Summary:

- American Airlines is expected to report a significant decline in EPS and minimal revenue growth for Q3 2023.

- Analysts have lowered their expectations for the company’s earnings and revenue over the past three months.

- American Airlines has a history of beating EPS expectations but may have a smaller beat this time, with flat revenue.

- Buying the stock here is likely to be a bumpy but rewarding experience.

Joe Raedle/Getty Images News

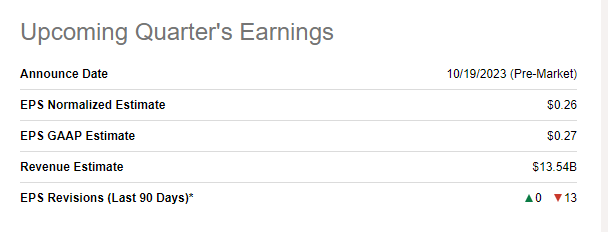

American Airlines Group Inc. (NASDAQ:AAL) is expected to report FQ3 2023’s earnings pre-market on Thursday, October 19th. Analysts expect the company to report earnings of 26 cents per share on the back of $13.54 billion in revenue. Should American Airlines meet these numbers, it’d represent a massive EPS decline of 62% and a minuscule revenue growth of 0.60%. This suggests that the company is expected to have much higher costs in FQ3 2023 compared to one year ago. Let’s wait and watch if that turns out to be true. Meanwhile, this article presents a few things to be aware of as American Airlines heads into its Q3 report.

AAL Earnings Preview (Seekingalpha.com)

Watered Down Expectations

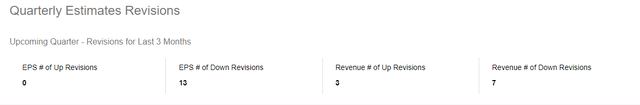

American Airlines is flying into the Q3 earnings report with muted expectations. 13/13 of EPS revisions and 7/10 revenue revisions over the last 3 months have been to the downside. FQ3 2023’s EPS expectation has gone down from 67 cents to 26 cents, representing a 61% decline since the beginning of the year. I am personally not surprised by this, as I’ve always been advocating that the “pent up demand” story had gone way too far with the likes of Airlines and Cruise ship companies. But American Airlines has more problems it is dealing with than just demand.

But going into earnings with lowered expectations may not be a bad thing for American Airlines and its investors, as explained in the section below.

AAL Q3 Revisions Count (Seekingalpha.com) FQ3 2023 EPS Trend (Seekingalpha.com)

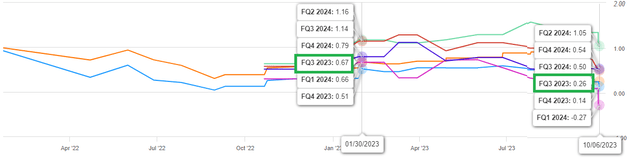

Beat or Miss? History Says EPS Beat and Revenue Meet

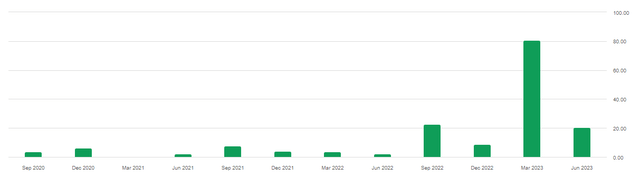

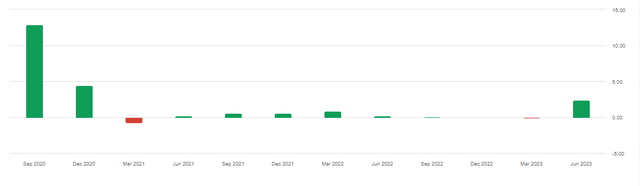

American Airlines has beaten EPS expectations in each of the past 12 quarters. The average beat in the last 4 has been by more than 30%, although it was aided by the March 2023 quarter being a huge beat by 80%. Given the concerns covered below, I predict the EPS beat will be much smaller this time with more or less flat revenue, just like it has been since December 2020.

AAL EPS Surprise (Seekingalpah.com) AAL Revenue Surprise (Seekingalpha.com)

What To Watch?

