Summary:

- American Airlines offers a 13.9% upside opportunity due to the recovery in air travel and strategic initiatives, with a fair share price of $16.3.

- The company’s improved fleet efficiency, expanded partnerships, and strong market presence contribute to its growth potential.

- Potential risks include fluctuations in fuel prices, competition, and the re-emergence of COVID-19 or a similar virus.

Kathrin Ziegler

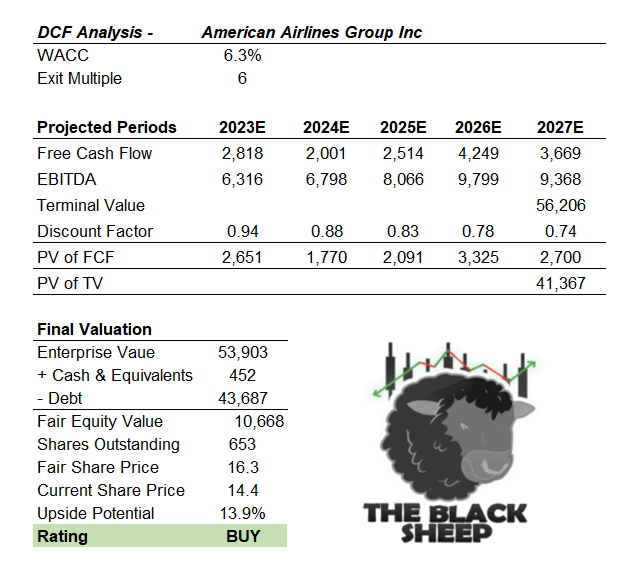

American Airlines (NASDAQ:AAL) is a prominent airline company headquartered in the United States. With a rich history and a strong presence in the global aviation industry, American Airlines offers an intriguing investment opportunity. The company’s market position, strategic initiatives, and recovering air travel sector contribute to its potential for future growth. According to my estimates, American Airlines stock currently presents a 13.9% upside opportunity, with a fair share price of $16.3 (according to my DCF), compared to its current price of $14.4.

Let’s examine some of the key factors driving American Airlines’ growth.

Recovery in Air Travel: The aviation industry, including airlines, experienced significant challenges due to the COVID-19 pandemic. However, as the world progresses towards recovery, air travel is gradually returning to pre-pandemic levels. With increasing vaccination rates and easing travel restrictions, there is a growing demand for air transportation services. American Airlines is well-positioned to capitalize on this trend by leveraging its extensive route network and operational capabilities.

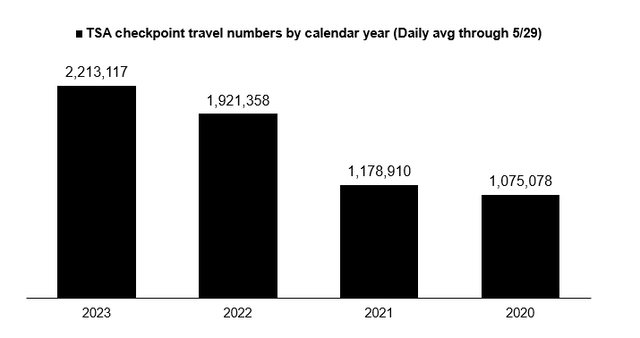

As the chart shows, average daily TSA checkpoint travel numbers have gradually gained since 2020 and are the highest they have been so far in 2023.

Strategic Initiatives: American Airlines has implemented several strategic initiatives to enhance its market position and improve operational efficiency. The company has focused on fleet modernization, investing in new aircraft with improved fuel efficiency and passenger comfort. This allows American Airlines to reduce costs and offer a superior travel experience, attracting more customers.

From American Airlines:

We’re improving our fleet’s fuel efficiency:

- As of 2022, more than 50% of our fleet is less than 10 years old with an average fleet age of 12.

- Last year, we added nine new Boeing 787-8 aircraft to our fleet. These planes are nearly 20% more fuel efficient compared to the aircraft they replaced. Additionally, we acquired 24 new Airbus A321neos that are equipped with sharklets and engines that make them 15% more fuel efficient than the previous generation aircraft. We’re scheduled to take delivery of more than 170 new mainline aircraft, including more Boeing 737 MAXs and 50 Airbus A321 XLRs.

- Since 2013, our efforts to renew our fleet have resulted in a significant improvement of more than 10% in fuel efficiency. As a result, we have successfully prevented the emission of an estimated 20 million metric tons of carbon dioxide.

Additionally, the airline has expanded its partnerships and alliances, strengthening its global reach and providing customers with a broader range of travel options.

