approval.

Amazon is acquiring robot vacuum cleaner maker iRobot. The merger spread has gradually widened from minimal levels to over 30% due to regulatory hurdles and a potentially prolonged closing timeline. Several senators have been pushing the regulator FTC to block the transaction. The companies have received a second request from the FTC. The regulator has been rumored to file a lawsuit against the merger. The deal has also raised antitrust concerns internationally – The European Commission has launched a detailed probe into the transaction, with the ruling expected by November ’23. Opposition’s concerns revolve around privacy infringements and Amazon’s history of anti-competitive acquisitions. Having said that, the UK’s CMA has recently cleared the transaction, arguing it will not lead to a substantial lessening in competition. Moreover, the buyer has reached a settlement with the FTC regarding privacy concerns related to its doorbell unit – a positive given the regulators’ concerns about Amazon’s previous privacy violations. Amazon’s another recent large acquisition of primary care provider One Medical has closed successfully.

111 (YI)

- Buyer: Management

- Consideration: $3.61/share

- Spread: 29%

- Exp. Closing: TBD

- Main Risk: Privatization offer withdrawal.

Chinese pharmaceuticals distributor YI is getting taken private by management (92% voting power, 44% economic interest). Merger consideration is $3.61/share after deducting ADS fees. A special committee is still reviewing the offer. Chinese non-binding privatization offers are inherently risky. However, reputable management as well as the financing for the buyout by a government-controlled entity give confidence that this offer has a higher chance of closing. The privatization seems to have a quite strong rationale behind it as YI is seeking a listing on the Shanghai STAR Market and delisting from the US seems like a necessary step toward this process. As part of a post-IPO investment round, YI had agreed to redeem preferred equity interests if the STAR listing is not achieved by June’23. The company recently reached an agreement with the majority of post-IPO investors to extend the redemption deadline to June’24. While the management has not provided any material updates on the proposed privatization, the redemption adjournment might indicate that the management buyout is still in the cards.

Black Knight (BKI)

- Buyer: Intercontinental Exchange (ICE)

- Consideration: $68 + 0.0682 ICE stock

- Spread: 25%

- Exp. Closing: Q3’23-Q4’23

- Main Risk: Regulatory approval.

Mortgage tech provider Black Knight is getting acquired by financial exchange and clearing house giant Intercontinental Exchange. Both companies each hold dominant market shares in specific US mortgage software segments – servicing (BKI) and origination (ICE). The FTC has filed a lawsuit to block the merger due to potentially lower competition in the loan origination software industry as well as in the pricing and eligibility engine (PPE) software market where BKI and ICE hold dominant positions. The regulatory pushback came despite the fact that merger parties recently agreed to divest BKI’s loan origination software business. However, the buyer remains confident in a successful litigation outcome. Along with the entry into a divestiture agreement, the companies have agreed to revise down the stock part of the merger consideration from 0.144 ICE to 0.0682.

Albertsons Companies (ACI)

- Buyers: The Kroger Co. (KR)

- Consideration: $27.25/share

- Spread: 23%

- Exp. Closing: Q1’24

- Main risk: Regulatory approval.

Merger of two grocery store chains. The transaction is synergistic from a geographical perspective – management states that ACI operates in several parts of the country with very few or no Kroger stores. The main risk is antitrust approvals as the merger would combine the two biggest supermarket companies in the country, particularly in the Northwest where ACI and KR together hold a commanding market share. US senators as well as a couple of farmer and consumer groups have raised anticompetitive concerns to the FTC. The buyer KR has already received a second request from the regulator. A prominent labor union has also expressed opposition to the merger. However, both sides are confident of circumventing the regulatory hurdles with proposed divestitures of a large number of stores. The companies have started to look for buyers of stores in overlapping areas, with reported strong interest from potential acquirers.

ForgeRock (FORG)

- Buyer: Thoma Bravo

- Consideration: $23.25/share

- Spread: 18%

- Exp. Closing: TBD

- Main Risk: Regulatory approval.

FORG is getting acquired by PE firm Thoma Bravo. Target’s shareholders have already approved the transaction. The main risk is regulatory approval due to increasing market concentration in the identity access management (IAM) software space. The transaction follows Thoma Bravo acquiring two other players in the IAM software industry, including one of FORG’s direct peers. FORG and Thoma Bravo have received second requests from the DOJ. In February, transaction parties agreed to extend the merger review timeline to allow the regulator more time to review the transaction. Interestingly, the downside might be limited in case of a deal break – after agreeing to a deal with Thoma Bravo, FORG was approached by an unidentified strategic suitor which was considering making an offer for the company, however, the bid eventually failed to materialize.

VMware (VMW)

- Buyer: Broadcom (AVGO)

- Consideration: $71.25 + 0.126 AVGO stock

- Spread: 17%

- Exp. Closing: Oct’23

- Main Risk: Regulatory review.

