Summary:

- The macroeconomic environment is worsening potentially creating a headwind for American Airlines.

- Consumer delinquency rates and total outstanding loan amounts are increasing, indicating a decline in consumers’ financial health, which could impact discretionary spending.

- American Airlines hints at a potential oversupply in its products, with expectations of declining revenue per seat mile and negative earnings outlook for 2024.

James Leynse/The Image Bank Unreleased via Getty Images

Introduction

In my previous article, I had a negative opinion of American Airlines (NASDAQ:AAL). My bearish thesis focused on the declining macroeconomic environment created by a weakening consumers’ financial health. At the time, I believed the continuation of this trend could negatively affect American Airlines as the company operates in a highly cyclical industry. Although American Airlines’ stock has increased about 25% since the publication of my last bearish article making my thesis wrong, I continue to have a negative view of American Airlines. Macroeconomic concerns are continuing to show signs of worsening potentially impacting the consumers’ willingness and ability to travel. In support of this macroeconomic progression, American Airlines and external analysts are expecting a worse 2024 in comparison to 2023. Therefore, I am maintaining my sell thesis on American Airlines.

Risk to Thesis

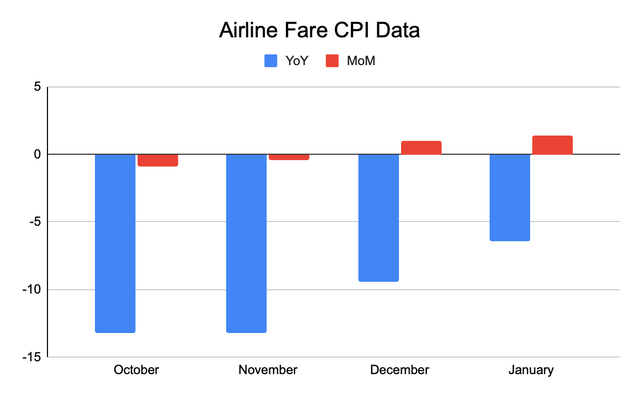

Before I start discussing the reasoning behind my negative view of American Airlines, I would like to point out some significant risks to my bearish thesis. Since the publication of the previous article, American Airline’s stock has seen a sharp increase. During this time, signs of easing pricing pressure on airfares have risen. According to the CPI data for January 2024, air fares increased 1.3% month-over-month to score two consecutive months of positive growth. Further, as the chart below shows, airline fare prices compared to the previous year, while still negative, have shown consistent signs of recovery.

[Chart created by author using BLS data]

While the continuation of the improving airfare trend could pose a meaningful risk to my bearish thesis, I believe it is too early to conclude that the improving pricing correlates to a long-term demand trajectory given the headwinds American Airlines faces due to the macroeconomic conditions, supply and demand imbalance, and slowing travel industry conditions. Therefore, improving airfare data is a risk to my bearish thesis.

Continuing Macroeconomic Concerns

The airline business is extremely cyclical. As such, I believe companies such as American Airlines have an extremely close tie to the macroeconomic conditions. Unfortunately, the macroeconomic conditions continue to deteriorate reflected by the weakening consumer financial health.

According to the Federal Reserve Bank of New York, consumer delinquency data has shown strong increases with no clear signs of a slowdown yet. For auto loans, the delinquency rate has increased from 2.22% to 2.66% or about 19.82% year-over-year. For credit card loans, the delinquency rate has increased from 4.01% to 6.36% or about 58.6% year-over-year. The delinquency rates on all loans increased from 1.03% to 1.42% or about 37.86% year-over-year. The low delinquency percentage points for all loans are the result of a higher proportion of mortgage loans and home equity lines of credit, which normally carry a significantly lower delinquency rate.

Further, on top of the increasing delinquency rates, the total outstanding loan amount has also been increasing, amplifying the risks. The total loan increased by about 3.57% year-over-year from $16.899 trillion to $17.503 trillion. Overall, it is evident that consumers’ financial health is quickly decelerating shown by all types of loans, especially auto loans and credit card delinquencies.

Weakening consumers’ financial health poses significant challenges to the travel industry as it is likely that consumers reduce discretionary travel spending in tougher economic times. Therefore, the continuing consumer financial health deterioration could pose a meaningful headwind to American Airline’s operations in 2024 in my view.

Possibility of an Oversupply

American Airlines reported a 2023 Q4 earnings report in late January, and during the earnings call, the company hinted at a potential oversupply in the company’s products.

In terms of total capacity, the company said that American Airlines expects “to grow capacity [by] mid-single digits year-over-year in 2024” while the company is expecting TRASM, total revenue per available seat mile, “to be down approximately 0% to 3%.” Further, in terms of CASM, cost per available seat mile, the company is expecting 0.5% to 3.5% year-over-year growth. As such, American Airlines is expecting the total capacity and costs per available seat to grow as the total revenue per seat mile to be down year-over-year potentially hinting at an imbalance in the supply and demand dynamics. These implications have resulted in a negative earnings outlook from external analysts. According to Yahoo Finance and Seeking Alpha estimates, American Airlines’ 2024 EPS is expected to be lower than that of 2023 by about 4.15% and 5.28%, respectively.

I believe this data to be significant. In a tough macroeconomic environment with an expectation for increasing headwinds, American Airlines is expecting to not only see an unfavorable balance in the supply and demand, but the company could also be seeing a declining year-over-year EPS in 2024.

Travel Industry Concerns

On top of the macroeconomic concerns and a negative outlook for American Airlines, the travel industry is also expecting a declining growth or decelerating growth in 2024 supporting my macroeconomic risk concerns.

Starting with the hospitality industry, both Marriott International (MAR) and Airbnb (ABNB) are expected to see their year-over-year EPS to decline. Marriott International is expected to see its EPS to decline by 5.01% while Airbnb is expected to see its EPS to decline by 39.54%. For Airlines, Delta Air Lines (DAL) is expected to see their EPS growth to slow to about 3.94% year-over-year from nearly a 100% increase from the previous year due to normalization from the pandemic while United Airlines (UAL) is expected to see a decline of about 4.45%.

The hospitality industry, along with American Airline’s other peers in the aviation industry, is signaling a weaker 2024 compared to 2023. As such, the travel industry as a whole is likely facing a tougher 2024 than 2023 in terms of both top and bottom lines.

Summary

American Airlines has experienced a strong tailwind following the depths of the pandemic. Airlines including American Airlines came back strong with record demands allowing the companies to start the deleveraging process. While this has been the case in 2023, I do not believe the rosy market environment to continue in 2024. Consumers’ financial health is continuing to weaken shown by the rise in delinquency rates while the growth and recovery in the aviation and the broad travel industry has slowed to a trickle if not a contraction. On top of these negative environments, American Airlines is expecting capacity growth potentially putting a further strain on the company’s operations. Therefore, despite some signs of easing airfare price data, I continue to hold a bearish thesis on American Airlines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.