Summary:

- American Airlines Group Inc. stock remains below $15 despite positive projections and expected profits.

- Q1 is always seasonally tough for airlines due to lower travel and restrictive weather, while higher fuel costs hits profits over the short term.

- American Airlines Group stock only trades at 6x ’24 EPS based on fears the airline doesn’t hit targets.

Wirestock

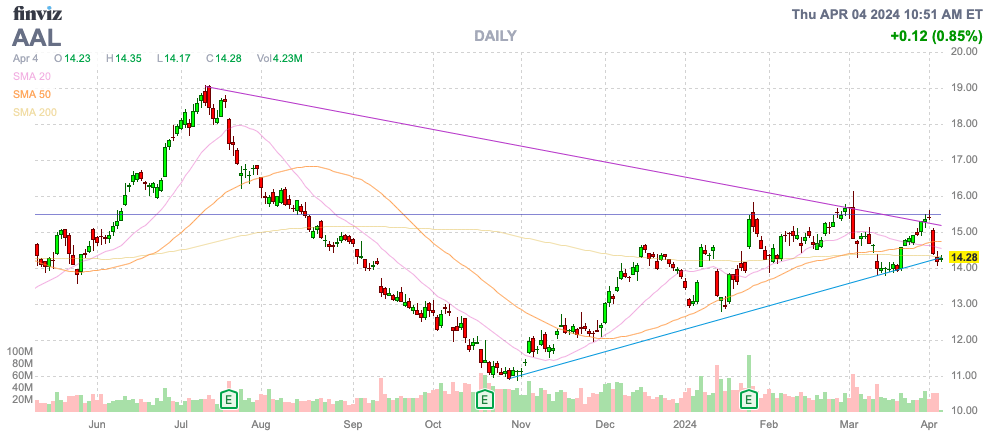

No matter the positive projections from American Airlines Group Inc. (NASDAQ:AAL), the stock just remains stuck below $15. The airline sector is dynamic, but the stock market constantly views this as a reason to fear financial results. My investment thesis remains ultra Bullish on the company projected to generate substantial profits and free cash flows going forward, while the stock still trades close to the Covid lows.

Source: Finviz

Tough Q1 Ahead

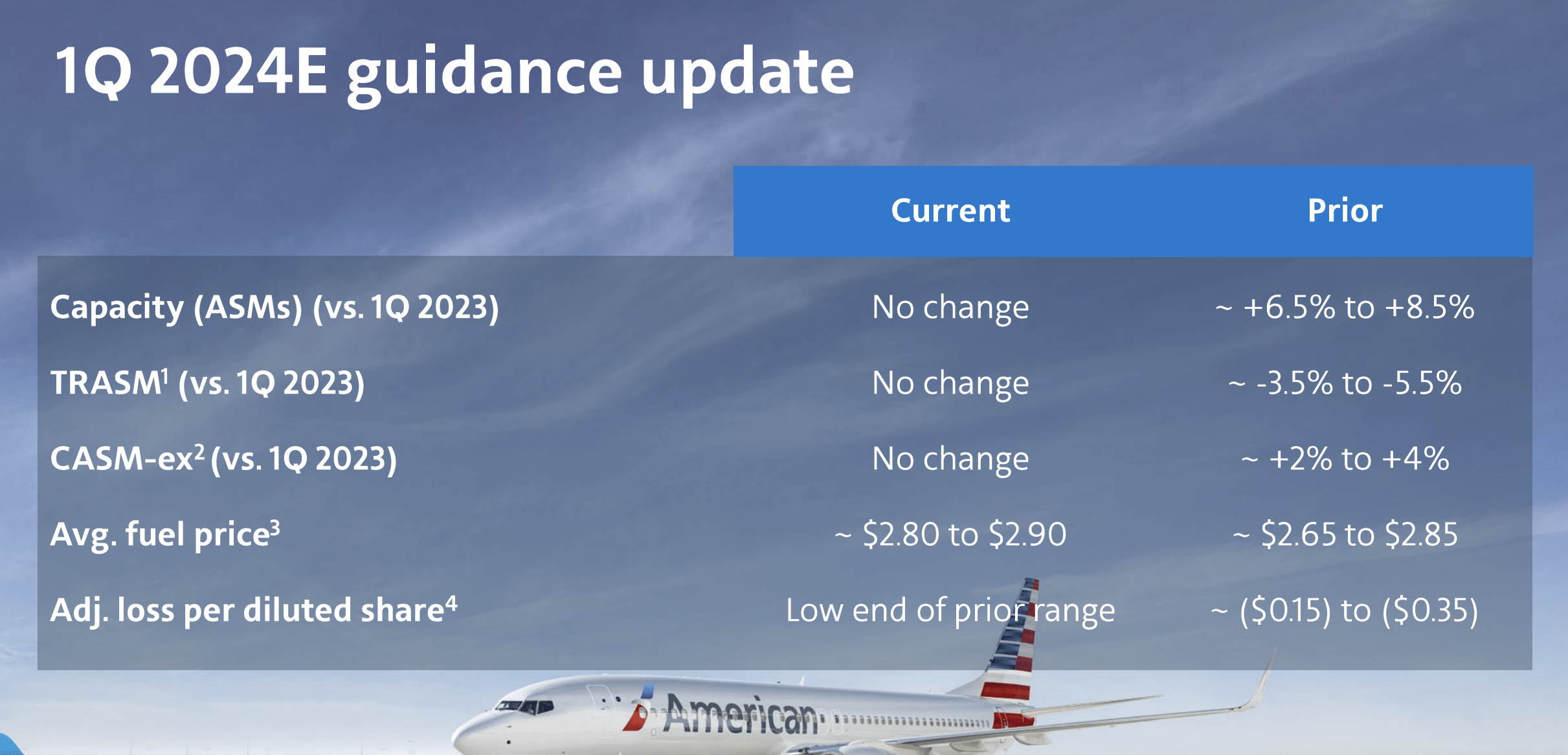

Airlines always face a tough Q1 due to lower travel and restrictive weather. In addition, the airline sector faced higher fuel costs during the quarter, and American Airlines already warned of a bigger loss.