Industry Outlook: The aviation industry is poised for long-term growth, driven by factors such as increasing global travel, expanding middle-class populations in emerging markets, and advancements in airline technology. American Airlines stands to benefit from these trends by leveraging its established brand, route network, and customer loyalty.

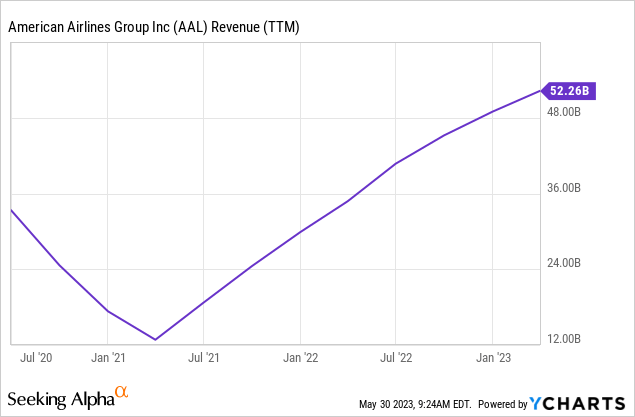

Financial Performance/Valuation: American Airlines has displayed resilience and adaptability in navigating the challenges posed by the pandemic. The company has taken steps to manage costs, optimize its operations, and maintain financial stability. As air travel demand recovers, American Airlines is expected to witness a gradual improvement in its financial performance, reflected in increasing revenues and profitability.

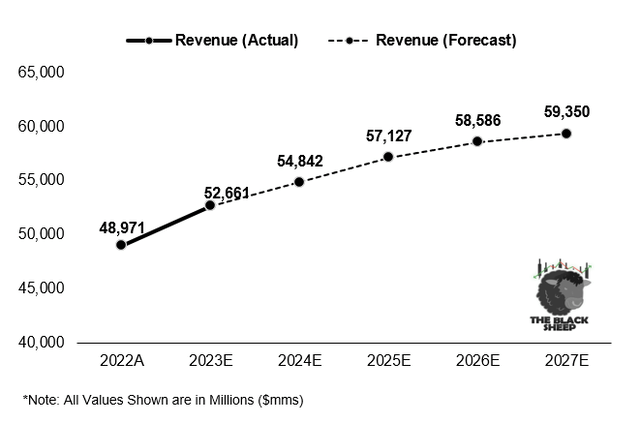

The revenue growth chart above illustrates the company’s potential to rebound from the pandemic’s impact and resume its growth trajectory.

On a more forward-looking basis, I have forecasted out revenues, EBITDA, and Free Cash Flow for the next 5 years which will be outlined below.

Revenue Forecast

I forecast a 4.3% 5Y CAGR for American Airlines’ top line revenue as air travel continues to improve, benefiting the company.

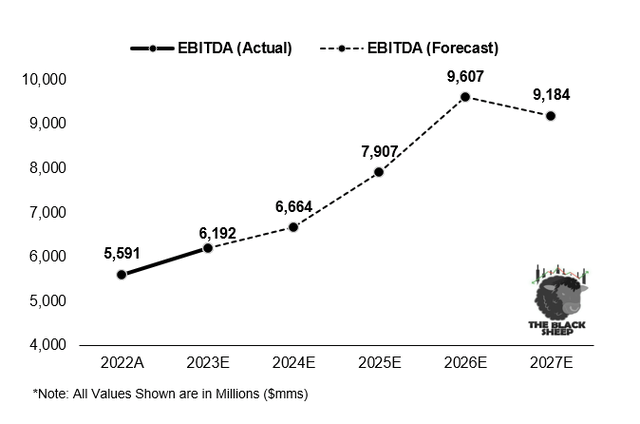

EBITDA Forecast

This pick up in revenue coupled with American Airlines’ cost-saving efforts (improved fleet efficiency) will help bolster the company’s EBITDA as well. I forecast a 10.9% 5Y CAGR for American Airlines’ EBITDA as a result.

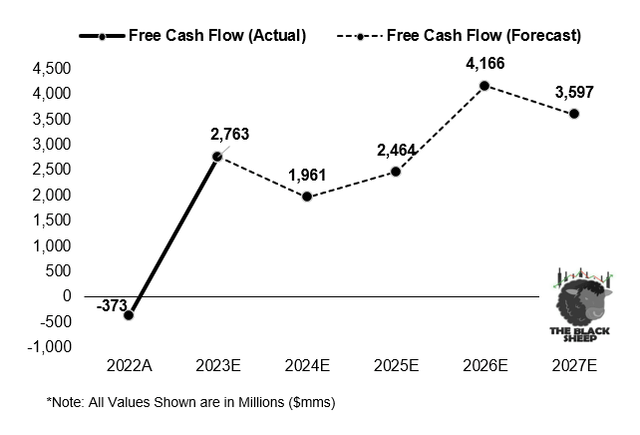

Free Cash Flow Forecast

And lastly, I estimate the company’s free cash flow will recover sharply from its 2022 negative level. My forecast can be found in the chart below.

