Summary:

- American Airlines reflects U.S. economic health, benefiting from government support during crises.

- In good years, American Airlines achieves modest margins; downturns lead to significant losses due to fixed costs.

- Rising debt and shareholder payouts raise concerns about its long-term financial strategy.

- American Airlines projected 5-year stock price CAGR is about 2%.

Wirestock

Investment Thesis

I believe American Airlines Group Inc. (NASDAQ:AAL) stock is a sell. In my opinion, the company’s performance is closely tied to the U.S. economic landscape, showing decent gains in favorable years and experiencing losses in tougher times, largely due to its fixed costs. The airline’s increasing debt, combined with its decision to prioritize shareholder payouts, brings its future financial stability into question. Furthermore, based on projections, the expected stock price (CAGR) for American Airlines over the upcoming five years hovers around 2%. This modest growth outlook, coupled with concerns about its financial decisions and the broader economic factors, suggests that potential investors should exercise caution when considering this airline as a viable investment option.

Company Overview

American Airlines serves numerous destinations both domestically and internationally. AAL’s business model focuses on transporting passengers and cargo. They generate revenue from ticket sales, cargo services, and other services like baggage fees, in-flight offerings, and loyalty programs. The airline uses a hub-and-spoke system, centralizing flights into major hubs for efficient connections and route management. This allows AAL to serve many destinations with fewer aircraft. In the airline industry, AAL competes with Delta Air Lines (DAL), United Airlines (UAL), and Southwest Airlines (LUV). These airlines, along with regional and international ones, challenge AAL in different markets, requiring them to continuously adapt.

Requires a Bailout Almost Every Downturn

American Airlines, like many major carriers, is deeply influenced by the broader dynamics of the airline industry. The challenges of maintaining operations amidst economic downturns, potential job losses, and disruptions to travelers are constants. Given AAL’s prominence, its performance is often reflective of the U.S.’s economic health and global standing. Airlines, especially flag carriers like AAL, carry a symbolic weight, representing a nation’s progress, ambition, and global outreach. Their success can boost national morale and pride, while their decline can impact a nation’s image. Given these stakes, it’s understandable why governments often intervene. In my view, these bailouts or financial aids are not merely about saving a business but about preserving a national asset. Given AAL’s prominence, its performance often mirrors the U.S.’s economic health and global standing.

Historically, the U.S. government has stepped in to support the airline industry during crises, and AAL has been a beneficiary of such interventions. For instance, after the September 11 attacks in 2001, the airline industry faced an unprecedented downturn. In response, Congress passed the Air Transportation Safety and System Stabilization Act, which provided $15 billion in aid to the airlines. AAL, being one of the largest carriers, received a significant portion of this assistance.

Another example is the COVID-19 Pandemic where the global health crisis severely impacted air travel in 2020. The U.S. government, recognizing the industry’s plight, included airlines in the CARES Act, which provided financial relief to various sectors. AAL received billions in payroll support and loans to help navigate the pandemic-induced downturn. These bailouts underscore the importance of airlines like AAL to the U.S. economy and infrastructure. However, the aggressive pricing strategies of some airlines, especially during challenging times, can strain AAL’s finances, forcing it to strike a balance between competitive pricing and maintaining profitability.

American Airlines Has Razor Thin Margins With High Fixed Costs

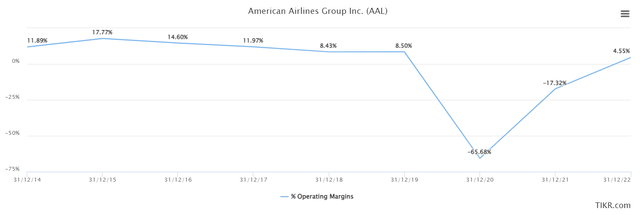

In my opinion, American Airlines operates in an industry where the balance between profitability and costs is incredibly delicate, heavily swayed by the interplay of high fixed costs and fluctuating demand. During prosperous years, when the skies are favorable and demand is high, AAL has impressively achieved operating margins in the low teens. This achievement stands out, especially when considering the substantial fixed expenses like aircraft financing, crew salaries, and airport fees that remain constant, regardless of how many passengers they serve.

However, the airline’s financial landscape can shift dramatically during challenging times. When demand drops, as the graph below illustrates, AAL has, at times, reported negative operating margins. Given AAL’s extensive network and fleet size, these challenges are even more pronounced. While the airline aims to ensure its planes are sufficiently filled to cover these costs and secure a profit, downturns in demand can leave many seats unoccupied, yet the bills remain unchanged. Coupled with unpredictable factors like fuel price volatility and competitive pricing pressures, it’s clear to me that AAL constantly grapples with the tightrope walk of maintaining profitability amidst industry challenges.

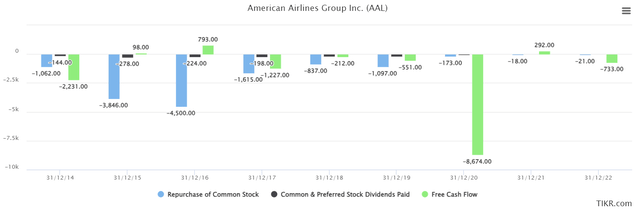

Questionable Capital Allocation

American Airlines has often been scrutinized for its capital allocation decisions, especially during years of financial strain. Notably, in 2014, 2017, 2018, and 2019, AAL reported negative free cash flow. Yet, in the face of this, the company persisted with its share buybacks and dividend distributions, effectively channeling cash to shareholders even as its own coffers ran at a deficit. Such a strategy baffles many observers. While it’s important to acknowledge that AAL prudently halted dividend payments in February 2020 and has yet to resume them, and that share buybacks between 2021 and 2023 were limited to $39 million—a stark reduction from pre-pandemic levels—the overarching strategy in those financially challenging years appears questionable. In those years of negative cash flow, a more judicious approach might have seen AAL bolster its reserves and prioritize debt reduction. Given the inherent cyclicity and susceptibility to external shocks in the airline industry, failing to build financial safeguards can jeopardize the firm’s future stability. By not forging these protective financial buffers, AAL potentially leaves itself exposed to downturns in travel demand, a known inevitability in their sector. Had the airline focused more on accumulating cash and addressing its debt in the lead-up to the pandemic, it may not have faced its current hefty debt obligations and could have potentially been in a stronger position to return capital to its shareholders today.

