Summary:

- American Airlines has the lowest Altman Z-score among significant airlines, indicating higher financial risk.

- The airline’s high debt and interest costs significantly challenge its profitability and potential for bankruptcy.

- American Airlines is working to reduce its debt burden ahead of a massive debt tower in 2025, but a recession or labor issues could worsen its financial situation.

- I would not bet against AAL today because its valuation is sensible under bullish economic conditions, and continued taxpayer aid remains possible.

- An ill-timed operating margin reversal in 2024 may give AAL significant risk ahead of its 2025 debt refinancing race.

Kevin Dietsch/Getty Images News

In recent weeks, I’ve revisited the airline industry as it faced significant volatility, particularly poor returns compared to virtually all other stock market segments. This began with my article on Southwest Airlines (LUV), which I believe may be overvalued, though I admit it has far less financial risk than many others. Last week, I covered JetBlue (JBLU), which appears to be in a difficult position due to its lack of a market share niche and high debt. In that article, I ranked the significant airlines by their Altman Z-score, which is a rough measure of bankruptcy risk that has efficacy for airlines. American Airlines (NASDAQ:AAL) had the lowest metric at -1.01X, showing ample deterioration through 2023.

The Z-score’s number is not as specifically crucial for airlines as other industries, since airlines are naturally capital-intensive. Still, the fact that American Airlines had the lowest score indicates it may be at higher financial risk than its peers. Indeed, American Airlines had the lowest Z-score when I covered it last in January 2023, although it’s deteriorated materially since then. In my past article, “American Airlines: Little Upside Left As Air Travel Returns To Pre-Pandemic Levels,” I had a bearish outlook due primarily to its high-risk financial position.

Since then, it has lost about 6% of its value but has faced immense volatility, rising to ~$18.7 and down to ~$11.3 over that period, now just below where I covered it last. As such, I believe it is an excellent time to analyze the stock again to estimate its 2024 potential better.

AAL is a Tiny Piece of a Huge Pie

Fundamentally, American Airlines went into 2020 in a weak position and faced massive revenue declines that year, leaving a vast debt-to-equity skew. Over the past two years, we’ve seen an enormous increase in Airline operating costs, namely in pilot wages, causing external strains on operating profit margins. However, unlike JetBlue and other low-cost airlines struggling with high labor turnover, American has had positive operating profits over the past year. However, unlike the others, its interest costs are taking much of its profits away from investors.

In my experience, many individual investors have a poor understanding of corporate debt. If I were to say that I believe AAL’s bankruptcy risk is high, then many would retort that AAL is “too big to fail,” has operated for nearly one hundred years, and is a favorite airline for many. While true, American Airlines already went bankrupt in 2011 and would have likely been bankrupted in 2020 if it were not for immense US taxpayer aid. Further, since 1978, there have been well over one hundred bankruptcies of US airlines. Bankruptcy does not mean a cessation of services but a restructuring of debt that usually wipes out equity. In recent years, AAL has, in my view, been chronically on the cusp of bankruptcy; it has become dependent on taxpayer bailouts to avoid wiping out equity.

If the US government ever allows AAL to restructure instead, most of its chronic debt issues would likely fade. Of course, the US government has historically been quick to bail out the industry, giving it a natural “put option” that makes it not short-sellable. Still, there is a chronic risk that the bailout stream will not continue, potentially wiping out AAL’s equity value.

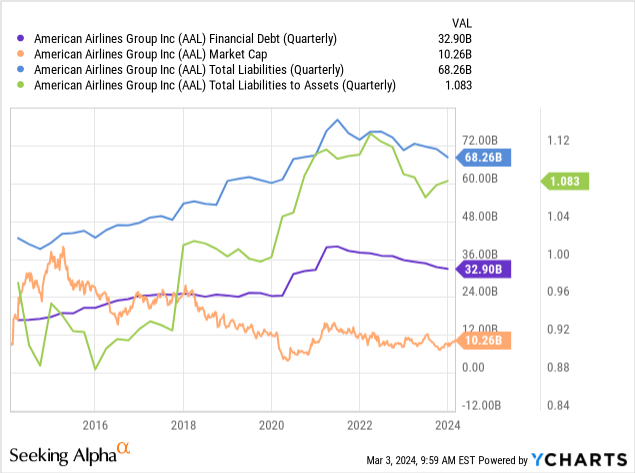

Remember, with its high debt, AAL’s equity is only a tiny portion of its balance sheet. The company has more total liabilities than assets. Its market capitalization of $10.26B is just 31% of its total financial debt and 15% of its total liabilities. See below:

Since AAL emerged from its last bankruptcy, there has been a relatively consistent decline in its equity market capitalization and an increase in its total financial leverage. Investors in AAL do not own the American Airlines enterprise; they own a tiny portion that is highly leveraged with junk-grade debt. American Airlines Enterprise Value has been virtually constant since 2014. Still, equity is not an enterprise, so even a tiny mistake in American Airlines’ profits and bankruptcy risk would likely soar.

