Summary:

- American Airlines stock is facing downward pressure and is relatively cheap, but there is more risk potential than reward potential.

- Macroeconomic conditions in the airline industry are souring, creating a significant headwind for American Airlines.

- American Airlines lacks premium offerings and a strong credit card partnership, making it harder to rely on high-spending consumers.

miglagoa

Introduction

American Airlines (NASDAQ:AAL) stock has been seeing downward pressure in the past few months, leading the company’s valuation to be relatively cheap. However, even as the stock has already seen some meaningful pullback, I believe that there is still more risk potential than reward potential in American Airlines stock due to a multitude of reasons. First, the macroeconomic conditions surrounding the airline industry are souring with no immediate end in sight, which will likely create a significant headwind for American Airlines for the foreseeable future. Second, American Airlines’ valuation is not cheap given the potential risks and the current financial health of the company. Finally, international and premium travelers are continuing to spend while more budget-friendly customers are cutting back, but as American Airlines is not the leader in capturing the highest spender in the industry, the current trend will likely be a meaningful factor for the company. Therefore, I believe American Airlines is a sell.

Macroeconomic Concerns

Rebounding from the depths of the pandemic, the past few quarters have created opportunities for the airline industry. Consumers spent on international travel and were willing to pay a premium. This could have been a result of a strong economy and low interest rate environment, leading to consumers with a better financial position to spend money on discretionary services like travel. However, over the past year, macroeconomic conditions have been souring, and data points suggesting an end to the strong tailwind for the travel industry are starting to emerge. As such, I believe macroeconomic headwinds will start to become a headwind for American Airlines for the foreseeable future.

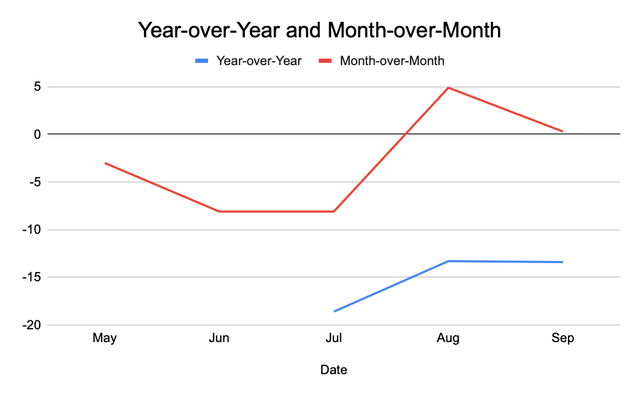

First, looking at the CPI data by the US Bureau of Labor Statistics for airfare shown below provides an insight into the airlines’ pricing power. The airfare continued its year-over-year decline at -9.3% while the month-over-month slowed from a positive 3.9% to 0.3%.

[Source – Chart created author]

The story this data purveys, in my opinion, is that airlines are losing their pricing power. Coming out of the pandemic, supplies of employees, logistical capabilities, and planes were limited while the demand was outpacing the airlines’ ability to address such a demand. However, airlines have added capacity or normalized their operations in the past year while the macroeconomic conditions have led to the demand to moderate, causing the pricing power to decline. After all, the price of a good or a service directly reflects the demand for a product.

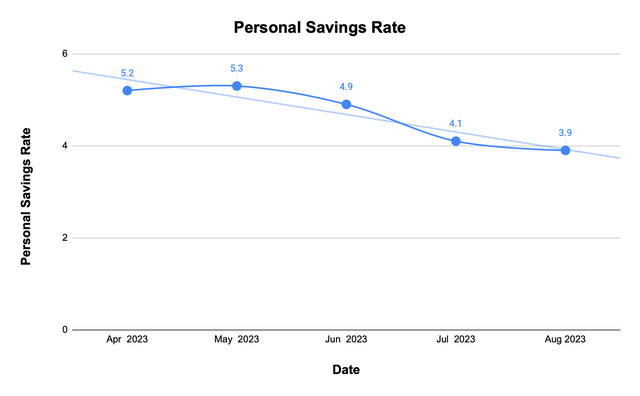

Why am I saying that macroeconomic conditions have worsened? Turning our focus to personal savings data, one could see the consumers’ overall financial health is quickly deteriorating. In April of 2023, the personal savings rate for US households was at 5.2%, which has declined about 25% to 3.9% by August of 2023. Considering that the personal savings rate has fluctuated from about 5% to 6% since 2013, the current rate and the trend at which the personal savings rate is moving is concerning. Thus, it is likely that the weakening of consumers’ financial health is leading to consumers cutting back on current and future travel, as discretionary spending such as travel is one of the first expenses consumers tend to cut in harder times.