This is a mammoth $61bn deal, giving Broadcom a push into the software industry. The FTC, the UK’s CMA and China’s SAMR have all launched their probes into the merger. The regulators’ concerns appear to revolve around reduced competition for particular hardware components used with VMW’s visualization software. However, the transaction has been recently approved by the European Commission. AVGO and VMW have agreed to extend the termination date from May’23 to August ’23, with a possibility of another extension to November ’23. The companies expect the merger to close by October ’23.

Seagen (SGEN)

- Buyers: Pfizer (PFE)

- Consideration: $229/share

- Spread: 17%

- Exp. Closing: 2023-2024.

- Main risk: Antitrust approval.

Pfizer is acquiring large cancer treatment-focused commercial-stage biopharma Seagen. This is the largest M&A transaction announced so far this year. The current spread seems to exist due to the potential pushback from antitrust regulators and likely prolonged closing timeline. The transaction would give Pfizer a leading position in cancer treatment space where the company already owns a sizable portfolio of drugs. This might increase the combined company’s power to negotiate with insurers. In June, both companies pulled and refiled the merger notification with the FTC. The merger is expected to close in late 2023-early 2024.

Horizon Therapeutics (HZNP)

- Buyer: Amgen (AMGN)

- Consideration: $116.50/share

- Spread: 13%

- Exp. Closing: December ’23

- Main Risk: Antitrust approval.

Biotechnology giant Amgen is acquiring a rare disease-focused biopharma Horizon Therapeutics. The target’s shareholders have already approved the transaction. The spread has widened from low-to-mid single digit levels to over 10% since May as the FTC filed a lawsuit to block the merger and was later joined by several US states. The opposition has argued that the transaction would allow AMGN to use rebates on its existing blockbuster drugs to pressure insurance companies and pharmacy benefit managers into favoring HZNP’s two key products, thus protecting their monopolistic positions. A positive here is that there is no horizontal overlap between AMGN and HZNP’s marketed products, so it is still possible that the judge will approve the merger. The trial is set for September 11, with a ruling expected within a month after. Worth noting that during the company sale process, HZNP has attracted interest from several other large industry players, with Sanofi putting forth a number of acquisition offers, including the final bid coming at $110.50/share. This suggests that the downside might be partially protected in case of a deal break.

PNM Resources (PNM)

- Buyer: Iberdrola (OTCPK:IBDRY)

- Consideration: $50.30/share

- Spread: 10%

- Exp. Closing: December ’23

- Main Risk: Regulatory approval.

Spanish electric utility giant Iberdrola is acquiring New Mexico-focused electricity provider PNM Resources. The transaction has received all the needed approvals other than the New Mexico Public Regulation Commission’s (NMPRC) consent. In December ’21, NMPRC rejected the transaction due to Avangrid’s history of providing low-quality services in the US, legal investigation in Spain and the risk of increases in electricity prices. PNM-AGR have appealed the commission’s decision to the Supreme Court, claiming that the main sticking points, related to the legal investigation and alleged low-quality services provided by AGR in the US, have been either resolved or unsubstantiated. Interestingly, in early 2023 the entire NMPRC was replaced with new members appointed by the governor who has previously openly supported the transaction. The merger sides have since asked for the merger to be reconsidered by NMPRC instead of the Supreme Court, however, the Supreme Court has recently denied the request for remand.

NeoGames (NGMS)

- Buyer: Aristocrat Leisure (OTCPK:ARLUF)

- Consideration: $29.50/share

- Spread: 9%

- Exp. Closing: May’24

- Main Risk: Prolonged timeline and regulatory approvals.

Australian gaming giant Aristocrat Leisure is acquiring an online lottery/gaming software provider NeoGames. The transaction is strategic for the acquirer giving it a push into the still nascent US real money gaming (RMG) industry. Shareholder approval is nearly guaranteed as 61% of NGMS equity holders are already in support (the approval threshold is 67%). The existing spread seems to be explained by the relatively long closing timeline and uncertainty surrounding antitrust and foreign investment approvals. The online gaming and sports betting markets are strictly regulated in the US and EU, implying that the transaction might face additional timeline delays. NGMS is the leading player in the online lottery space in the US with a c. 67% market share. Given that Aristocrat is among the largest gambling machine and related gaming content producers/operators worldwide, the transaction might potentially run into antitrust issues. However, a positive here is that the horizontal overlap between the companies is limited.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMED either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Highest conviction ideas for Premium subscribers first

Thanks for reading my article. Make sure to also check out my premium service – Special Situation Investing. Now is a perfect time to join – with today’s high equity market volatility, there is an abundance of lucrative event-driven opportunities to capitalize on. So far our strategy has generated 30-50% returns annually. We expect the same going forward.

SIGN UP NOW and receive instant access to my highest conviction investment ideas + premium weekly newsletter.