Summary:

- American Airlines stock has declined by 35% since March, while short interest on it has risen to 12.7%, indicating hedge funds or speculators may be betting on continued declines.

- AAL’s financial stability is at risk due to high debt, declining profitability, and a potential decline in airline demand. To me, this makes it the least solvent US airline after Spirit.

- I expect AAL’s operating margins to continue to slide, with recession risks potentially exacerbating negative headwinds in 2025.

- American Airlines’ refinancing risks appear high, with over $4B in current LT debt maturities and negative free cash flow.

- AAL’s stability will likely depend on Federal Reserve stimulus, with significant rate cuts potentially necessary to carry it through its refinancing pressures.

FangXiaNuo

In March, I published a very bearish outlook for American Airlines (NASDAQ:AAL): “American Airlines: Betting On Another Bailout.” Since then, AAL has declined by 35%, while the S&P 500 has risen by around 9%. The article was published within a few days of its highest 2024 price, before posting disappointing earnings and guidance. Short interest in AAL has also increased to around 12.7%, indicating growing speculation that the company may face more significant challenges.

Its forward “P/E” valuation is now ~9.8X, notably higher than its 6.2X valuation when I last covered it. This is due to the sharp decline in its income and EPS outlook. Analyst and investor opinions on AAL remain very mixed, with many considering it a discount opportunity facing temporary headwinds.

To me, although there could be value in AAL, particularly at its lower price, it is one recession away from losing its financial stability. Further, since March, I believe there are clearer indications that airline demand may decline due to economic consumer strains.

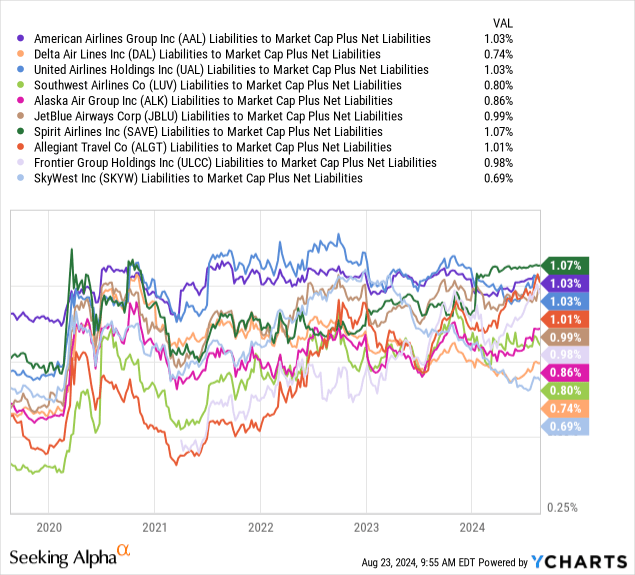

American Airlines is likely one of the least solvent US airlines today. The worst is undoubtedly Spirit Airlines (SAVE), which, based on its stock price, I believe appears likely to face bankruptcy soon. However, American Airlines’ liabilities-to-market cap plus net liabilities are nearly as bad. This figure represents a company’s total liabilities to its Enterprise Value (or a similar figure). Suppose it’s near or close to one; that tells us that the market may be pricing its liquidation value at or near zero. See how the airlines stack up below:

Note that the unit is off in this figure, so AAL’s 1.03% means 1.03X, or 103%. Since it is over one, that tells us its total liabilities are more significant than the market value of its assets (or market cap plus net liabilities). Although not a perfect measure, that tells us AAL may be at the highest long-term financial risk within airlines after Spirit. Now, United Airlines is the same, and all but four (Alaska, Southwest, Delta, and SkyWest) are at very similar levels. Thus, it may be that around half of the US airline industry is at some high degree of solvency risk, particularly after the debt spike of 2020.

The discount airlines Spirit, Jet Blue, and Frontier are all in abysmal financial shape based on negative operating income TTM (Allegiant’s being slightly positive) and very high debt. While I believe Spirit and, likely, Jet Blue are at elevated solvency risk, these two may also benefit in a recession as consumer preferences shift toward cheaper alternatives. Their poor TTM performance is partly attributable to relatively high consumer spending trends and their difficulties in keeping up with the pilot and other labor costs.

