American Airlines: Speculative Buy Ahead Of Q4

Summary:

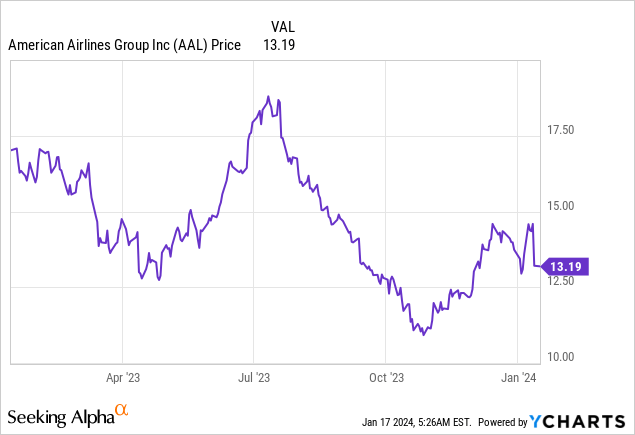

- American Airlines shares dropped nearly 10% on Friday due to large-scale flight cancellations caused by severe weather conditions.

- The dip in share price, driven by a souring of investor sentiment, could present an opportunity for investors to buy.

- American Airlines is expected to report positive earnings for Q4’23 and has a positive EPS estimate revision trend.

- Shares are cheap, and industry projections imply continual growth in FY 2024.

Wirestock

Shares of American Airlines (NASDAQ:AAL) skidded almost 10% on Friday after severe weather conditions forced U.S. airline companies to cancel a large number of flights. Obviously, flight cancellations mean lost revenue for airline companies, but the effects should prove to be temporary and not impair the long term value proposition of American Airlines. I believe that the 10% drop last week was widely exaggerated and American Airlines looks poised to submit a decent earnings score card next week next week Thursday. Considering that American Airlines is selling for a low earnings multiplier factor and that investors appear to overreact to the announcement of flight cancellations, I have initiated a speculative buy position ahead of the company’s Q4’23 earnings report!

Change in investor sentiment driving engagement opportunity, positive EPS trend

There may be an opportunity to take advantage of a short term deterioration in investor sentiment with regard to American Airlines. Arctic weather conditions have led to a surge in flight cancellations on Monday and resulted in significant delays for passengers just at a time when millions of Americans prepared to travel over the Martin Luther King Jr. holidays. The creation of negative sentiment overhang ahead of the company’s fourth-quarter earnings sheet, which is scheduled to be released on Thursday, January 25, 2024, may be an opportunity that investors could exploit.

One reason why I am optimistic about American Airlines’ Q4’23 report is that Delta Air Lines (DAL) already delivered very solid results last week which included record revenues for FY 2023, a strong free cash flow forecast as well as favorable comments regarding air travel demand in FY 2024. Delta Air Lines’ shares, however, also sold off on Friday, partially because of flight cancellations, which affect the airline’s short term earnings outlook, and because investors may have overreacted to a slightly reduced earnings forecast for FY 2024: Delta Air Lines downgraded its earnings forecast from $7 per-share to $6-7 per-share due to higher costs.

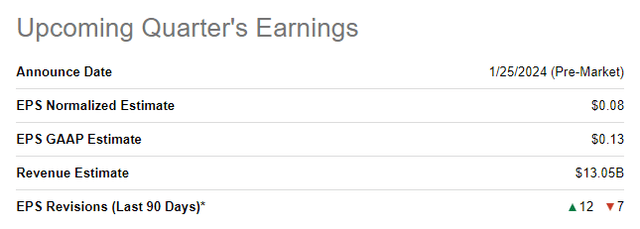

According to American Airlines’ EPS revision trend, the company could be set for a reasonably robust earnings score card next week given a strong holiday travel season in the fourth-quarter. American Airlines is expected to generate $0.08 per-share in earnings on revenues of $13.05B. Upside EPS revisions in the last 90 days outnumber downside EPS revisions 12:7, indicating positive earnings surprise potential.

Given the Delta Air Lines context, investors can reasonably expect a jump in Q4’23 revenues due to the holiday boost and possibly even a decent earnings forecast for FY 2024. I believe AAL also has a reasonable chance to see a decent EPS beat. Key metrics that I will be watching next week will be the airline’s revenue trajectory, margin outlook as well as free cash flow. Given that Delta Air Lines submitted record results last week due to strong growth in passenger numbers, American Airlines will likely also make favorable comments about its domestic and international demand situation.

