Summary:

- American Airlines provided bullish guidance, boosting Q4’24 EPS to $0.65, above consensus estimates of $0.39.

- The airline has an exclusive loyalty deal with Citi aiming for 10% annual growth, potentially adding ~$2 to EPS by 2030.

- The stock only trades at 5x to 6x normalized EPS and still trades far below pre-Covid levels, unlike other legacy airlines.

Wirestock

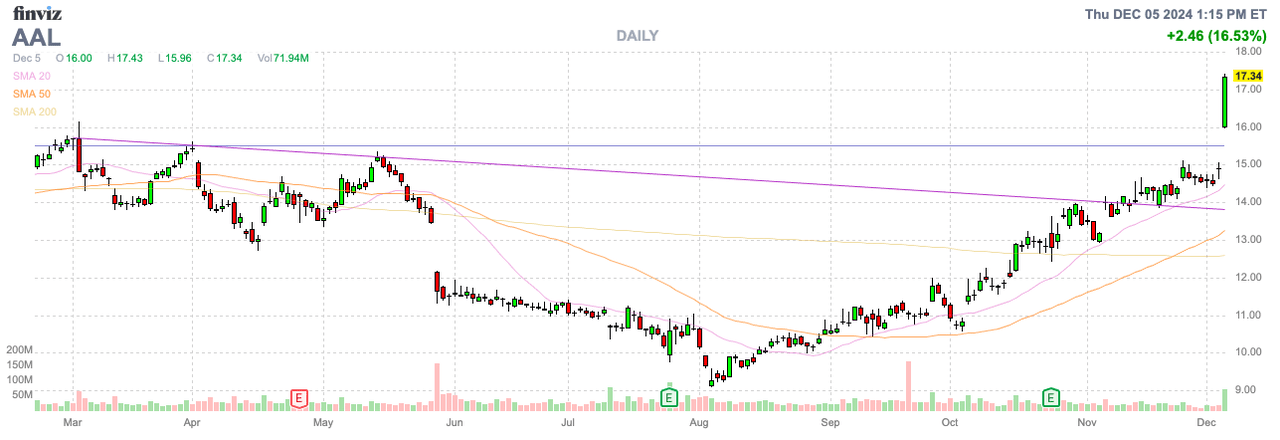

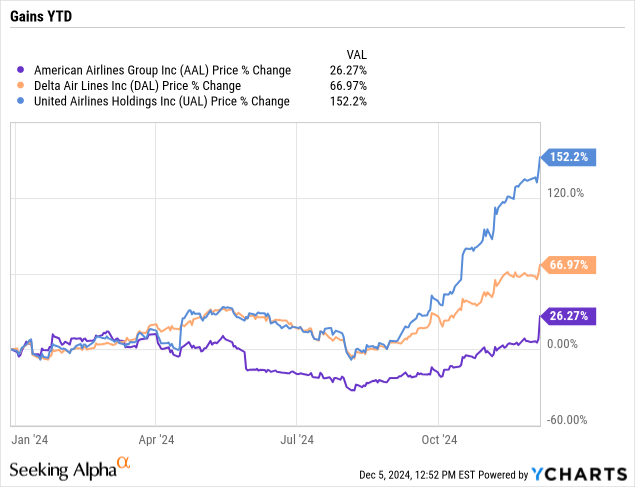

Some airline stocks have flown higher this year, but American Airlines Group, Inc. (NASDAQ:AAL) was generally left behind. The legacy airline just provided some extremely bullish guidance on the long-term profit picture due to a new loyalty agreement. My investment thesis is ultra-Bullish on the stock with only minimal gains so far in 2024 compared to legacy airline peers.

Guidance Boost

The airline had some big news this morning with both a hike to Q4 guidance and a boost to the loyalty program via an expanded deal with Citi. Both of the news items help boost profits for the struggling business.

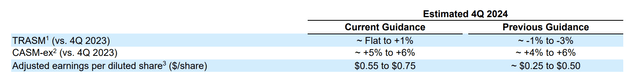

American Airlines boosted Q4’24 EPS to $0.65 at the midpoint, above the consensus estimates at $0.39. The airline should make around $1.75 for the year now.

