Summary:

- American Airlines reported Q3 adjusted pre-tax profit of $362 million, surpassing EPS guidance range.

- Finalized contract with Allied Pilots Association improves compensation and quality of life for pilots.

- Strong Q3 revenue of $13.5 billion driven by demand and successful travel rewards program.

Boarding1Now

American Airlines (NASDAQ:AAL) has been a trailblazer in the skies, but its new iteration presents a distinctly different feel. Previously, airlines aggressively battled for market share in what was often a highly competitive industry. Profitability in the airline sector was seen as the result of a strategic financial war involving some of the biggest names rather than a given. However, the pandemic fundamentally altered the landscape for airlines. In the past, investors would eagerly buy shares, attracted by progressive dividends and repurchase plans set forth by the leadership teams. Now, respected industry players like American Airlines are adopting a more balanced approach, weighing shareholder rewards against the need to maintain a strong balance sheet and position the company for future success. As shareholders, we always focus on the return on investment over the planned duration of our stock ownership. Strengthening a company’s balance sheet and responsible leadership might not always be immediately rewarded by investors, but at these levels, there is much to appreciate about American Airlines.

The company reported an adjusted pre-tax profit of $362 million, exceeding the upper limit of its own EPS guidance range.

This achievement is not only a numerical victory but also a testament to the team’s relentless pursuit of excellence. They have focused on key areas such as reliability, profitability, accountability, and strengthening the balance sheet.

Financially, the company is thriving. A record third-quarter revenue of $13.5 billion was driven by strong demand and a successful travel rewards program. The airline is seeing steady domestic demand and robust international growth, especially in the Atlantic, Caribbean, and Central American markets.

Financially, the airline navigated the industry’s challenges with strategic and focused management, reporting a third-quarter net income of $263 million. The company’s aggressive approach to debt reduction, which targets a reduction of total debt by $15 billion by the end of 2025, demonstrates a clear commitment to financial stability and long-term success.

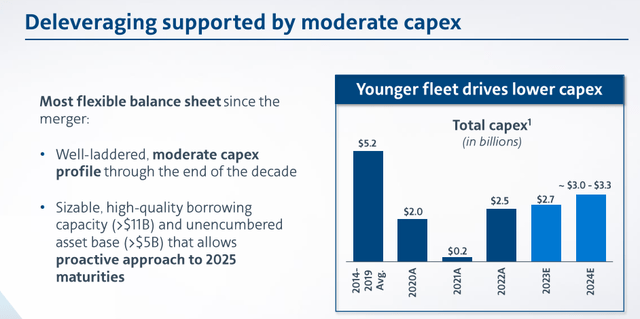

The projected debt reduction will largely be driven by lower anticipated CAPEX spending, owing to American Airlines’ relatively young fleet.

Recently, it appears that the leadership team at American Airlines has been diligently working on strengthening the company’s balance sheet. This effort is aimed at ensuring more stable financial outlays in the coming years. Investors might remember how, during the 2020 pandemic, many major airlines, including American, were unprepared for the crisis. They had focused heavily on rewarding shareholders through stock repurchases and dividends, resulting in inadequate cash reserves. As the industry faced sudden and significant challenges, these airlines lacked the necessary balance sheet flexibility to withstand the shock, leading to plummeting stock values.

In a notable strategic shift, American Airlines is now prioritizing the long-term health of the company. This approach contrasts with that of its competitors, who continue to focus on aggressive expansion and the promotion of premium services and seats to drive value. This difference in strategy could explain why American Airlines’ stock has not recently shown strong performance. However, it also suggests that the airline might be more resilient in the face of potential downturns, such as a recession. This built-in resilience positions American Airlines potentially ahead of its peers in terms of preparedness for both a downturn and the subsequent recovery.

While this strategy may lack the immediate appeal of short-term sensational gains that investors often seek in cyclical and consumer discretionary sectors, it should not be underestimated. In comparison to industries like bitcoin mining or big tech, which can offer rapid returns, American Airlines’ approach may seem less exciting. However, this resilience could be a crucial factor in the company’s long-term capital gains potential.

As investors focus on capital gains, it’s important to consider whether American Airlines, with its current strategy, will ultimately deliver these gains. This consideration raises the question: are there better opportunities out there, especially when considering sectors known for quick returns? While American Airlines’ strategy may lack the immediate excitement of rapid growth sectors, its approach to resilience and long-term stability could prove advantageous in the broader investment landscape.

