Summary:

- High inflation has put significant pressure on worker standards of living with wage growth not keeping up with soaring costs.

- Railroads, staring down strike threats, are facing similar worker compensation demands as airlines.

- Airlines are highly unionized and the industry now is seeing strong demand and increasing air fares post-pandemic.

- American Airlines’ pilot union leadership rejected a proposed new contract, setting up a potentially more confrontational labor environment.

Tim Boyle/Getty Images News

While the U.S. railroad industry has been in the news because of a potential strike that could take place within weeks, many segments of the U.S. economy are facing the pressure of higher wages as employees attempt to recover their standards of living which have been damaged by high inflation. Unions have been effective in highlighting the impact of inflation on their workers. The transportation industry as a whole is heavily unionized and also critical to the U.S. economy. The U.S. airline industry has returned to profitability with strong post-pandemic travel demand and the reopening of more and more countries around the world to normal levels of human interaction and travel. Many airline industry labor contracts became amendable during the pandemic including at American (NASDAQ:AAL). In order to discuss the investor impact of the current labor environment, it is first necessary to understand the airline labor process in the United States.

Airline labor regulatory and political realities

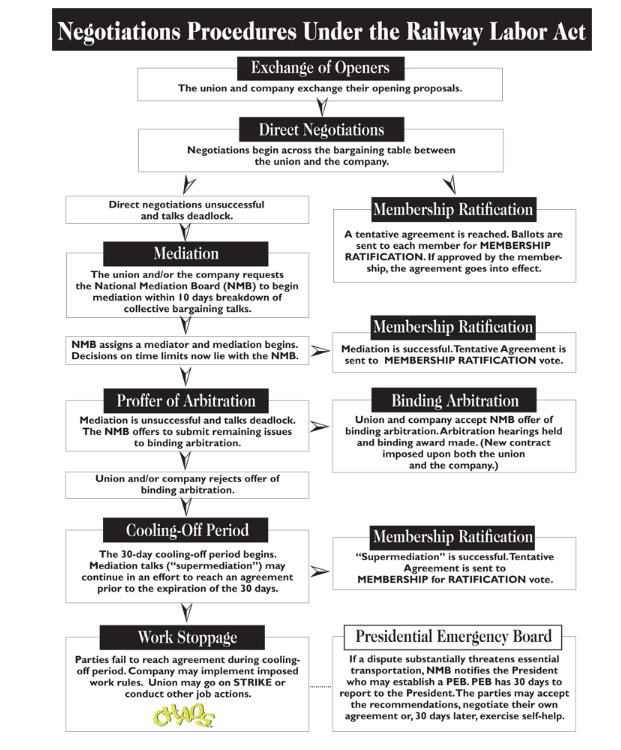

The most significant aspect of airline labor relations that must be understood is that they are governed by the Railway Labor Act – RLA – which provides a very different regulatory framework for the U.S. airline industry and their labor unions than for most industries. Originally enacted nearly a century ago, the RLA provides both a guaranteed mechanism for employee representation in the railroad industry and an elaborate system of checks and balances to prevent damage to the U.S. economy should labor unions seeks to strike. The RLA remains largely as it was implemented in 1924 but has been expanded to include the interstate airline industry. One of the most important differences between airline labor contracts and those governed by other statutes is that airline and railway labor contracts do not expire but rather become amendable. Once a labor contract becomes amendable, there is a defined process that includes federal mediation and escalation procedures should labor and management fail to reach agreement on new contracts. The National Mediation Board – a unit of the Dept. of Labor – is available at the request of labor and management; once they are requested to assist with a labor negotiation for an airline or railroad company, the NMB will be involved until both parties either reach an agreement or the complete process under the RLA has been exhausted which could end with a strike by the union or a lockout by management. Should mediation fail, the NMB encourages arbitration. Should arbitration be rejected by either labor or management and the NMB determines that the lack of resolution to a contract could harm the U.S. economy, the NMB is required to notify the President of the United States which forms a fact-finding Presidential Emergency Board – PEB. While the findings of the PEB do not result in an imposed decision on either side, both parties are strongly encouraged to negotiate an agreement. While outside of the Railway Labor Act and after all other mechanisms within the RLA have been exhausted, Congress does have the right under the Commerce Clause of the U.S Constitution to impose a settlement.