[Source – Chart created by author]

Further supporting my views, one can look at delinquency rates on consumer loans. According to the St. Louis Federal Reserve data, the delinquency rates on all consumer loans have increased from 1.65% in 2022Q1 to 2.36% in 2022Q2, which is about 43%.

Overall, as the inflation continues to stay above the Federal Reserve’s 2% target, it is likely that the interest rates will stay elevated continuing to pressure the consumers and ultimately affecting travel demands potentially creating a headwind for American Airlines. I believe that the current weakness in airline pricing power is the initial proof of the souring macroeconomic trend.

American Airlines and Premium Consumers

Although the macroeconomic conditions are souring, high-income households or premium travelers are often affected at a far less magnitude than the average household. For example, Delta Air Lines (DAL) reported 2023Q3 earnings on October 12th, and during the earnings report, the company said that Delta “generated record September quarter revenue” with robust demand for travel continuing into the December quarter. Largely, the airline benefited from “International strength extending through fall” along with “premium revenue growth” and American Express (AXP) remuneration or loyalty program revenue. Thus, looking at this report, one might say that international travel and premium seating are still in high demand, and because American Airlines is a full-service carrier with an extensive international route network, they should benefit. However, I do not believe this to be the case.

First, American Airlines does not have a strong credit card partnership like Delta Air Lines and American Express. For Delta Air Lines, American Express’s remuneration was $1.7 billion during 2023Q3; however, for American Airlines, the loyalty program revenue is far lower. In the 2023 Q2 earnings report, the company’s nonpassenger or cargo revenue came in at about $880 million. Considering that these numbers could include other factors along with the loyalty program revenue, it is evident that Delta Air Lines’ loyalty program brings in far greater value.

Further, American Airlines does not have a strong market share among premium seat travelers like Delta does. During 2023Q2, for the busy summer months, American Airlines’ management team said that the company’s premium revenue increased by 15% year-over-year, which is far lower than Delta’s 25% year-over-year in the second quarter.

During harder economic times, lower-income or more budget-friendly individuals are disproportionately affected. As such, having a premium passenger market share could offset the worsening macroeconomic conditions, which is not the case for American Airlines.

I am comparing American Airlines’ premium seat offering to that of Delta, as Delta Air Lines was the only major airline to report 2023Q3 earnings. I am not saying that Delta Air Lines is a buy, but rather compared to American Airlines’ industry peer, the company is in a weaker position.

Valuation and Financials

American Airlines’ valuation multiple is currently low. The airline has a forward price-to-earnings ratio of only about 5.18. Thus, one might argue that the market has already taken into account the rougher macroeconomic conditions and slowing travel except for the premium travelers; however, because I believe that the macroeconomic conditions will continue to stay at these levels or even decelerate further, I do not think the current low valuation multiple reflects all the risks associated with American Airlines, especially due to the heavy debt load on the balance sheet.

American Airlines does not have the healthiest balance sheet. The company’s total liability to total asset ratio stands at about 106.52%. This means that the company’s total book value per share is negative. I believe the majority of American Airlines’ outsized liabilities comes from the company’s long-term debt load that was mostly accrued during the pandemic. Today, the company’s long-term debt stands at about $30 billion on $2.6 billion in trailing twelve-month net income. Thus, as the macroeconomic conditions start to sour creating a headwind, American Airlines will likely not only feel the pressure from operations but also from high debt loads, potentially creating risks for investors.

Therefore, although the valuation multiple is already low, I believe that it could be lower as it does not fully reflect the risks coming from the combination of macroeconomic conditions and the company’s balance sheet in my view.

Investor Takeaway

The airline industry is highly cyclical, and I believe that we are currently passing the peak and flying towards a downtrend in the business cycle. Worsening consumer financial health indicates potential future demand declining, while American Airlines’ lack of premium offerings will likely make it hard for the company to rely on high-spending consumers as much as its industry peers. Further, because American Airlines has a significant debt load, any downturn in the industry could amplify the risks associated with the airline. Therefore, I believe American Airlines is a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.