Pilot Update and Recent Events

The airline’s improvements go beyond the balance sheet, as seen in its finalized contract with the Allied Pilots Association, which improves compensation and quality of life for its pilots. This move underscores American’s priority – its people.

Operationally, American Airlines is in top gear, striving towards new agreements for flight attendants and agents. The company’s operational efficiency, customer focus, and free cash flow generation are all part of a carefully crafted strategy to ensure stability and growth.

Looking Forward

The outlook for the fourth quarter remains positive, with steady improvements in business travel and strong international demand. The airline’s capacity and revenue management strategies are set to adapt to the changing market dynamics, ensuring continued growth and profitability.

The Travel Rewards program has been a game-changer for American Airlines, with significant growth in co-brand credit card acquisitions and enrollments in the Advantage program. Approximately 80% of bookings now come directly through the airline’s channels, up 11 points from the previous year, indicating a successful shift to more efficient distribution channels.

American Airlines remains focused on leveraging its Network and Travel Rewards program. The company’s fleet, the youngest and most efficient among U.S. Network carriers, is a strategic asset. Their initiatives to drive incremental value, coupled with limited near and medium-term capital expenditure requirements, are expected to maintain a healthy cash flow for reinvestment in the business.

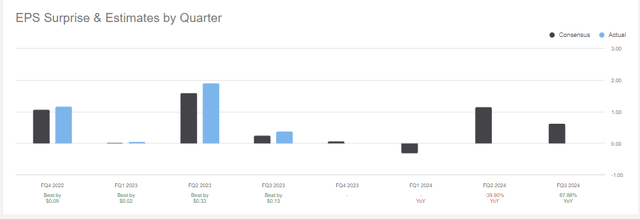

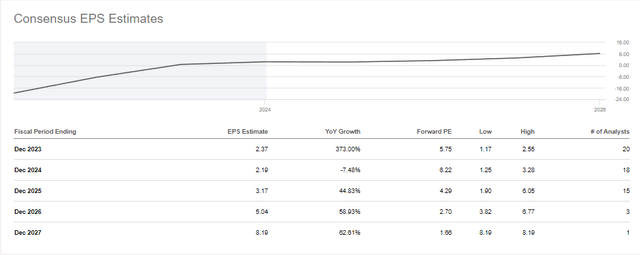

The company has been doing a great job at meeting or beating EPS estimates, but as suggested with the debt reduction strategy mentioned earlier, EPS estimates going forward are far from exciting.

In fact, it will likely be some time before investors can expect significant growth, which is likely why the stock has stalled a bit. We can see from the analyst estimates below that meaningful growth will likely return during the calendar year 2025, which suggests that if things go well, calendar year 2024 may turn out to be an amazing buying opportunity for a long-term hold.

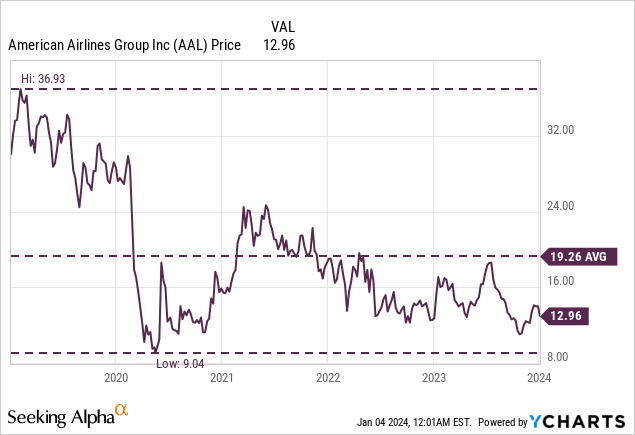

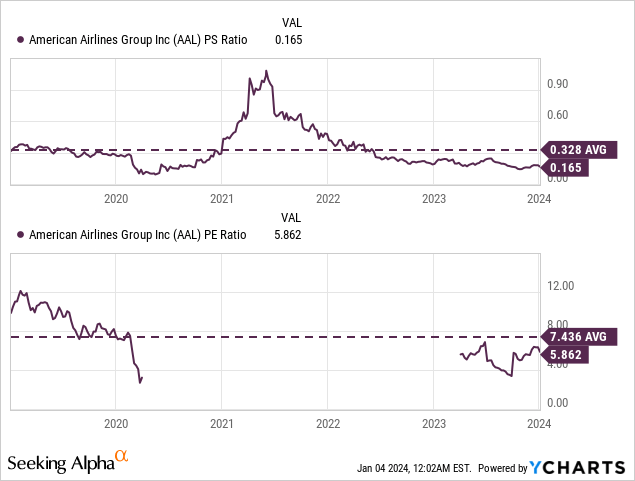

With respect to valuation, we are certainly at attractive levels, and again, there are good reasons for that.