Railway Labor Act Processes (ourcontract.org)

While the current dispute between railroad unions and management has reached the PEB stage and the Biden Administration believed it had assisted in a obtaining an agreement two months ago, some railroad labor groups rejected the agreement which is why the potential for a strike is now much higher. Because the President and Congress have additional powers to prevent damage to the U.S. economy which have not been exercised in the current railroad dispute, the chances remain low that a prolonged strike will occur.

In contrast, no U.S. airline labor group has reached the stage where they might be free to strike. Because there is no specified time for mediated negotiations, labor and management have every incentive to continue to make progress. Failure of either side to negotiate in good faith could result in escalation of the process. Because contracts under the RLA can stretch on for years after they become amendable, seeking retroactive pay is common by labor while it often becomes necessary for management to include it as long as economic conditions indicate that they could have economically supported if a settlement had been reached earlier in the process.

Unlike railroads, airlines were not profitable throughout the pandemic and received substantial amounts of government assistance, which was targeted directly at labor costs, making it unlikely that mediators would support terms of retroactivity that extended before the 2nd quarter of this year. Airline labor groups are allied with their railroad counterparts in seeking double digit initial increases in compensation with above average single digit increases in pay during the life of the proposed contracts which generally are proposed to extend from two to four more years. A number of airline pilot groups have engaged in informational picketing over the past six months as airline industry profits returned in frustration by employees for the two-year delay in moving forward with negotiations due to the pandemic – but none are allowed to strike at this point.

Unionized transportation workers including railroad and airline employees receive above average compensation compared to the general American workforce but also seek continually improvements in quality of life issues since both industries work around the clock and require many employees to travel away from home. The primary sticking point in the current railroad labor dispute is about the lack of true time off, free from any obligations to the company while airline crewmembers want to see improvements in their scheduling; many airlines used their labor groups very inefficiently during the pandemic, requiring some crew members to work demanding schedules while other crewmembers did not work as much as they could have because of backed up training processes.

Politically, post mid-term elections, airlines and railroads are in a far less advantageous position than they have been for more than two years. Airline labor rallied to obtain federal support for the industry leading up to the 2020 elections while the proposed Administration settlement for railroads happened before the recently completed mid-terms. The Biden Administration has been much more vocal in speaking in recent days about the danger to the economy if a railroad strike occurred. Similarly, the responsibility for settling airline labor contracts shifts much more heavily back to labor and management rather than with the likelihood that politics will favor either side.

American’s Labor situation

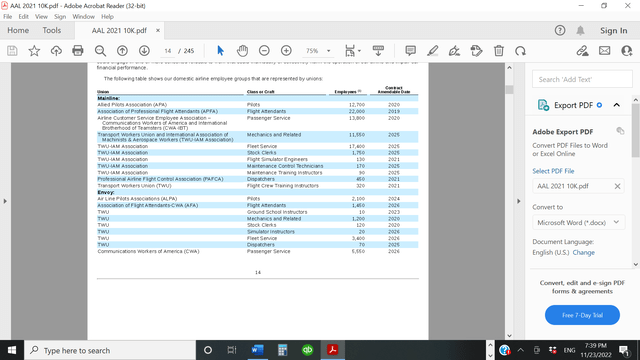

American Airlines is not only the largest employer in the U.S. airline industry with more than 123,000 employees but also has the most employees currently working under amendable contracts including its pilots, flight attendants, and passenger service agents. United (UAL) has a similar number of employees and amendable contracts while Delta’s (DAL) pilots are its only large unionized group. Four of Southwest’s (LUV) five large labor groups have amendable contracts although the number of employees in each labor group at LUV is smaller than at the big 3 global airlines. Contracts for pilots at all four of the largest airlines are in negotiation and the big 3 airlines are most advanced in their pilot negotiations. Pilot compensation represents about one-third of the total salary and benefits expense for U.S. airlines, about twice the ratio of total employees at each airline, making it important for airlines to settle pilot contracts in order to know the impact on total labor cost increases. In 2020, according to data which American reported to the U.S. Dept. of Transportation, American paid its pilots an average of $250,000 with an additional $60k in benefits and payroll taxes. For 2021, American spent nearly $12 billion on labor expenses which amounted to 38% of its total operating expenses.