The airline cut Q1 ’24 guidance due to higher fuel costs sending the stock lower. The only change to the original guidance for a $0.25 quarterly loss in the March quarter was fuel costs up at the high end of the original target range.

Source: American Airlines J.P.Morgan Industrials presentation

A 10 cent move in the fuel costs impacts costs by $100 million per quarter, but the number goes both ways. American Airlines beat Q4 numbers due to lower fuel expenses. Over time, fuel doesn’t impact profits due to fares incorporating such costs with a small lag.

The amazing part of airlines is that investors appear to fear the same issues over and over. Back during early Q4, American Airlines warned of a larger than forecast loss due to higher fuel costs. The stock slumped from nearly $15 to $13.

Ironically, American Airlines ended up beating those EPS estimates by $0.21 due to lower fuel costs, and the stock jumped back to $16. The key point is that airlines shouldn’t trade based on volatile fuel prices, but the market appears to have an insatiable fear with airlines.

The cruise sector faces volatile traffic patterns and gets hit by higher fuel prices, but the stocks don’t bounce around nearly as much. The whole airline sector is forecast to generate strong profits in 2024 and outside of another highly unlikely global shutdown, the sector should be rapping debt and facing excess capital again, similar to prior to Covid.

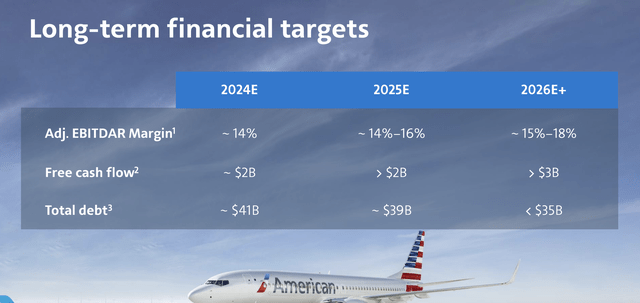

Future Remains Bright

While the market is busy worried about Q1 numbers, investors need to understand the airline forecasts 2024 free cash flow of $2 billion turns into $3 billion in annual free cash flow by 2026. The stock doesn’t trade like a highly profitable airline with strong free cash flow plans.

Source: American Airlines J.P.Morgan Industrials presentation

A big part of the story is the reduced need to buy new aircraft. American Airlines only planned 29 deliveries this year on a fleet of 1,544 aircraft. The plan for the rest of the decade to stick to around 35 aircraft deliveries a year with a capex cost below $3.5 billion annually.

Another issue where American Airlines doesn’t help itself is the constant focus on listing total debt, including the above presentation. The company ended the last quarter with a very large cash balance of $8.5 billion leading to a net debt of only $24.3 billion.

Also, the market seems to not understand that airline producing $3 billion in free cash flow and buying $3+ billion in aircraft is boosting the balance sheet by $6+ billion. American Airlines will both boost the cash balance or repay debt while hiking the PP&E balance with very valuable aircraft.

The airline still guided to a 2024 EPS of $2.50 to nearly $3.25. The Q1 weakness due to fuel costs aren’t a big deal to the investment thesis and earnings power of an airline built on peak demand during the prime travel season of Q2-Q3.

Another big key is that the 2024 EPS guidance is a baseline for future growth. The debt repayment over the next 3 years of $6 to $7 billion would reduce annual interest expense by up to $500 million based on 7% interest rates.

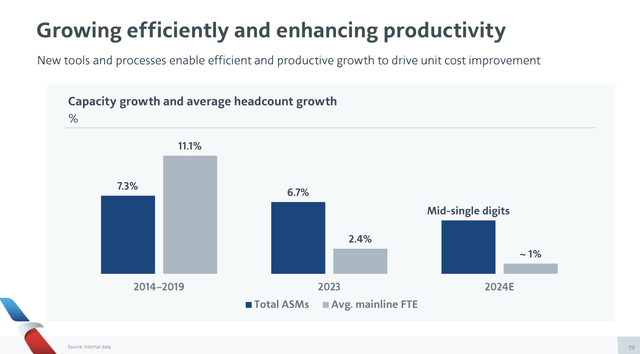

On top of this, American Airlines forecasts growing capacity in the mid-single digit range without needing to expand the employee base. In essence, the airline should be able to generate massive leverage by growing the revenue base without growing the expense base.

Source: American Airlines J.P.Morgan Industrials presentation

The combination of these 2 factors is a prime reason the consensus EPS targets rise to $3 to $4 over the next couple of years. The stock currently trades at less than 6x the consensus 2024 EPS targets of only $2.47 due again to fears the airline doesn’t even hit the low end of guidance starting at $2.50 per share.

Takeaway

The key investor takeaway is that American Airlines Group Inc. stock is crazy cheap at $14 with a $2.50+ EPS target for the year and a goal for free cash flow reaching $3 billion by 2026 for a stock with a market cap of only $9 billion. American Airlines trades on such insatiable fear that the market has no concept the airline hits the upper end of guidance of $3.25 per share and grows this EPS level over time.

Investors should continue using the stock weakness to load up on the airline stock not priced for the improving financials.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q2, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.