Summary:

- American Airlines won’t be harmed by higher oil prices.

- The airline reported profits last year with higher jet fuel costs.

- The stock is crazy cheap at 4.5x ’23 EPS targets with further upside simply from repaying debt with large cash flows.

Jetlinerimages

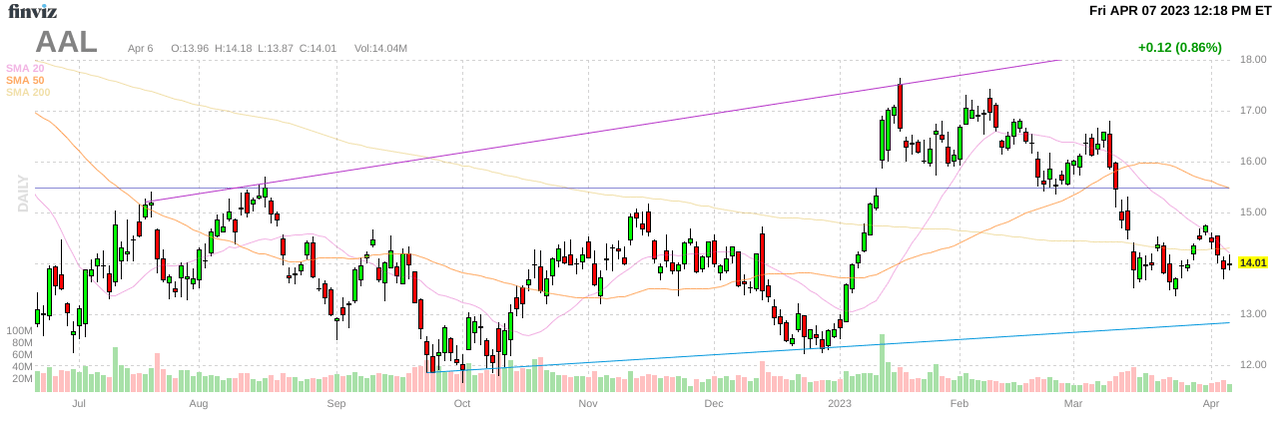

Due to fears of higher oil prices from the OPEC+ production cut last week, American Airlines Group (NASDAQ:AAL) has dipped back to $14. The move is amazing considering the airline guided to strong profits for 2023 after reporting solid profits to end 2022 when jet fuel prices were higher. My investment thesis remains ultra bullish on the airline generating strong cash flows to repay debts regardless of jet fuel prices.

Source: Finviz

Strong Profits Despite High Fuel

While fuel costs are important to airlines, high fuel costs don’t prevent the airlines from making substantial profits. The airline earned $2.4 billion in Q4’22 pre-tax profits when jet fuel prices were far higher than now and up 70% from 2019 levels.

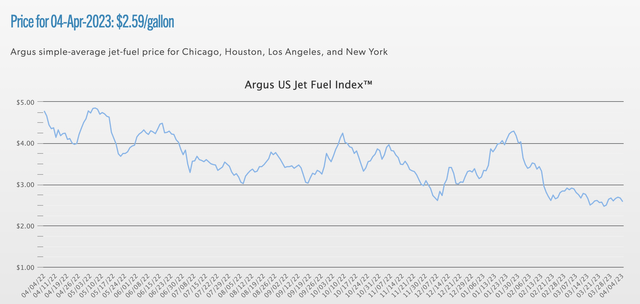

Heck, jet fuel prices haven’t even rebounded with the jump in oil prices over the last week. The average fuel price at $2.59 per gallon is starting Q2’23 far below the prices reaching $4 per gallon in most of 2022.

Source: Argus

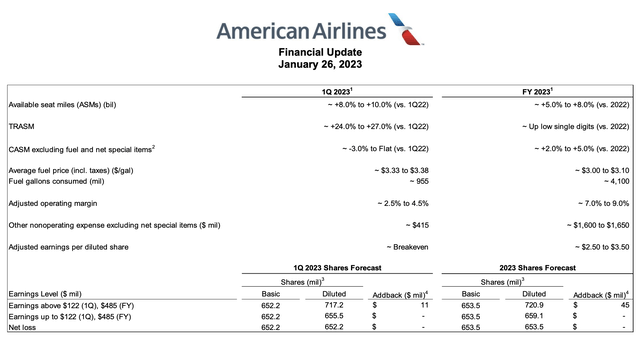

American Airlines guided to average fuel prices of ~$3.35 per gallon for Q1’23 and $3.05 per gallon for the full year. Current jet fuel prices are $2.59 per gallon without including taxes.