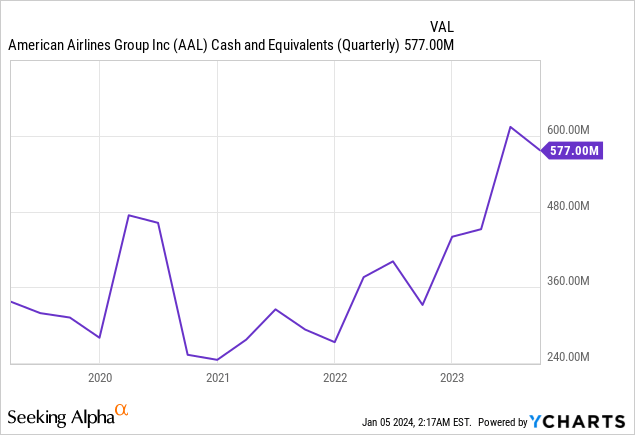

The worrying part of this is that we have been at attractive valuations for some time now, and the stock seems to be getting cheaper. But we are also seeing the effects of the responsible management practices by the leadership team. The cash balances have been improving, and as shown above, so too have debt levels. Though the improving cash balance is likely at least partially attributable to the notes offered last November.

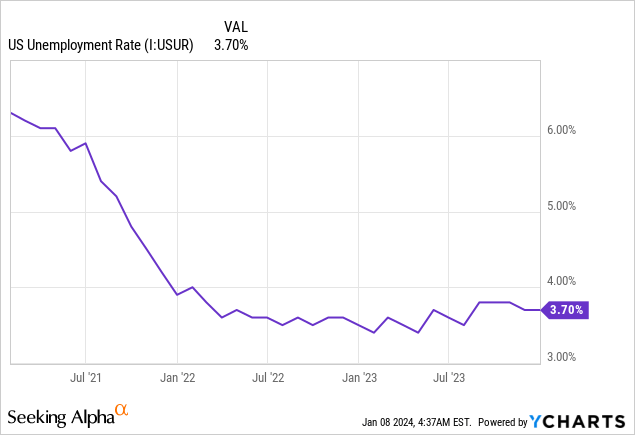

Navigating the debt overhang will likely take some time. I would say the end of the calendar year 2025 would be a good time for investors to target noticeable appreciation. In the meantime, this company is improving, but the stock will likely take some lumps. I’m working on building with the position of these levels, but it is not my highest priority. This is because of the recession risk. So far, there have been very few signs that the US will be going into a major recession. Business travel has been strong, and to be honest, the economic situation seems somewhat good, with low unemployment and the lack of any real financial crisis.

No one knows for sure if or when things might shift, but there is a feeling of uncertainty in the market, and for this reason, I’m buying up shares slowly rather than all at once and keeping a reasonable allocation as I redirect funds temporarily from technology.

The Takeaway

American Airlines has embarked on a transformative journey that goes beyond mere financial restructuring. Its recent agreement with the Allied Pilots Association, improving pilot compensation and quality of life, reflects a deep-seated commitment to its workforce. Moreover, the airline’s operational improvements and negotiations with flight attendants and agents illustrate a holistic approach to organizational excellence. American Airlines is not just recalibrating its balance sheet; it is reshaping its corporate culture to prioritize people, operational efficiency, and customer satisfaction. This approach bodes well for the airline’s long-term resilience and growth prospects.

Looking ahead, American Airlines seems well-positioned to navigate the evolving dynamics of the airline industry. The company’s positive outlook for the fourth quarter, buoyed by robust business travel and international demand, indicates a steady trajectory toward growth and profitability. The success of its Travel Rewards program and its strategic focus on leveraging its network and fleet efficiencies further reinforce this optimism. However, the path to significant growth might take time, with the calendar year 2025 earmarked as a potential turning point. Until then, investors might witness a period of consolidation, with the stock price reflecting the cautious but strategic steps taken by the company. In essence, American Airlines presents a picture of a company steadily fortifying itself for the future, making it an intriguing consideration for long-term investors who value stability and incremental progress over rapid but potentially volatile gains. As a long-term-oriented investor, I am fine with this, and I am building a position that I plan to hold for some time. I rate American Airlines as a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.