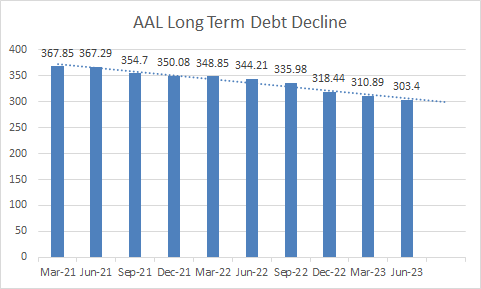

- American Airlines has been chipping away at its long-term debt for a while now. Since the March 2021 quarter, the long-term debt portion of its balance sheet has been going down every single quarter. It remains to be seen if September 2023 will mark the 10th consecutive quarter of reducing long-term debt, or if the streak will be broken. Any time a company pays off debt is good news for investors, and especially at times like the present, where refinancing is likely to be much costlier.

AAL Long-Term Debt (Author, data from Seekingalpha.com)

- As I mentioned in the introduction section of the article, the fact that American Airlines is expected to show a small bump in revenue and a huge decline in EPS suggests higher expenses. The company is expected to have higher fuel costs compared to its peers and has already aligned expectations as such. The company also recently agreed to increase its pay (compensation and benefits included) to pilots. Fuel and crew are obviously the biggest contributors to cost for an airline, and it now makes sense why expectations are so low going into the Q3 report.

- The situation in Israel is very concerning, and it feels very close to home, given Seeking Alpha’s rich connections with the country. American Airlines and other major U.S. carriers have now suspended direct flights between the two countries. While this is outside of the September quarter, I do expect analysts to pose some questions to the company about the situation and their insight on when things may revert to normalcy.

Valuation

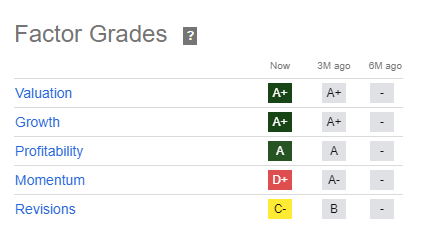

Heading into Q3 earnings, American Airlines’ stock has an A+ valuation rating on Seeking Alpha, and it is hard to argue against it. The stock has a forward multiple of 5, which compares favorably against immediate peers like Delta Air Lines, Inc. (DAL) at 6 and Southwest Airlines Co. (LUV) at nearly 16.

The 16 analysts covering the stock have a median price target of $16, which represents a 33% upside from the current market price of ~$12. That makes me believe the risk-reward is fair for someone looking at buying the stock here.

AAL Quant Ratings (Seekingalpha.com)

Technical Indicators

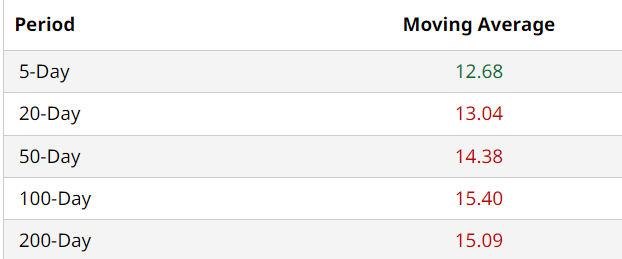

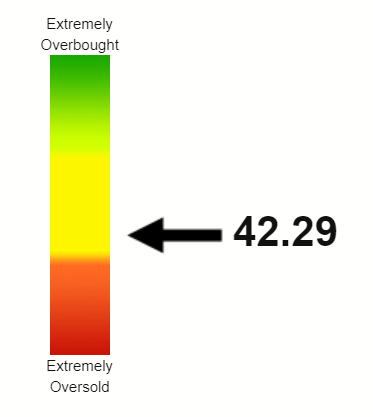

American Airlines stock has been making lower-lows based on the moving averages below, as each of the moving averages from 100-Day on are progressively lower. The 200-day moving average is nearly 30% away from the current market price of ~$12, which suggests the base has shifted in the short to medium term at least. A Relative Strength Index [RSI] of 42 suggests the stock is in a bit of a no man’s land with a downward tilt. The upcoming earnings report is likely to act as a catalyst in determining whether the stock continues marching lower or if it establishes a new support area in the $12 to $13 region.

AAL Moving Avgs (Barchart.com) AAL RSI (Stockrsi.com)

Conclusion

The ride will be bumpy and investors need to fasten their seat belts. Okay, that pun felt good. But that’s how I see things right now for American Airlines. Expectations are fairly low heading into the Q3 report, even as the company is chipping away at its long-term debt. The recent Israel-based sell-off has punished a weak stock further, thereby setting the stage for a nice bounce should Q3 surprise on the upside on the back of lower-than-expected cost or higher-than-expected revenue. I rate the stock a “bumpy Buy” here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.