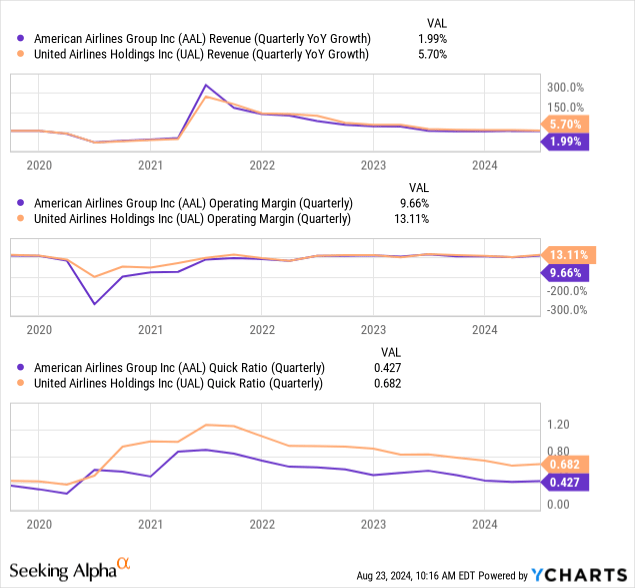

Those key labor shortage issues are calming as the airline market shifts firmly toward a cyclical peak in demand. American Airlines and United have higher risks associated with falling demand, given their per-mile prices are above $0.17, compared to the discounts at around $0.1-$0.13. American is also slightly more expensive than United, the same as Southwest and just below Delta (the most costly).

Comparing American Airlines and United, I think AAL is in a worse position. Its annual revenue growth and operating margins are lower, which have seen declining profitability since 2023. American Airlines also has a lower quick ratio of ~0.43X compared to United At ~0.68X, indicating a weaker liquidity position. See below:

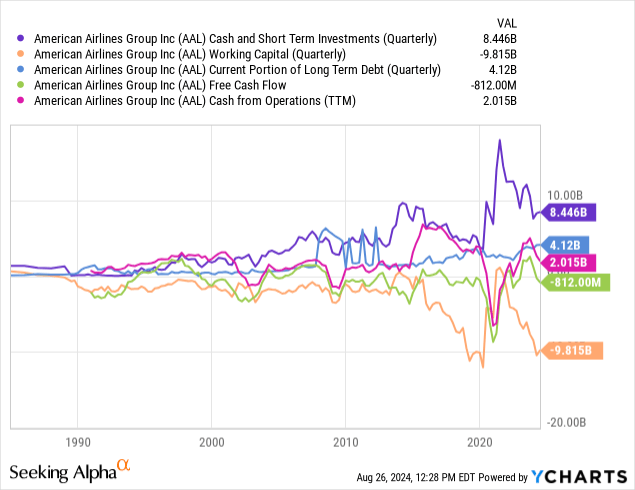

American Airlines’ excessive leverage is a near-term issue. The company has over $4B in debt it must repay or refinance over the coming year. In my view, it lacks the strong cash flows needed to repay this debt, given its working capital is near -$10B, meaning some may be refinanced at higher interest rates. See below:

Most of this debt is based on rolling maturity loans due over the coming years. The company has managed to extend some of these loans. S&P Global previously said it expected debt reductions from higher free cash flow in 2024, but the opposite may be true, as its cash flow has turned in an explicit negative direction since then. With this in mind, I believe there is a material risk that American Airlines will see either a credit downgrade or a negative outlook, potentially raising its interest rates and costs, making a consistently positive net income less tenable.

American’s Revenue May Fall Through 2026

In my view, this risk is closely tied to macroeconomic trends facing airlines. The company failed to earn a substantial profit during the “good times” of 2022-2023, which saw record air travel demand—a trend that has largely continued today. What will happen in a slowdown if American Airlines struggles in good times? Given its liquidity and solvency profile, I believe it may fall at the mercy of bailouts of 2020-like debt stimulus. Of course, the airline debt stimulus of 2020 left American Airlines in a much worse condition, despite saving its short-term liquidity.

To me, American Airlines, and to a lesser extent, United Airlines, are dependent on external stimulus through direct bailouts or supportive Fed policies, as seen in 2008 and 2020. That is not to say the company itself may liquidate, but its debt is so high that I doubt its ability to earn sufficient cash flow to reduce its debt without restructuring. If air travel demand remains relatively strong, that may be possible, but air travel is historically cyclical.