The airline segment saw a big boost to profits as the segment cut capacity towards the end of Q3, following a weak summer. American Airlines is reporting TRASM might be only flat for the period contributing to solid profits in a normally weak period, including the airline only earning $0.29 last Q4.

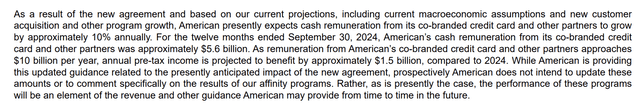

The bigger news is that America Airlines moved to a new exclusive loyalty agreement with Citi. The previous co-branded deal, including Barclays, wasn’t maxing out the program’s potential.

The company announced plans for 10% annual growth in the loyalty program with $1.5 billion in pre-tax income via the next $4.4 billion in revenue for a 34% pre-tax margin.

American Airlines has ~720 million diluted shares, so we’re talking about ~$2 is additional EPS in the process of growing the loyalty program to $10 billion by 2030 as follows:

- 2024A – $5.6 billion

- 2025E – $6.16 billion

- 2026E – $6.77 billion

- 2027E – $7.45 billion

- 2028E – $8.20 billion

- 2029E – $9.02 billion

- 2030E – $9.92 billion

The loyalty program update helps provide investors with a glimpse into the growth opportunity for a sector generally ignored by the market. American Airlines will nearly double the high-margin program revenues by the end of the decade.

Only Starting

American Airlines entered the day only trading at $15, some 50% below the pre-Covid levels. The other legacy airlines had already topped those peak levels.

Delta Air Lines (DAL) despite an IT outage is up 67% this year while United Airlines (UAL) has soared over 150%. American Airlines was nearly flat on the year and has now only risen 26% after the big rally from the earnings boost due in small part to ironically being removed from the S&P 500 this year.

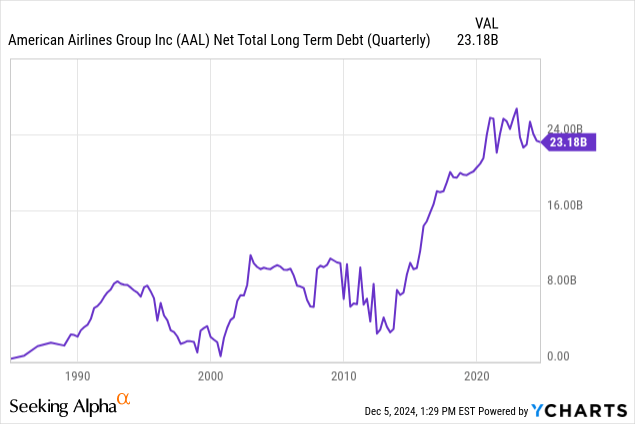

The airline has already made some progress on reducing debt with a balance of $31.7 billion offset by $8.5 billion in cash and shot-term investments. The net debt position has dipped to $23.2 billion, though interest expenses are still hitting the profit picture by nearly $2 billion annually.

American Airlines should return to the plan when the year started for a nearly $3 EPS as the company moves into 2025. The new loyalty program has the potential to boost profits over the long term while the airline still has substantial opportunity to lower interest expenses in another easy path to boost EPS. The combination could provide a $3+ EPS boost potential under a scenario where the airline operates the remaining business at breakeven margin impact.

The stock only trades at 5x to 6x more normalized EPS, prior to this loyalty agreement EPS boost over time. A stock like Delta Air Lines trades at nearly 9x EPS targets for 2025, suggesting American Airlines has more upside to catchup with legacy airlines and the sector is still undervalued compared to industrial transport stocks.

Takeaway

The key investor takeaway is that American Airlines has still been left far behind, even after this minimal rally. The stock has the potential to rally to pre-Covid levels of $30 similar to the other legacy airlines. Naturally, the airline sector is always volatile and the market could have other plans for the stock, whether via another natural disaster or a more competitive environment again with peers looking to grow capacity.

Investors should use the current price to build any position in American Airlines.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAL, UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start December, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.