DCF Model

Given the assumptions I have laid out above, my DCF model (with forecasts) can be found below.

The Black Sheep

I estimate that American Airlines stock is currently 13.9% undervalued based on my DCF valuation approach. This represents a buying opportunity for investors.

Quant Ranking:

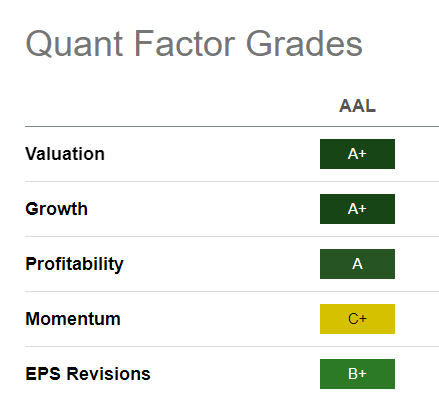

American Airlines does not only rank well on an absolute, fundamental basis, but also with Seeking Alpha’s quant factor grades.

Seeking Alpha Premium Features

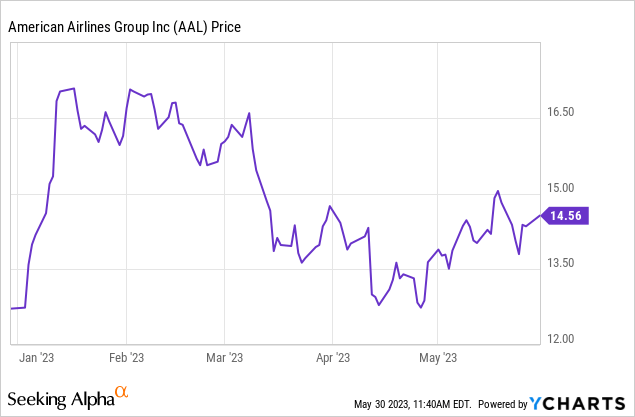

Currently, the stock ranks as an A+ on valuation and growth, an A on profitability, B+ on EPS revisions, and C+ on Momentum. While momentum has been lackluster for the stock recently (see below), this is more of a “value opportunity” and less of a technical momentum trade that I am suggesting here. Therefore, the momentum factor being relatively low does not concern me.

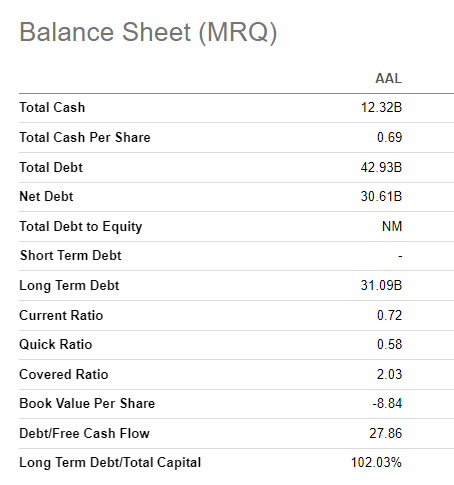

Balance Sheet Strength: Examining American Airlines’ balance sheet reveals a solid financial position. The company currently has total cash of 12.32B which is strong. The concerning part of American Airlines’ balance sheet is with its debt load of 42.93B. While it is a “risk” to point out, I am not all that worried given my outlook in the stability of American Airlines’ cash flows in the coming years to support its debt repayments.

Seeking Alpha Premium Features

Potential Risks to Consider: As an airline, American Airlines is exposed to fluctuations in fuel prices, which can significantly impact its operating costs. Sudden increases in fuel prices could put pressure on the company’s profitability and financial performance. The airline industry is highly competitive, with numerous players vying for market share. American Airlines faces competition from both traditional carriers and low-cost airlines, requiring continuous efforts to differentiate its services, improve customer experience, and maintain its market position. Additionally, the re-emergence of COVID-19 or another similar virus would hinder American Airlines’ growth potential and change my assumptions for revenue, EBITDA, and free cash flow. These aspects should be closely monitored by investors.

Conclusion: American Airlines presents an attractive investment opportunity as the aviation industry rebounds from the challenges posed by the COVID-19 pandemic. The company’s strong market presence, strategic initiatives, and recovery in air travel demand contribute to its growth potential. With an estimated 13.9% upside opportunity, my fair share price for American Airlines stands at $16.3, compared to its current price of $14.4. Investors may consider American Airlines as a potential investment choice in the evolving aviation sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.