Source: American Airlines Jan. ’23 update

Though, the amounts don’t appear to include the same taxes, jet fuel costs aren’t a big problem for airlines right now. Jet fuel prices were far higher at the start of the year.

American Airlines spent $13.8 billion on fuel expenses last year. The forecasts for 2023 are closer to $12.5 billion while consuming more gallons at ~4.1 billion due to higher capacity this year. In total, the airline consumed 3.9 billion gallons last year with an average fuel price of $3.54 per gallon.

As noted above, jet fuel prices were exceptionally high last year while the airline wasn’t running at full capacity yet. Despite these headwinds, American Airlines still reported the following quarterly EPS last year after COVID ended:

- Q4’22 – $1.17

- Q3’22 – $0.69

- Q2’22 – $0.76

Paying Down Debt

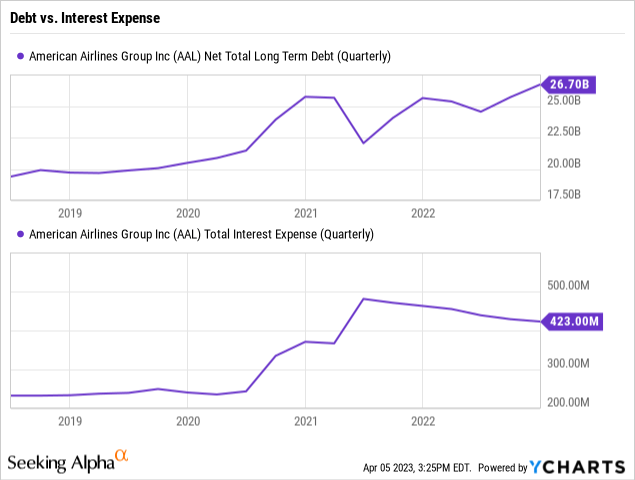

A big part of the investment story for American Airlines going forward is the repayment of debt and the related savings on interest expenses. The airline already had seen net interest expenses decline as sizable cash balances are now generating strong interest income.

At the end of 2022, American Airlines had a cash and short-term investment balance of $10.0 billion while total debt was up at $36.1 billion. A lot of investors watched total debt and didn’t follow how airlines were holding onto large cash balances to fund any further COVID disruptions without needing to borrow more money. The net debt is only $26.1 billion, though a still elevated amount.

The end result is that net interest expenses peaked at nearly $500 million per quarter back in mid 2021. American Airlines only spent $423 million on net interest expenses in Q4’22 with interest income soaring to $110 million.

The airline can still save half of those interest expenses just by returning the quarterly costs back to the pre-COVID levels of $200+ million. With a diluted share count now of 715 million shares, the interest expense increase alone hits EPS by $1+ each year.

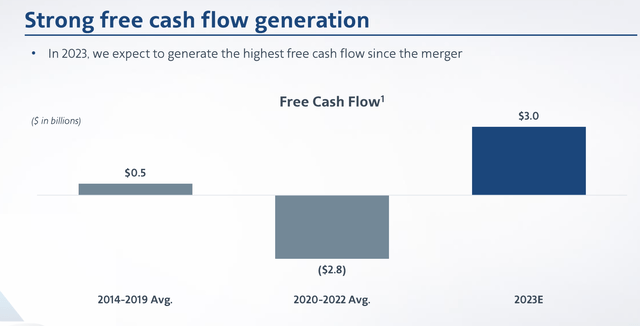

The airline forecast 2023 free cash flows of $3.0 billion. Note, this forecast came recently at the J.P. Morgan Industrials Conference on March 14.

Source: American Airlines ’23 JPMorgan Industrials presentation

The airline will use the vast majority of free cash flow over the next few years to repay substantial amounts of debt. As American Airlines lowers debt, the company will increase net income by cutting interest expenses. As debt levels are cut, the management team will likely have more confidence to repay even more debt from lowering the excessive cash balances.

Takeaway

The key investor takeaway is that jet fuel costs won’t impact the financials of airlines like American Airlines. The stock should rally as the airline generates strong cash flows, repays debt and boosts EPS further with lower interest expenses.

American Airlines remains incredibly cheap trading at just 4.5x EPS targets for 2023.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.