AAL union contract status (AAL 10K 2021)

United led the current airline pilot contract cycle with a proposed contract for its pilots that ended up being soundly rejected by its rank-and-file pilots during the ratification process. United management had stated that it intended to lead the industry with a new contract in order to obtain the pilots necessary to staff the hundreds of new aircraft that the airline is acquiring in order to replace regional jets which are operated by other airlines on contract to United. In addition to unfavorably low pay increases compared to what railroads have negotiated with their employees, United pilots did not like the higher premiums which were being offered to pilot trainers at the expense of comparable raises for rank-and-file pilots. The rejected proposed contract has led to recalls of several union officials in United’s pilots’ union – the Airline Pilots Association – which will further delay negotiations for a new contract.

American proposed slightly richer terms for a new contract with its pilots just days after United released its proposed contract to its pilots for a vote, dooming the United contract to failure. However, American’s pilots’ union leadership rejected the proposed contract its negotiating team reached with the company and never sent the proposal to its pilots for a vote, fearing the backlash that has cost United pilot union leaders their jobs. American executives have released statements on several occasions demonstrating confidence that they will be able to absorb the pay levels that become the norm for legacy U.S. airlines – specifically established by Delta and/or United.

American’s labor situation is different than United’s and the rest of the airline industry. While the difference in hourly compensation at the big 3 airlines is similar for similar aircraft, American’s pilot work rules and total compensation are generally regarded as inferior to Delta and United’s as a lingering result of American’s chapter 11 bankruptcy reorganization. While it has been a decade since American reorganized, industry history shows it often takes two or more contract cycles for the losses suffered under bankruptcy to be reversed. In addition, American has the most senior pilot group at U.S. airlines, meaning that, although it has the most pilots that will face required retirement due to mandatory age restrictions during the remainder of this decade, its current average pilot compensation could grow higher than other airlines due to a more senior workforce. In addition, a number of strategic decisions by the company has reduced the earnings potential for American pilots, pressuring the company to increase compensation in other areas to offset; American disposed of more widebody aircraft than Delta or United during the pandemic and has been slow to replace them, admitting that current market realities make it impossible to support the size of international fleet that it operated before the pandemic. As I have noted previously, American operated its international network at lower profit margins (and consistent losses across the Pacific) than Delta, the industry’s most profitable global airline, or United which operates the U.S. industry’s largest widebody fleet. In addition, American has outsourced flying on the east coast to JetBlue (JBLU) as part of the Northeast Alliance between the two airlines (which is being challenged by the Dept. of Justice) and Alaska Air Group (ALK) on the west coast.

AAL JBLU partnership (AA.com)

Delta For the Breakthrough?

Delta has also been actively negotiating with its pilots in a process mediated by the NMB. Its CEO recently appeared on NBC’s Today Show repeating that the company wants to have a pilot agreement before the end of the year – which is less than a month away considering holidays. While neither Delta nor its pilot union (also ALPA) have not received terms of any proposed contracts, internet chatter indicates that Delta is offering considerably richer terms than American or United offered its pilots, validating Delta CEO’s statements that DAL will offer its pilots the richest pilot contract in the industry.

If Delta and its pilot union agree on a new pilot contract, it will set a standard for American’s pilot contract; American has the best chance of reaching a contract after Delta. Southwest’s pilot union appears to not be as advanced as the big 3 in the process, although their contract is much less complicated because of their use of a single aircraft type and lack of long haul international flying. The chaos at United’s pilots’ union could well push it to the back of line in the timeline for new pilot contracts.

If American’s pilots obtain a new contract, it will almost certainly accelerate negotiations for a new contract for is flight attendants and passenger service agents. American also has a more senior flight attendant workforce than at other airlines. However, American has refocused efforts to reduce its labor efficiency which includes reducing the number of gate agents. American has also reduced the number of flight attendants per flight which will accelerate as the airline ends international and transcontinental first-class service. Airline labor history shows that workforce efficiencies are usually offset by increased compensation for the remaining employees.