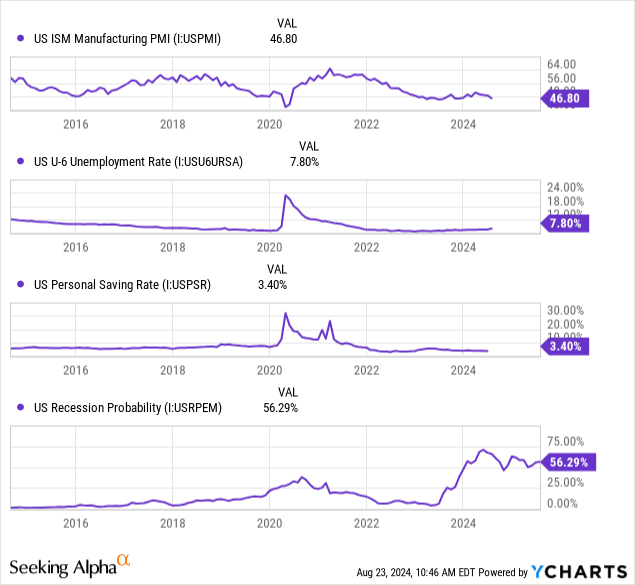

While we cannot predict a recession with absolute certainty, the economic leading indicators give a relatively clear signal today. The manufacturing PMI failed to recover above 50 and shifted in a negative direction, indicating accelerating declines in US manufacturing activity. Although not clear in the chart, unemployment and underemployment (measured in “U-6”) are now rising at a considerable pace, triggering the “Sahm Rule” recession signal. The odds of a recession based on changes in interest rates, notably the steepening after prolonged curve inversion, place the Estrella-model recession odds at over 50%. Finally, personal savings levels are declining, indicating that many households lack discretionary spending capacity. See below:

Other trends, such as weak consumer sentiment, stagnant real wages, and falling credit card debt (after a considerable increase), all point to specific weaknesses in US household demand. Put simply, if people do not have money, they cannot travel. Moreover, they may opt for cheaper airlines than American. This slowdown need not harm the majority of its customers; if American Airlines faces even a 10% decline in ticket demand over the next year, that could be enough to trigger issues relating to refinancing its debt at a reasonable rate.

The Bottom Line

If we assume a perfectly fair competitive market where the Federal Reserve or US Treasury would not lend money or create QE stimulus that could help airlines, I would be confident that AAL is headed to zero in the event of a consumer-driven recession. The company’s debt leverage is unreasonably high, while its competitive edge against Delta is weak (and perhaps equal to United). Its liquidity profile is also weak, coming out of a decently strong period in airline demand, likely headed into a weakening period.

That said, a very reasonable argument may be made that the US government is responsible for American Airlines’ difficulties because the lockdown measures worsened its existing issues by forcing it to have no revenue for much of 2020. The lockdowns also indirectly resulted in labor and material shortages that exacerbated its costs, although that may also be attributable to inflationary Fed stimulus programs.

My point is that American Airlines is not operating in a free market. Realistically, airlines’ highly competitive and capital-intensive nature makes them poor investments that are often public enterprises in other countries. In the US, they’re not public enterprises (as in government-owned/sponsored) but are still taxpayer-dependent. Given the potential for similar bailouts or indirect liquidity stimulus from the Federal Reserve, I would not short it. Further, because the FTC blocked the Spirit-Jet Blue merger (again, not a free market), it appears very likely to me that Spirit Airlines will face bankruptcy.

If Spirit fails next year due to its 2025 maturity wall, it may still operate for some time. Still, there may be some argument that surviving airlines will see a boost if Spirit liquidates. Of course, its CEO doesn’t expect Chapter 11, but I’m unsure how it will stay in business at a chronically negative operating margin if the FTC blocks mergers and acquisitions. In my view, Spirit’s potential failure is unlikely to benefit American Airlines but more likely the newer airlines, such as Breeze (not public), which should not have excess debt created during 2020 because they did not exist then.

Overall, I remain bearish on AAL because I doubt its ability to earn a positive EPS through 2026. My views on AAL are closely tied to my economic outlook, which is not shared by many analysts, who generally expect air travel demand to remain abnormally high, giving it a stable EPS outlook. Of course, based on its short interest, some hedge funds or speculative traders likely see a similar issue relating to the alarming combination of its refinancing risks and a deterioration in its economic outlook.

The key risk to my bearish thesis is the potential impact of government stimulus. That can be in the form of direct stimulus for airlines, such as those in the bailout program of 2020 or 2008. It can also likely take the form of Federal Reserve interest rate cuts and QE, particularly buying activity of junk bonds, which was seen in 2020. Those efforts may lower debt costs for AAL enough that its leverage becomes more manageable. That said, even with high air travel demand, I believe the company is far from improving its leverage without external help.

Still, while I doubt AAL’s ability to save itself, I do not doubt the US government may directly or indirectly try to do so. Categorically, I do not short stocks when the Federal Reserve or US Treasury may become my counterparty, either through direct (bailouts) or indirect means (such as a return to quantitative easing into junk bonds and excessive rate cuts).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.