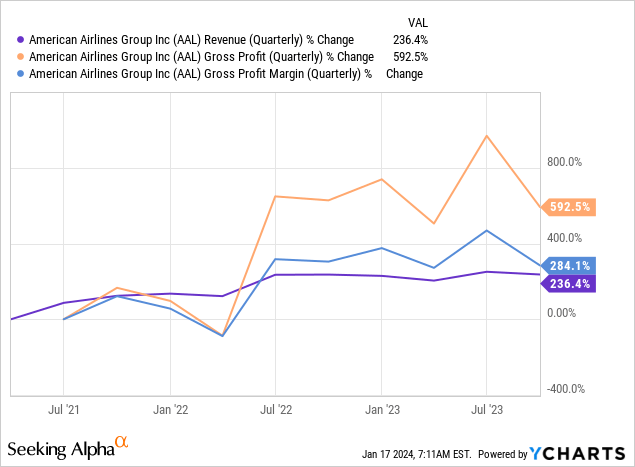

American Airlines’ and industry trajectory are generally favorable

American Airlines suffered serious financial pain during the COVID-19 pandemic which prompted the U.S. government to bail out the industry. However, American Airlines’ business stabilized quickly thereafter and in 2022 saw a huge improvement in its financials, especially as it relates to top line growth and a return to profitability. The revenue trend post-pandemic is supported by projections made by the International Air Transport Association (see below) which indicates that American Airlines could also be set, like Delta Air Lines, to report record FY 2023 revenues next week.

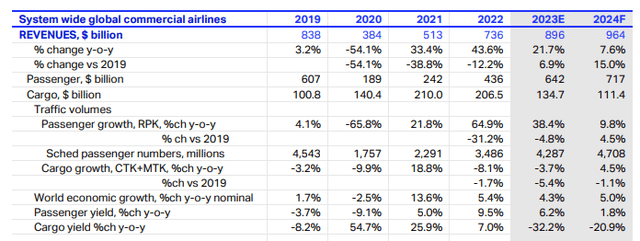

Delta Air Lines’ comments about strong travel demand are also reflect in the December 2023 fact sheet of the International Air Transport Association which is where the industry association projected a 47% year over year increase in global passenger revenues. The growth in industry revenues is due chiefly to a massive return of passengers after the pandemic and a phenomenon called “revenge travel”… meaning consumers splurge on trips in order to make up for lost fun during the COVID-19 episode.

The IATA is an industry association that makes projections about passenger growth and passenger numbers are expected to continue to rise this year. For FY 2024, IATA expects another 12% growth in passenger revenues to $717B which would make this year a new record year for the global airline industry.

American Airlines’ valuation compared against other U.S.-based carriers

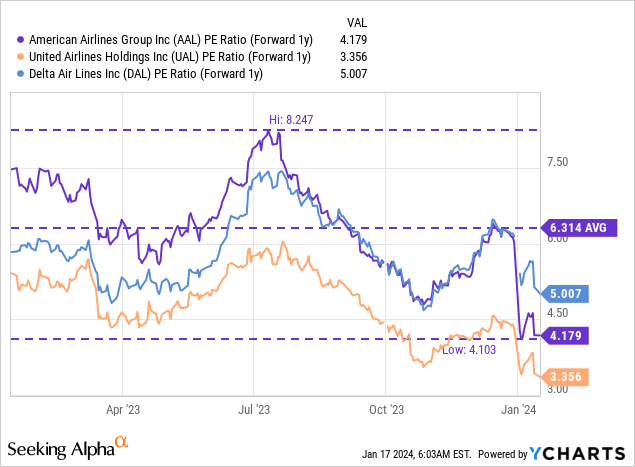

American Airlines has surprise potential next week, but even without a potential near term catalyst, shares are interesting from a valuation perspective. American Airlines, based off of consensus forecasts, is expected to generate $3.16 per-share in earnings in FY 2025, implying a P/E ratio of only 4.2X. Delta Air Lines is trading at 5.0X while United Airlines (UAL) is valued at a P/E ratio of 3.4X, with the industry average calculating to 4.2X.

However, shares have traded at up to 8.2X last year and have had an average P/E ratio of 6.3X. I do believe that American Airlines is nearing a positive catalyst event next week which may result in an upside revaluation of the airline’s shares. With industry projections indicating continual growth in FY 2024, I wouldn’t see shares of AAL as overvalued even if they returned to their average 6.3X P/E ratio ($20 fair value) within the next twelve months.

Risks with American Airlines

Airlines do well when the U.S. economy is doing well and consumers go on leisure and business trips. However, the industry is also widely cyclical and subject to risks outside of its control, such as the outbreak of a new pandemic (and temporary restrictions on airplane travel) or terrorist attacks. A rise in fuel costs would also potentially be a problem for American Airlines as well as other airlines and hurt the margin/EPS picture.

Final thoughts

I believe American Airlines is set for a reasonably solid earnings release next week and by that time the current weather situation may already be in the rearview mirror. American Airlines is set to benefit from continual growth in projected passenger numbers in FY 2024 and the business trajectory as described is generally favorable with revenues trending up and industry projections indicating a robust year as well. Additionally, shares of American Airlines can now be bought at a 10% discount to last week although the airline’s long-term value proposition has not fundamentally changed at all!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAL, UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.