Competitive Labor Situation

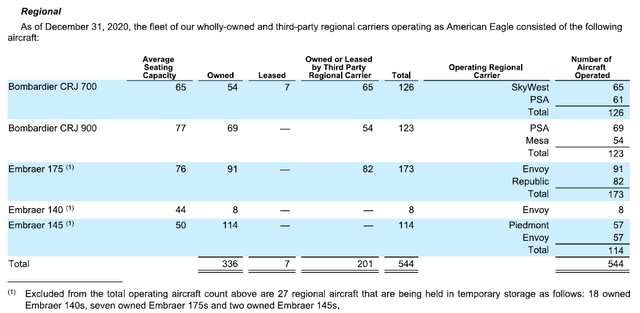

U.S. airlines are suffering from the same manpower shortages that have swept through the economy for months. Many airlines offered early retirement packages during the pandemic in order to reduce costs since there was no certainty of the economic or demand future while many airline employees chose to leave the workforce using covid aid for individuals. Some airline employees including at Delta received their 2019 profit sharing payouts a week after covid shutdowns began the crippling process that would decimate airline demand for nearly two years. Because airline pilots face a federally mandated retirement age of 65, many took early retirement packages. Once demand returned earlier this year, many airlines found themselves short of pilots. Further, the training pipeline for new pilots was interrupted as fears grew that the airline industry would face yet another of its many historic down cycles which would remove the pre-pandemic attraction of pilot careers. All of these factors combined have resulted in one of the deepest pilot shortages that the U.S. airline industry has ever seen with the impact being first by regional airlines and then low-cost carriers with legacy carriers such as American in a relatively strong position.

AAL regional jet fleet (AA.com)

American operates over 600 regional jets with half operated by one of its two wholly owned regional carriers and the remaining aircraft operated by contract carriers. AAL’s wholly owned regional airlines have led the regional carrier industry in offering hefty bonuses of as much as $100,000 or more for pilots to remain at AAL’s regional airlines instead of advancing to low-cost carriers or legacy airlines including AAL as soon as they gained the necessary experience. The effect has been to require carriers such as Alaska Airlines, which has reached an agreement with its pilots to significantly increase pay in order to remain as an attractive option for pilots. Ultra-low-cost carriers such as Frontier (ULCC) and Spirit (SAVE) are experiencing high levels of attrition as pilots choose to fly with the big 3 global airlines and Southwest because of higher career earnings. While Southwest doesn’t operate widebody international aircraft, they have long had pilot compensation that has provided career earnings potential as high as at the global airlines. The effect of wage pressure has been for the gap between pilots flying the smallest aircraft such as regional jets and for those that fly for smaller airlines to shrink and for pilots at the global carriers to expect compensation increases of a similar magnitude as the increases that are being seen at airlines such as Alaska and regional airlines. Since none of the big 4 airlines have reached agreement on a new pilot contract, it is hard to know the increased level in personnel expense that American will face but it is very likely that at least a 10% increase in salary and benefits expense will be seen within one year of signing a new pilot contract if similar increases are provided to other employee groups with open contracts.

Revenue Growth will fund labor cost increases

While the prospect of a $1.5 billion or more increase in labor costs might seem daunting, American execs are likely justified in believing they can absorb whatever raises they need to offer, likely driven by Delta’s stated commitment to have the highest paid pilots. There are a number of reasons to be optimistic about American’s ability to fund a new pilot agreement and the follow-on agreements that will come for other labor groups.

- American, like most of the rest of the industry continues to see strong demand, esp. on its domestic system which is currently generating the highest revenues among U.S. airlines. American is focusing its network rebuilding efforts on its two largest hubs at Charlotte and Dallas/Ft. Worth which provide strong connectivity across and to/from the southern U.S. which continues to lead air travel recovery.

- American’s largest international region is Latin America where it is also the largest carrier; the upcoming winter travel season promises to be one of the strongest. Low-cost carriers including JetBlue and Spirit have reduced some of their capacity in the region including from S. Florida where AAL is the largest carrier and where AAL’s massive Miami hub is the primary gateway to the region.

- American has recognized that its previous forays on a number of routes to Asia and continental Europe have not been profitable and they are taking a careful approach to restarting long haul international markets as well as in replacing the capacity from its Airbus 330 and Boeing 767 fleets which it retired during the pandemic.