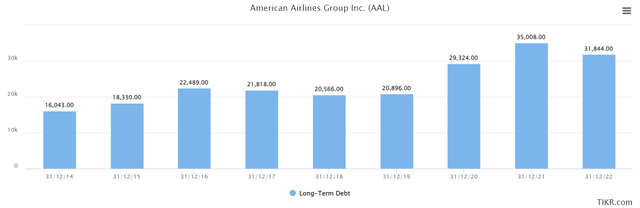

In my opinion, over the past decade, American Airlines has exhibited a concerning financial pattern. The company has consistently carried a hefty debt load, which has alarmingly increased over time. What strikes me as particularly perplexing is AAL’s decision to return capital to shareholders amidst this rising debt. Rather than channeling available resources to mitigate this growing liability, the company has seemingly prioritized dividends and share buybacks. This approach, in my view, casts doubt on AAL’s long-term financial strategy and its readiness to handle potential industry downturns.

Financial Analysis

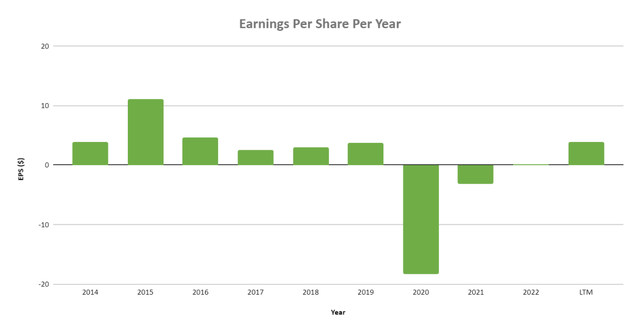

Over the last five years, American Airlines has faced financial hurdles. Revenue has been erratic, swinging from $44,541.00 million in 2018 to $17,337.00 million in 2020 to $52,894.00 million in the trailing 12 months of 2023. The CAGR stands at around a low single digit amount, pointing to challenges in achieving consistent growth. In my view, the Earnings Per Share (EPS) is very inconsistent given the cyclical nature of the airline industry. We can see that in reasonable good condition, AAL is profitable where in 2018 EPS was $3.03, though in 2020 it was -$18.36 and in the last twelve months it was $3.85.

In terms of liquidity, the most recent quarterly report shows cash and cash equivalents of $12,061.00 million. The company’s long-term debt is $30,340.00 million, which has been a point of concern for investors especially given that the management team in the past has shown unwillingness to improve the debt situation. The current ratio of 0.75 suggests that short-term liabilities cannot be covered by short-term assets, this means that over the next 12 months, AAL may need to use credit facilities to meet their current liabilities.

Looking ahead, when the economy is strong and travel demand is steady, AAL as a business will perform well, however as soon as a downturn approaches due to the high fixed costs and low margins, AAL will suffer large losses which the balance sheet is not prepared for. Therefore, AAL is the sort of business that I choose to stay clear of as an investment.

Valuation

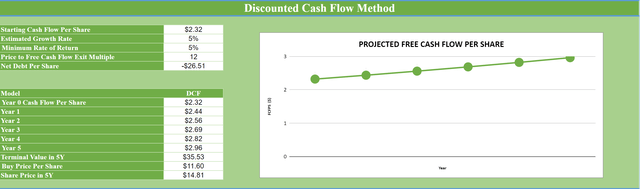

In my opinion, valuation should be a comparison between the market capitalization and the underlying business fundamentals, including future earnings. One method I find useful for this is a discounted cash flow (DCF) analysis. As of Q2, 2023 AAL’s current TTM Cashflow per Share is $2.32. I anticipate an annual growth rate of 5% for AAL’s Cashflow per Share over the next five years. Taking this growth into account, the projected Cashflow per Share for AAL by Q2 2028 would be $2.96.

Using an exit multiple of 10, which is based on what is reasonable for AAL in a stable economic environment over the past decade, the estimated price target for the stock in five years would be $13.74. It should be noted that this valuation accounts for $26.51 per share worth of net debt that is held on the balance sheet which then consequently increases the overall enterprise value of the business, hence lowering the expected annualized return. Therefore, if you invest in AAL at its current share price, the expected Compound Annual Growth Rate would be about 2% over the next five years, based on these calculations.

Conclusion

In my opinion, American Airlines is closely tied to the U.S. economic landscape. Its performance varies, with decent gains in good years and losses in challenging ones, primarily due to fixed costs. The airline’s rising debt, coupled with its choice to prioritize shareholder payouts, raises questions about its future financial direction. Based on projections, the expected (CAGR) for American Airlines stock price over the next five years is around 2%. Given these factors and the modest growth outlook, I see AAL as a sell. The combination of its financial decisions and the broader economic environment suggests caution when considering this airline as an investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.