A Race Against Time as 2025 Tower Looms

American Airlines is working hard to reduce its debt burden, looking to end 2024 with a $1.5B debt reduction from its Q4 23 position. That comes ahead of its massive debt tower in 2025, worth around $7.6B in Q2. Interest rates are 3-5% higher than in periods AAL took out debt. Though its credit rating has also fluctuated over this period, there is a decent probability that it will see a $200M+ interest cost spike as it refinances, assuming a 3% higher rate on average on this debt refinancing.

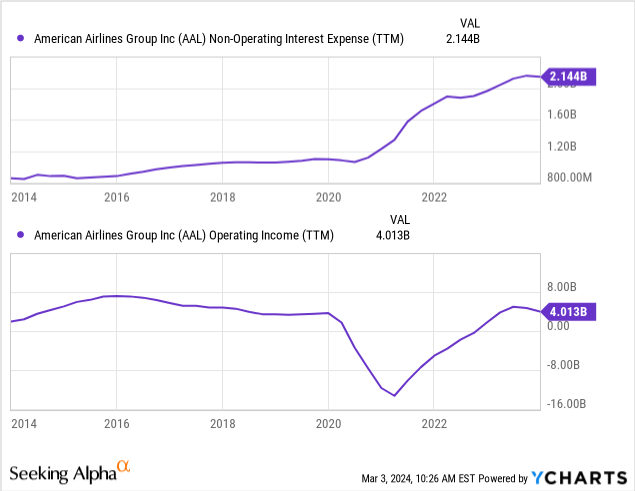

Its interest costs are currently ~$2.15B annually. Its operating income is higher at $4B, but it has dipped in recent quarters, potentially pushing American Airlines back toward unprofitability in 2024. See below:

If we assume American Airlines can continue to maintain its operating income, then it should meet interest costs with a small net profit that can be used to reduce debt. However, that is based on the assumption that airlines will continue to be profitable over the coming year. If either labor issues grow or a recession happens, I expect AAL’s margins will continue to reverse.

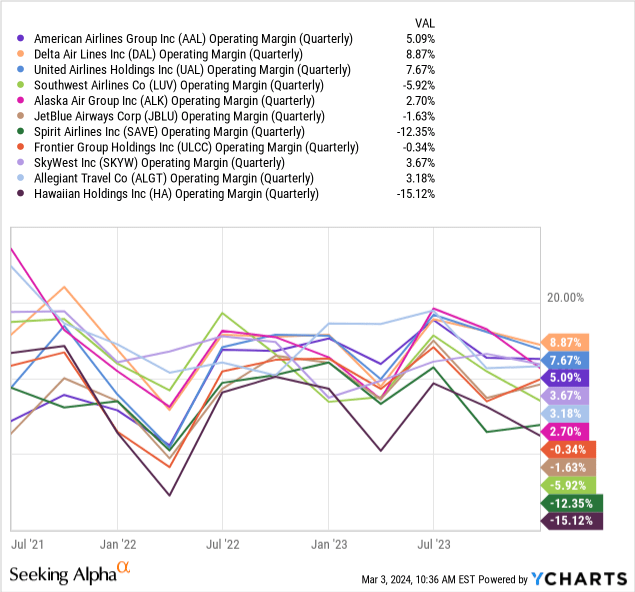

For the most part, American Airlines has among the best operating margins in the industry, a fact shared with the other two US giants. Conversely, niche and low-cost US airlines more often have negative operating margins. See below:

The equalizing fact to the margin situation is that those with higher margins usually have the highest debt leverage. The low-cost airlines have lower margins today because they’re struggling more with high labor turnover due to the airline labor shortage. However, in the event of an economic slowdown or recession, many people will likely shift back toward lower-cost airlines, leaving Americans with significant overhead costs toward highly paid pilots and lower revenue.

US air travel has reached a record high despite low consumer savings and confidence. Thus, if we assume a natural cycle in consumption activity, then American Airlines should see its operating margins slip, potentially (to me, likely) below the level needed to maintain a profit due to its immense (and rising) interest costs. If that occurs in 2024, as it’s trying to refinance its upcoming debt wall, the company would likely be at a very high restructuring risk.

The Bottom Line

Overall, I remain bearish on American Airlines and believe it will likely face financial restructuring over the coming years, potentially sooner in the event of a recession. However, I would not short AAL because it often benefits from US taxpayer-funded bailouts or similar government programs to try to keep it afloat.

Further, if there is a slowdown in US consumer travel spending in 2024, AAL may rise since its overall valuation is low and unadjusted for debt. Its “P/E” is just 6.2X. However, that is largely a function of its high leverage, since its overall Enterprise Value remains virtually unchanged from its normal range. Thus, the fundamental upside in AAL also appears very limited.

However, it seems investors are not accounting for debt risk today with high discretion, potentially under the assumption that some form of bailout is inevitable. To me, that is the major issue with AAL. From a bullish or bearish standpoint, we’re mainly betting on how the US Federal Reserve will alter interest rates or how the US government will prop up or fail to aid the airline industry.

For better or worse, I see American Airlines as a “zombie corporation” that is too dependent on the government. It is earning a profit on its own accord, benefiting from the low rate of 2020 debt; however, it only earns a small profit with extremely high air travel demand. I believe a slight decline in air travel demand would likely be sufficient to make its restructuring risk materially high.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.