Summary:

- American Airlines Group Inc.’s Q1 earnings show a significant erosion of earnings, with operating income declining 98.5% and operating margin hitting 0.6%.

- The airline is facing challenges in controlling costs, with unit costs increasing due to inflationary pressures and higher salaries, wages, and benefits.

- Despite the challenging operating environment, I believe that American Airlines stock is undervalued and maintain a buy rating based on the company’s deleveraging plans and forward projections.

Ceri Breeze/iStock Editorial via Getty Images

Airline stocks are rather difficult to invest in. In my view, the airline industry is in a continuous value destructing cycle by throwing capacity on the market exceeding demand. After the pandemic, many airlines would do things differently, aiming to run a leaner business. However, what we see is that inflationary pressures have pushed cost up, and those costs cannot be passed on indefinitely to consumers. The high risk for airlines will be that it will face a higher cost balance while growth to the unit revenues is rather limited.

The erosion of American Airlines Group Inc. (NASDAQ:AAL) first quarter results portrayed this rather well. In this report, I will discuss Q1 2024 earnings, the outlook for Q2, and assess whether American Airlines stock is still a buy as I claimed earlier this year.

American Airlines Sees Full Erosion Of Earnings

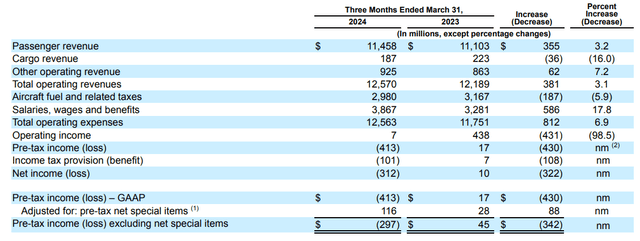

The first quarter last year might have led to hopes among investors that the seasonally weak quarter would a profitable one going forward. However, a year later we already see that that is not the case, with operating income declining 98.5% and hitting 0.6% operating margin. Total revenues increased 3.1% where higher passenger revenues were partially offset by the continued decline in cargo revenues. However, even the passenger revenues growth was rather unfavorable. Capacity growth of 8.5% outpaced revenue growth, indicating unit revenue pressure.

Operating expenses grew by $812 million or 6.9%, which looks like a more favorable cost development as it brings the unit cost reduction to 1.4%. However, excluding fuel costs, we see a 2.3% increase in unit costs. That growth is driven by continued inflationary pressures on rent and landing fees, as well as higher maintenance costs. To me, it makes sense that Q1 maintenance costs are higher in preparation for summer.

The big driver of cost, however, are the salaries, wages and benefits. What I find interesting is that airline employees have globally been looking for higher pay as airlines were booking robust results coming out of the pandemic on strong consumer demand for air travel. We are now seeing that for airlines, including American Airlines, the race to increase pilot pay to service demand coming out of the pandemic is nothing more than a race to the bottom that is biting the airline back now that it is not as easy to pass cost on to the consumer. The result is that while airline employees were looking to get a bigger share of the pie because airlines were doing great, they have now become the major contributing factor to strong margin erosion.

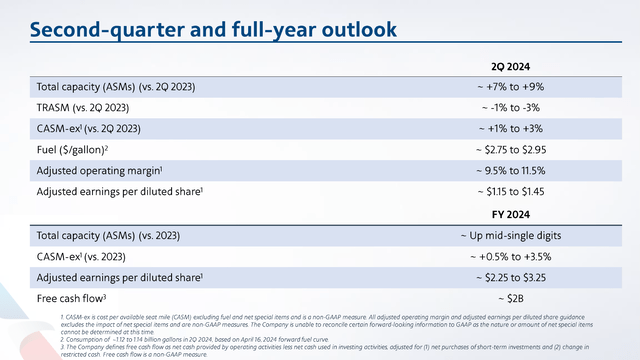

American Airlines Guidance Shows A Challenging Path To Cost Control

Luckily for airlines and investors, the first quarter is not an indicator for margins in the subsequent quarter. For the second quarter, the company expects 7 to 9 percent capacity growth, which coupled to further TRASM erosion will lead to modest growth in revenues. However, we continue to see that non-fuel unit cost remain a burden and are difficult to bring down and are expected to be up one to three percent, resulting in margins of 9.5 to 11.5% which will be down from 15.4% last year.

American Airlines will benefit from flying less off-peak flights, which is a sequential change, and the company is also seeing more bookings coming through from its own modern distribution system. So, things are going to get better sequentially, but margins remain challenged.

Is American Airlines Stock Still A Buy?

I previously noted that I like the approach that American Airlines is taking to deleverage its balance sheet with prudent capacity allocation and an increased focus on driving growth outside the main cabin, like many airlines are doing these days with a better premium offering. The company, however, did too much off-peak flying in Q1, which can be seen as a mistake.

Furthermore, I find the elevated cost structure that airlines, including American Airlines, are operating on to be a threat to the performance of the business. We continue to see unit revenues coming down with costs up significantly, forcing airlines to add even more capacity. This ultimately will result in continued reduction in unit revenues, all while the same cost structure remains in place. So, the big question is whether unit revenues will decline harder than CASM as is the case now or there is some inflection point.

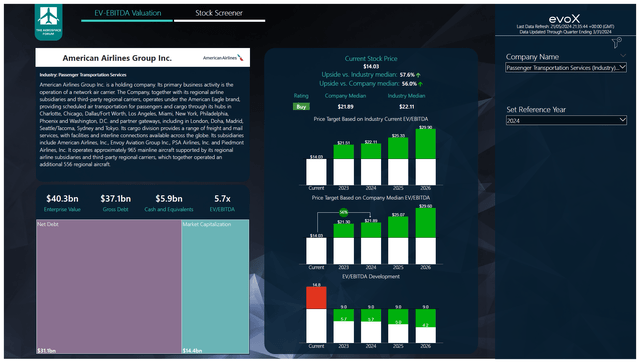

Overall, I do see a nice execution to deleverage but with a challenging operating environment. Combining the balance sheet with forward projections on cash flows, debt and EBITDA provides us with a good indication of the investment case for American Airlines.

Putting everything together, I believe that American Airlines stock is significantly undervalued. The company is set to significantly deleverage in the years ahead, resulting in lower interest expense. Its median EV/EBITDA multiple, which closely coincides with that of the peer group, signals 56% upside, bringing the price target to $21.89. American Airlines is among the top shorted S&P 500 stocks, but if I look at the deleveraging process and the forward projections, I do believe the stock should have upside rather than downside. As a result, I am maintaining my buy rating.

Conclusion: A Solid Execution In A Tough Market

While AAL stock is definitely lacking any positive movement, I believe that the market is failing to appreciate the deleveraging path that management is executing on rather well. My fear regarding American Airlines centers on the high-cost balance, and that is a cost balance that many airlines have created to execute capacity plans. We are now seeing that there is no infinite opportunity to pass through higher cost to passengers, and that is eroding margins. However, even with that in mind, I do believe that the value for American Airlines is significantly bigger than what the market currently has priced in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.