Summary:

- Airline stocks are volatile; American Airlines struggles with long-term value but offers short-term gains for risk-takers, evidenced by recent stock performance.

- Q2 results show modest revenue growth but declining unit revenues and rising controllable costs, pressuring operating margins.

- The 2024 outlook predicts further margin pressure due to higher costs and declining unit revenues, despite capacity increases.

- Maintaining a buy rating, but American Airlines’ significant debt and long-term debt management remain critical concerns.

Boarding1Now

Airline stocks are not my favorite investments due to the volatile nature of the business and the subsequent impact it has on the stock prices of airlines. We recently saw with Spirit Airlines, Inc. (OTC:SAVEQ) how shareholder value can evaporate extremely quickly if the business is facing pressures. American Airlines is not facing bankruptcy, but it is definitely a name that has had a tough time generating long-term value. After the stock tanked following a down revision for the second quarter outlook, I continued marking the stock a buy and since then, we saw the share price increase by 23.8% compared to 13.3% for the S&P 500. So, while long-term shareholder value creation remains an illusion for many airlines, there definitely is value for those who want to take the risk and “ride the waves”.

Since my last report in September, the stock gained 10.8% compared to S&P 500 that rose less than 2%. In this report, I will be discussing the most recent earnings and I will discuss whether this changes anything to the price target and rating that I previously put.

American Airlines Faces Margin Pressure

American Airlines

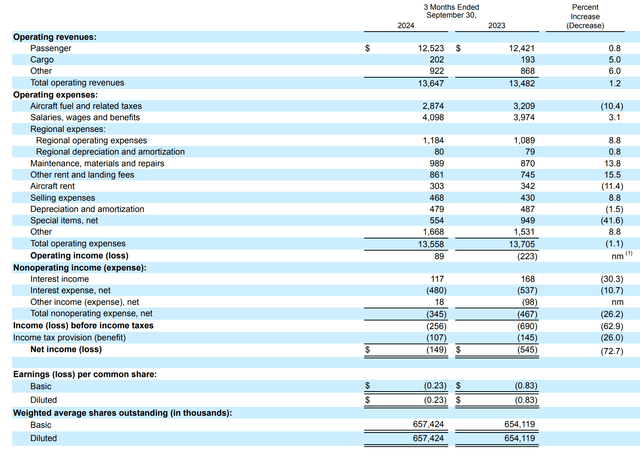

Total revenues increased by 1.2% to $13.65 billion. Cargo and other revenues increased by 5 and 6 percent, but the biggest absolute contributor to revenues was the 0.8% increase in passenger revenues. The modestly higher revenues were realized on a 3.2% increase in passenger capacity, which points to a decline in unit revenues. During the quarter domestic capacity increased by 3.9% while unit revenues declined by 3.1% leading to a 0.8% increase in passenger revenues. In Latin America, capacity remained stable while revenues decreased 3.8%. Atlantic revenues increased 2.6% with a 0.5% increase in passenger revenues pointing at 2.2% higher revenues while Pacific revenues increased 15.3% despite a 4.6% decrease in unit revenues. The increase was driven by a 20.9% increase in capacity.

Total operating expenses decreased by 1.1%, but this was primarily driven by a lower fuel bill, lower aircraft rent, and lower special items. Excluding fuel, costs were 1.8% higher, and excluding the special items as well the costs would have been 6.1%. This indicated adjusted operating margins of 4.7% compared to 5.4% a year ago. The cost pressure was also visible in the operating costs per available seat mile which increased by 2.8%. Overall, the company beat analyst estimates on revenues by $74.1 million and beat on core earnings per share by $0.13. The reality, however, is that unit revenues have continued to weaken and unit costs excluding fuel, which I consider the controllable costs, have continued to increase.

