Summary:

- I maintain a bullish stance on American Airlines due to the strong travel demand and improving industry supply/demand imbalance.

- Anticipated Federal Reserve rate cut could ease American Airline’s heavy debt load.

- Declining oil prices can have a meaningful positive impact on the company’s operations.

Kevin Porter

Introduction

I had a bullish opinion on American Airlines (NASDAQ:AAL) in my previous article. At the time, I cited a continued strong travel demand, the company’s relatively young fleet portfolio, and the company’s revised loyalty program as reasoning for my bullish thesis. While American Airline’s stock has seen a significant decline since the previous publication due to its missteps and market challenges, I continue to stand by my thesis on the company. The demand environment continues to be strong, which will likely create a strong tailwind for American Airlines as the industry’s oversupply issues start to ease following the busy summer months. Further, the federal funds rate is expected to fall over the next few quarters creating a more favorable environment for American Airlines to manage and cut away its high debt load. Finally, with a lower oil prices, American Airlines could see meaningful margin benefits. Therefore, I believe American Airlines is a buy.

Elevated Demand and Over-Supply Balance

The airline industry has been hammered by an over-supply headwind throughout the busy summer travel season impacting margins on domestic travel. During the 2024Q2 earnings call, the American Airlines management team said that the company “saw the impact of too much industry supply in the domestic market” acknowledging the industry challenges.

However, as suggested by the CPI data, the industry challenge has mostly disappeared. Due to the over-supply, the month-over-month airfare has declined throughout the peak summer months. From May to June, the airfare declined by 5% before falling by another 1.6% from June to July. Then, from July to August, the airfare finally started to recover growing at a healthy 3.9% signaling that the majority of the over-supply overhang has likely abated.

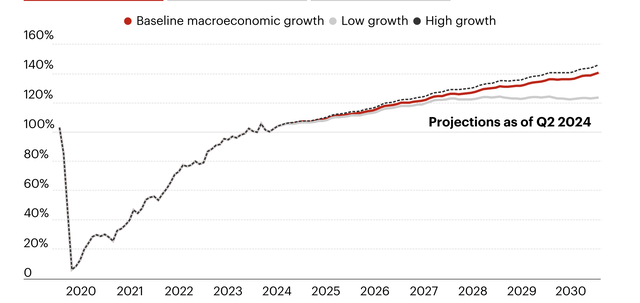

Further, in terms of air travel demand, the demand environment continues to be elevated. As the picture below shows, the baseline estimation for the air travel demand suggests a healthy growth throughout 2024 and for the foreseeable future.

Overall, as the over-supply risks in the airline industry are being resolved while the air travel demand continues to stay elevated, American Airlines will likely be able to continue to enjoy a favorable operating environment for the foreseeable future.

Impact of Rate Cuts on Debt

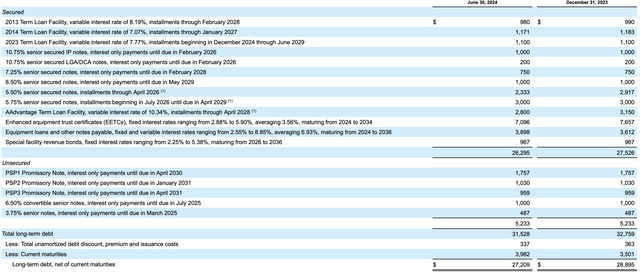

American Airlines has a significant debt load on its balance sheet. As of 2024Q3, the company had a long-term debt of $27.64 billion with current maturities on a long-term debt and finance lease obligations of $4.12 billion. As a result, American Airlines had a stockholders’ deficit of about $4.75 billion, which means that the company’s total liability is greater than the company’s total assets. In terms of the interest rate on the debt, American Airlines paid $486 million in 2024Q3 or $318 million in net interest expense. For a company that reported a net income of $717 million and an operating income of $1.03 billion in 2024Q3, the interest is burdensome.

The picture below is a screenshot from American Airline’s 10-Q filing. It contains information on the debt and its interest rates.

Fortunately, I believe this debt burden to ease over the next several quarters as the Federal Reserve starts to reduce the federal funds rate. The current market expectation is that the federal funds rate will reach the 3.75% – 4.00% range by the end of 2025, which is a significant decline from the current 5.25% – 5.50%.

Although it is hard to quantify the exact impact the rate reductions will have on American Airlines as there are numerous fixed-rate debts, variable debt, etc as shown in the picture above, the management team stated in 10-Q that “If annual interest rates increase 100 basis points,…annual interest expense on variable rate debt would increase by approximately $100 million.” Thus, the potential federal fund’s reduction of about 1.50% by the end of 2025 could have a $150 million annual positive impact to American Airlines.

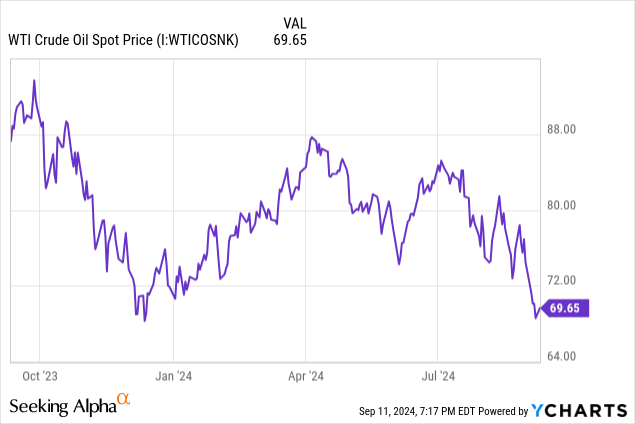

Falling Oil Prices

As the chart below indicates, oil prices have been declining at a rapid rate over the past several months, and as is the case that a significant portion of American Airline’s expenses are made up of fuel costs, the current market environment will likely be beneficial for the company’s margins while these conditions last.

In 2024Q2, American Airline’s fuel expenses totaled $3.06 billion on a revenue of $14.33 billion and an operating income of $1.38 billion. Relative to a total operating cost of $12.95 billion, the company’s fuel expenses were responsible for about 23.63% of the total operating expense, signaling the critical importance of fuel prices to American Airline’s operation. This view is reflected in the company’s 10-Q: “[the] business is very dependent on the price and availability of aircraft fuel.”

While it is hard to quantify the expected impact of the falling oil prices on American Airlines as the current oil price only captures a single moment in time without consideration for various existing contracts and hedges, the current oil price movement suggests a strong tailwind for the company. In the company’s 10-Q filing, the management team outlines that a “one cent per gallon increase in the price of aircraft fuel would increase our 2024 annual fuel expense by approximately $45 million.” Thus, considering that even a minor movement in the fuel price has a profound impact on the company, I believe it is reasonable to argue that the current oil market decline creates a positive environment for American Airlines in a meaningful way.

Risk to Thesis

Oil prices are often extremely volatile. The current sharp downward movement in the oil price may not last, which could limit the potential benefit American Airlines could reap from the current environment. Further, in the case that the Federal Reserve does not lower the federal funds rate to the magnitude expected by the market participants, American Airlines may not see a meaningful benefit to the company’s interest expense. These challenge my bullish thesis altogether.

Summary

American Airlines is expected to operate in a favorable operating environment. Not only is the airline industry supply and demand imbalance being resolved, but the air travel demand environment continues to show strength. Further, as the Federal Reserve lowers the interest rate throughout 2024 and 2025, American Airlines’ current burdensome debt load could ease through lower interest expenses. Finally, as a result of the falling oil prices, American Airlines could see a meaningful benefit to the company’s bottom-line. Therefore, I continue to believe that American Airlines is a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.