- American’s fleet spending over the next three years will the lowest of the big 4 after years of leading the industry, giving American the youngest fleet among the largest U.S. airlines. AAL has upgauged (increase the average aircraft size) of its mainline fleet and pushed back deliveries of its remaining Boeing 787s beyond this year in order to buy the improved performance package which Boeing is developing for that aircraft.

- Because American’s stock price has remained depressed because of its low earnings and high debt levels, which has resulted in the highest amount for debt service among U.S. airlines, AAL’s reduced capex will allow it to reduce its debt levels, a strategy it is committed to pursuing during the next three years.

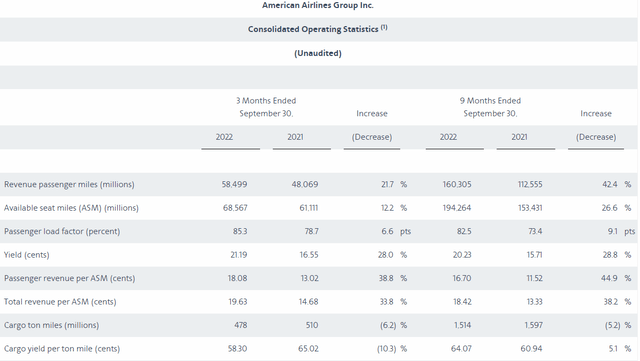

AAL operating stats 3Q2022 (AA.com)

Further, the legacy airlines have demonstrated over the past year that they are more capable of absorbing higher costs and translating them into higher revenues than the low cost carriers. Legacy airlines have years of history of offering fares competitive with low-cost carriers but the legacy carriers also are capable of attracting premium passengers. For years, AAL was the lowest margin airline in the airline industry but low several cost carriers generated profit margins lower than AAL in the most recent quarter. The legacy carriers as a group and specifically American are better positioned relative to low-cost carriers than they have been for years.

There are a few negative factors that could weigh on AAL’s financial performance which investors should track. American is committed to maintaining one of the largest regional jet fleets in the world which will require above average labor costs per passenger on those aircraft; AAL believes the increased domestic feed from regional jets will give it a competitive advantage by connecting more passengers to its mainline flights.

AAL continues to have more employees than either Delta or United even adjusting for the amount of outsourced work at each airline. American execs have previously AAL’s large workforce is due in part to the massive operation that American has at DFW airport where it operations from multiple terminals spread across more space than any other U.S. airline. American has considered building a massive new terminal at DFW airport which would likely be the largest airline terminal project in the U.S. if not the world if American moves forward.

AAL stock remains undervalued

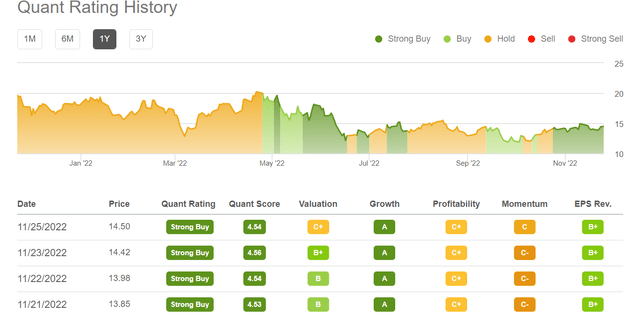

AAL stock is down the most of the big 4, down over 22% on a YTD basis and yet Seeking Alpha’s Quant Rating is at a strong buy, driven by growth and EPS revision. Given that airlines, as network businesses, are able to translate increased revenue growth and efficient capacity additions into bottom line growth, AAL is in a favorable position to see earnings growth. AAL’s market cap at $9.4 billion is also the lowest of the big 4 airlines, continuing a years-old trend but disconnected from the industry-topping revenues the company is generating.

AAL chart 25Nov2022 (Seeking Alpha)

AAL quant rating (Seeking Alpha)

AAL is an attractive potential investment as the airline industry continues to recover and as American builds on its own strengths while gaining competitive advantages esp. relative to several low-cost carriers.

Disclosure: I/we have a beneficial long position in the shares of DAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.