American Airlines Margins To Fall In 2024

American Airlines

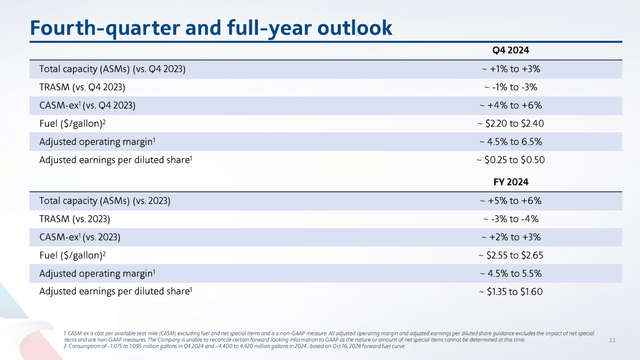

For the fourth quarter, the company expects capacity to be up one to three percent, but unit revenues are expected to decrease by the same percentages. At the same time, CASM excluding fuel and special items is set to rise to four to six percent with operating margins of 4.5% to 6.5%. So, we continue to see pressure on the operating revenues and costs and margins currently are mostly supported by lower fuel prices.

For the full year, the company expects to increase five to six percent in capacity additions with a three to four percent decline in unit revenues and a two to three percent increase in unit costs with adjusted operating margins of 4.5% to 5.5%. As a reference, last year the adjusted operating margins were 7.5%.

Besides the challenging cost environment, what has definitely not helped is American Airlines’ approach with respects to its sales distribution channels. That was primarily used to cut distribution costs rather than optimizing sales and that has resulted in indirect channel sales decreasing significantly with a 10% reduction in the quarter, and it will take a while for American Airlines to repair that damage.

American Airlines Stock Can Fly Higher

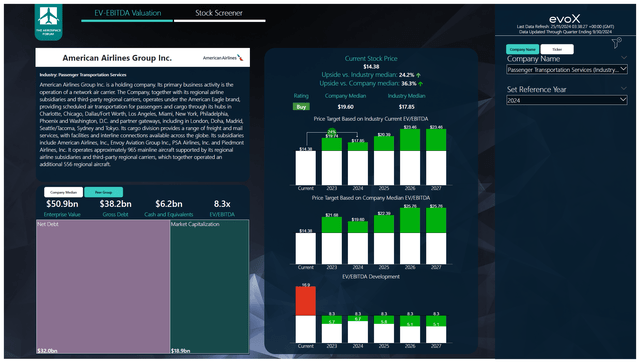

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions and update the stock price targets accordingly. In a separate blog, I have detailed our analysis methodology.

The Aerospace Forum

I previously had a $17.75 price target for American Airlines based on the FY25 valuation. However, given the significant debt load and the declining margins, I feel it is appropriate to be more reluctant and apply the FY24 valuation instead against a peer group EV/EBITDA which implies a $17.85 price target, which is a $1.82 lift to the price target that I previously calculated based on FY24 earnings. EBITDA estimates are not showing anything that excites me with a modest increase to the estimate for 2024 and a total increase in EBITDA estimates of 1% or $201 million to $19.9 billion between 2024 and 2026. The reason why the stock price targets have gone up is primarily due to the improved cash flow generation expected in 2024 due to aircraft delivery delays that are pushing out some capital expenditures.

Conclusion: American Airlines A Long Deleveraging Path

The financial results of American Airlines show the challenging landscape for airlines with lower unit revenues and ex-fuel unit costs that continue to go up as higher labor costs are now in play. Essentially, this squeezes the margins of airlines. American Airlines faces some additional pressures due to the significant debt load that is, in fact, higher than its market capitalization and could be a sign that investors have doubts about the company’s ability to reduce its debt.

I don’t think that American Airlines will have major challenges to refinance its debt, but we do keep an eye on free cash flow. The company is currently expected to generate between $670 million and $1.45 billion in free cash flow annually until 2026, but that is really not a lot for a company with $39.2 billion in debt and operating lease liabilities. I do believe that the current market environment for commercial airplanes does provide a positive prospect for American Airlines to sell and leaseback some nearly 500 airplanes that it owned fleet and the fleet that has yet to be delivered could be a lever to accelerate debt reductions but from operational perspective generating the free cash flow to cover maturing debt will be a challenge and by 2026, the company’s liquidity is set to fall below the $10 billion minimum that it aims to have available making it necessary to raise $6 billion through debt or sale-and-leaseback transactions. For now, I am maintaining my buy rating for the stock, but the debt levels and how American Airlines addresses its long-term debt maturities remain a key watch item.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.